Hoptocopter

A Fast Take On Expro Group Holdings

Expro Group Holdings N.V. (NYSE:XPRO) reported its Q3 2023 monetary outcomes on October 26, 2023, lacking each income and consensus earnings estimates.

The agency offers a spread of oilfield providers to exploration & manufacturing corporations worldwide.

Given the challenges the corporate is dealing with in restarting its LWI section, decreased drilling exercise in North and Latin America and rising competitors in sure North American basins, I’m not optimistic about Expro’s development trajectory within the close to time period.

My outlook on XPRO is, subsequently, Impartial [Hold] at the moment.

Expro Group Overview And Market

UK-based Expro Group was based to offer a rising vary of oilfield providers on a worldwide foundation.

The agency is headed by Chief Government Officer Mike Jardon, who joined the agency in 2011 after a profession in numerous senior roles at Schlumberger, a significant oilfield providers firm.

The corporate’s main choices embrace the next:

-

Nicely development

-

Nicely intervention and integrity

-

Nicely circulation administration

-

Subsea nicely entry

-

Geothermal options

-

Carbon seize and storage.

Expro acquires prospects by means of its direct enterprise growth and advertising efforts.

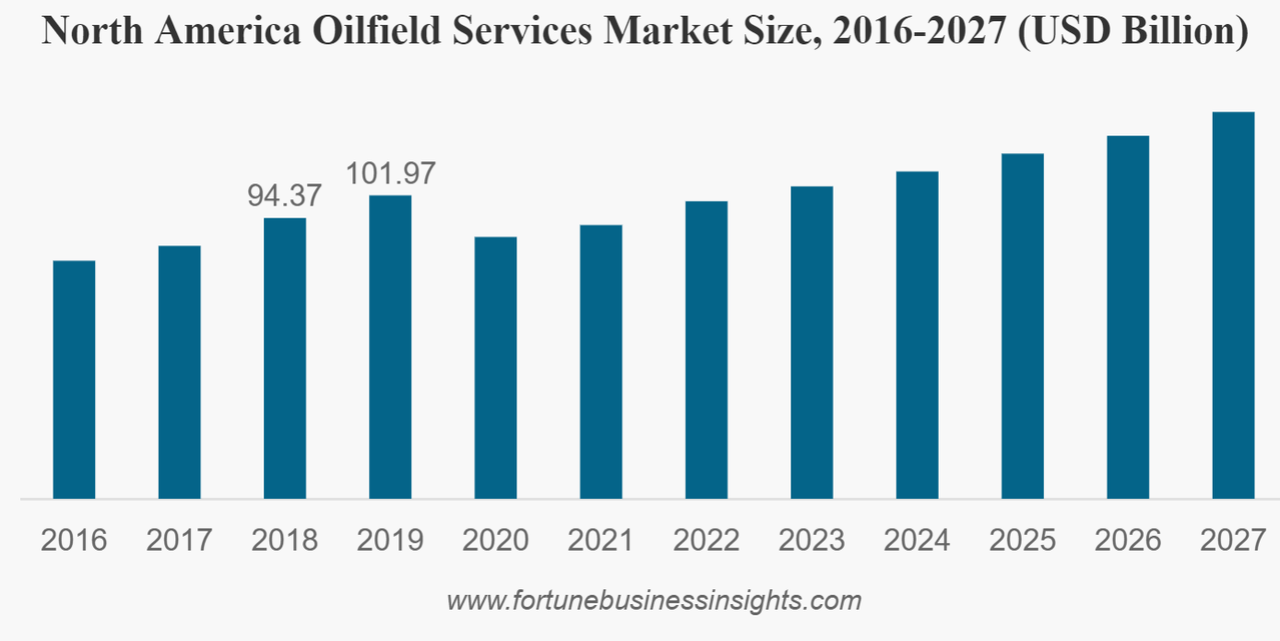

In line with a 2020 market research report by Fortune Enterprise Insights, the worldwide marketplace for oilfield providers of every type was estimated at $268 billion in 2019 and is forecasted to achieve $346 billion by 2027.

