- XRP didn’t react to the event regardless of its elementary deflationary affect.

- Demand for the token decreased however the liquidations ranges advised a worth enhance.

RippleX, the open developer platform of Ripple [XRP], introduced that the ‘fixAMMOverflowOffer’ modification has gone stay. In keeping with the post, the event meant that the AMM had resumed performance on the XRP Ledger (XRPL).

For the unfamiliar, the AMM stands for Automated Market Maker. On the XRPL, it serves as a sensible contract for enhancing liquidity for property on the ledger. It additionally provides a deflationary impact for XRP.

Difficulties addressed

AMBCrypto’s assessment of the ledger confirmed that ‘fixAMMOverflowOffer’ v2.1.1 had been enabled. Therefore, the community may be capable of deal with giant artificial AMM provides which was beforehand a problem.

Regardless of the improve, XRP’s worth stalled instantly after the replace. The truth is, 12 hours later, it fell additional down, on the again of Bitcoin’s personal depreciation.

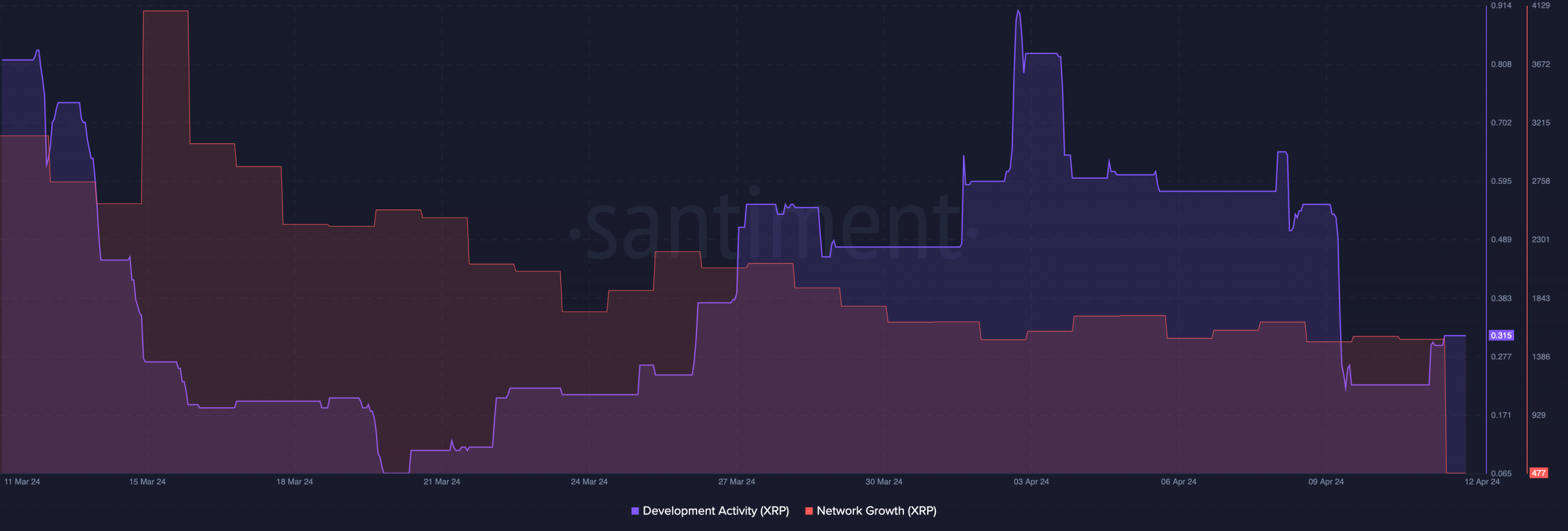

