- Fetch.ai and Rendr confirmed a excessive quantity of lively addresses

- The latest pullback was adopted by the buildup of RNDR

A latest submit on X from Santiment famous that the social media engagement was more and more centered round whether or not Bitcoin [BTC] costs might keep afloat. AI and buying and selling methods had been additionally key matters of dialogue.

Fetch.ai [FET] and Rendr [RNDR] had been two of the most important tokens by market capitalization within the AI sector. Given the hype round AI regardless of the market downturn, AMBCrypto determined to research what buyers should be ready for within the coming weeks.

Fetch.ai confirmed sturdy on-chain exercise

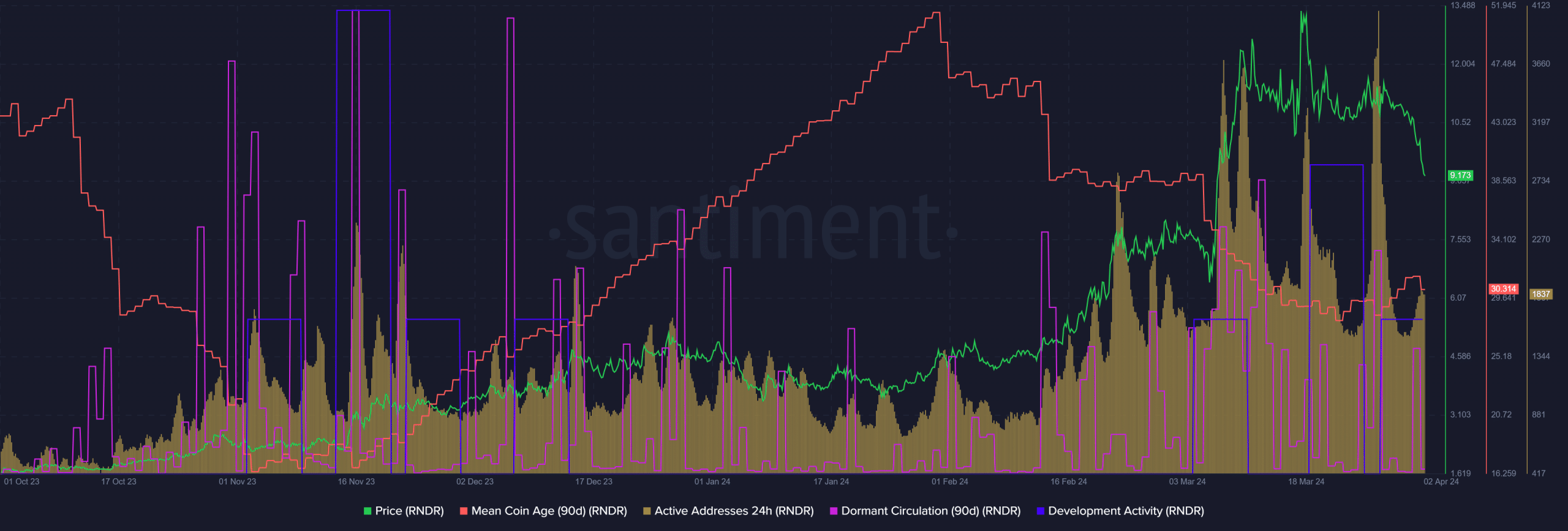

The lively addresses rely trended strongly increased. This was a constructive signal and confirmed elevated participation and demand for the token. The imply coin age has been in decline.

It meant that holders had been transferring their tokens round, probably for promoting functions. It additionally denotes older cash re-entering circulation. The dormant circulation additionally noticed a number of giant spikes.

These spikes rivaled the late December ones in measurement. The metric is one other that usually underlines a sudden enhance in promoting exercise. The worth of RNDR was regular above $10.5 for many of March. The promoting stress of the previous two days noticed consumers lastly succumb.