This represents a forecast CAGR (Compound Annual Development Charge) of 6.6% from 2020 to 2027.

The principle drivers for this anticipated development are rising manufacturing wants by E&P corporations and ongoing technological enhancements in well-site providers.

Additionally, the chart under reveals the approximate historic and projected trajectory of the North American oilfield providers market by means of 2027:

Fortune Enterprise Insights

Main aggressive or different trade contributors embrace:

-

Schlumberger

-

Halliburton

-

Baker Hughes

-

Weatherford.

Expro Group’s Latest Monetary Tendencies

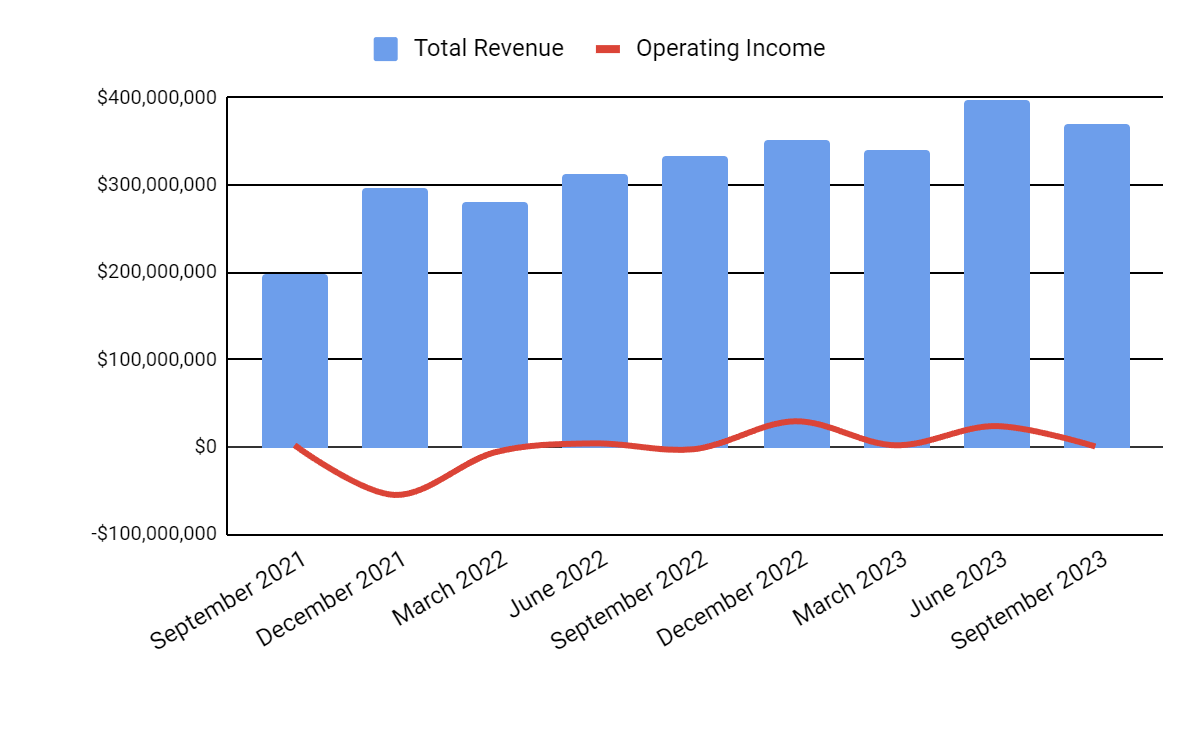

Complete income by quarter (blue columns) has continued to rise year-over-year; Working earnings by quarter (purple line) has been decreased to simply above breakeven:

