Investor Perception

First Helium’s scalable improvement technique, differentiated by a multi-commodity method and supported by a well-defined venture roadmap, positions it as a possible chief in helium manufacturing inside North America.

Overview

First Helium (TSXV:HELI,OTCQB:FHELF,FRA:2MC) is a Canadian firm specializing in exploring and creating helium assets in Alberta, Canada. The corporate’s major asset is the Worsley venture, which spans 53,000 acres and consists of each helium-enriched pure fuel, oil and different pure assets. First Helium has made vital progress with a number of discoveries, together with a helium discovery nicely and profitable oil wells. The corporate goals to develop its manufacturing and money stream by means of ongoing exploration and drilling actions.

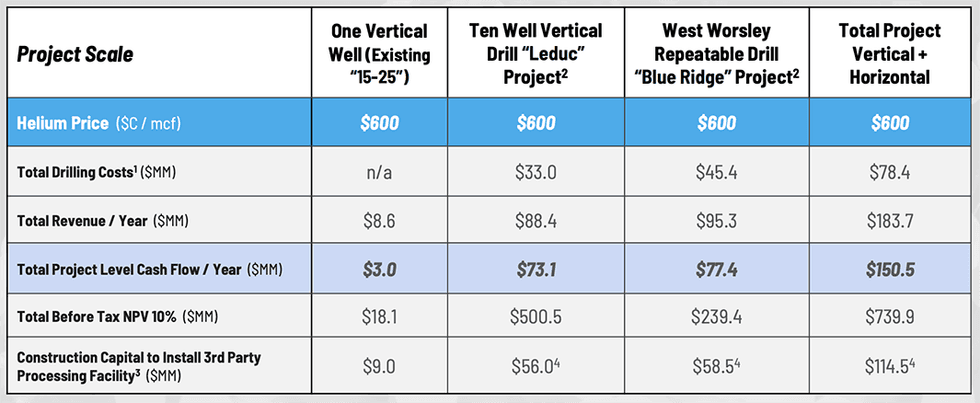

First Helium is poised for substantial progress within the coming years, with the scalability of the Worsley venture offering a path to vital will increase in manufacturing and income. The corporate has set bold monetary targets, focusing on over $100 million in annual income inside the subsequent three to 5 years. Based mostly on present projections, vertical drilling alone might generate over $100 million in annual income, with money stream estimated to achieve $70 million yearly.

Helium, a crucial and scarce useful resource, is indispensable in varied high-tech industries, together with semiconductor manufacturing, synthetic intelligence, house exploration, protection and healthcare. Helium’s demand is projected to develop 300 p.c by 2030, pushed by its irreplaceable function in industries that require precision, cooling and inert properties. Main firms like Google, Amazon, SpaceX, NVIDIA and Intel depend on helium for his or her operations. The worldwide helium market, valued at $3.94 billion in 2021, is predicted to develop to $13.26 billion by 2030.

Nevertheless, the availability of helium is beneath stress as a result of geopolitical uncertainties and manufacturing limitations from main international suppliers, together with Qatar, Algeria and Russia. Moreover, the US, presently the biggest producer of helium, is predicted to turn out to be a internet importer inside the subsequent three to 5 years. This shift opens vital alternatives for Canada, which is the fifth-largest international useful resource of helium however contributes lower than 2 p.c of the world’s annual manufacturing. The Canadian authorities has additionally labeled helium as a crucial mineral, underscoring its strategic significance within the transition to a sustainable future.

This international dynamic is creating alternatives for helium explorers reminiscent of First Helium to leverage a rising market. Led by an skilled administration and technical group with profitable observe information within the oil and fuel, mining and vitality sectors, First Helium is well-placed for vital progress.

First Helium’s long-term imaginative and prescient is to determine a regional helium-enriched pure fuel and oil play in Alberta, with the Worsley venture serving as a template for future developments. The corporate is actively evaluating potential partnerships and acquisition alternatives to speed up the event of its property and capitalize on the rising demand for helium throughout North America and globally.

Firm Highlights

- Helium is a crucial mineral with regular progress in demand. Main firms like Google, Amazon, SpaceX, Samsung, NVIDIA and Intel depend on it.

- Helium costs have elevated by over 50 p.c within the final three years and the market is predicted to develop 300 p.c by 2030.

- First Helium’s indicative money netbacks are three to 4 occasions increased than typical Canadian pure fuel producers.

