Dragon Claws

ETF Overview

The iShares Fallen Angels USD Bond ETF (NASDAQ:FALN) seeks to offer buyers with funding outcomes which correspond to the Bloomberg U.S. Excessive Yield Fallen Angel 3% Capped Index. The index is designed to mirror efficiency of U.S. dollar-denominated, excessive yield company bonds that had been beforehand rated funding grade.

FALN at present has ~$1.3 billion in web belongings and costs an expense ratio of 0.25%. The fund at present holds 209 completely different securities, has a mean yield to maturity of 8.14%, a 30 Day SEC Yield of 8.17%, and an efficient length of 4.74 years.

FALN is properly positioned to make the most of pressured promoting that happens when an organization’s credit standing will get downgraded from funding grade to junk. The fund has exhibited very sturdy threat adjusted returns in comparison with conventional excessive yield ETFs suggesting the structural edge associated to fallen angel investing is persistent and powerful. For that reason, I imagine FALN represents a wonderful means for buyers to get publicity to the excessive yield bond market.

Funding Technique

The concept behind the fallen angels technique is that junk bonds which had been beforehand rated funding grade have a decrease chance of default than bonds which had been rated excessive yield at issuance. Regardless of the comparatively prime quality nature of many fallen angel issuers, some regulated institutional buyers together with some insurance coverage corporations are pressured to promote as they can’t maintain bonds rated beneath funding grade. Moreover, some insurance coverage corporations and banks face a significantly bigger capital cost for holding junk bonds in comparison with funding grade bonds and infrequently promote within the occasion of a credit score downgrade.

Affordable Administration Payment

FALN costs an expense ratio of simply 0.25%. To place that into context, the common fastened earnings ETF expense ratio is ~0.11%.

Whereas FALN is dearer than the common fastened earnings ETF, it permits buyers to get publicity to a phase of the market which is troublesome to entry. FALN seems moderately priced in comparison with its closest peer the VanEck Fallen Angel Excessive Yield Bond ETF (ANGL) which has an expense ratio of 0.35%. FALN is attractively priced in comparison with different excessive yield merchandise such because the SPDR Bloomberg Excessive Yield Bond ETF (JNK) and the iShares iBoxx $ Excessive Yield Company Bond ETF (HYG) which have expense ratios of 0.40% and 0.49% respectively.

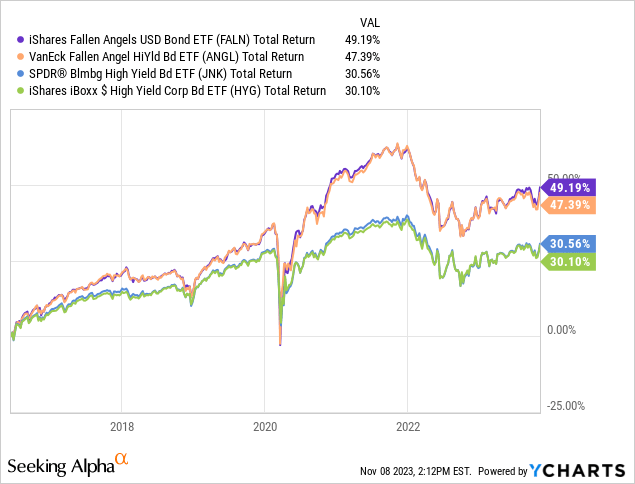

Sturdy Historic Efficiency

FALN launched in June 2017 and has considerably outperformed different conventional company excessive yield since then. Since inception, FALN has delivered a complete return of 49.2% in comparison with a complete return of 30.5% delivered by JNK and a complete return of 30.1% delivered by HYG. Along with outperforming these ETFs, FALN has additionally outperformed its closest peer ANGL by 1.8%.

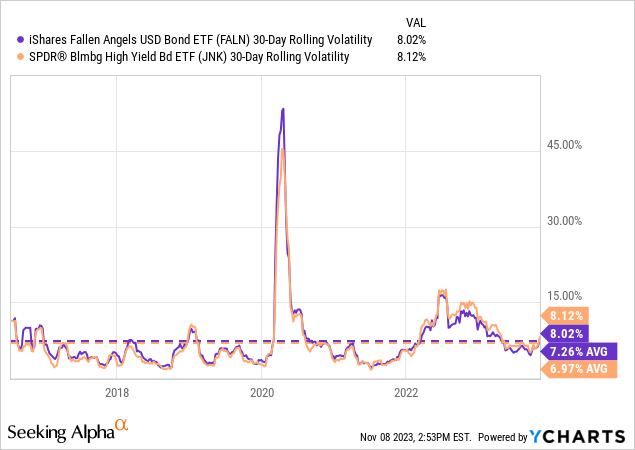

FALN’s outperformance of conventional excessive yield ETFs reminiscent of JNK if much more spectacular when contemplating FALN has realized roughly the identical common volatility as JNK. Thus, along with outperforming on an absolute foundation FALN additionally has outperformed on a threat adjusted foundation.