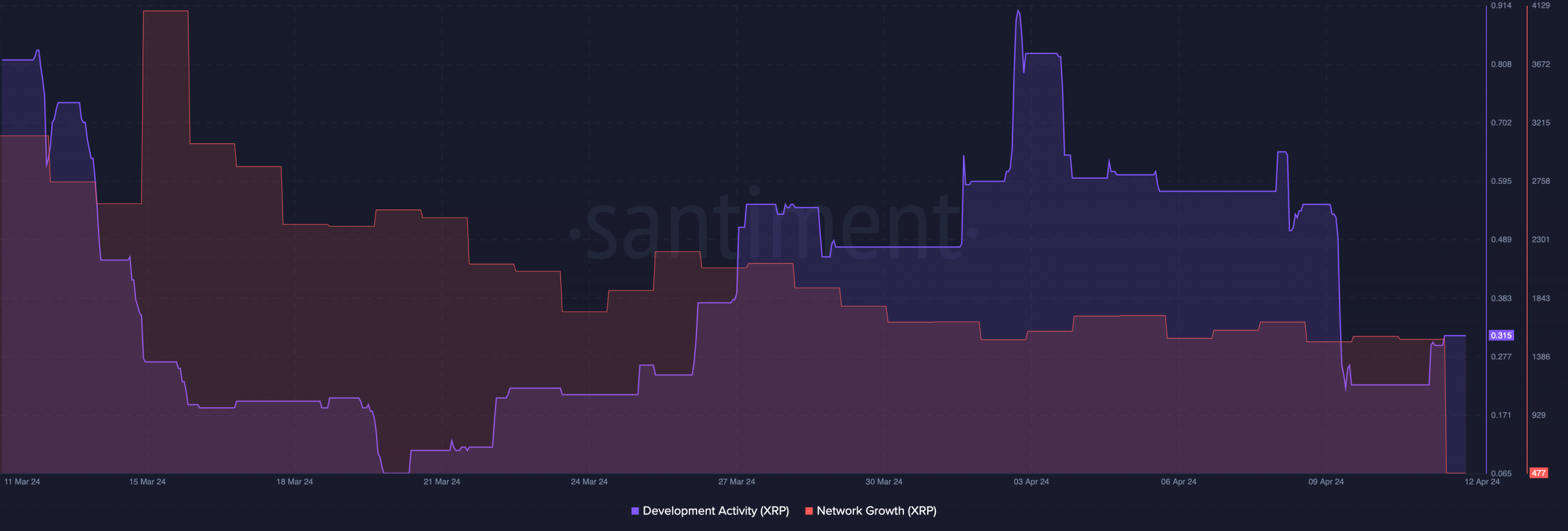

Apart from that, plainly the improve didn’t have a lot impact on Ripple’s growth exercise. In keeping with Santiment, growth exercise on the community dropped.

This implied that builders weren’t doing a lot with respect to sharpening the community. Ought to this studying proceed to lower, XRP’s worth will likely be affected, with the altcoin dropping under its press time worth of $0.54

Then again, if growth exercise improves, the token may have an opportunity at recovering. Like growth exercise, one other metric at an underwhelming state was community progress.

Supply: Santiment

XRP nonetheless isn’t a best choice

Community progress tracks the variety of new addresses interacting with a community. If the metric will increase, it signifies that adoption is rising as new entrants are making their first transactions.

Nevertheless, that was not the case with XRP. At press time, community progress declined, indicating low traction. In a case the place this metric will increase, the demand may spur XRP within the upward route.