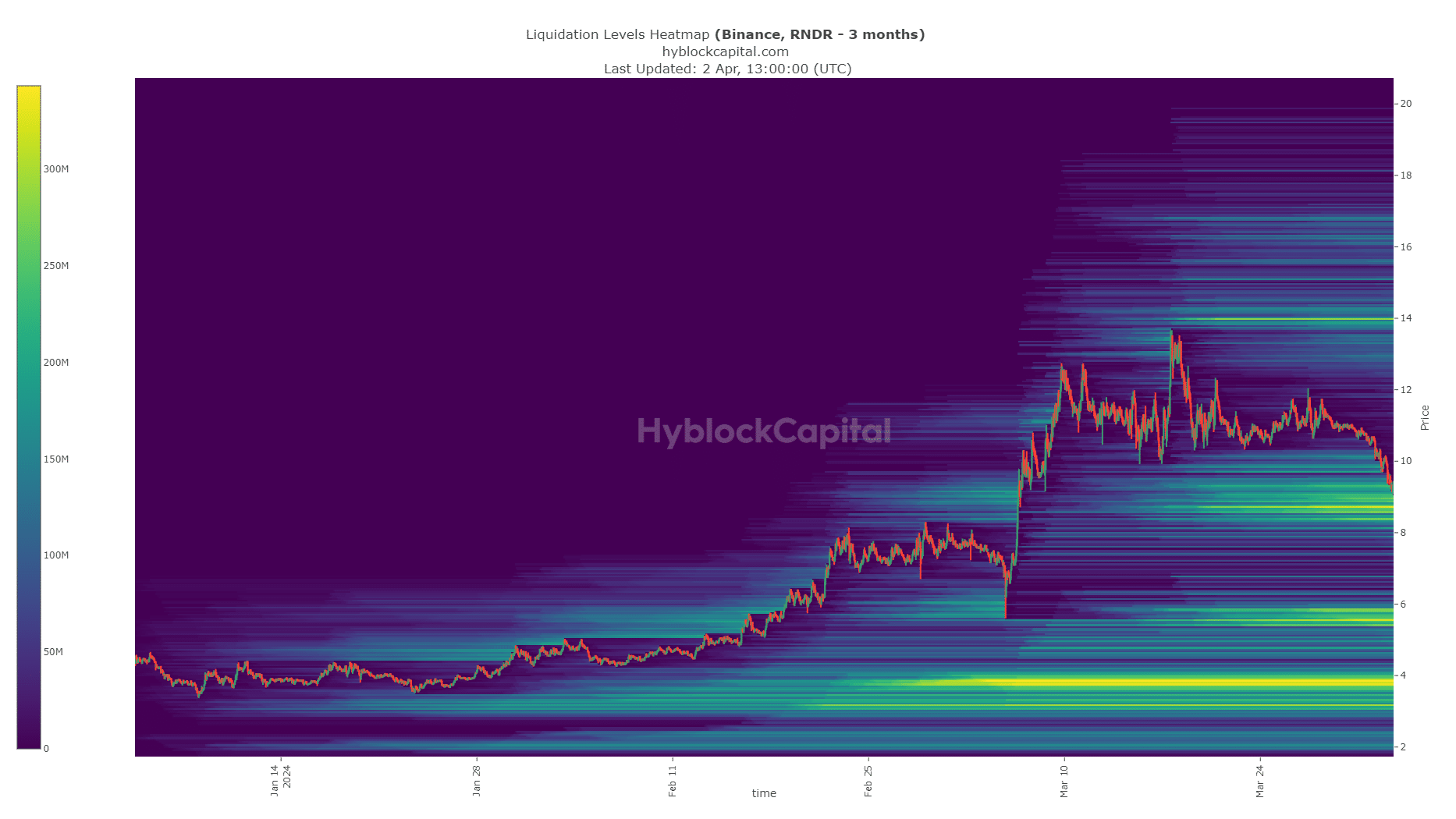

The liquidation heatmap confirmed RNDR costs falling right into a hefty area with an excellent focus of liquidation ranges. The $8.4-$8.7 space was estimated to have much more liquidation ranges.

It’s attainable that one other wave of promoting stress might trigger costs to cascade beneath the $8 mark earlier than we see a constructive response from costs. For long-term buyers, the $8.4 and the $5.7-$5.9 areas offered an excellent shopping for alternative.

