- BTC recovered barely during the last 24 hours, gaining by 1.20%

- Bitcoin dangers mass sells-off if it stays under quick time period holders’ realized value at $63,000

Over the previous week, Bitcoin [BTC] has seen a pointy decline on the charts, dipping by 5. 61%.

The final 24 hours had been completely different although, with the identical adhering to the cryptocurrency’s usually bullish pattern over the previous couple of weeks. Actually, on the time of writing, BTC was buying and selling at $62,099 following a 1.2% hike.

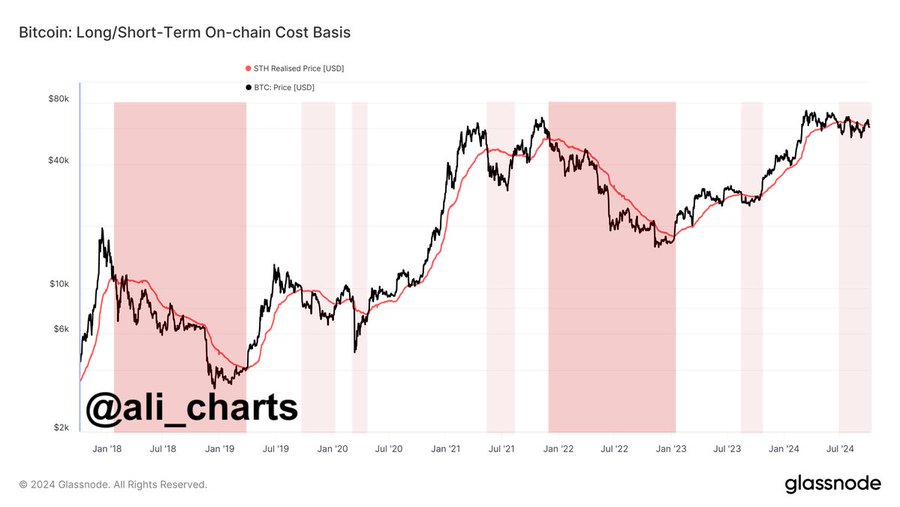

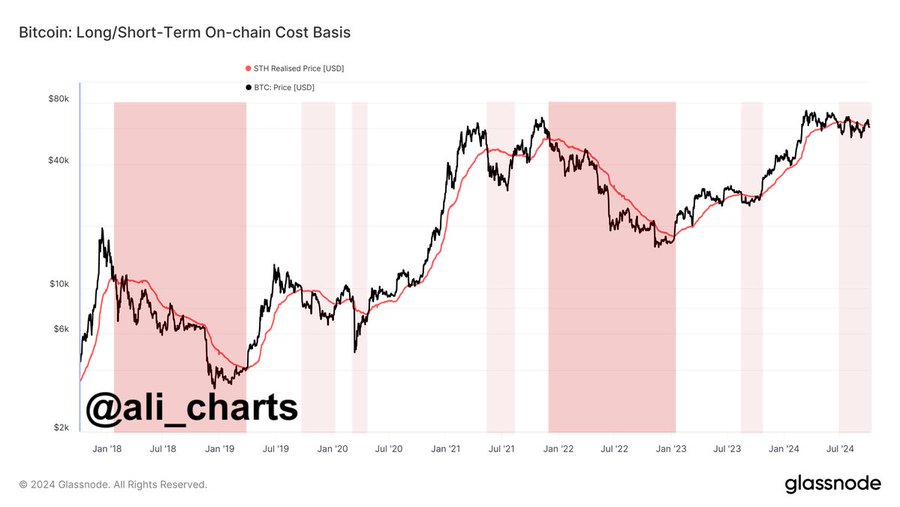

Regardless of this uptick, nevertheless, key stakeholders within the crypto market are apprehensive. Particularly over short-term holders’ realized value. A type of voicing their considerations is the favored crypto analyst Ali Martinez. Actually, he predicted a possible sell-off by short-term holders if BTC doesn’t reclaim its $63,000 ranges.

What does market sentiment say?