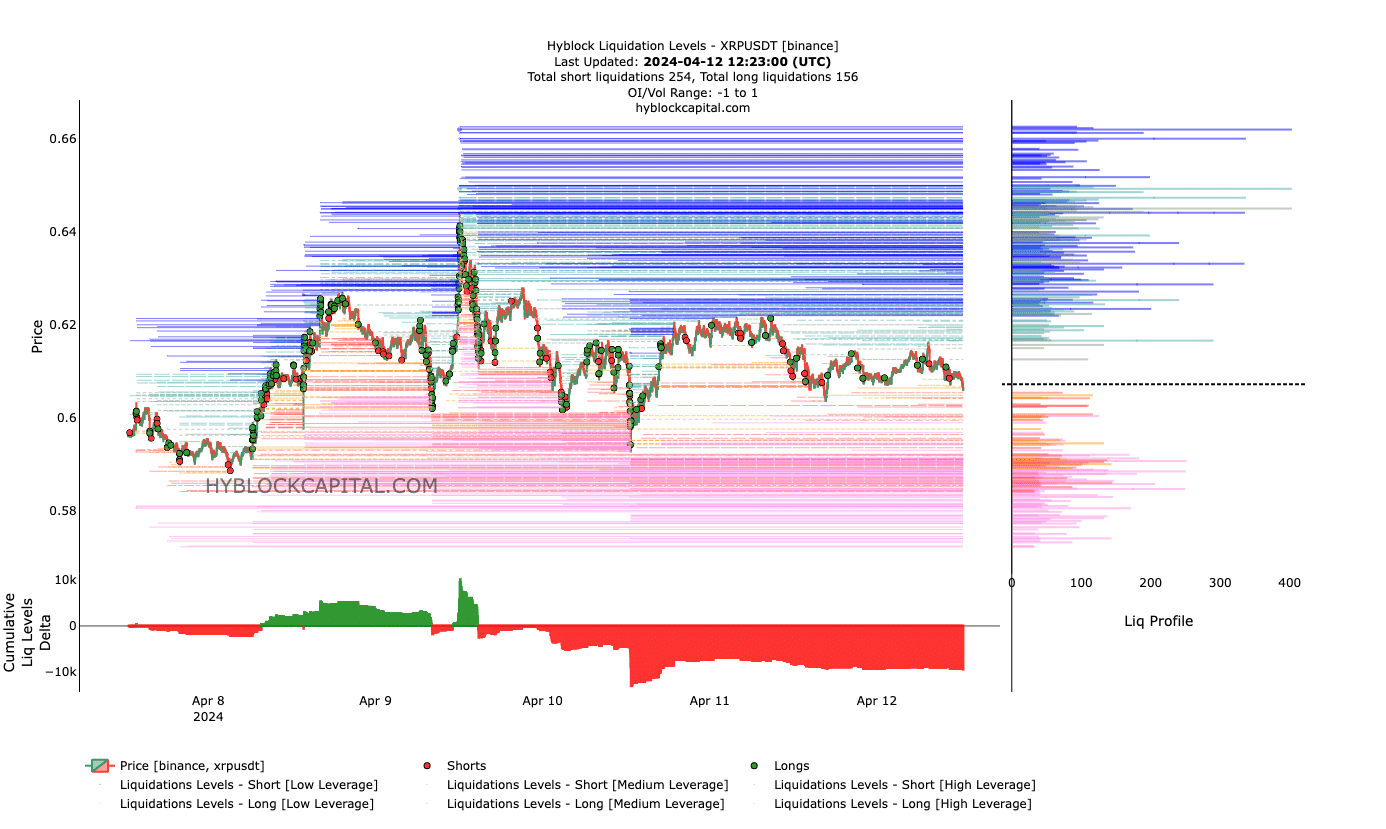

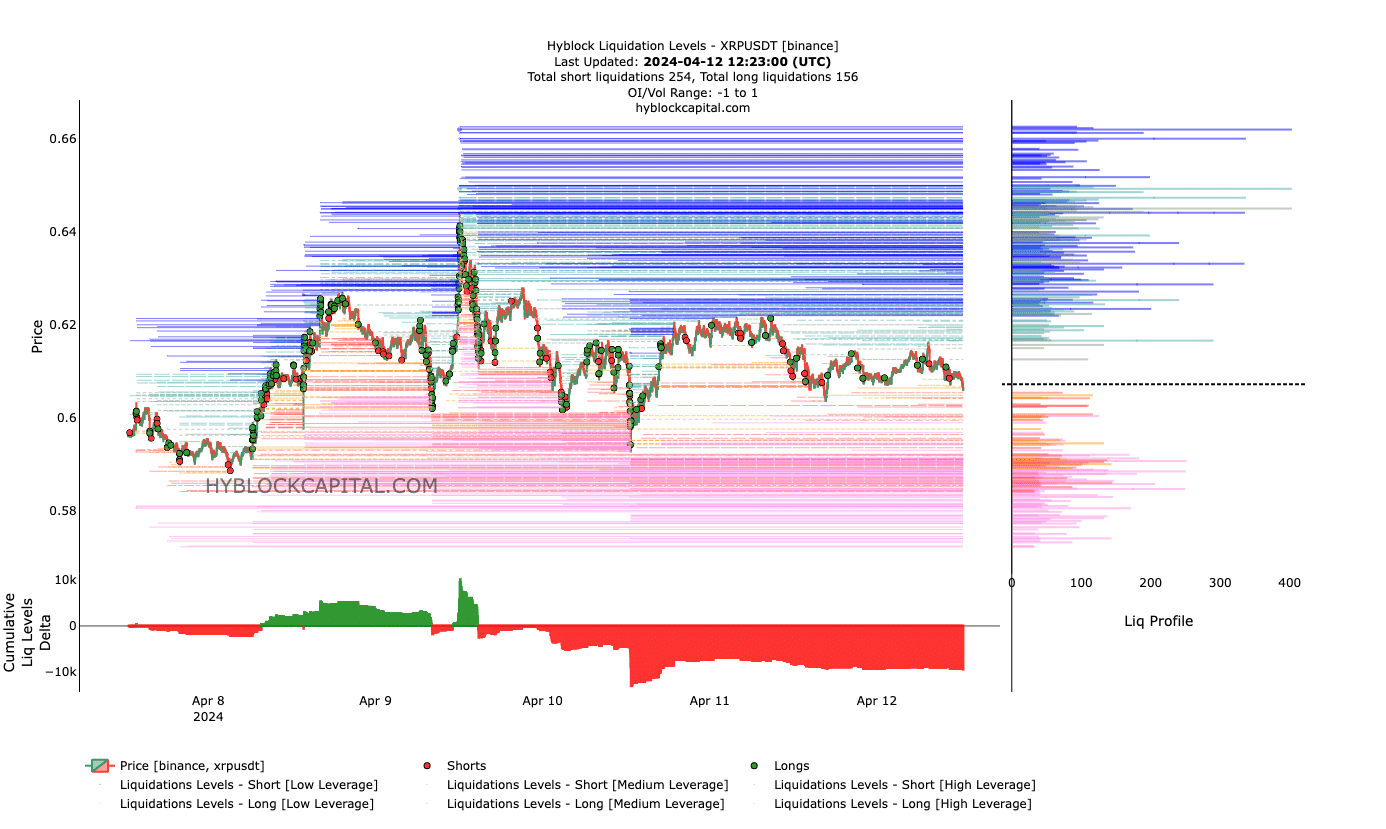

However being in an identical state prefer it was as of this writing, or worse may trigger the worth to faucet decrease spots. Aside from these metrics, AMBCrypto additionally analyzed the liquidation ranges.

Liquidation ranges are predicted worth ranges the place giant liquidation occasions may occur. At press time, XRP lacked a excessive quantity of liquidity between $0.60 and $0.61.

If this stays the identical, then longs or shorts liquidations may be minimal round these factors. But when the token strikes increased, and rises between $0.63 to $0.67, many positions may be worn out.

Supply: Hyblock

As well as, the Cumulative Liquidation Ranges Delta (CLLD) displayed indicators that favored longs. As of this writing, the CLLD was unfavorable, suggesting that there have been extra shorts liquidations than longs.

Learn Ripple’s [XRP] Value Prediction 2024-2025

For XRP’s worth, the spike within the unfavorable route provided a bullish bias. So long as the CLLD stays unfavorable, then XRP might need a better likelihood of a rise.

But when the situation modifications, the token may commerce sideways within the brief time period.