- BlackRock’s iShares Bitcoin Belief (IBIT) noticed a $102.7M influx, marking 9 days of features.

- Bitcoin’s RSI at 59 indicated robust bullish sentiment, regardless of current unfavourable sentiment traits.

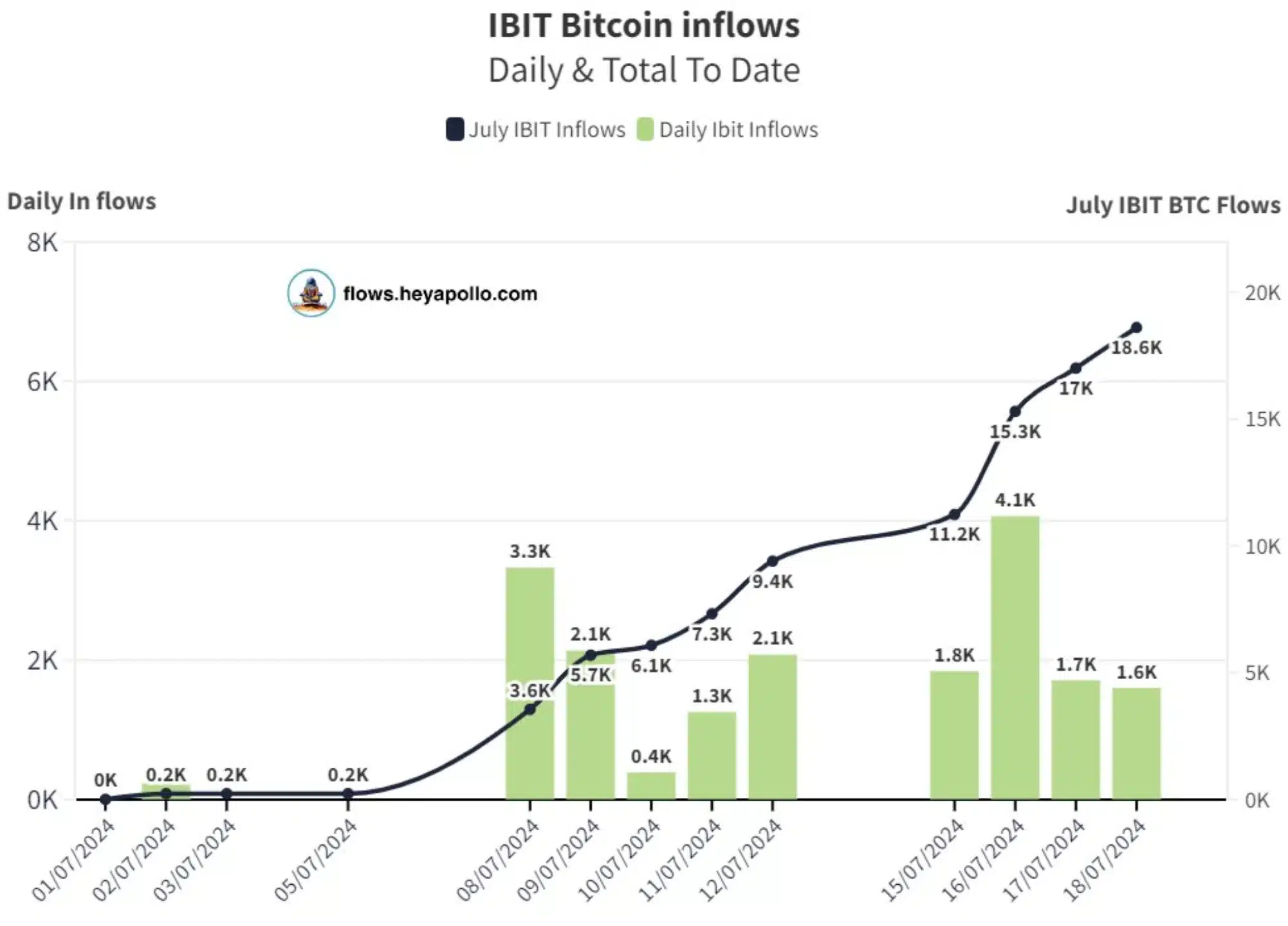

On the 18th of July, the BlackRock-issued iShares Bitcoin [BTC] Belief (IBIT) noticed a powerful influx of $102.7 million.

This marked the ninth consecutive day of optimistic inflows, making IBIT the one spot Change Traded Fund (ETF) to realize such a streak.

BlackRock’s rising Bitcoin adoption

BlackRock additionally made headlines for buying over $1 billion value of BTC this month, highlighting the rising institutional adoption of Bitcoin.