Holdings Evaluation

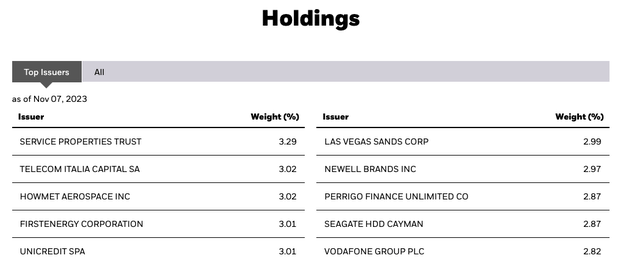

FALN is properly diversified with the highest 10 issuers accounting for 15.3% of the whole fund.

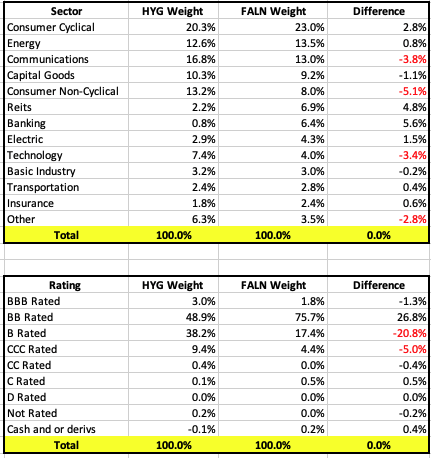

To get a way of how FALN compares to conventional excessive yield ETFs reminiscent of HYG, it’s helpful to check sector and credit score rankings. As proven by the desk beneath, on a sector foundation FALN has important overweights in banking and REITs relative to HYG. These overweights are offset by underweights to the buyer non-cyclicals, communications, and know-how sectors.

Whereas the sector variations are significant, FALN actually stands out for its completely different common ranking profile vs HYG. FALN has considerably extra publicity to BB rated credit than HYG (75.7% in comparison with 48.9%) which is offset by much less publicity to B and CCC rated credit. Thus, primarily based on credit score rankings FALN seems to exhibit a better high quality portfolio than HYG.

iShares

Writer (information from iShares)

Barely Decrease Yield Than Conventional Excessive Yield ETFs

As mentioned within the earlier part, FALN has a better high quality credit score portfolio than HYG. The market is conscious of this and thus FALN presents barely much less credit score unfold in comparison with HYG.

At present, JNK has a mean yield to maturity of 8.68% in comparison with 8.14% for FALN. This distinction is pushed by credit score spreads as JNK has an choice adjusted unfold (“OAS”) of 371bps in comparison with a 322bps for FALN.

Future Efficiency

I count on FALN’s long-term threat adjusted historic outperformance of conventional excessive yield ETFs to proceed. FALN’s sturdy historic efficiency via a number of investing environments suggests the structural edge associated to fallen angel investing is powerful and constant. Furthermore, the whole mixed belongings of FALN and its peer ANGL is simply $3.8 billion. Comparably, different conventional excessive yield ETFs have a a lot excessive stage of belongings. JNK and HYG mixed at present have $21.7 billion in belongings.

Dangers To Think about

The first threat think about when investing in FALN (or some other excessive yield ETF) is credit score threat. Whereas FALN holdings are targeted on the upper high quality a part of the excessive yield market, the very fact stays that FALN holds excessive threat company bonds. Within the occasion of a recession, FALN may expertise important losses. Buyers who maintain FALN ought to proceed to actively monitor the macroeconomic surroundings.

One other threat to think about because it pertains to FALN is the likelihood that the market turns into extra environment friendly in the best way it costs “fallen angles.” Given the sturdy historic efficiency of fallen angel merchandise reminiscent of FALN relative to different excessive yield bonds, buyers might search to take a position extra aggressively in fallen angel bonds. Vital inflows into the technique might drive up the worth of fallen angel bonds vs different excessive yield bonds. The results of this can be a lack of structural edge for the fallen angel technique. With a view to monitor this threat buyers ought to do just a few issues.

First, buyers ought to monitor the distinction in yield between FALN and conventional excessive yield ETFs reminiscent of HYG as a wider yield differential might point out a change in relative credit score pricing. Second, buyers ought to regulate relative efficiency of FALN vs conventional excessive yield ETFs to see if the structural edge continues to persist. Lastly, buyers also needs to monitor the whole belongings invested in FALN and ANGL in comparison with conventional excessive yield funds reminiscent of JNK and HYG.

Conclusion

In a world the place many new ETFs have come to market providing very excessive charges for merchandise that fail to ship, FALN stands out as an ideal ETF which has delivered on its aims whereas charging cheap charges.

FALN permits buyers to profit from pressured promoting of top of the range that get downgraded.

FALN has a really sturdy historical past of outperforming conventional excessive yield ETFs reminiscent of HYG and JNK on each an absolute and threat adjusted foundation. FALN has additionally outperformed its closest peer ETF ANGL.

FALN presents increased high quality excessive yield company bond publicity in comparison with conventional ETFs. The market is conscious of the standard distinction between FALN’s holdings and conventional ETFs reminiscent of HYG and thus FALN carries a barely decrease yield than conventional excessive yield ETFs (0.54% decrease common yield to maturity.) Nonetheless, historic efficiency has proven that that distinction is greater than accounted for by the upper high quality nature of FALN’s portfolio.

I imagine FALN represents a wonderful means for buyers to get publicity to the excessive yield company bond market. FALN has a really sturdy historic efficiency in comparison with different excessive yield merchandise and I count on this to proceed going ahead. Nonetheless, buyers ought to proceed to observe yields, belongings, and efficiency relative to conventional excessive yield ETFs to make sure the structural edge stays in place.