Overview

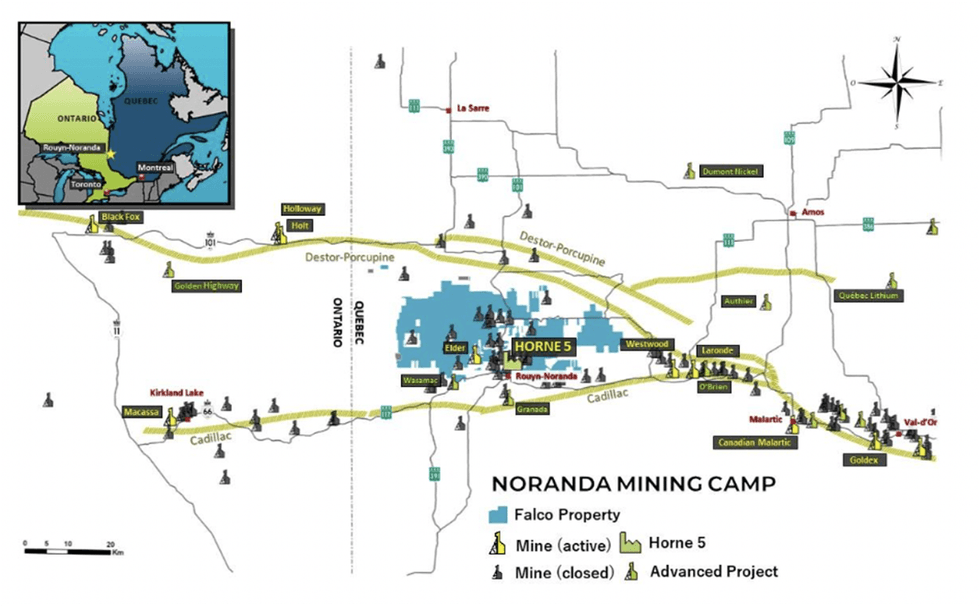

Falco Sources (TSXV:FPC) is a Canadian firm centered on creating gold and base metallic initiatives within the Rouyn-Noranda area of Quebec. Rouyn-Noranda is a longtime mining camp with an extended historical past of exploration and growth. The Noranda mining camp has traditionally produced 19 million ounces (Moz) of gold and a couple of.9 billion kilos (Blbs) of copper, and but it’s nonetheless under-explored for gold.

Falcon’s principal property, Horne 5 venture, holds 67,000 acres or almost 67 % of the whole space of your entire mining camp and is positioned underneath the previous Horne mine which produced 11.6 Moz of gold and a couple of.5 Blbs of copper. The 2021 feasibility examine on the Horne 5 venture suggests sturdy venture economics with a complete mine lifetime of 15 years, after-tax NPV at 5 % of US$761 million, and a payback interval of 4.8 years, assuming gold costs at $1,600/oz. On the present gold costs of over $2,300/oz, the venture economics might be even higher.

Current information circulation together with the working lease and indemnity settlement (OLIA) with Glencore (LON:GLEN) and the Horne 5 venture’s environmental influence evaluation (EIA) admissibility are important milestones within the development of the venture in the direction of development. Falco is now aiming to proceed with the following steps associated to acquiring authorities permits and financing for its Horne 5 venture.

Falco Sources working license and indemnity settlement (OLIA) with Glencore Canada will allow Falco to make the most of a portion of Glencore’s lands. The settlement entails establishing a technical committee comprising two representatives from Glencore and two from Falco, tasked with safeguarding the uninterrupted operations of Glencore’s Horne copper smelter. Moreover, a parallel strategic committee might be shaped. Glencore will nominate one consultant to hitch Falco’s board of administrators.

The profitable completion of the OLIA, coupled with life-of-mine copper-zinc focus offtake agreements with Glencore, positions Falco to advance its Horne 5 venture in the direction of development. The corporate is advancing with the allowing and financing processes for the venture.

The Horne 5 venture is a world-class deposit positioned beneath the previous Horne mine within the Rouyn -Noranda mining camp. Horne mine was operated by Noranda from 1926 to 1976 and produced 11.6 Moz of gold and a couple of.5 Blbs of copper. The Rouyn-Noranda mining camp has a wealthy exploration historical past having produced 19 Moz of gold and a couple of.9 Blbs of copper. The camp has hosted 50 producers together with 20 base metallic mines and 30 gold mines.

