- ETH’s value dropped beneath $3000 on the thirtieth of April.

- The decline will seemingly proceed if bearish momentum climbs.

Ethereum’s [ETH] temporary decline under $3000 throughout the buying and selling session on the thirtieth of April led to a spike in its social exercise, Santiment famous in a submit on X (previously Twitter).

#Bitcoin and #Ethereum are seeing considerably greater dialogue in comparison with different belongings in the present day. Merchants have confirmed a large quantity of worry with $BTC dropping as little as $59.5K and $ETH as little as $2.9K in the present day. Counter merchants have used these indicators as an excellent #buythedip… pic.twitter.com/6pRAFHidcD

— Santiment (@santimentfeed) April 30, 2024

In line with the on-chain knowledge supplier, on the time of press, the altcoin ranked second by way of social dialogue after Bitcoin [BTC].

Between the twenty ninth and the thirtieth of April, ETH’s social dominance skyrocketed by 150% because the chatter involving the coin throughout Telegram, Reddit, X, and 4Chan elevated.

To rise or fall?

Usually, when an asset’s value decline is adopted by a surge in social exercise, it typically indicators an impending value correction.

Nevertheless, a have a look at the coin’s value actions on a every day chart instructed that ETH won’t be poised for any vital rebound within the quick time period. Its value could even witness additional draw back.

