- Bitcoin’s value now has a powerful correlation to macro occasions, together with Fed fee selections

- Analysts count on a variety breakout, however they disagree on when it would occur

Bitcoin [BTC] rallied by 7.5% to faucet $66,000 on the value charts following the discharge of lower-than-expected key U.S inflation knowledge. The constructive response to cooler inflation knowledge is a part of Bitcoin’s broader motion following main macro occasions, together with Fed fee expectations.

Rob Hadick, Normal Companion on the crypto-venture agency Dragonfly, lately commented on the identical, referring to Bitcoin as a ‘macro’ asset. In accordance with the exec,

“I feel Bitcoin is a macro asset, it appears to buying and selling in keeping with how a lot liquidity is out there.”

He went on so as to add that the market will react to something that impacts liquidity, together with quantitative easing, discount in steadiness balances, or Fed fee selections.

Will ‘higher’ macro circumstances assist Bitcoin in 2024?

In accordance with CoinShares’ data, the stronger correlation between BTC and macro occasions, particularly Fed fee selections, intensified lately after flows into new U.S spot BTC ETFs dried up.

Most market watchers famous that total liquidity was sluggish, which defined BTC’s muted value motion over the previous few weeks. In actual fact, one of many watchers, crypto-analyst Jamie Coutts, claimed that whereas world liquidity was on an uptrend, momentum has been flat.

One other market watcher and Bitcoin analyst, Willy Woo, confirmed the ‘sluggish’ liquidity tempo however projected a breakout in October 2024.

“World liquidity forming a bullish ascending triangle. Anticipated breakout earlier than Oct 2024. #Bitcoin 2025 will probably be one for the report books.”