Evaluation of the value motion of Bitcoin and cautious threat administration would assist maintain buyers from panicking within the situation of an prolonged downtrend in April.

Fetch.ai noticed sturdy improvement exercise

The bullish efficiency of FET on the charts was simply one of many components that will maintain buyers assured. The alliance for decentralized synthetic intelligence was one other occasion whose narrative might final all through this run.

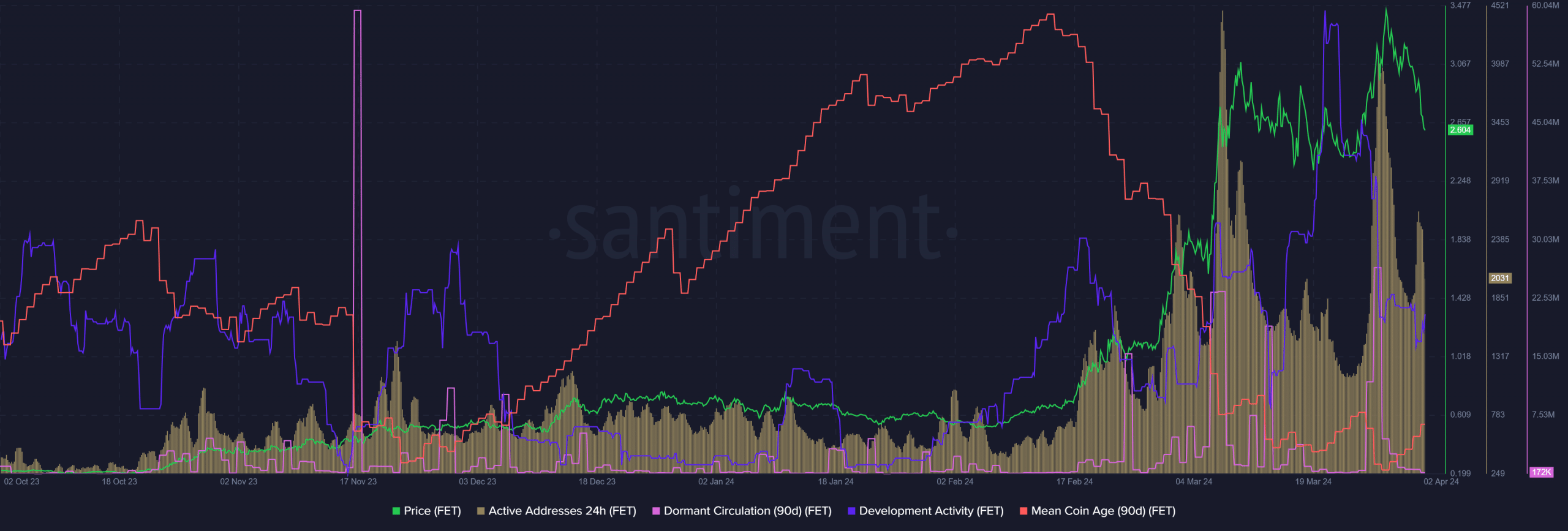

The event exercise of FET has been excessive since February, displaying that there was important work happening behind the scenes. The lively addresses noticed a number of spikes of a substantial measurement in March.

The dormant circulation additionally noticed a rise It was an indication of promoting exercise from holders who realized earnings from the latest rally. But, this promoting was not sufficient to drive a bearish market construction break on FET within the increased timeframe charts.

The imply coin age had been trending firmly downward as costs rallied since February. Over the previous 5 days, the metric tried to push increased and start to determine an uptrend. Merchants and buyers can keep watch over its motion within the coming days to get clues on whether or not an accumulation part is starting.

