The third quarter of 2023 was the primary quarter of tightening monetary circumstances since 2022 with September the largest month-to-month tightening of circumstances in a yr.

And in case you’re questioning why? It is easy, the low got here at nearly precisely the time of the final Fed hike (July 26)…

Supply: Bloomberg

That tightening of economic circumstances in Q3 corresponded to a collapse in ‘onerous’ knowledge (its greatest quarterly plunge since This autumn 2020) whereas ‘comfortable’ survey knowledge soared (its greatest quarterly leap since Q1 2020)…

Supply: Bloomberg

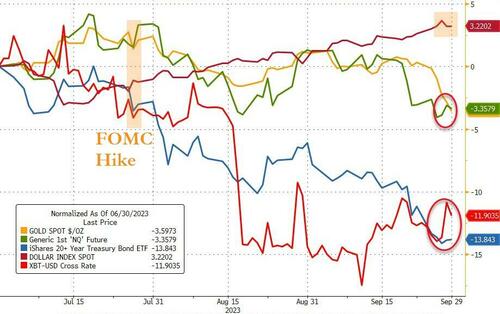

And that left the greenback greater in Q3, however all the pieces else decrease (bonds and bitcoin worst, gold and shares unhealthy)…

Supply: Bloomberg

Since making YTD highs in mid-July (final Fed hike), NDX is down 8 of 11 weeks for a cumulative selloff of seven%. Over the identical timeframe, US 10-year be aware yields have risen from 3.79% to 4.58% – most likely not a coincidence.

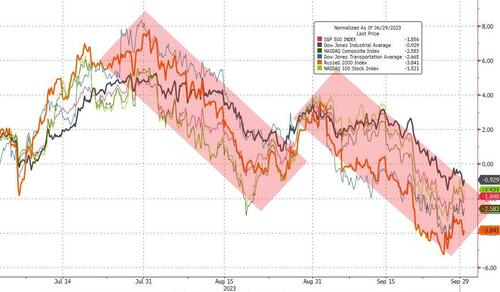

All of the majors are within the pink to shut Q3 with Small Caps the laggard and Dow the prettiest horse within the glue manufacturing unit…

Supply: Bloomberg

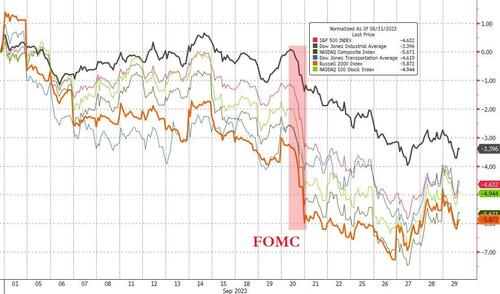

September noticed losses speed up after the FOMC assembly…

Supply: Bloomberg

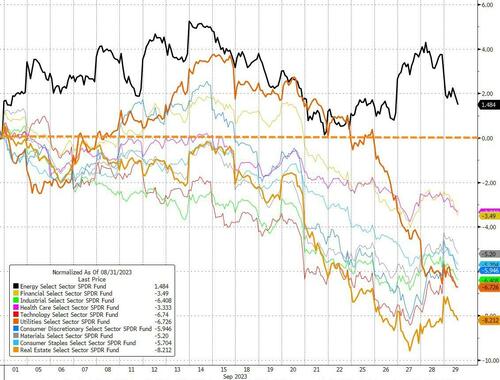

The power sector was the one fairness cohort to finish the third quarter within the inexperienced with Utes and Actual Property the ugliest horse within the glue manufacturing unit…

Supply: Bloomberg

Equally, September was even uglier general with Vitality managing to carry inexperienced however each different fairness sector slammed (once more led by Utes and Actual Property)…

Supply: Bloomberg

Bonds have been battered in Q3 with the long-end yields up over 90bps…

Supply: Bloomberg

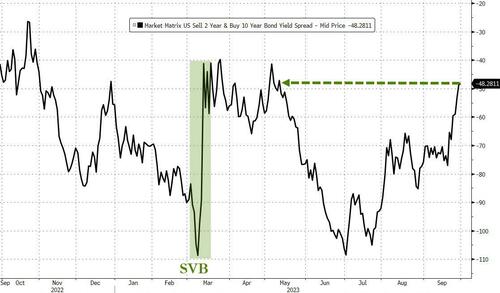

September was a US bond market massacre with all the curve dramatically greater in yield. The final week has seen the short-end outperform, steepening the yield curve…

Supply: Bloomberg

Bonds have been battered…globally

-

5y US yield highest since 2007

-

10y US yield highest since 2007

-

30y US yield highest since 2010

-

10y German yield highest since 2011

-

Japan 10y highest since 2013

-

Japan 20y highest since 2014

-

Japan 30y highest since 2013

-

That US 30-year yields prolonged April 2022’s escape of a downtrend that’s lasted because the Nineteen Eighties might be probably the most vital financial improvement of the present period.

Fee change expectations for 2023 are principally unchanged for Q3 (inexperienced strains) however the expectation for rate-cuts in 2024 (blue line) has fallen dramatically (hawkishly greater expectations for charges)…

Supply: Bloomberg

The greenback rallied for the second straight month in September to its highest shut since Nov 2022. Q3 was the greenback’s first constructive quarter since 2022…

Supply: Bloomberg

Crypto was principally unchanged in September, rallying again within the final couple of days to erase the puke on the finish of August. Nonetheless, Whereas Solana and Ripple outperformed in Q3, Ethereum and Bitcoin have been battered, down 10-11%…

Supply: Bloomberg

In commodity-land, Q3 was an ideal one for crude markets. NatGas additionally gained… however copper and PMs principally went nowhere…

Supply: Bloomberg

September was a shitshow throughout commodities with power (crude and natgas hovering) whereas copper (progress) and valuable metals (tightening coverage) dumped. Silver was clubbed like a child seal to finish the month…

Supply: Bloomberg

Gold suffered ‘Dying Cross’ this week…

Supply: Bloomberg

Oil has prolonged its positive factors since its ‘Golden Cross’ in August, buying and selling again at pre-Putin-Invasion ranges…

Supply: Bloomberg

The huge outperformance of crude over copper pushed it as much as traditionally key resistance stage…

Supply: Bloomberg

Additionally, Gold is at its most cost-effective to crude in a yr and likewise at a key assist stage…

Supply: Bloomberg

Lastly, the disconnect between actual yields and the S&P 500’s P/E valuation got here into the month at a famous excessive. And whereas the index has repriced ~5% decrease, actual yields elevated, too…

Supply: Bloomberg

As Powell mentioned at Jackson Gap final yr, there’s extra ache to come back right here.

Loading…