Supply: X/Willy Woo

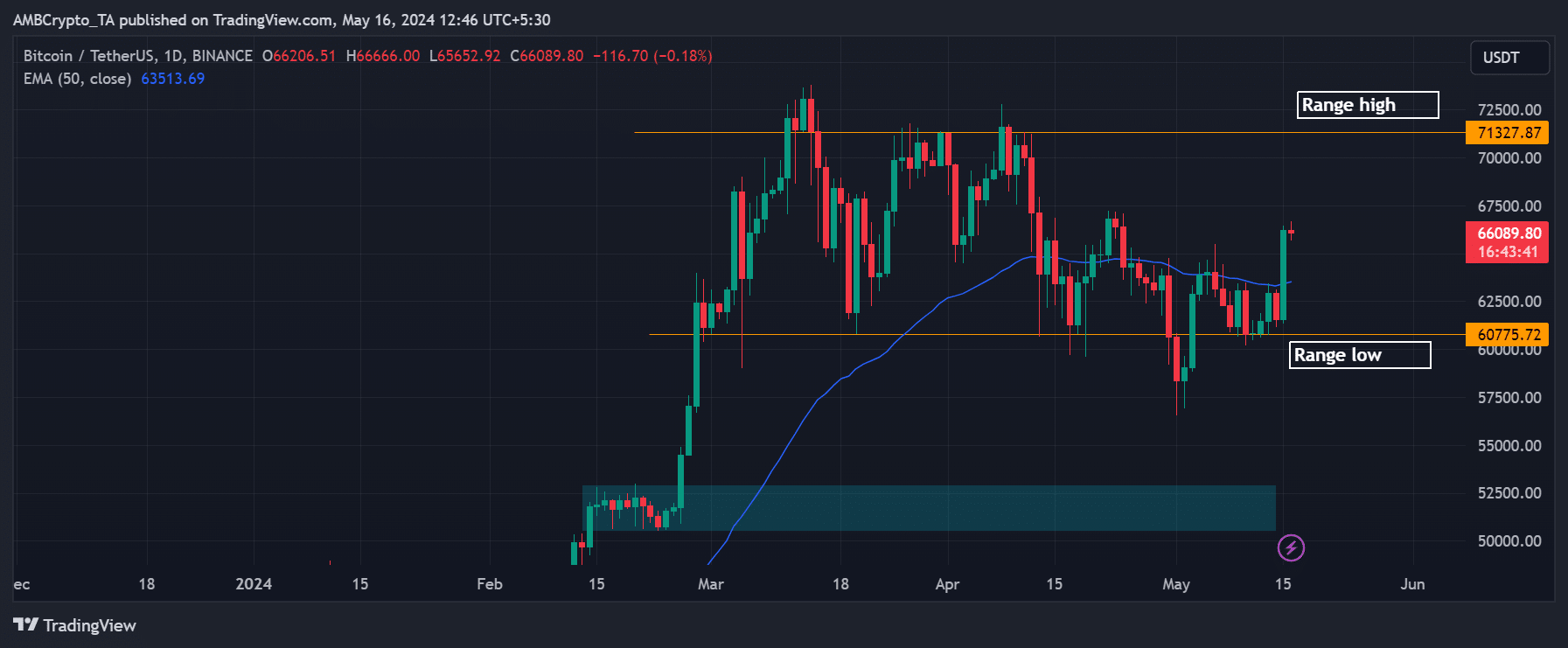

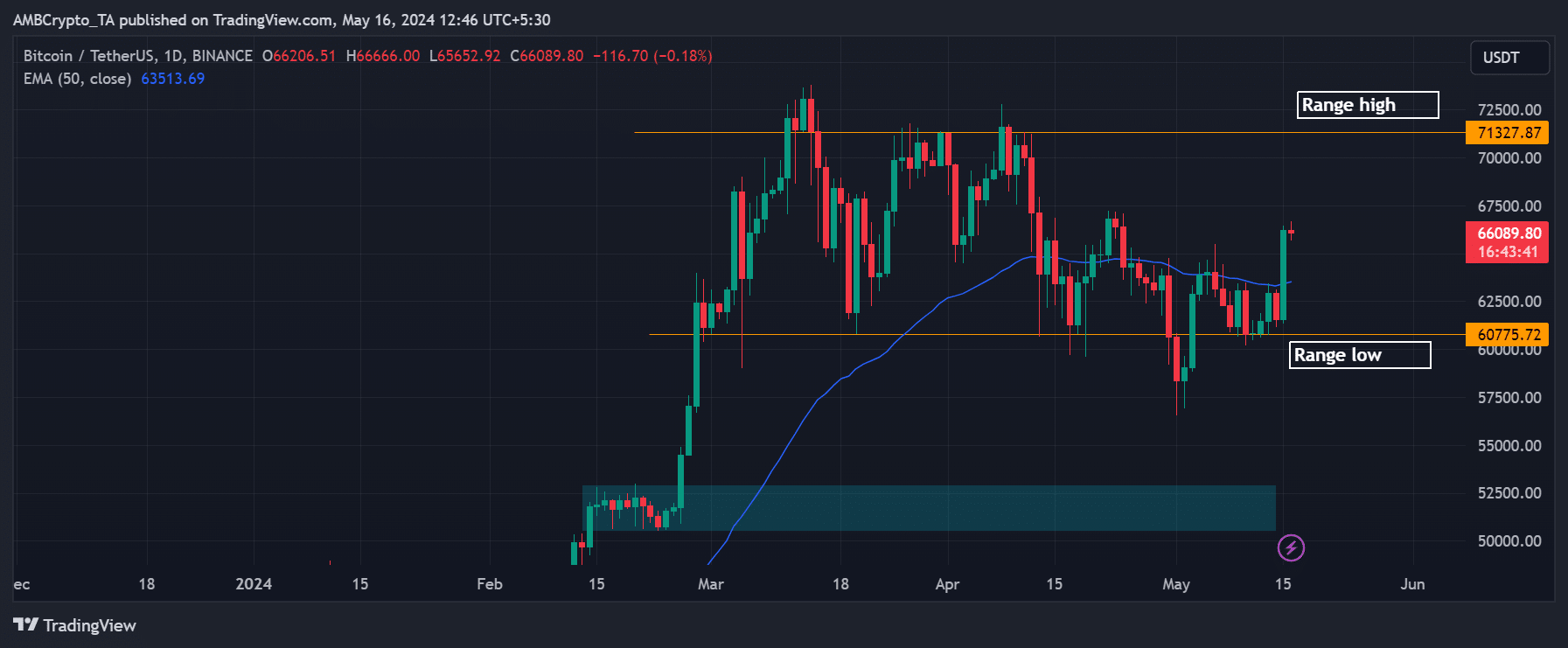

Based mostly on the aforementioned world liquidity projections, BTC may prolong its ongoing consolidation ($60K—$72K) till early This fall 2024. The timeline of the above forecast is barely totally different from Mike Novogratz’s predictions.

Mike Novogratz, Founding father of Galaxy Digital, projected a attainable vary breakout by the tip of Q2.