Increasing on the identical, Thomas Fahrer, co-founder of crypto knowledge platform Apollo, mentioned,

“Blackrock has bought over $1B value of #Bitcoin this month – Together with $107M At this time. That’s 18,600 #Bitcoin. This can be a whole acceleration of inflows.”

Supply: Thomas/X

Drop in optimistic sentiment

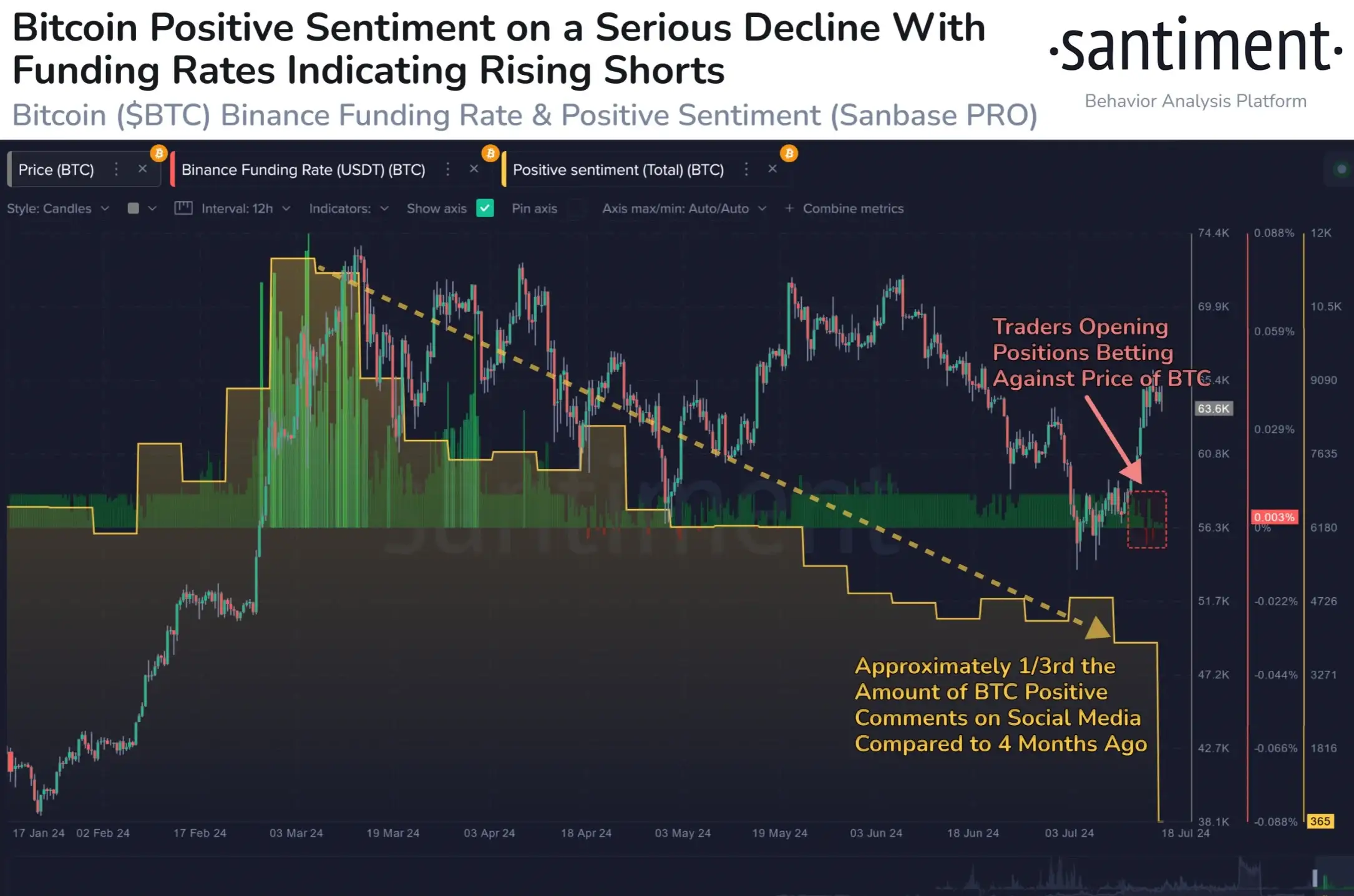

Furthermore, there was a mid-sized crypto market bounce this week. Nevertheless, this has had no impression on the optimistic sentiment round BTC, which has sharply declined in comparison with March.

This contains sentiments from social media platforms like Twitter, Reddit, BitcoinTalk, and 4chan.

That being mentioned, along with the drop in optimistic sentiments, merchants are more and more additionally taking on brief positions on the asset.

