The decentralized finance (DeFi) panorama is riddled with vulnerabilities, and the current Multichain hack has added one other darkish chapter to historical past. Fantom, a strong, scalable and safe good contract platform, has been hit arduous after its colossal $1.5 billion exploit, elevating questions on its future viability.

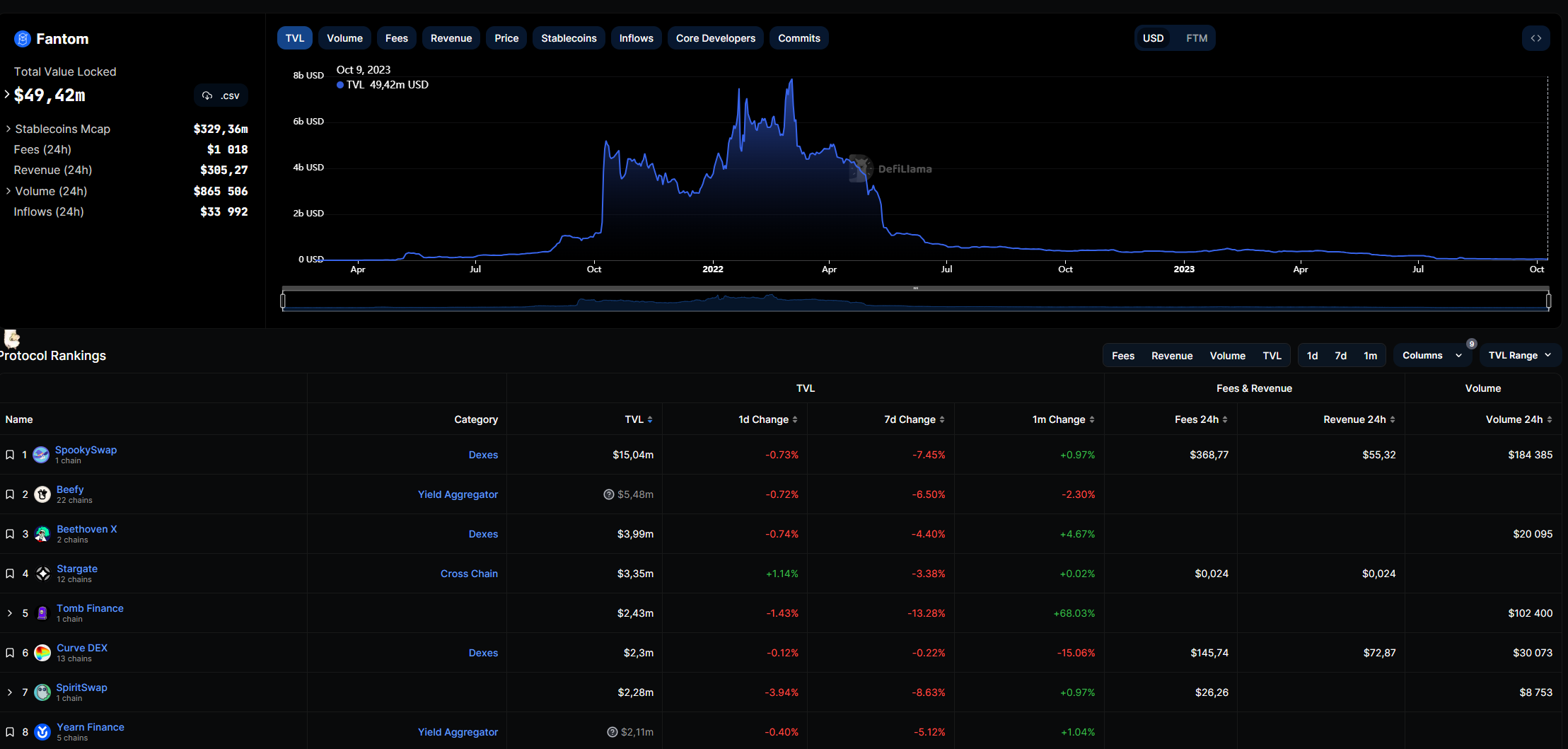

The aftermath of the hack was devastating for Fantom. The TVL (Whole Worth Locked) knowledge, a vital metric to gauge the well being and adoption of DeFi platforms, is at the moment inaccessible, indicating potential knowledge integrity points or a big drop in consumer belief. This lack of transparency additional will increase issues surrounding the platform.

Fantom’s native token, FTM, has additionally suffered the brunt of the hack. The token’s worth is at the moment buying and selling at $0.1847, reflecting the shaken confidence and uncertainty clouding Fantom’s future. The dramatic worth drop is a testomony to the unfavourable impression such safety breaches can have on a platform’s repute and consumer base.

Outstanding figures within the DeFi panorama have expressed issues about Fantom’s future. One notable declare means that FTM, with a market capitalization of $563 million, is “essentially overvalued” and on its method to turning into a “ghost chain,” drawing parallels to the destiny of Concord. Such sentiments, coming from influential voices locally, can additional dampen investor and consumer enthusiasm.

The Multichain hack serves as a stark reminder of the challenges and vulnerabilities inherent within the DeFi area. Whereas the promise of decentralized finance is revolutionary, the trail to its mainstream adoption is affected by hurdles. Safety breaches of this magnitude not solely hurt the affected platform, but in addition forged a shadow over the complete ecosystem.