In his evaluation, Martinez posited that if Bitcoin continues to commerce under short-term holders’ realized value, the market will see higher promoting stress.

Supply: X

Based on this evaluation, BTC has traded under this stage since 22 June 2024. Thus, if the worth stays under this stage, these holders who’ve held BTC for lower than 155 days will promote to keep away from additional losses which is able to lead to a cascading sell-off.

Subsequently, the market should keep this stage round $63,000 to find out the following final result.

In context, so long as BTC stays under its realized value for short-term holders, the chance of extra promoting stress builds. If extra short-term holders panic and promote, it might drive the costs decrease, doubtlessly triggering large liquidations from leveraged positions, thus exacerbating the downtrend.

Merely put, Bitcoin has to reclaim $63,000. It will incentivize short-term holders to carry on to their BTC, anticipating additional upside.

What do the charts say?

Notably, the evaluation supplied by Martinez additionally shared a worrying market final result. Nevertheless, it’s important to find out what different market fundamentals counsel.

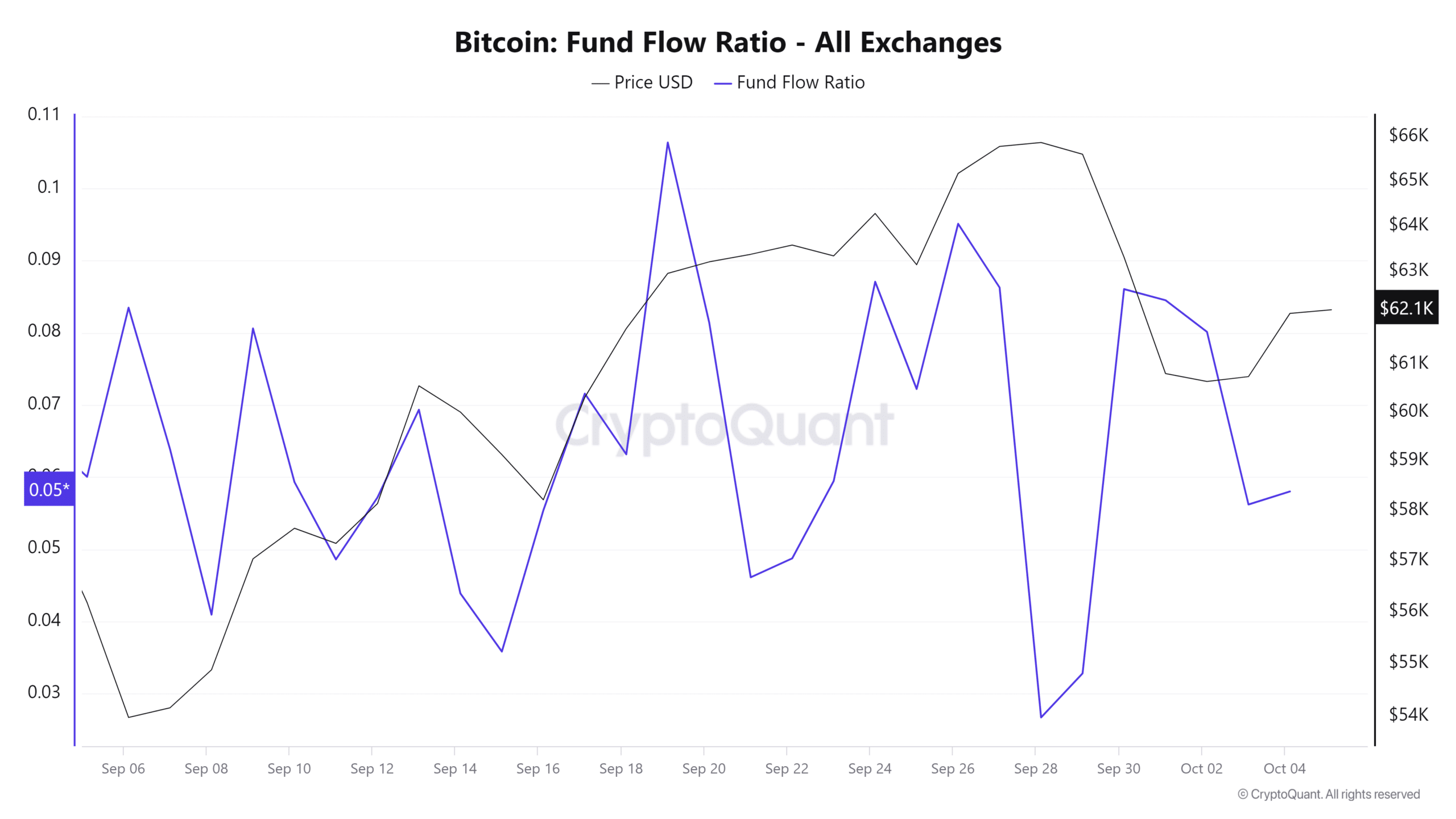

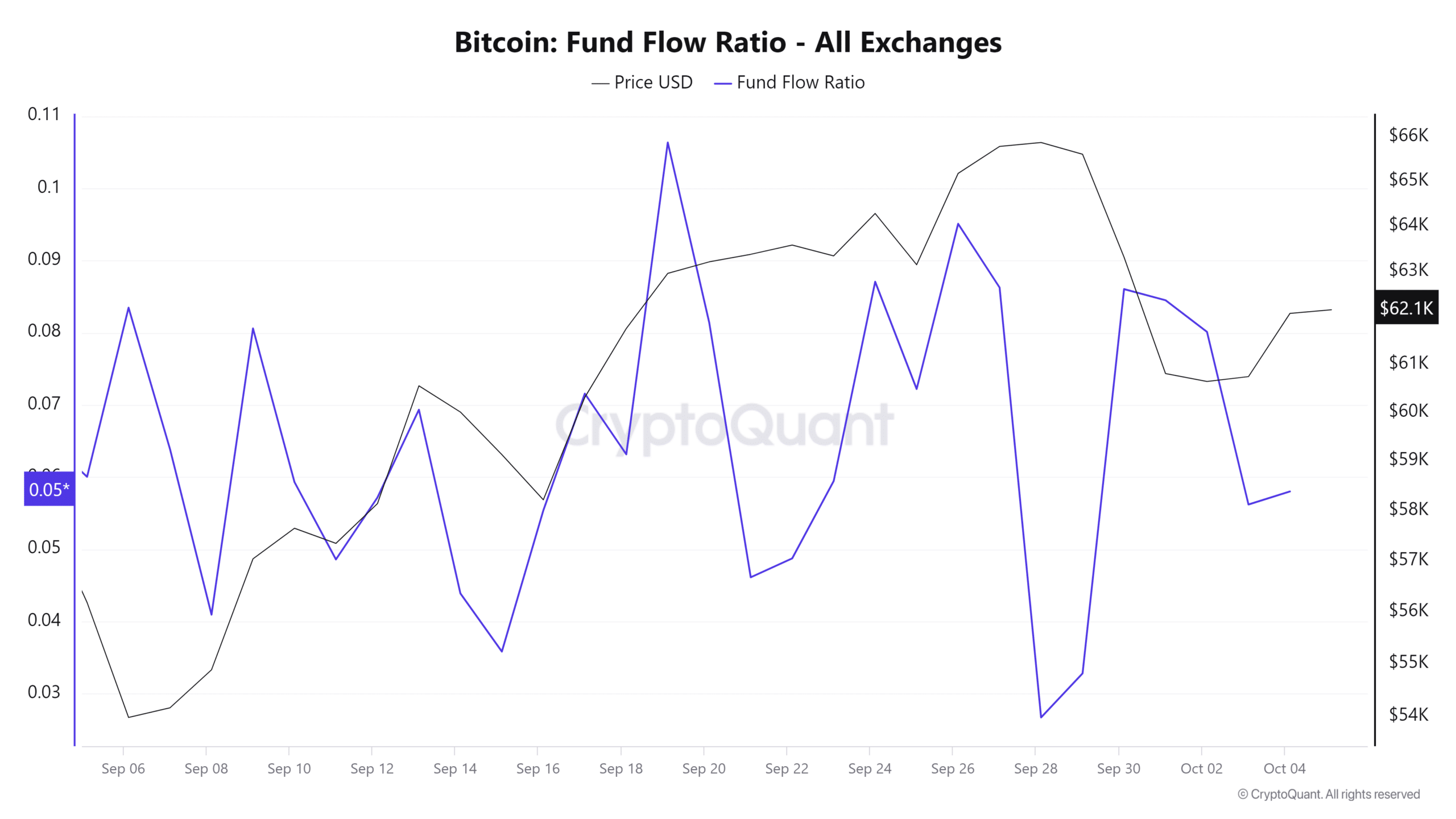

Supply: CryptoQuant

