stocklapse/E+ by way of Getty Photos

Abstract

Investing in Brazil is irritating, the nation has all of the substances to develop right into a developed nation, and anybody who has been to Sao Paulo feels and sees a dynamic trendy progress engine. Nonetheless, in my opinion, the nation persistently shoots itself within the foot by way of dysfunctional political and institutional resolution making i.e. populism and corruption. Thus, Brazil is extra a medium-term commerce thought vs a long-term compounder. The iShares MSCI Brazil ETF (NYSEARCA:EWZ) is an inexpensive car to commerce Brazil.

Efficiency

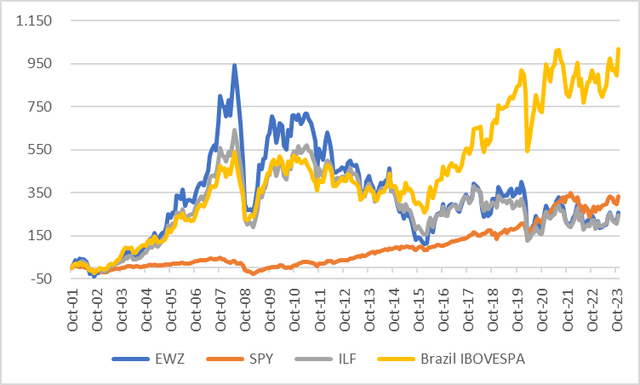

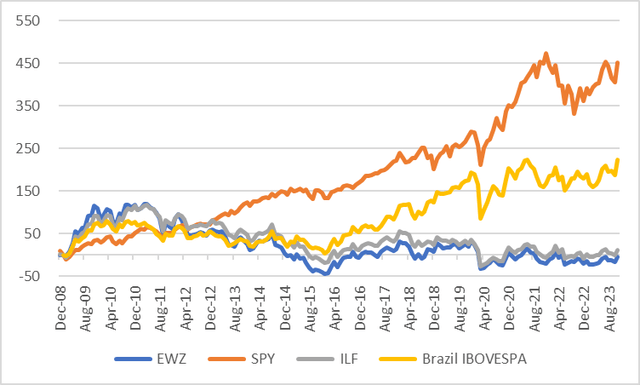

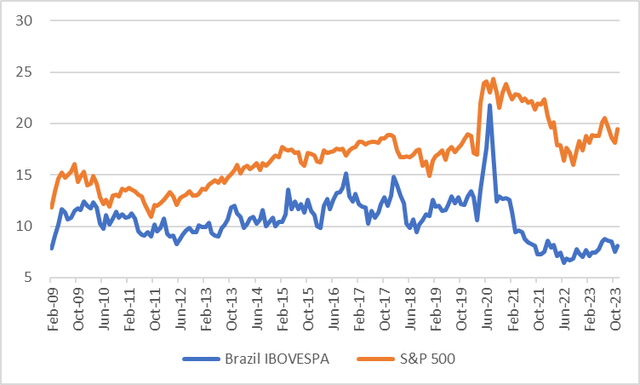

As will be seen within the charts, the EWZ had a large return as much as 2008 and has given most of it again by 2023. The principle detractor has been the foreign money. After I lived in Brazil the BRL was risky, the foreign money peg broke in 1999, with the BRL climbing from $1 to $3.5 at the beginning of Lula’s first time period in 2003 after which again to $1.5 pre-GFC in 2008. Since then, the BRL has continued to be risky and customarily misplaced vs the USD to the $5 vary right this moment. This foreign money devaluation has sapped the USD returns as will be seen when one compares the EWZ vs the Bovespa Index.