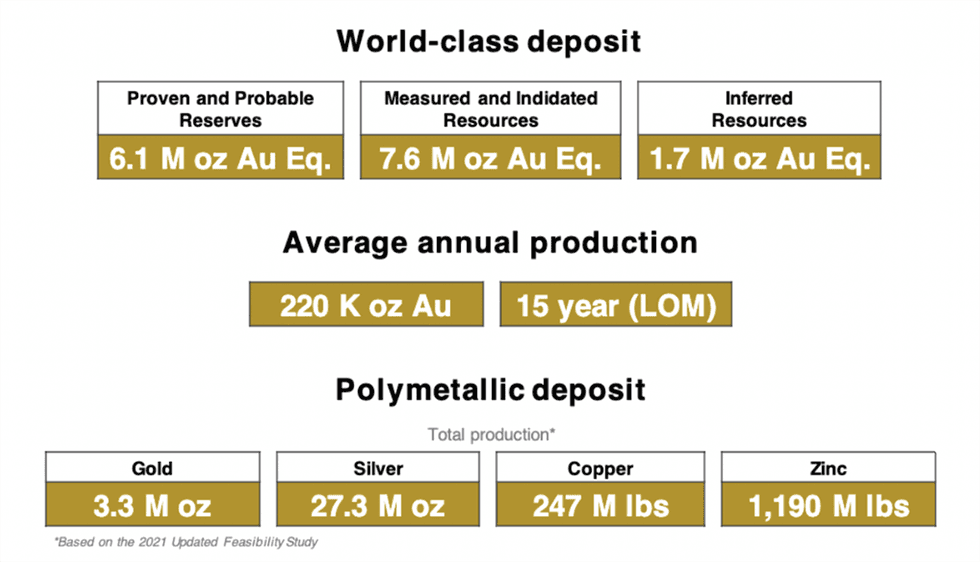

The Horne 5 is a world-class deposit containing 6.1 Moz gold equal in confirmed and possible reserves, 7.6 Moz gold equal in measured and indicated assets, and 1.7 Moz gold equal in inferred assets. The venture boasts sturdy companions together with Osisko Growth, Osisko Gold Royalties, Glencore, and the Quebec Authorities. Osisko Growth is a significant shareholder in Falco Sources with a 17.3 % stake, and the Quebec Authorities holds shut to eight % stake in Falco.

Except for gold, Horne 5 has important base metallic by-products. As per the feasibility examine, valuable metals (gold + silver) account for 75.6 % of the mining income, whereas base metals (copper and zinc), account for twenty-four.3 % of the whole mine income.

The 2021 up to date feasibility examine on the Horne 5 venture signifies sturdy venture economics. The feasibility examine reveals the venture would generate an after-tax NPV at 5 % of US$761 million and an after-tax IRR of 18.9 % over the 15-year mine life. The manufacturing profile would common annual manufacturing of 220,300 ozgold over the lifetime of the mine. Additional, the examine suggests important copper and zinc by-product credit from the copper and zinc manufacturing, in addition to the extremely automated trendy operations leading to a low projected all-in sustaining price (AISC) of $587/oz. Horne 5’s AISC is among the many first quartile of worldwide low-cost operations.

Current information flows together with the OLIA with Glencore and the Horne 5 venture’s EIA admissibility are important milestones within the development of the venture in the direction of development.

Falco Sources’ OLIA with Glencore Canada permits Falco to make the most of a portion of Glencore’s lands. The settlement entails establishing a technical committee comprising two representatives from Glencore and two from Falco, tasked with safeguarding the uninterrupted operations of Glencore’s Horne copper smelter. Moreover, a parallel strategic committee might be shaped. Glencore will nominate one consultant to hitch Falco’s board of administrators.

The profitable completion of OLIA coupled with life-of-mine copper-zinc focus offtake agreements with Glencore positions Falco to advance its Horne 5 venture in the direction of development. Additional, the receipt of affirmation of the admissibility of its EIA for the Horne 5 venture from the Ministry of the Setting, the Struggle Towards Local weather Change, Wildlife and Parks is a major milestone. It supplies a path ahead for the development of the venture.

The corporate is now advancing with the allowing and financing processes for the venture. The development of the Horne 5 mine may start by February 2025.