The primary indicator to think about is Bitcoin’s Fund Circulate ratio, with the identical declining since 30 September. The fund stream ratio dipped from 0.08 to 0.05, signaling that fewer BTC is being transferred into exchanges.

Which means traders are transferring their belongings into personal wallets, somewhat than promoting. This usually alluded to a extra bullish sentiment as holders aren’t liquidating their positions within the quick time period.

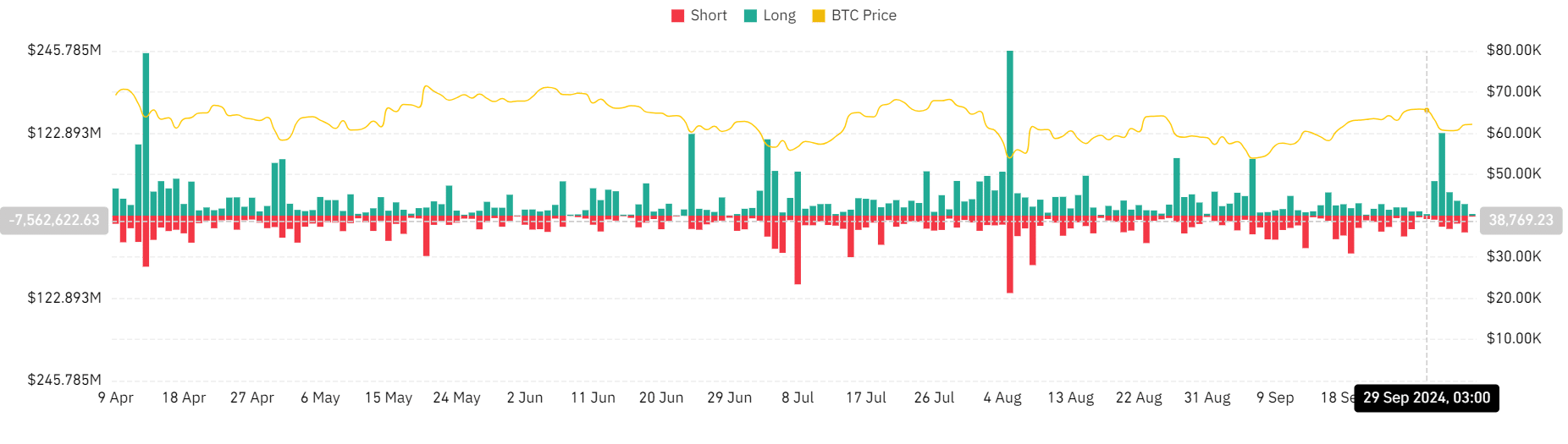

Supply: Coinglass

Moreover, since October began, liquidations for lengthy positions declined from $123 million to $2.47 million at press time.

Such a discount implies that many traders are anticipating the worth to rise. Thus, they’re paying a premium to carry, even throughout market downturns.

