After the collapse in housing begins and permits in March, it’s no shock that present dwelling gross sales disenchanted in the identical month, dropping 4.3% MoM (-4.1% exp) after surging 9.5% in February. That’s the greatest drop since Nov 2022.

Gross sales have been down nearly 10% from a 12 months earlier on an unadjusted foundation, as gross sales of each single-family properties and condominiums and co-ops dropped.

Supply: Bloomberg

This dragged whole present dwelling gross sales SAAR again right down to 4.19mm…

Supply: Bloomberg

“Although rebounding from cyclical lows, dwelling gross sales are caught as a result of rates of interest haven’t made any main strikes,” stated NAR Chief Economist Lawrence Yun.

“There are almost six million extra jobs now in comparison with pre-COVID highs, which suggests extra aspiring dwelling patrons exist out there.”

…and it is about to worsen…

Supply: Bloomberg

Whole housing stock registered on the finish of March was 1.11 million models, up 4.7% from February and 14.4% from one 12 months in the past (970,000). Unsold stock sits at a 3.2-month provide on the present gross sales tempo, up from 2.9 months in February and a pair of.7 months in March 2023.

“Extra stock is at all times welcomed within the present atmosphere,” Yun stated.

“It’s a good time to record with ongoing a number of provides on mid-priced properties and, total, dwelling costs persevering with to rise.”

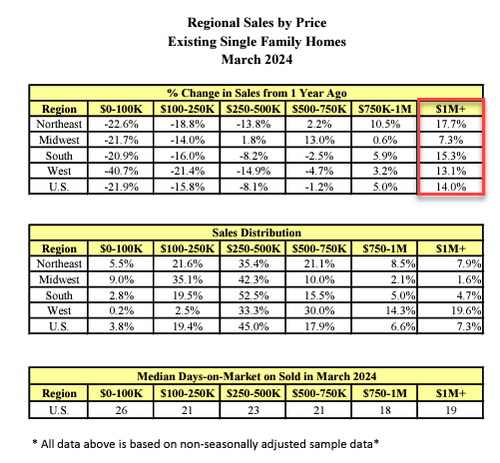

All value ranges noticed gross sales decline besides $1mm+…

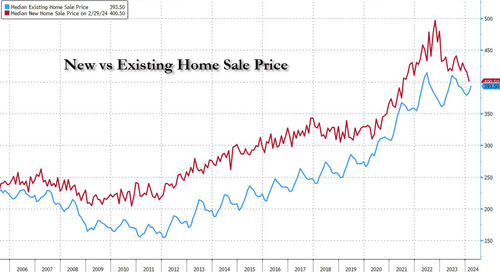

The median promoting value elevated 4.8% from a 12 months in the past to $393,500, the best for any March on document.

Supply: Bloomberg

…and present dwelling costs are about to prime new dwelling costs…

Supply: Bloomberg

First-time patrons made up 32% of purchases in March, up from 26% a month earlier.

Loading…