Leonidas Santana/iStock through Getty Pictures

In latest months, I have been providing an summary of the Brazilian Ibovespa inventory market, which is intently mirrored by the iShares MSCI Brazil ETF (NYSEARCA:EWZ). In my most up-to-date articles from August and September, I maintained a impartial stance relating to the potential for a sophisticated correction in Brazilian equities. This strategy relies on Brazil’s efficient inflation management by a strong financial coverage carried out final 12 months, outperforming main international economies.

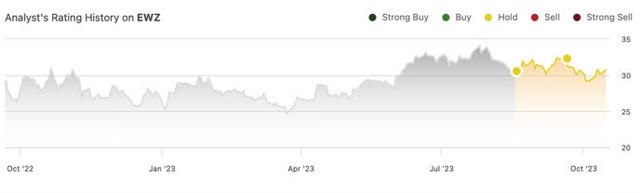

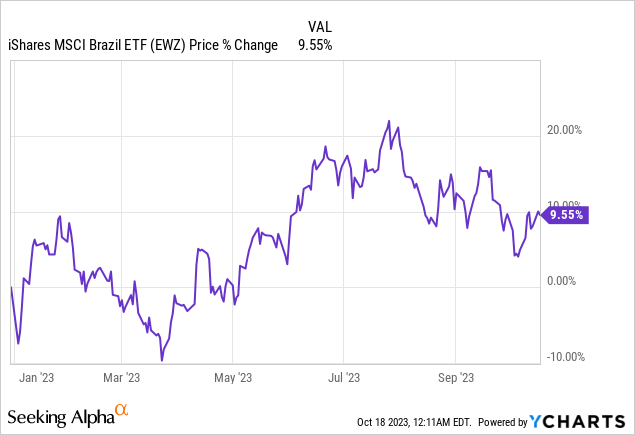

As you possibly can observe, since my newest articles, the EWZ has basically been buying and selling inside a slim vary with out vital upward or downward motion.

Searching for Alpha

All through 2023, the EWZ has displayed a cumulative efficiency of 9.5%. This efficiency is primarily attributed to optimism within the 12 months’s first half, pushed by expectations of forthcoming rate of interest reductions. The sentiment was additional bolstered by diminishing issues a few fiscal disaster, significantly following the change in management at the start of the 12 months when President Lula assumed workplace.

Quick ahead a month from my final evaluation, and never a lot has considerably improved. Nonetheless, I consider the outlook seems to be leaning extra in direction of optimism than pessimism. Nonetheless, this is not adequate to sway my cautious perspective on the momentum surrounding the important thing Brazilian equities represented by the EWZ.

For individuals who had anticipated a big rally following the preliminary rate of interest cuts in August and September, their hopes have been dashed. That is primarily as a result of confluence of things, together with the surge in long-term American rates of interest and the appreciation of the US greenback in opposition to the Brazilian actual.

On the flip aspect, I see a silver lining in bettering the commodities cycle. Gasoline costs have remained excessive attributable to expectations of elevated demand, and iron ore costs have additionally held regular attributable to sustained demand from China.

Challenges Loom for Brazilian Financial Exercise in H2

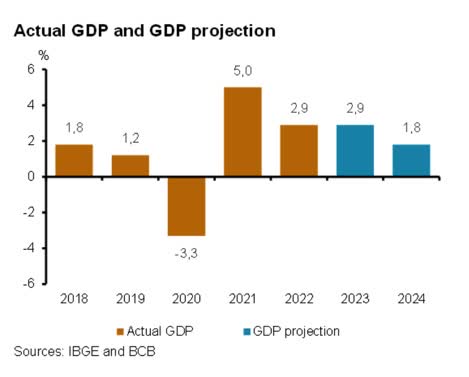

Within the second quarter of 2023, Brazil’s GDP grew 0.9% within the seasonally adjusted collection, exceeding market expectations. Within the annual comparability, there was a big enhance of three.4%. This quarterly stable development will be primarily attributed to strong family consumption, a thriving providers sector, a buoyant extractive trade, and elevated authorities spending.

Regardless of the optimistic momentum witnessed within the 12 months’s first half, it’s difficult to foresee this development persevering with by the top of 2023. The outlook for GDP within the remaining a part of the 12 months seems comparatively secure, with the potential for minor declines.