EWZ vs Bovespa (Created by creator with information from Capital IQ) EWZ vs Bovespa (Created by creator with information from Capital IQ)

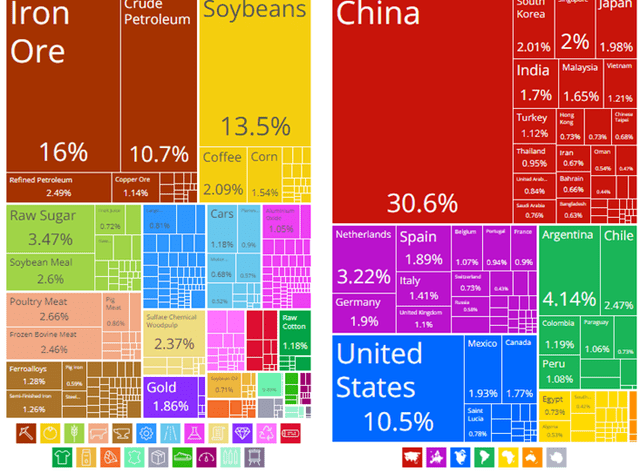

The Commerce Stability

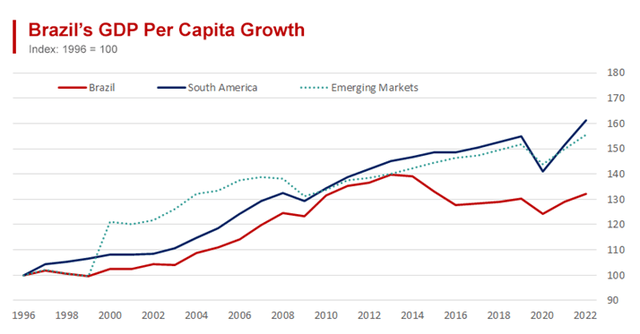

Brazil just isn’t China or India, it has not often seen greater than 3% GDP growth and this impacts total inventory market returns. In my opinion, the explanation for poor progress is primarily as a result of dysfunctional establishments from the federal government to the justice system. Brazil is a wealthy nation with a poor inhabitants that may be wooed by populism that has created a renter or shopper financial system i.e., the place the federal government makes an attempt to supply advantages for the poor that winds up handicapping progress and ends in a vicious cycle of institutional overspending, overtaxing, protectionism, and inefficiency.

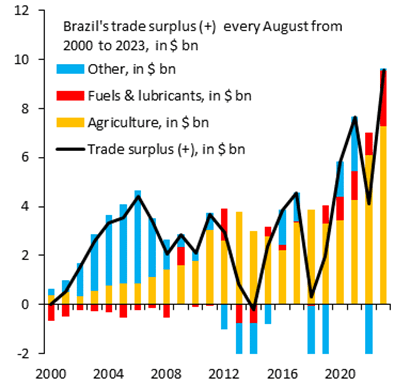

Key to the power of the BRL and potential GDP progress is the trade balance. Brazil is experiencing a second commodity boom, this time led by agriculture. Which when mixed with low valuations might end in constructive returns into 2024.

Brazil GDP Progress (Picture from World.economics.com)

Brazil Commerce Stability (Picture from RobinBrooksIIF on X)

Brazil Exports (Picture from OEC.World)

Historic Valuation

The Bovespa has traded north of 10x PE within the final 20yrs, that is regardless of the extent that native risk-free or bench market rates of interest had been. From 2021 to the current this a number of has declined to 8x because the market integrated a decline in EPS and a dramatic improve in SELIC charges, the Central Financial institution equal of the Fed Funds charge, from 2% to 14% to fight inflation. These charges are actually being lowered and will return to an 8% stage, whereas EPS are slated to rebound 30% in YE24. This, plus cheap GDP progress, ought to drive valuation as much as 10x in my opinion.