Searching for Alpha

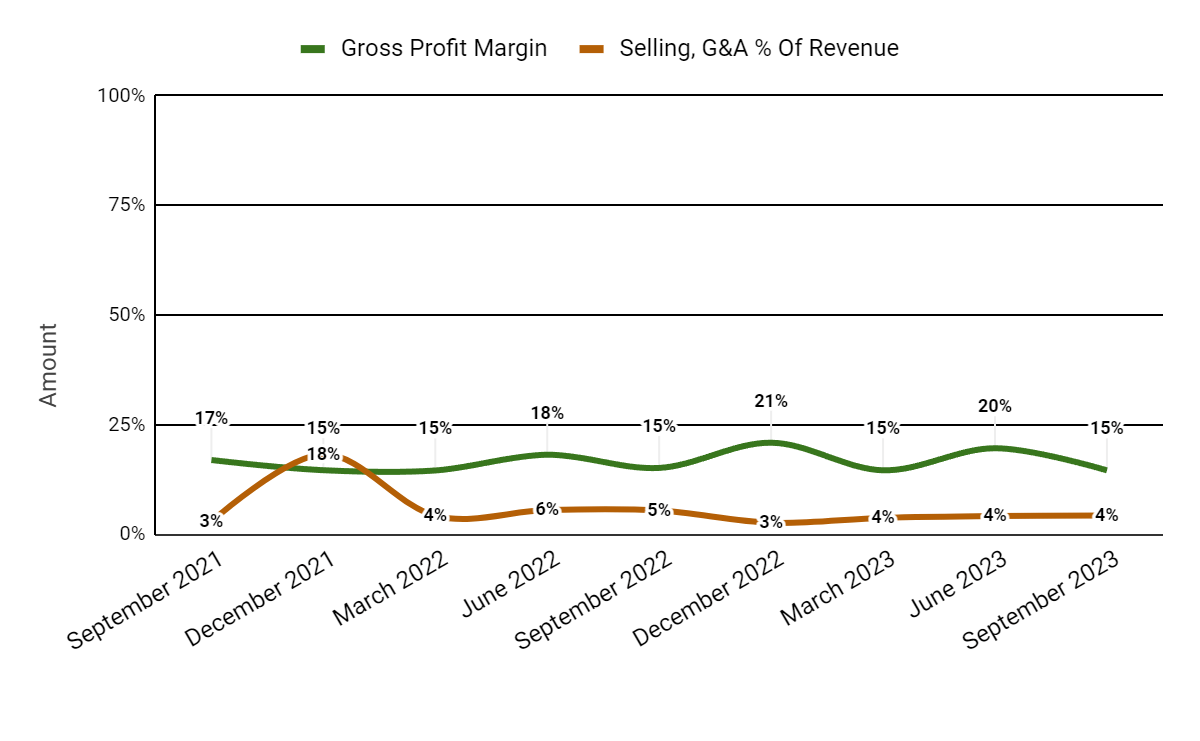

Gross revenue margin by quarter (inexperienced line) has assorted inside a spread with none discernible pattern; Promoting and G&A bills as a proportion of whole income by quarter (amber line) have remained flat at 4% within the final three quarters:

Searching for Alpha

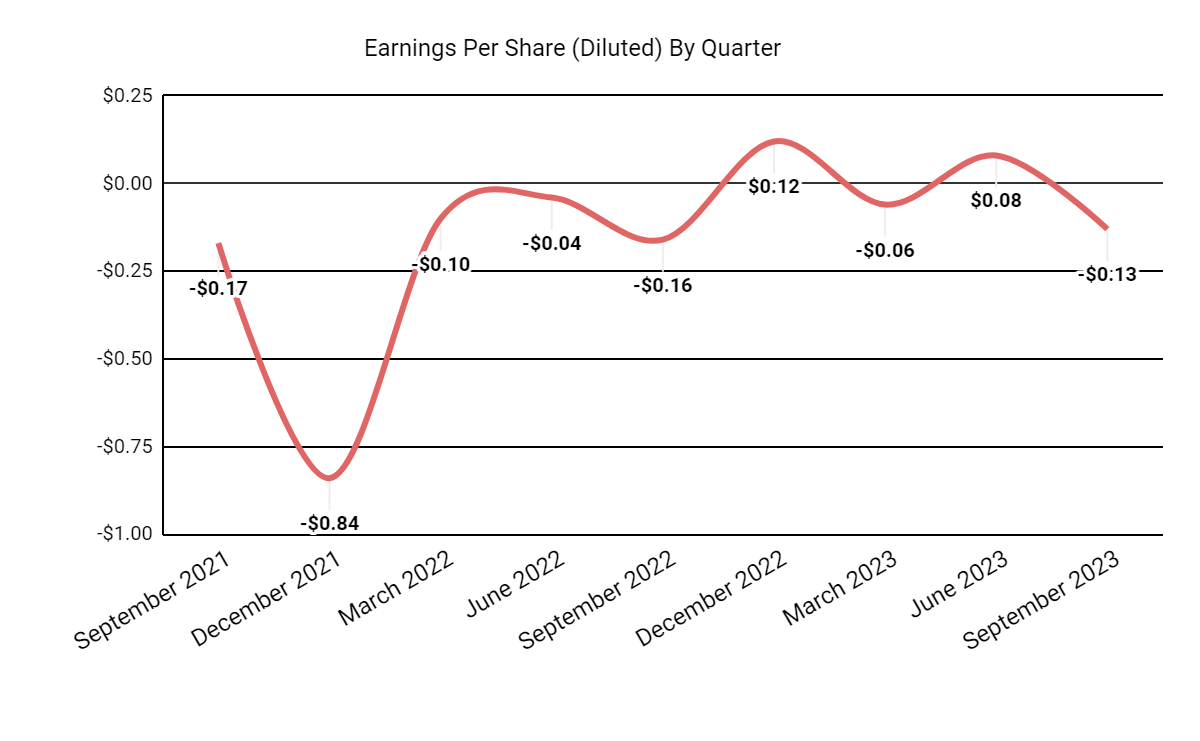

Earnings per share (Diluted) have dropped into detrimental territory in Q3 2023:

Searching for Alpha

(All information within the above charts is GAAP.)