Banco Central do Brasil and IBGE

Quite a few elements, together with the Brazilian Central Financial institution’s implementation of financial tightening measures, the excessive ranges of family indebtedness and defaults, the diminishing affect of contributions from the agricultural sector, and the persistent challenges offered by exterior financial circumstances, are all a large danger to impede additional enhancements in financial exercise in the course of the second half of the 12 months.

Fiscal Outlook: Declining Income

Knowledge from the Brazilian tax authorities reveals that in August 2023, the Federal tax and different income assortment amounted to R$172.78 billion, marking the third consecutive month of decline. Within the annual comparability, there was a drop of 4.14%.

From January to August this 12 months, the full income reached R$1.52 billion, exhibiting a lower of 0.83% in comparison with the identical interval in 2022. It is value noting that this gathered determine is the very best within the collection since 1995.

Moreover, based on the Nationwide Treasury, the central authorities reported a main deficit of R$26.4 billion in August, and over the 12 months, a destructive results of R$70.9 billion, equal to 0.69% of GDP.

The Internet Public Sector Debt (NPSD) and Gross Normal Authorities Debt (GGGD) stood at 59.9% and 74.4% of GDP in August. With declining income and ongoing expenditures, the nation is expected to shut this 12 months with a deficit of 1% of GDP.

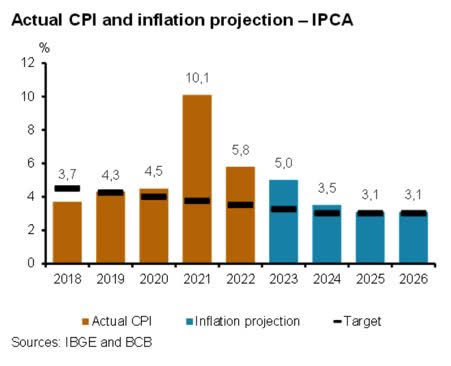

Inflation: Traits Are Nonetheless Favorable

Brazil continues to expertise a positive development in inflation, with notable deceleration noticed within the costs of providers, underlying providers, industrial items, and meals, coupled with declines within the core and diffusion indexes.

The forecast signifies that the IPCA (Client Value Index) is predicted to peak in September this 12 months, with a projected enhance of 5.33% over the gathered 12 months. Subsequently, the index is anticipated to stabilize, concluding the 12 months at 5%. Shifting into 2024, the Brazilian Central Financial institution has set an expectation of three.5%.

Brazil’s CPI (Banco Central do Brasil and IBGE)

Regardless of these optimistic indications, there are a number of noteworthy dangers to contemplate. The exterior financial atmosphere stays difficult, with slight indicators of inflation slowing down, but core figures persisting above the specified ranges. Moreover, persistent pressures on oil costs might probably result in will increase in gasoline prices. The potential results of El Niño on meals costs additionally pose a danger, whereas inside fiscal uncertainties inside Brazil could affect inflation expectations.

Curiosity Charges In a Downtrend Trajectory, however at What Tempo?

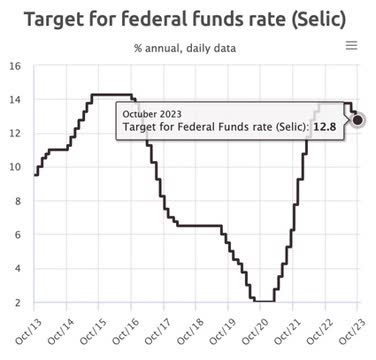

The rate of interest situation in Brazil is at present experiencing a downward development, however the tempo of this decline stays unsure.

In September, the Copom (Financial Coverage Committee) reduced the Selic price by 50 foundation factors (0.5 proportion factors), bringing the rate of interest to 12.75% yearly. In my evaluation, Copom’s choices have been fairly assertive. The financial authority has constantly emphasised the significance of addressing the fiscal deficit problem, aiming to realize a balanced finances by 2024 to assist anchor inflation expectations.

Brazil Curiosity Price (Selic) (Banco Central do Brasil)

Moreover, Copom has highlighted the necessity for warning within the combat in opposition to inflation since some inflation indicators, significantly the underlying measures, nonetheless exceed the Central Financial institution’s goal. This means that there’s solely partial anchoring of inflation expectations.

The expectation is an additional 50 foundation level minimize within the rate of interest over the following two conferences. The Brazilian Central Financial institution tasks a terminal rate of interest of 11.75% each year in 2023, anticipated to say no to 9.25% in 2024.

