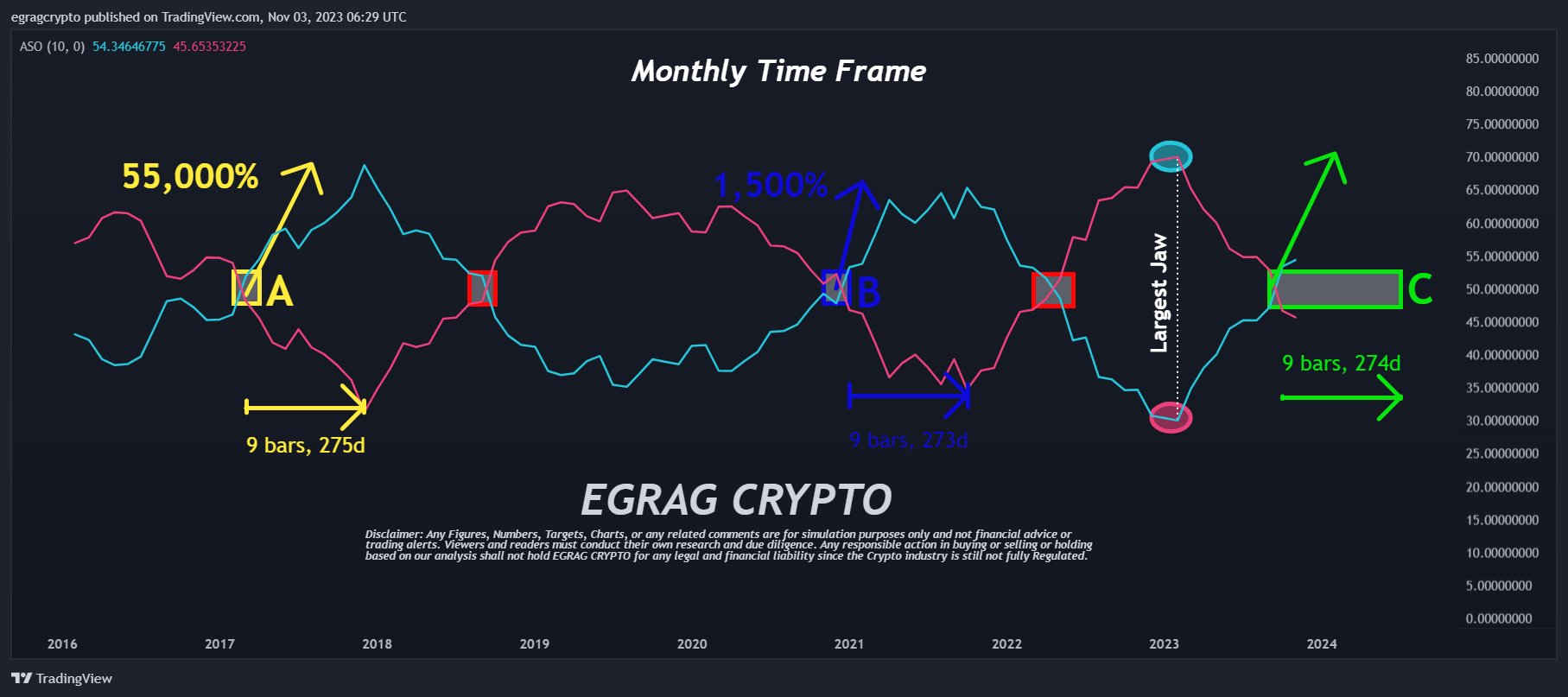

Crypto analyst Egrag lately delved into the XRP worth charts and spotlighted indicators that counsel a potential rally of greater than 1,500% is on the horizon. The main focus of this analysis is the ASO (Common Sentiment Oscillator), a metric that merchants make use of to find out market sentiment.

XRP Value Rally Of 1,500%+ Forward?

Egrag’s month-to-month XRP/USD chart showcases the convergence of the blue line, symbolizing bulls, and the crimson line, representing bears. A month in the past, Egrag had marked a yellow field on his chart, predicting the bullish crossover to happen between the top of 2023 or the onset of the latter half of 2024.

At present, Egrag famous, “XRP ASO Replace: The journey is barely heading UP! I’ve been eagerly awaiting the bullish crossover of the ASO since February 2023. And guess what? It’s lastly right here!” Ought to XRP mimic its historic patterns, and if Egrag’s predictions maintain true, the XRP worth would possibly witness some appreciable worth actions within the coming months.

Traditionally, the cryptocurrency skilled this bullish crossover twice earlier than. The 2017 occasion led to a staggering 55,000% improve in XRP’s worth, whereas the one from late 2020 to April 2021 resulted in a 1,500% appreciation. Given the “largest jaw” ever noticed on the chart, Egrag has sparked discussions suggesting that the forthcoming rally might even outpace its predecessors.

By connecting the dots from the historic information and the current crossover, Egrag additional elaborated, “ historic information, we are able to see that it usually takes round 275 days to achieve the height after this occasion.” If XRP follows its historic traits, as Egrag suggests, the XRP worth is perhaps gearing up for some substantial worth motion inside the subsequent 7-10 months.

Ending his tweet on a rallying observe for the huge neighborhood of supporters, generally known as the ‘XRP Military’, Egrag inspired, STAY STEADY and carry on sporting your area go well with.”

To supply extra context, the ASO acts as a momentum oscillator, giving averaged percentages of bull/bear sentiment. It’s significantly potent in discerning sentiment throughout particular candle intervals, helping in development identification or pinpointing entry/exit moments. The software was conceived by Benjamin Joshua Nash and modified from its MT4 model. The oscillator’s design, showcasing Bulls % with a blue line and Bears % with a crimson line, illuminates the prevailing sentiment available in the market.

At press time, XRP traded at $0.5990. Upon analyzing the 1-day chart, it’s evident that the XRP worth confronted a second rejection on the 0.382 Fibonacci retracement degree, which stands at $0.625.

Though the RSI has settled considerably, it stays elevated within the overbought zone at 71. This implies that the worth would possibly gear up for an additional shot at overcoming this resistance. Nonetheless, if it doesn’t succeed, a pullback to the 0.236 Fibonacci retracement degree, priced at $0.553, could also be on the horizon. On the upside, the 0.5 Fibonacci retracement degree, pegged at $0.683, represents the following potential worth goal.

Featured picture from Shutterstock, chart from TradingView.com