Information exhibits that cryptocurrency traders’ sentiment has surged to excessive greed just lately, an indication that will not be excellent for Bitcoin.

Bitcoin Worry & Greed Index Is In The Excessive Greed Territory Proper Now

The “Worry & Greed Index” is an indicator created by Alternative that retains monitor of the common sentiment current among the many merchants within the Bitcoin and wider cryptocurrency market.

The index represents this sentiment as a quantity between zero and 100. To calculate the rating, the metric takes into consideration 5 elements: volatility, buying and selling quantity, social media sentiment, market cap dominance, and Google Tendencies.

Associated Studying

When the Worry & Greed Index has a worth larger than 54, the traders are grasping. Then again, values underneath 46 indicate that the market is fearful at the moment. The area between these two cutoffs signifies the territory of a impartial mentality.

Along with these three core sentiments, the index has two particular zones: “excessive greed” and “excessive worry.” The previous happens when the metric surpasses 75, whereas the latter happens at ranges underneath 25.

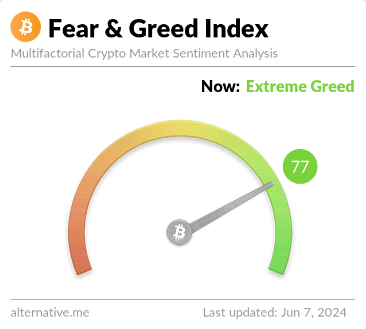

Now, here’s what the sentiment within the Bitcoin market appears like proper now based mostly on the Worry & Greed Index:

As is seen above, the Bitcoin Worry & Greed Index has a worth of 77 in the intervening time, which means that traders as a complete really feel excessive greed.

The present worth means, nonetheless, that the market is simply simply inside this territory. Earlier, the indicator had a decrease worth, however the newest value surge past the $71,000 stage has meant that traders have brazenly jumped on the bull bandwagon.

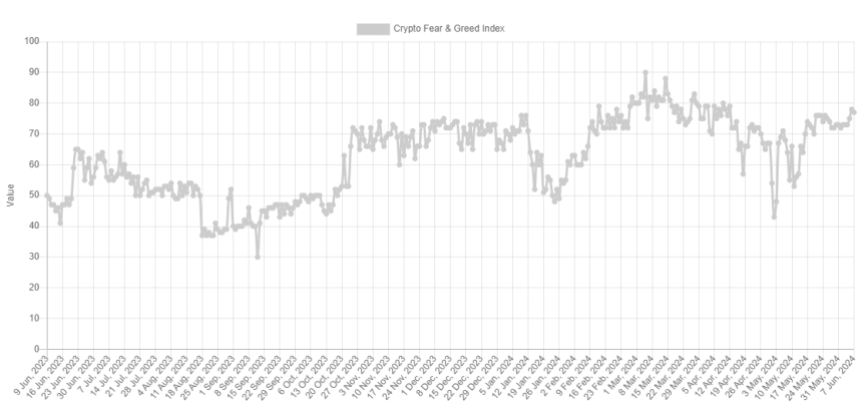

Beneath is a chart exhibiting how the sector’s sentiment has modified over the previous 12 months.

The graph exhibits that the most recent values of the Worry & Greed Index are the best that the cryptocurrency has witnessed for the reason that first half of April.

Between then and now, the one different time the indicator stepped inside the acute greed zone was throughout a stretch in Might. Throughout this part, 76 was the best the metric might go, which is true on the area’s boundary.

Traditionally, the value of Bitcoin has tended to go towards the bulk’s expectations, and the stronger this expectation has turn out to be, the extra doubtless it’s that such a opposite transfer will happen.

Associated Studying

For the reason that excessive sentiment zones are the place the market turns probably the most lopsided, reversals are possible. Naturally, excessive worry is the place bottoms occur, whereas excessive greed can result in tops.

As such, the most recent breach into the acute greed territory might maybe be unhealthy information for the restoration rally. It must be famous, although, that the present stage of the indicator should still not be too excessive in comparison with previous bull run ranges. For instance, the rally to the brand new all-time excessive value in March noticed the indicator peak at 90.

BTC Worth

Up to now in its restoration run, Bitcoin has risen in direction of the $71,500 stage.

Featured picture from Dall-E, Various.me, chart from TradingView.com