Based on blockchain market intelligence agency Santiment,

“Many merchants, notably on @binance, are opening shorts with the expectation of BTC dropping once more. Each of those elements improve the probability of cryptocurrency rising.”

Supply: Santiment/X

Lengthy-term holders stand robust

In truth, on the time of writing, BTC was down 0.84%, buying and selling at $64,304. Nevertheless, the Relative Energy Index (RSI) at 59 signifies a powerful bullish sentiment for the main cryptocurrency.

Supply: TradingView

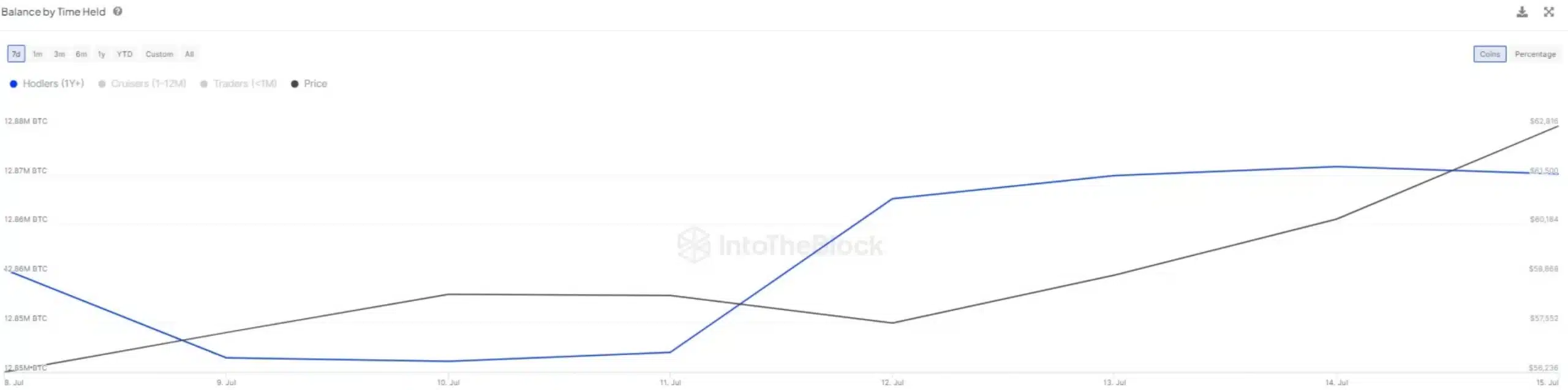

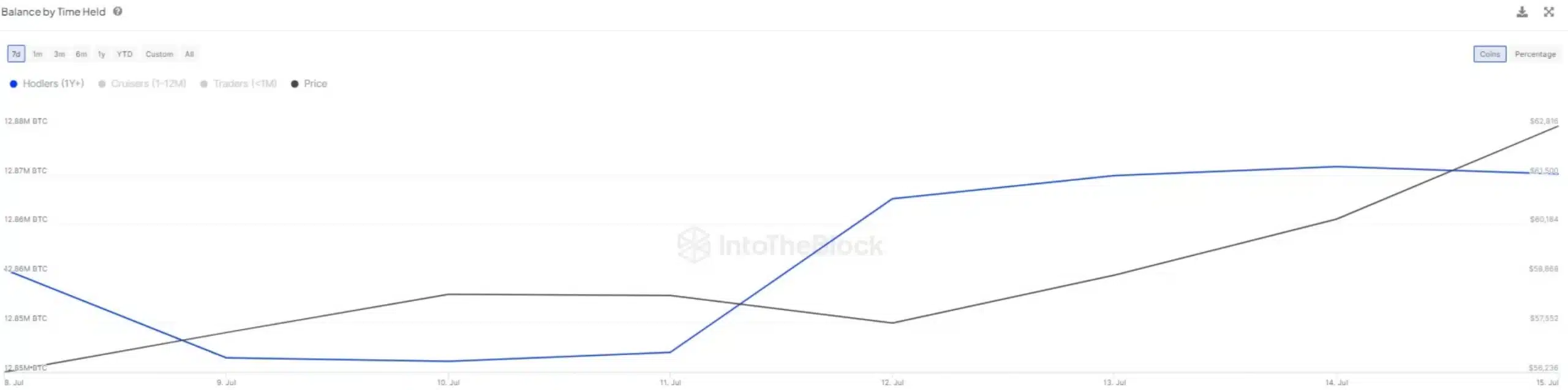

This highlighted the boldness of long-term Bitcoin holders. On-chain analytics platform, IntoTheBlock highlighted it greatest when it famous,

“Lengthy-term Bitcoin holders confirmed confidence final week, including to their holdings regardless of fears about current transactions involving Mt. Gox and the German authorities.”

Supply: IntoTheBlock/X