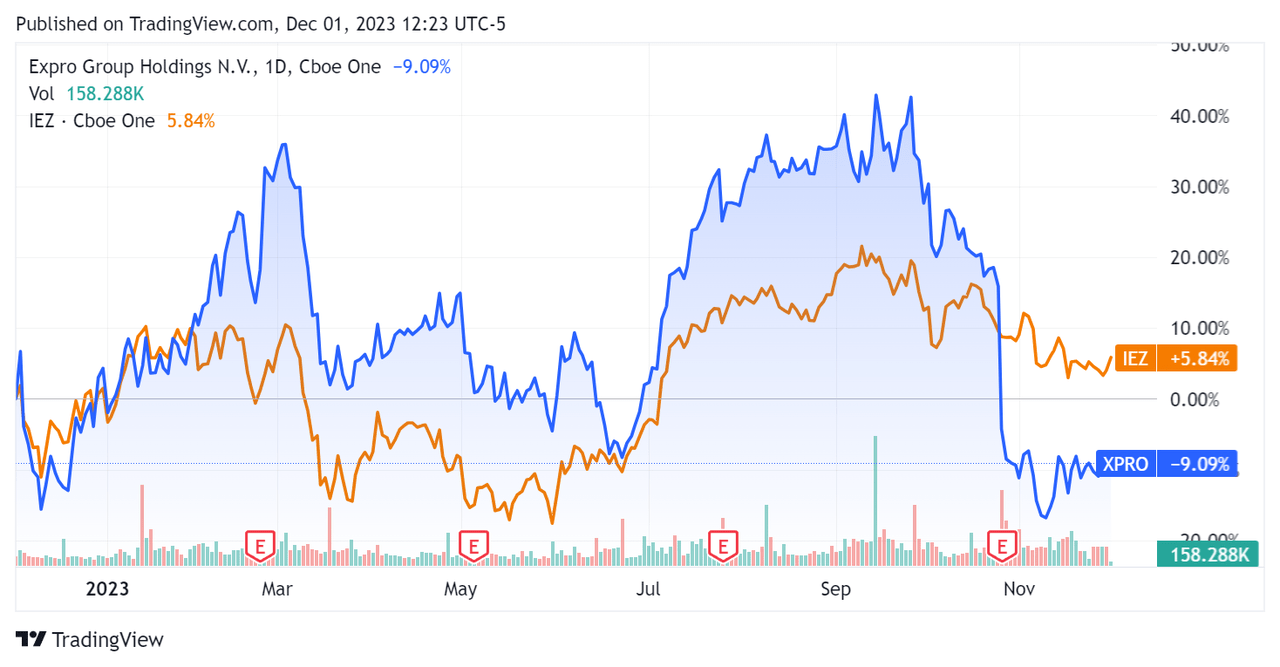

Previously 12 months, XPRO’s inventory worth has fallen 9.09% vs. that of the iShares U.S. Oil Tools & Companies ETF (IEZ) rise of 5.84%:

Searching for Alpha

For steadiness sheet outcomes, the agency ended the quarter with $255.3 million in money and equivalents and $50.0 million in whole debt, all of which was categorized as long run.

Over the trailing twelve months, free money circulation was $82.6 million, throughout which capital expenditures had been $115.9 million. The corporate paid $18.2 million in stock-based compensation within the final 4 quarters.

Valuation And Different Metrics For Expro Group Holdings

Beneath is a desk of related capitalization and valuation figures for the corporate:

|

Measure (Trailing Twelve Months) |

Quantity |

|

Enterprise Worth / Gross sales |

1.1 |

|

Enterprise Worth / EBITDA |

8.1 |

|

Worth / Gross sales |

1.2 |

|

Income Development Charge |

19.0% |

|

Web Earnings Margin |

14.0% |

|

EBITDA % |

13.7% |

|

Market Capitalization |

$1,730,000,000 |

|

Enterprise Worth |

$1,610,000,000 |

|

Working Money Circulation |

$198,470,000 |

|

Earnings Per Share (Totally Diluted) |

$0.01 |

|

Ahead EPS Estimate |

$1.14 |

|

Free Money Circulation Per Share |

$0.76 |

|

SA Quant Rating |

Promote – 2.25 |

(Supply – Searching for Alpha.)