- First Helium gives publicity to helium, pure fuel and oil income streams, which diversifies threat and will increase worth.

Key Challenge

Worsley Helium Challenge

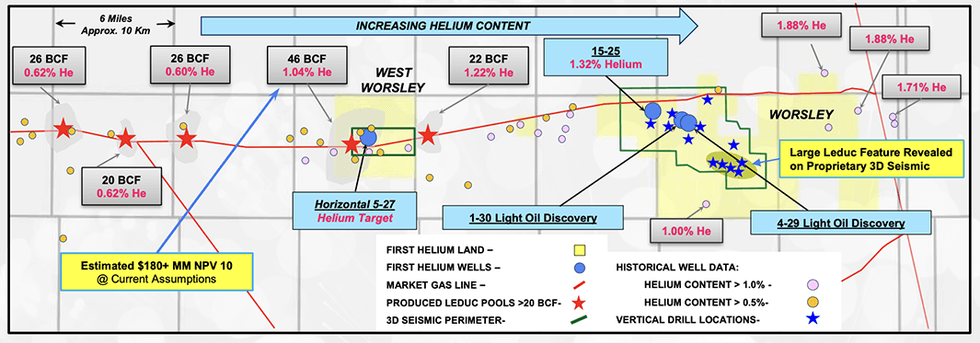

The corporate’s 100% owned flagship Worsley venture, spans 53,000 acres (roughly 83 sq. miles) in a multi-commodity area of Alberta. The venture is positioned in a traditionally productive space that has yielded over 315 billion cubic toes (Bcf) of pure fuel and 17 million barrels of oil. The Worsley venture is distinguished by its vital helium assets and multi-zone drilling potential for helium, pure fuel and oil. Worsley space has produced over 1 Bcf of helium, which was not recovered in earlier pure fuel operations, highlighting the untapped potential of the area for helium extraction. Specifically, the deeper Leduc formation to the japanese a part of the land base stays largely unexplored as a result of increased nitrogen concentrations within the pure fuel useful resource, which made the product unacceptable to the native fuel pipeline transportation firm, and discouraged additional drilling by historic pure fuel firms. This spells large exploration alternative for First Helium, as in the present day’s helium processing tools can separate helium, pure fuel and nitrogen, leading to marketable helium and pure fuel.

First Helium’s vertical helium discovery nicely, 15-25, is able to be introduced into manufacturing and is predicted to offer a gentle stream of helium and pure fuel provide. Moreover, the corporate has recognized 12 follow-up vertical drilling targets, and a big structural alternative primarily based on proprietary 3D seismic knowledge, which positions the venture for vital scalability.

First Helium has secured a 10-year “take-or-pay” helium offtake settlement with a serious international industrial fuel provide firm, which might assist sturdy and predictable money stream. The settlement covers as much as 80 p.c of helium manufacturing from the Worsley venture’s 15-25 nicely, with the potential to buy 100% of manufacturing relying on the tempo of progress. The settlement additionally supplies First Helium with flexibility, permitting the corporate to market as much as 20 p.c of helium manufacturing on a probably extra profitable “spot” gross sales or service provider liquefaction foundation.

The Worsley venture space advantages from an present pure fuel gathering infrastructure, expediting the timeline to convey helium to market. First Helium expects the primary manufacturing to start within the fourth quarter of 2025, positioning it to turn out to be a key provider within the rising North American helium market.

Worsley venture indicative economics

The useful resource base of the Worsley venture is important. The venture includes one confirmed, undeveloped oil location with reserves of roughly 200,000 barrels of oil (as verified by third-party reserve engineers) and one pure fuel/helium nicely. The unrisked, finest estimate of contingent assets for this nicely consists of slightly below 13 Bcf of pure fuel and over 300 million cubic toes (MMcf) of helium. These reserves present a steady basis for the corporate’s progress, with the pure fuel/helium manufacturing providing substantial financial upside because of the high-value nature of helium. Helium costs have elevated by greater than 50 p.c over the previous three years, with international import costs rising from roughly $US 310 per thousand cubic toes (Mcf) in January 2020 to over $US 476 per Mcf by November 2023. This worth progress, mixed with helium’s crucial purposes, underpins the sturdy economics of First Helium’s Worsley venture.

