Authored by Michael Maharrey via SchiffGold.com,

The monetary disaster that kicked off in March continues to bubble beneath the floor…

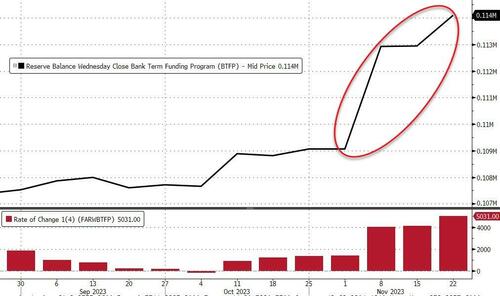

Complete excellent loans within the Federal Reserve’s bank bailout program jumped by simply over $5 billion in November.

There was a sudden spike in banks tapping into the bailout program in the course of the first week of the month with monetary establishments borrowing $3.87 billion from the Bank Term Funding Program (BTFP). There was one other surge in borrowing between Nov. 15 and Nov. 22, in accordance with Fed knowledge.

As of Nov. 22, there was $114.1 billion in excellent loans within the BTFP financial institution bailout program.

As you’ll be able to see from the chart, borrowing had leveled off in August earlier than the sudden spike in November. Remember that banks have been nonetheless tapping into the bailout whilst the full stability in this system plateaued. Some banks have been paying off loans as others borrowed.

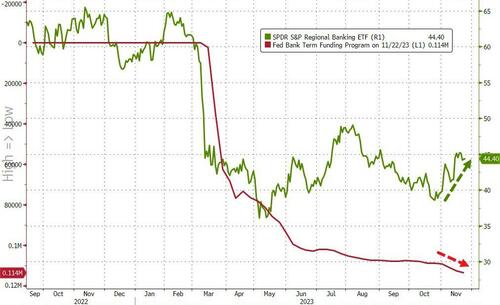

The truth that banks are nonetheless accessing the bailout program, and out of the blue at a quicker price, would appear to point that the banking sector stays shaky.

After the collapse of Silicon Valley Financial institution and Signature Financial institution, the Fed created the BTFP, permitting banks to simply entry capital “to assist guarantee banks have the flexibility to fulfill the wants of all their depositors.”

The BTFP provides loans of as much as one yr in size to banks, financial savings associations, credit score unions, and different eligible depository establishments pledging US Treasuries, company debt and mortgage-backed securities, and different qualifying belongings as collateral. Banks can borrow in opposition to their belongings “at par” (face worth).

In line with a Federal Reserve assertion, “the BTFP can be a further supply of liquidity in opposition to high-quality securities, eliminating an establishment’s have to shortly promote these securities in occasions of stress.”

The flexibility to borrow in opposition to the face worth of their bond portfolios is a sweetheart deal for banks given the large drop in bond costs.

Because the Fed jacked up rates of interest to battle worth inflation, it decimated the bond market. (Bond costs and rates of interest are inversely correlated. As rates of interest rise, bond costs fall.) With rates of interest rising so shortly, banks weren’t in a position to regulate their bond holdings. Consequently, many banks have turn out to be undercapitalized on paper. The banking sector was buried under some $620 billion in unrealized losses on securities on the finish of final yr, in accordance with the Federal Deposit Insurance coverage Corp.

The BTFP offers banks a manner out, or no less than the chance to kick the can down the highway for a yr. As an alternative of promoting bonds which have dropped in worth at an enormous loss, banks can go to the Fed and borrow cash on the bonds’ face worth.

Within the first week of the BTFP, banks borrowed $11.9 billion from this system, together with greater than $300 billion from the already-established Fed Low cost Window.

The Low cost Window requires banks to put up collateral at face worth and loans include a comparatively excessive rate of interest and should put up collateral at honest market worth. Whereas Low cost Window borrowing surged within the weeks after the collapse of SVC and Signature Financial institution, the balances have been shortly paid again down, and Low cost Window borrowing returned to regular ranges.

However borrowing by way of the bailout program by no means slowed down after which out of the blue accelerated this month.

It’s notable that the sudden spike in bailout borrowing occurred even because the bond market rallied and bonds regained a few of their worth. This ostensibly offered some reduction on banks’ stability sheets.

Granted, the $114 billion excellent is insignificant in comparison with the $22.8 trillion in business financial institution belongings held by the 4,100 business banks within the US. The truth that some troubled banks are nonetheless tapping right into a bailout program eight months after the disaster doesn’t essentially imply the banking system is on the snapping point. However whereas the bailouts won’t be a fireplace, it’s no less than smoke. There are nonetheless issues within the banking system effervescent beneath the floor.

It is a predictable consequence of the Fed elevating rates of interest to battle price inflation.

Artificially low rates of interest and straightforward cash are the mom’s milk of this bubble economic system. With everyone from firms, customers, and the federal authorities buried in debt, this economic system and the monetary system merely can’t operate long-term in a excessive rate of interest surroundings. The banking disaster earlier this yr was the very first thing to interrupt because of rising rates of interest. Different issues will observe. We’ve already seen some tremors in the commercial real estate market.

Whilst you may be tempted guilty the Fed’s current price hikes for these points, the actual downside began years in the past.

After the Nice Recession, Federal Reserve coverage deliberately incentivized borrowing to “stimulate” the economic system. It minimize charges to zero and launched three rounds of quantitative easing. After an unsuccessful try and normalize charges and shrink its stability sheet in 2018, the Fed doubled down on simple cash insurance policies in the course of the pandemic. This monetary inflation inevitably led to cost inflation. That pressured the Fed to lift rates of interest. The central financial institution seems to have cooled worth inflation (for now), nevertheless it additionally broke the monetary system.

In impact, the Fed managed to paper over the monetary disaster with this bailout program. It principally slapped a bandaid on it. However it has not addressed the underlying difficulty – the influence of rising rates of interest on an economic system and monetary system hooked on simple cash.

And it’s solely a matter of time earlier than one thing else breaks.

Loading…