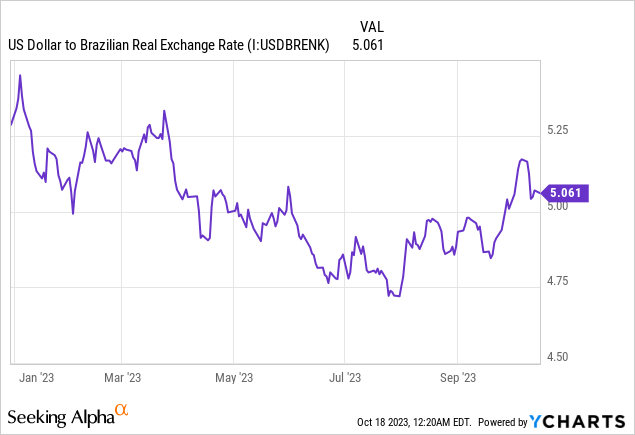

U.S. Greenback Strengthens In opposition to the Brazilian Actual

In September, the real-dollar alternate price closed at R$5.00, a slight enhance in comparison with its August closing price of R$4.92. Though the alternate price initially displayed some appreciation within the first half of the month, it skilled a notable surge following vital financial coverage choices in each Brazil and america.

In the direction of the top of the month, a mix of exterior uncertainties strengthened the U.S. greenback. These elements included issues a few potential rate of interest hike within the U.S., which put strain on the longer finish of the yield curve, the looming danger of a authorities shutdown within the U.S., and points within the Chinese language actual property sector, inflicting worldwide apprehension.

Moreover, overseas traders appear to be harboring issues about Brazil’s fiscal scenario and are skeptical about its capability to realize its deficit discount purpose for the approaching 12 months. Nonetheless, it’s noteworthy that two elements are exerting downward strain on the alternate price: Brazil’s favorable commerce steadiness and its actual rate of interest, which stays one of many highest globally. These components proceed to draw and preserve funding.

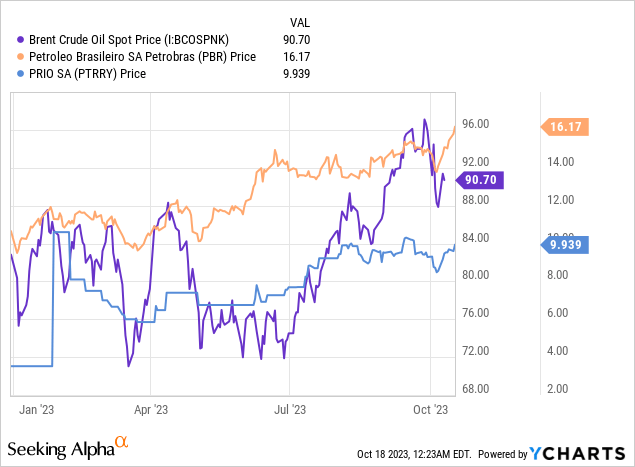

Commodities: Encouraging Alerts

Within the realm of oil, the latest worth surge will be attributed to the announcements of manufacturing cuts by Saudi Arabia and Russia. Moreover, decreased issues a few recession within the U.S. and expectations of extra strong development this 12 months have bolstered the demand outlook.

The oil market is predicted to keep up relative stability, with demand predicted to outpace provide by the top of the 12 months. This could lead to costs remaining close to their present ranges, roughly between $90 and $95 per barrel. This enhance in oil costs has positively impacted the efficiency of Petrobras (PBR) (PBR.A), which holds probably the most vital weight within the ETF, and Prio S.A. (OTCPK:PTRRY), making up roughly 17% and 1.8% of EWZ, respectively.

Nonetheless, it is vital to notice that Petrobras continues to keep up its pricing construction, and with Brent crude oil costs remaining excessive, the corporate is prone to function at a loss. This places strain on income and results in decrease dividend distributions.