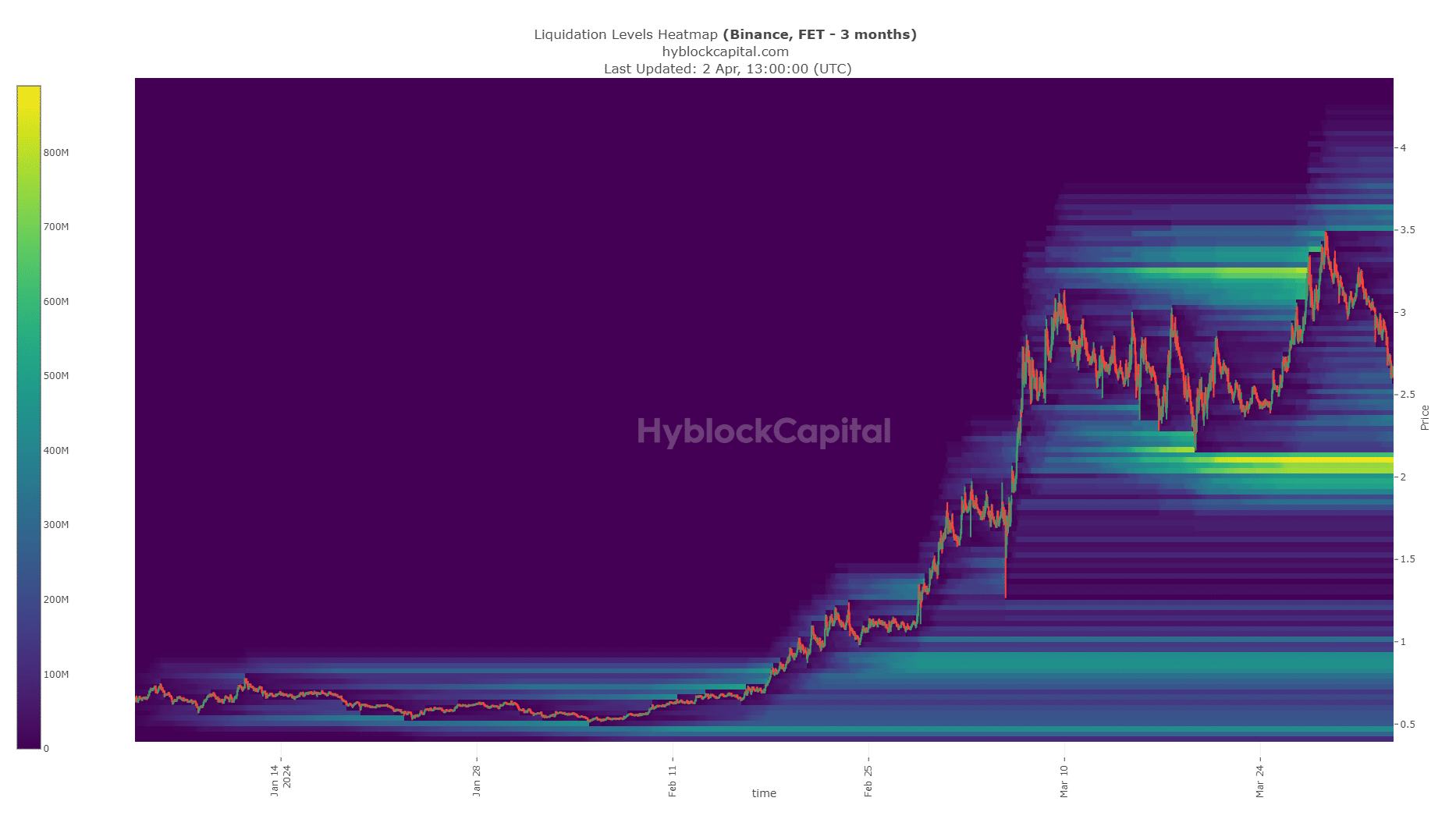

The latest rally to $3.5 took out the big focus of liquidation ranges at $3.25. After sweeping that pool of liquidity, the value started to reverse its development. FET had begun its retracement even earlier than the latest Bitcoin downturn.

Learn Fetch.ai’s [FET] Worth Prediction 2023-24

There was a excessive focus of liquidation ranges on the $2-$2.15 area.

It was attainable that Fetch.ai costs might fall to this zone, particularly if Bitcoin continued to submit losses. The development would possibly reverse as soon as this pocket of liquidity is hit.