Bovespa PE Ratio (Created by creator with information from Capital IQ)

EWZ Progress and Valuation

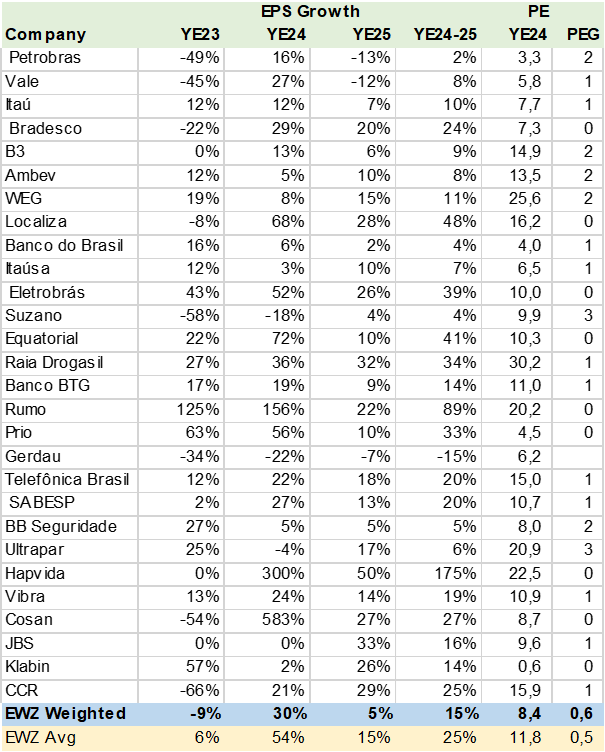

Utilizing consensus estimates for the EWZ portfolio I calculated weighted EPS progress of 15% within the YE24-25 interval vs. a PE of 8x or a PEG of .6x, which I might classify as low-cost. Word that the easy common or equal-weighted portfolio has far larger EPS progress as a result of Petrobras’s (PBR) declining EPS estimates.

EWZ Consensus EPS Progress (Created by creator with information from Capital IQ)

Portfolio Upside

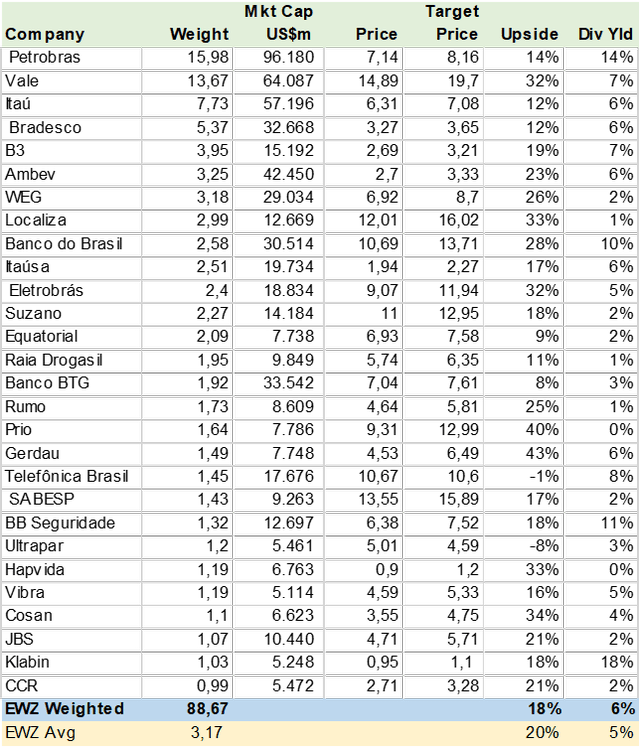

I calculated that the EWZ holding might have an 18% upside to the top of 2024 on the consensus value targets. As well as, the estimated dividend yield of 6% can also be engaging. Some fascinating outliers, with ADRs are Banco do Brasil and Sabesp (SBS), which is being privatized as I write this text.

EWZ Consensus Value Goal (Created by creator with information from Capital IQ)

Conclusion

I charge the EWZ a BUY. The Brazil ETF ought to profit from the nation’s charge reduce cycle, EPS progress restoration, and robust commerce surplus that helps the foreign money. Consensus value targets level to an 18% upside with a further 6% dividend yield buying and selling at a PE of 8x for year-end 2024.