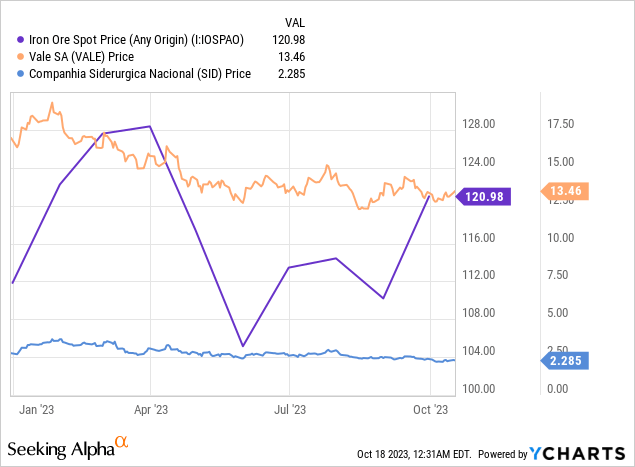

Conversely, iron ore has maintained its elevated costs, hovering round US$120 per ton. A number of elements contribute to this stability, together with the sustained demand from Chinese language steelmakers, financial stimulus measures from Beijing, and the optimistic seasonality of the present interval.

Vale’s (VALE) shares have skilled a 17% decline over this 12 months. It is vital to notice that Vale is the second-largest holding within the EWZ, representing 13% of its composition. One other inventory affected by the strain on iron ore is Companhia Siderúrgica Nacional (SID), which can also be in a downtrend with a 15% lower and constitutes about 0.50% of EWZ.

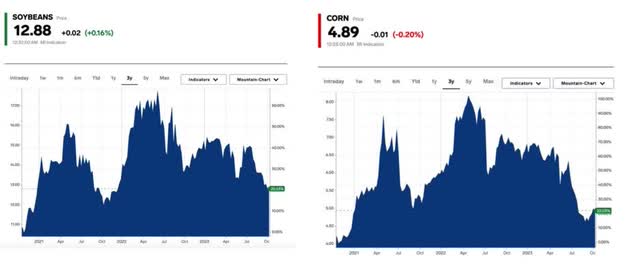

Lastly, the continued worth decline in agricultural commodities is primarily attributable to a big enhance in international provide, pushed by document harvests in Brazil, improved climate circumstances within the U.S., and weakened Chinese language demand. Each corn and soybean costs have reached their lowest ranges in three and two years, respectively.

Market Insider

This case is anticipated to positively affect the third-quarter outcomes of the meals and beverage industries. It might enhance the shares of corporations like Ambev (ABEV) and JBS (OTCQX:JBSAY), constituting roughly 3.2% and 0.9% of EWZ’s composition, respectively.

Sustaining a Impartial Stance

In a broader context, I nonetheless observe that main Brazilian corporations throughout the index are buying and selling at notably discounted price-to-earnings (P/E) ratios in comparison with their trade friends. These corporations are prone to yield substantial dividends over the following two years.

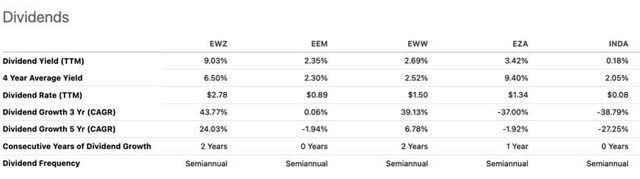

Consequently, with a P/E ratio of 5x, the iShares MSCI Brazil ETF (EWZ) continues to be a gorgeous possibility for gaining publicity to rising markets in comparison with different counterparts. As an illustration, the iShares MSCI Rising Markets ETF (EEM) trades at a P/E of 11x, the iShares MSCI Mexico ETF (EWW) at 10x, and the iShares MSCI South Africa ETF (EZA) at 10.5x.

Relating to dividends, the EWZ additionally stands forward of its rising market friends with a yield of 9%.

Searching for Alpha

Ibovespa, Brazil’s inventory market, noticed a modest restoration in September, registering a 0.71% enhance after a big 5% decline within the earlier month. Nonetheless, the panorama stays unsure, characterised by frequent and unpredictable actions among the many index’s constituent shares. These shifts in-stock positions are difficult to forecast, contributing to the market’s general uncertainty regardless of the potential for an improved atmosphere attributable to declining rates of interest.

To undertake a extra optimistic stance, I’d await extra exact alerts of China’s financial progress, a lower in long-term American rates of interest, and a stronger indication of fiscal enhancements in Brazil to make sure that rates of interest proceed to say no quicker.

For these causes, for now, I preserve a impartial bias and take into account extra favorable alternatives for profitability within the Brazilian and American fixed-income markets reasonably than publicity to the Brazilian inventory market.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please pay attention to the dangers related to these shares.