Prime copper miner First Quantum Minerals (TSX:FM,OTC Pink:FQVLF) has hit a serious setback in Panama.

On Tuesday (November 28), the nation’s Supreme Court of Justice ruled that the corporate’s mining contract for the Cobre Panama copper mine is unconstitutional, casting uncertainty on the operation’s future.

“We have now determined to unanimously declare unconstitutional your complete Legislation 406 of October 20, 2023,” Supreme Court docket President Maria Eugenia Lopez stated in a short assertion saying the choice.

Legislation 406 refreshed First Quantum’s mining contract for Cobre Panama, giving the corporate a 20 yr mining proper with the choice to increase for an additional 20 years. In change, Panama was to obtain US$375 million in annual income.

Nevertheless, the information was poorly received by locals who’ve issues concerning the mine’s environmental affect and imagine the deal is “overly beneficiant” to First Quantum. Protestors have taken sturdy steps in opposition to the corporate in current weeks, together with organizing a blockade that has compelled a manufacturing halt at Cobre Panama. Their actions have additionally attracted consideration on a worldwide scale — actor Leonardo DiCaprio took to Instagram with a supportive post on November 24.

First Quantum stated in a press launch that it’s reviewing the ruling, and “continues to order all its native and worldwide authorized rights with reference to developments in Panama.” The corporate additionally reportedly gave legal indication of its intent to start out arbitration below a commerce settlement between Panama and Canada, the place First Quantum is predicated.

Taking a look at how the method might pan out, Dalton Barretto, managing director of fairness analysis, metals and mining at Canaccord Genuity (TSX:CF,OTC Pink:CCORF), explained to CBC that it is the course of by which First Quantum’s contract was signed that is been known as into query, not the contract itself. “It signifies that the method adopted by the federal government to take the renegotiated contract and enshrine it into regulation didn’t observe constitutional course of,” he stated.

With elections approaching in Panama within the spring, Barretto thinks it is probably that First Quantum should negotiate with the brand new authorities at the moment. Nevertheless, he thinks Cobre Panama will finally be capable of transfer ahead — the mine accounts for five % of Panama’s GDP, and a whole shutdown could be damaging for the nation’s economic system.

First Quantum Minerals’ year-to-date share value efficiency.

Chart through Google Finance.

For now, buyers are spooked by the state of affairs, with First Quantum’s share value falling off a cliff over the previous month. It closed Tuesday at C$12.64, and is now down 55.07 % because the begin of the yr.

Though Panama isn’t a high copper-producing nation, First Quantum is without doubt one of the greatest copper miners on the earth, placing out 776,000 metric tons of the purple metallic final yr. Its flagship asset is the Kansanshi copper-gold mine in Zambia, however Cobre Panama is the corporate’s latest operation, having began business manufacturing in 2019.

Cobre Panama’s current issues date back to 2018, when Panama dominated that Legislation 9 of 1997 was unconstitutional; on the time, that was the regulation below which First Quantum was working the mine. The court docket’s ruling was upheld in 2021, and the corporate then needed to negotiate a brand new settlement with the federal government — the consequence was the October 20 deal.

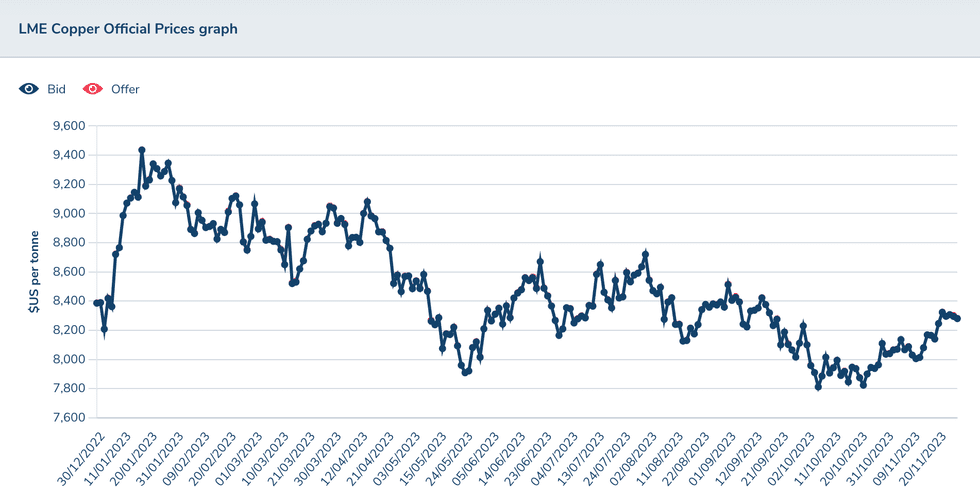

Copper’s year-to-date value efficiency.

Chart through the London Metal Exchange.

Cobre Panama accounts for about 1 % of worldwide copper manufacturing, and though protests are presently stopping the mine from working, Panama’s authorities hasn’t restricted its output.

In October, the Worldwide Copper Examine Group stated it expects copper provide and demand to stay balanced in 2023 forward of a giant 2024 surplus, with weaker western demand and powerful manufacturing out of China driving the imbalance. Nevertheless, consultants are already suggesting that continued disruptions at Cobre Panama could tighten the market and increase costs, which have largely trended downward this yr after a January spike.

Trying long run, market members have broad issues about copper provide as a consequence of low grades, a scarcity of contemporary discoveries and the lengthy durations of time essential to convey new mines into manufacturing.

“Whereas I can not predict (copper) demand, even when it is flat, the provision’s not there. That is what I do know,” stated Joe Mazumdar, editor of Exploration Insights, in a dialog earlier this yr. “That is what you’ll be able to put your hat on, as a result of that from discovery to mainly manufacturing the common time is 15 to 18 years.”

Copper closed Tuesday at 8,278 per metric ton.

Do not forget to observe us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the knowledge reported within the interviews it conducts. The opinions expressed in these interviews don’t mirror the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.