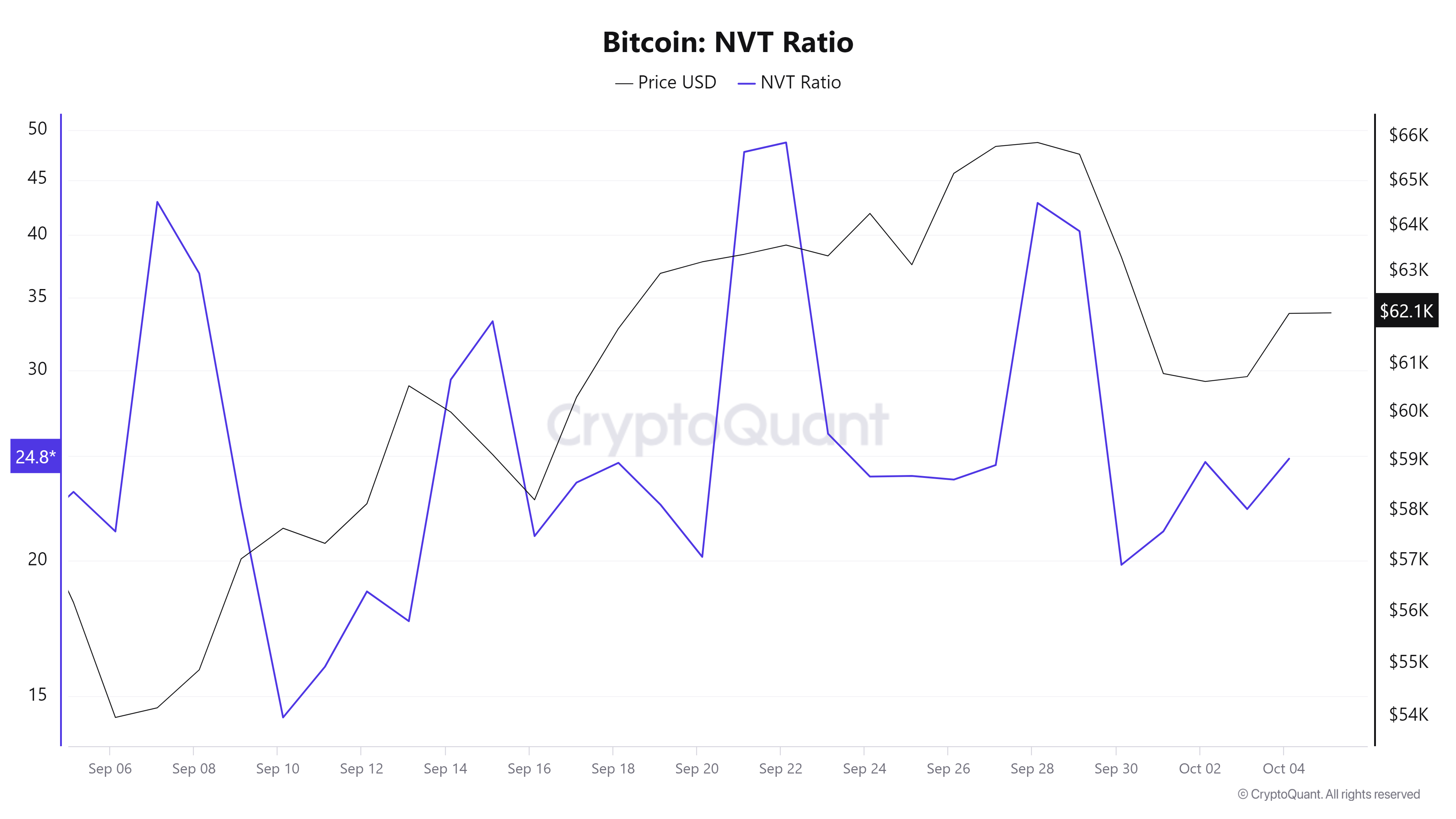

Supply: Cryptoquant

Equally, Bitcoin’s NVT ratio declined from 42.8 to 24.8 over the previous week. Merely put, BTC could also be at the moment undervalued, relative to its community exercise. What this implies is that the market has not but caught up with the rising exercise.

In conclusion, the prevailing market situations might set BTC for additional positive aspects on value charts.