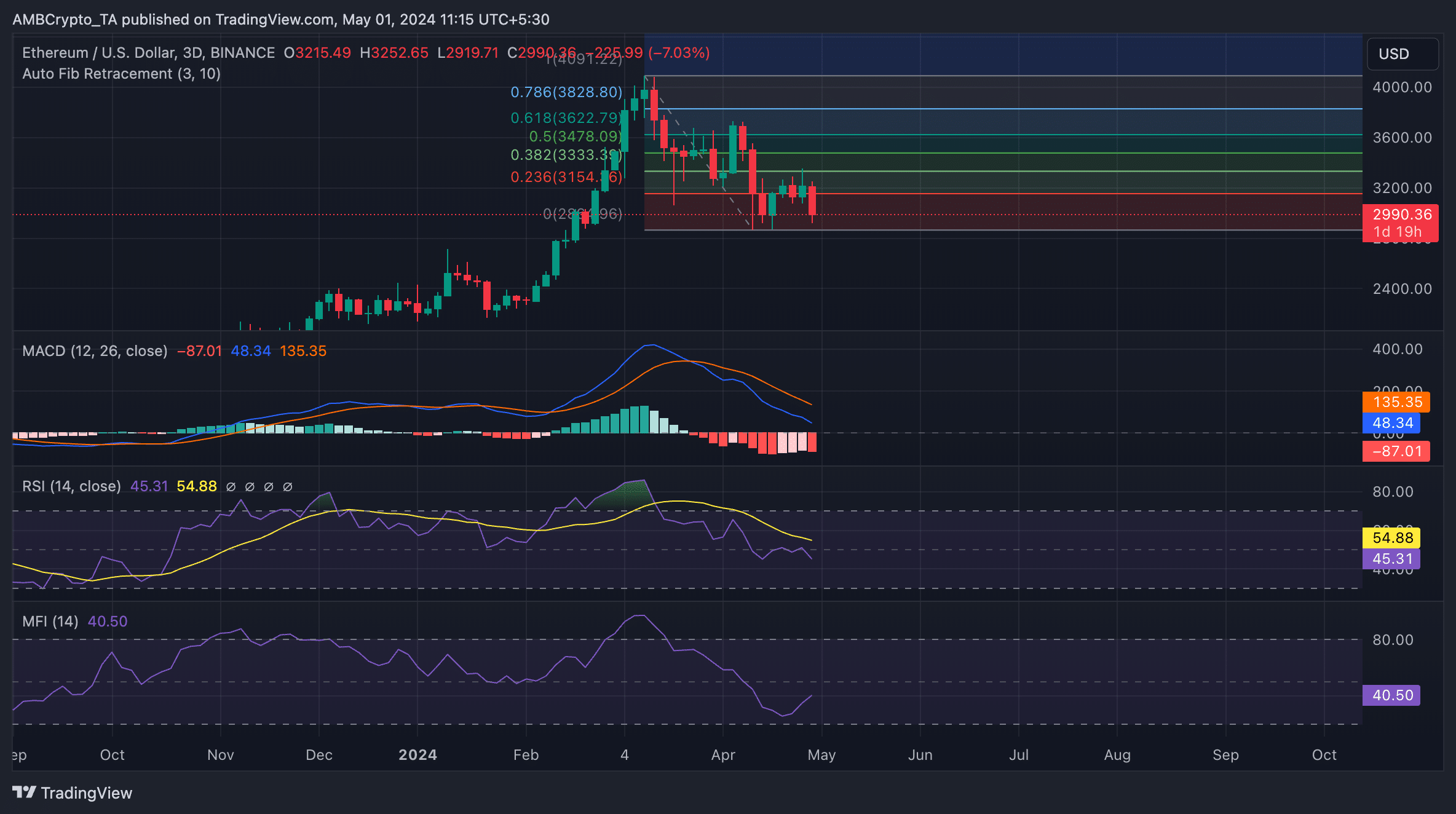

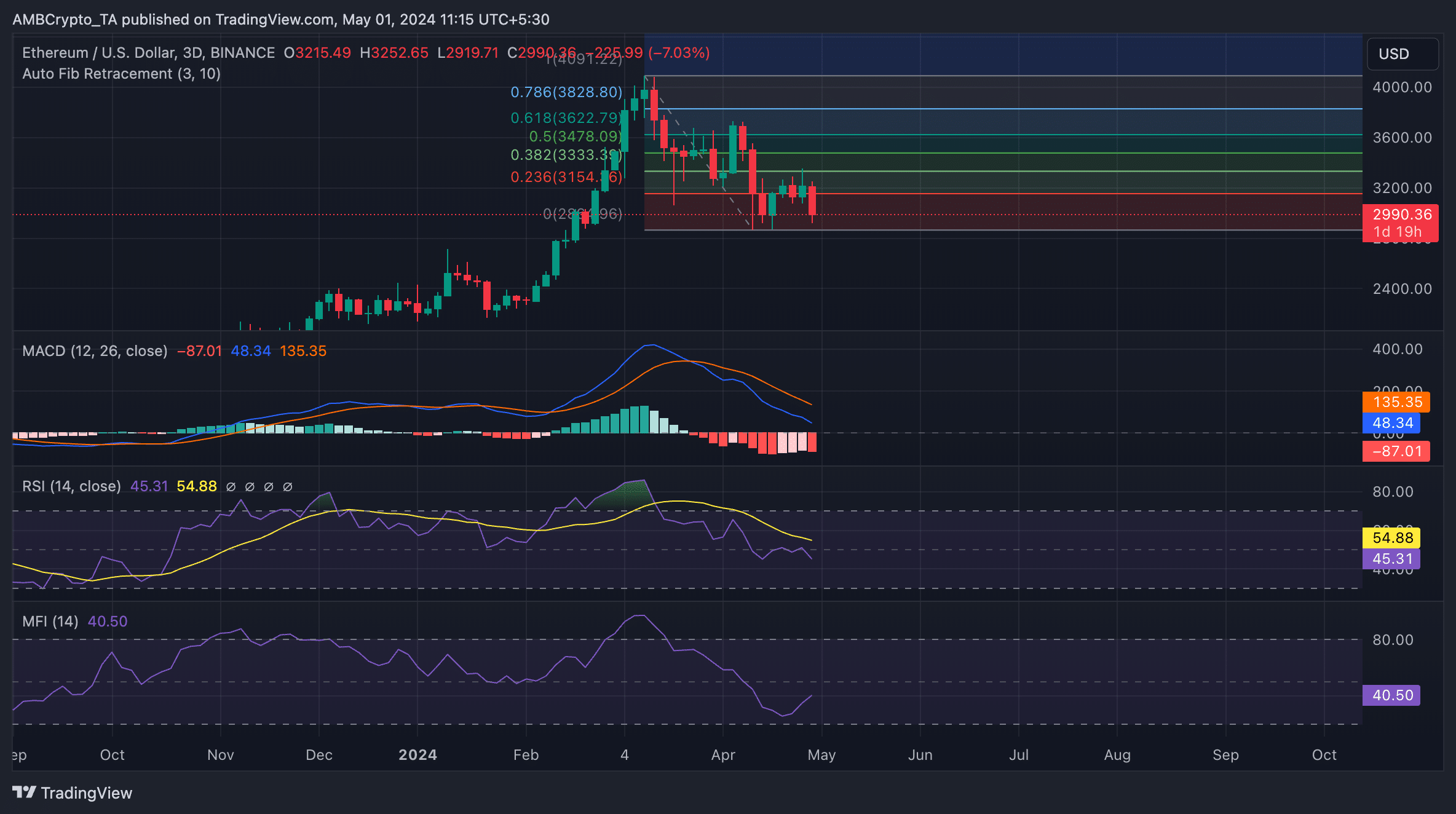

Readings from the coin’s Fibonacci Retracement ranges confirmed that ETH’s decline under $3000 marked a breach of an necessary help degree, which it had shaped at $3145 over the previous few weeks.

Exchanging palms at $2,899 at press time, the probability of an additional decline stays excessive as demand for the main altcoin continues to plummet amongst market individuals.

For instance, ETH’s key momentum indicators had been positioned under their respective middle strains on the time of press. Its Relative Power Index (RSI) was 45.31, whereas its Cash Circulation Index (MFI) was 40.50.

At these values, the symptoms signaled a desire for coin distribution over accumulation.

Additional, the coin’s MACD line (blue) rested under its sign line (orange) and approached the zero line at press time.

When an asset’s MACD line rests under its sign line, it signifies an increase in bearish momentum. Which means the asset’s value might be in a downtrend or that it’s anticipated to expertise downward strain quickly.

Merchants typically interpret it as a possible promote sign.

Supply: ETH/USDT on TradingView

Learn Ethereum’s [ETH] Worth Prediction 2024-25

If bearish momentum climbs, ETH’s subsequent value level could be $2867.

Nevertheless, if the bulls enhance their demand and are in a position to provoke a value rally, the coin may appropriate its motion, reclaim help at $3145, and rally towards $3300.