Administration Crew

Luc Lessard – President, Chief Government Officer and Director

Luc Lessard brings over 30 years of expertise within the design, development, and operation of mines. Earlier than becoming a member of Falco, he held senior govt positions at Osisko Gold Royalties, Canadian Malartic GP (a three way partnership of Agnico Eagle Mines and Yamana Gold), and Osisko Mining Company. At Osisko Mining Company, he oversaw the design, development, and commissioning of the Canadian Malartic gold mine. Lessard has been concerned in quite a few floor and underground mining initiatives all through his profession. Lessard holds a bachelor’s diploma in mining engineering from Laval College.

Anthony Glavac – Chief Monetary Officer

Anthony Glavac has 20 years of expertise in monetary reporting, together with over 14 years within the mining business. Earlier than becoming a member of Falco, he served because the director of economic reporting and inner controls at Dynacor Gold Mines and because the interim chief monetary officer at Alderon Iron Ore. Glavac was beforehand the senior supervisor at KPMG, the place he labored with a various portfolio of private and non-private firms, providing companies corresponding to audit, taxation, strategic advisory, and help with public choices. Glavac can be engaged with different public firms inside the mining sector.

Helene Cartier – Vice-president Setting, Sustainable Growth and Neighborhood Relations

Helene Cartier possesses over 20 years of experience within the environmental area. She started her mining profession as a part of the Cambior crew earlier than transitioning to the function of vice-president of environmental companies and sustainable growth at Osisko Mining Company. There, she performed a pivotal function within the growth and commissioning phases of the Canadian Malartic gold mine. She has served on the board of administrators of a number of private and non-private firms.

Mireille Tremblay – Vice-president Authorized Affairs and Company Secretary

Mireille Tremblay possesses greater than 25 years of expertise in enterprise regulation, primarily in securities, mergers and acquisitions, company finance, and governance. Earlier than becoming a member of Falco in January 2021 because the director of authorized affairs, Tremblay served as a authorized advisor to shoppers throughout various industries, together with the mining sector. She advocated for firms and buyers concerned in mining transactions in Africa, notably throughout the development of a gold mine in Burkina Faso and in negotiations with the Ivorian authorities. Moreover, she has represented quite a few firms, underwriters, and buyers in numerous contexts, together with public choices and personal placement financings, each domestically and internationally. Tremblay holds a regulation diploma from the College of Montreal.

Mario Caron – Impartial Chair

Mario Caron possesses in depth experience within the mining sector, accumulating over 4 many years of expertise in senior govt and board roles. He has garnered this wealth of data via engagements in underground and open pit operations, each domestically and overseas. Caron has served as CEO of public firms and has expertise securing mining licenses and numerous permits in quite a few jurisdictions. Caron earned his Bachelor of Engineering in mining, at McGill College.

Alexander Dann – Non-independent Director

Alexander Dann, a chartered skilled accountant, has served with multinational public enterprises on monetary operations and strategic planning. He brings greater than 25 years of expertise inside the mining and manufacturing domains. He was chief monetary officer of The Flowr Company, the place he led the corporate in the direction of its public itemizing on the TSXV. He additionally served because the CFO of Avion Gold and Period Sources, contributing considerably till their acquisitions by Endeavour Mining and The Sentient Group, respectively. He holds a bachelor’s diploma in enterprise administration from L’Universite Laval in Quebec Metropolis.

Claude Dufresne – Impartial Director

Claude Dufresne has over three many years of expertise within the mining business. He has served in management roles at firms corresponding to Niobay Metals and IAMGOLD. He was the founding father of a metals firm, Camet Metallurgy, which specialised within the sale and advertising and marketing of varied metals. He obtained a diploma in mining engineering with a specialty in mineral processing from Universite Laval in 1991.

Paola Farnesi – Impartial Director

Paola Farnesi has over 30 years of expertise in company finance, monetary reporting, M&A, and threat administration. She is presently vice-president and treasurer of Domtar Company. Earlier than this, she held numerous senior govt positions at Domtar together with vice-president, inner audit. Earlier than becoming a member of Domtar, Farnesi labored at Ernst & Younger. She holds a Bachelor of Commerce and a Graduate diploma in Public Accountancy from McGill College. She is a member of the Chartered Skilled Accountants of Quebec and has earned the ICD.D designation from the Institute of Company Administrators.

This text was written in collaboration with Couloir Capital.