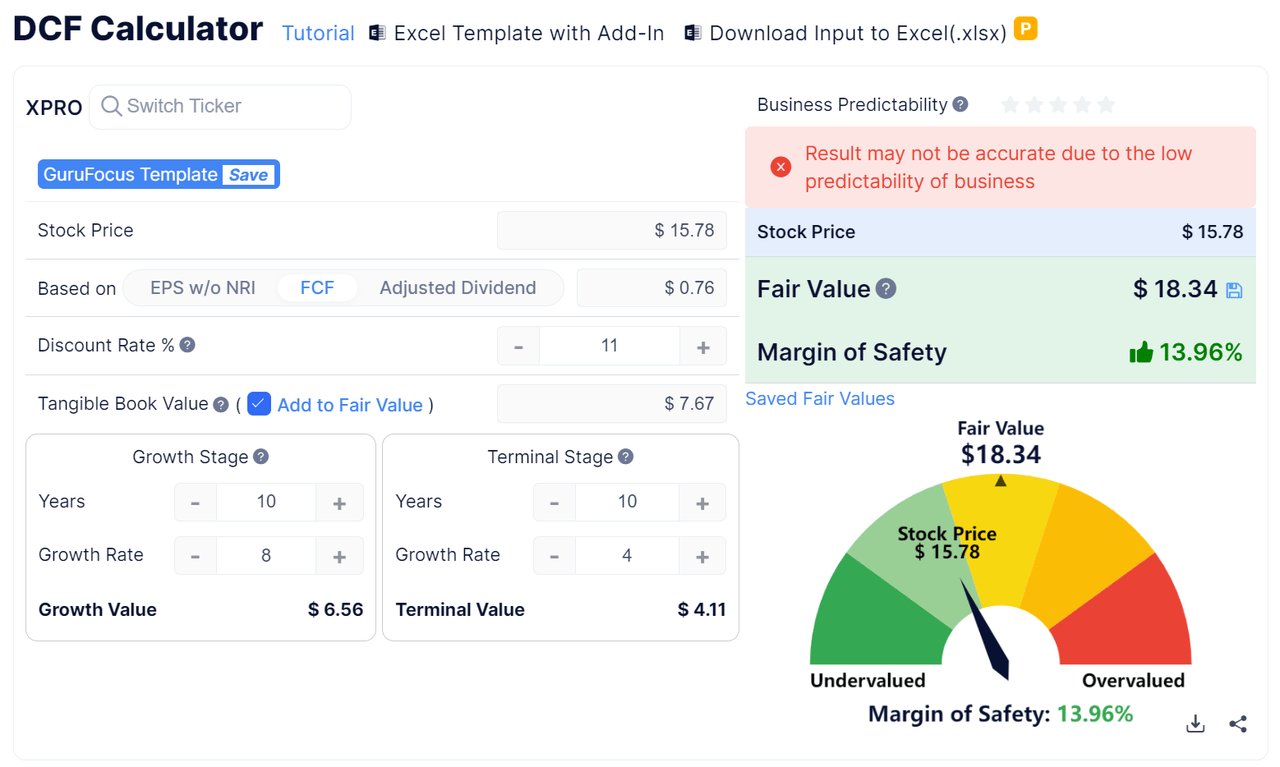

Beneath is an estimated DCF (Discounted Money Circulation) evaluation of the agency’s projected development and free money circulation:

GuruFocus

Based mostly on the DCF, the agency’s shares can be valued at roughly $18.34 versus the present worth of $15.78, indicating they’re doubtlessly at present undervalued.

Nonetheless, the agency’s money circulation era has been “lumpy” and at a traditionally excessive charge in the latest trailing twelve-month interval, so the consequence could also be much less correct attributable to unpredictability in future money flows.

Commentary On Expro Group Holdings

In its final earnings name (Supply – Searching for Alpha), protecting Q3 2023’s outcomes, administration’s ready remarks referenced its current Australia offshore incident involving a vessel-deployed LWI (Mild Nicely Intervention) system failure.

The system will probably take a number of months to get well, and the corporate has suspended all of its vessel-deployed LWI operations consequently.

Its failure has highlighted challenges with “the very best service supply different and essentially the most applicable apportionment of business threat amongst stakeholders.”

The corporate’s Q3 outcomes additionally mirrored decreased drilling actions in North American and Latin American areas.

Expro is contending with an oversupply of tubular operating providers in areas of the U.S. onshore market, with opponents reducing costs to develop market share, so it’s redeploying gear away from the most-impacted markets accordingly.