The corporate’s operations concentrate on two key formations inside the Worsley venture space. The Leduc formation, recognized for its helium-enriched pure fuel and lightweight oil, gives substantial manufacturing potential. The Blue Ridge formation is one other high-margin, helium-enriched premium pure fuel play that provides additional worth. The corporate has drilled three wells within the space, reaching 100% drilling success on two oil wells, which have collectively generated roughly $13 million in income. These outcomes spotlight the resource-rich nature of the Worsley venture and show First Helium’s functionality to ship constant drilling success and income era. The third nicely, drilled horizontally into the Blue Ridge formation, was cased, and is prepared for completion and testing. If profitable, it’s going to set up a regional, repeatable, helium-enriched pure fuel play.

The corporate has recognized 12 extremely potential places for extra drilling within the Leduc formation, and the profitable testing of its horizontal nicely (5-27) is predicted so as to add over 30 follow-up horizontal drill places within the Blue Ridge formation at West Worsley, additional enhancing the size of the venture.

After receipt of regulatory licensing approvals in late 2024 and early 2025, First Helium has begun drilling its confirmed undeveloped (PUD) 7-30 oil location on the Worsley property. Following drilling of the 7-30 vertical nicely, the contractor’s drilling rig will transfer on to the 7-15 location to start drilling in early February, barring any unexpected delays.

Processing plant

Together with proving up further helium useful resource, the corporate can be exploring financing choices for the development of a helium processing plant, which might additional improve its manufacturing capabilities. The completion of this facility is predicted to generate $3 to $5 million in annual project-level money stream from the only 15-25 nicely alone, setting the stage for future progress and growth.

Administration Staff

Ed Bereznicki – President, CEO and Director

Ed Bereznicki is a extremely skilled vitality sector govt with greater than 25 years in company finance, capital markets, and M&A, focusing notably on oil and fuel exploration and manufacturing. He spent 15 years as a senior funding banker with corporations reminiscent of Raymond James and GMP Securities, the place he raised over $20 billion in fairness and convertible debt for vitality sector initiatives. His management roles prolong to start-up vitality ventures, the place he has guided firms by means of IPOs, mergers and acquisitions. He has additionally dealt with threat administration, pipeline operations, and worldwide initiatives, making him an knowledgeable in main large-scale vitality and pure useful resource firms. His broad expertise throughout monetary and operational domains has contributed considerably to his means to handle advanced company progress initiatives within the helium sector.

Robert J. Scott – CFO and Director

Robert Scott is a chartered skilled accountant and a chartered monetary analyst with over 20 years {of professional} expertise in monetary administration, company compliance, and strategic enterprise planning. He has held senior administration and board positions at a number of TSX-V listed firms, the place he was instrumental in elevating greater than $200 million in fairness capital for growth-stage firms. His in depth experience covers IPOs, reverse takeovers, mergers and company restructuring. Along with company finance, he has in-depth expertise in service provider and industrial banking, which has bolstered his functionality to information firms by means of advanced monetary environments, particularly within the pure useful resource sector.

Shaun Wyzykoski – Vice-president, Engineering

Shaun Wyzykoski brings 25 years of expertise within the Canadian oil and fuel trade, specializing in engineering, operations, acquisitions, and divestitures. He has held senior roles at a number of main vitality firms, together with chief working officer of Orlen Upstream Canada, and senior engineering positions at Fairmount Vitality and TriOil Assets. He was additionally a part of the founding engineering group at Crescent Level Vitality, one among Canada’s main oil and fuel producers. Wyzykoski’s experience consists of designing and executing advanced operational methods to main acquisition efforts and integrating new applied sciences into exploration and manufacturing actions. His deep operational information helps him drive effectivity and innovation at First Helium.

Marc Junghans – Geology and Asset Improvement Advisor

Marc Junghans is a seasoned geologist with greater than 40 years of expertise within the oil and fuel sector, specializing in the Western Canadian Sedimentary Basin and U.S. markets. He co-founded and efficiently offered two private-equity-backed junior oil and fuel firms, the place he served as vice-president of exploration. At Compton Petroleum, he helped develop manufacturing from 2,500 barrels of oil equal per day (boed) to 34,000 boed, main exploration efforts that considerably enhanced the corporate’s worth. He has held senior geological positions at main corporations reminiscent of Husky Oil, Anderson Exploration, Canterra Vitality, and Tundra Oil & Gasoline. Junghans has drilled over 170 horizontal wells throughout Alberta, Saskatchewan and Manitoba, bringing invaluable technical experience to First Helium’s asset improvement technique.