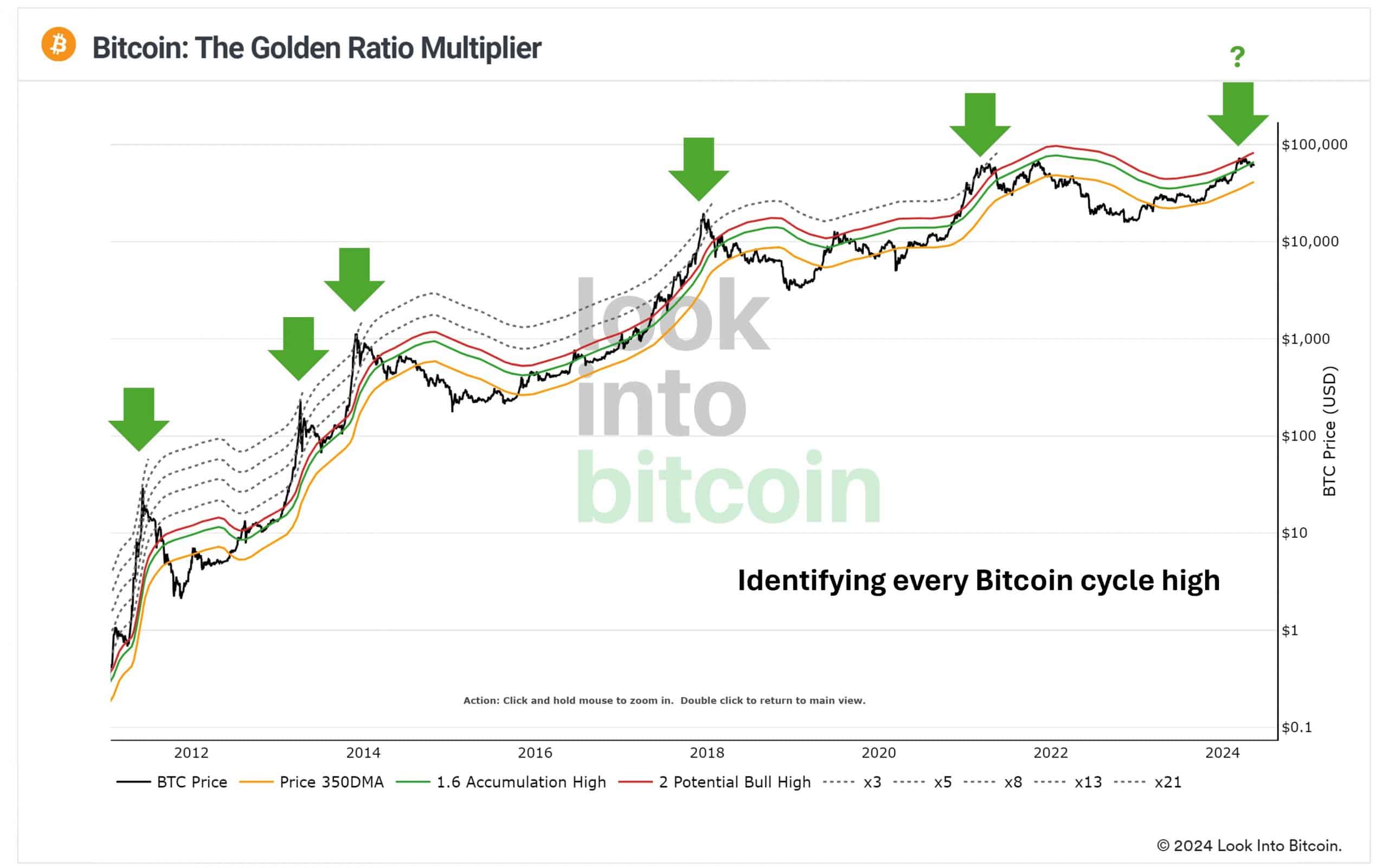

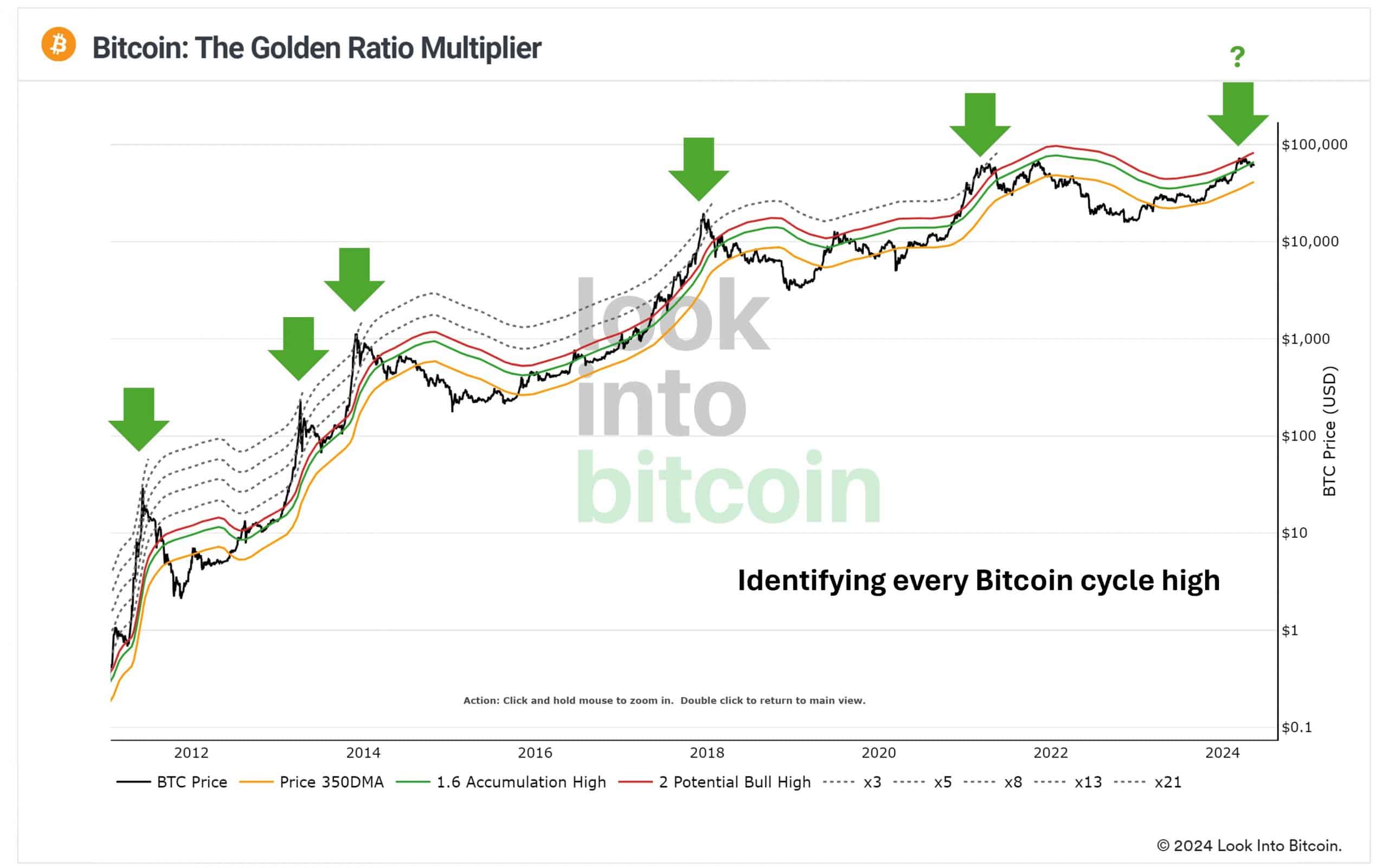

He’s not the one one both. Philip Swift, founding father of the evaluation platform Look Into Bitcoin, mentioned that primarily based on the Golden Ratio Multiplier, BTC may explode twice or thrice its present worth.

“The GR Multiplier did a fantastic job in Bitcoin’s adoption section. We’re now coming into a brand new section (supercycle?! kek)”

Supply: X/Philip Swift

The GR multiplier gauges quick and long-term value projections primarily based on Bitcoin’s adoption curve and market cycles.

Though it precisely predicted earlier market cycle tops, Swift believes that the present GR Multiplier ‘high’ suggests BTC’s adoption section is coming to an finish.

“Bitcoin is coming to the tip of its Adoption development section and coming into a extra mature section, built-in into world markets. See latest Bitcoin ETF’s as proof.”

Ergo, analysts count on BTC to interrupt from the vary and surge additional, however have totally different timelines for the breakout.

Within the quick time period, BTC may eye the range-high at $71k after flipping the decrease and better timeframe market buildings to bullish.

Supply: BTC/USDT on TradingView