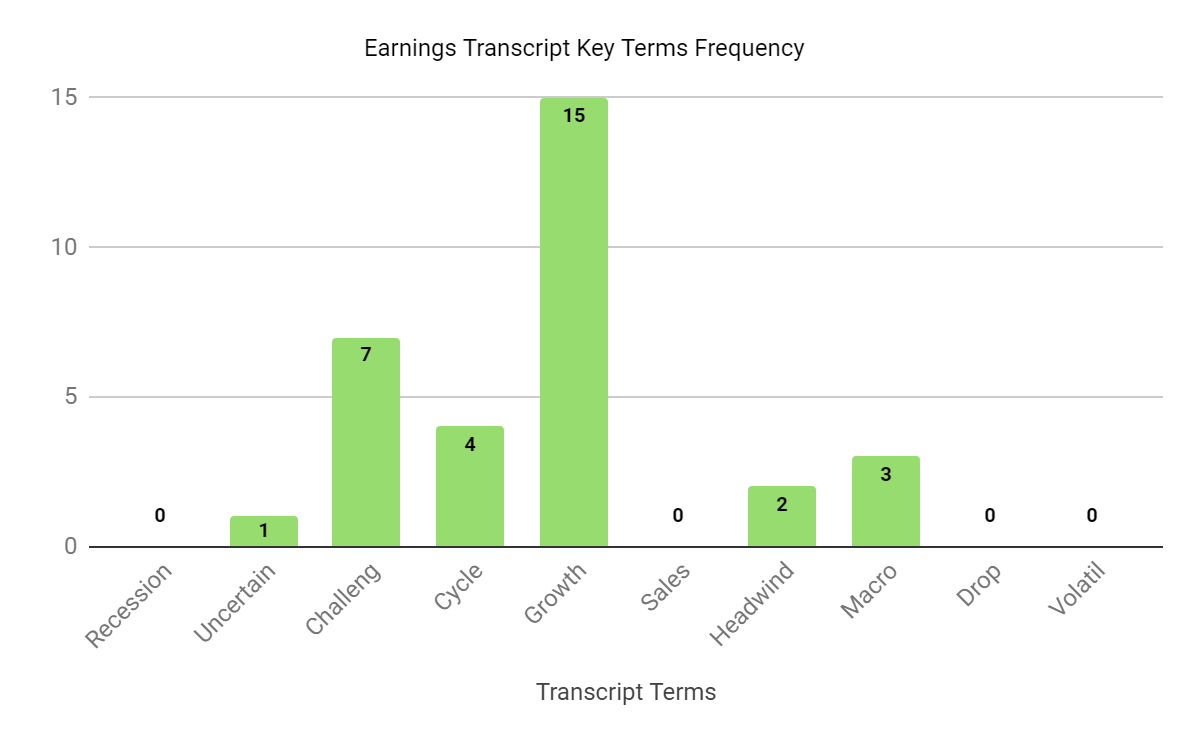

Within the earnings name, I tracked the frequency of key phrases and phrases talked about by administration or analysts:

Searching for Alpha

The chart reveals that the corporate is dealing with plenty of challenges and headwinds in the latest quarter.

Analysts questioned administration about restructuring the U.S. onshore TRS unit and reconsidering its LWI enterprise strategy in gentle of the Q3 failure incident.

Administration responded that it’s lowering its U.S. TRS enterprise to acquire higher margins and redeploy property versus divesting.

For its LWI section, management is reevaluating its vessel supplier partnership and contemplating totally different working and partnership fashions to provide higher outcomes and keep away from failures.

Complete income for Q3 2023 rose by 10.6% year-over-year, however gross revenue margin fell by 0.6%.

Working earnings remained barely optimistic, though falling sequentially by a considerable quantity.

The corporate’s monetary place is robust, with ample liquidity, minimal debt and powerful free money circulation era.

Wanting forward, the consensus income estimate for the complete yr 2023 suggests prime line development of 17.2% over 2022.

If achieved, this is able to signify a considerable decline in income development charge versus 2022’s development charge of 55% over 2021.

Given the challenges the corporate is dealing with in restarting its LWI section, decreased drilling exercise in North and Latin America and rising competitors in sure North American basins, I’m not optimistic about Expro’s development trajectory within the close to time period.

My outlook on Expro Group Holdings N.V. inventory is, subsequently, Impartial [Hold] at the moment.