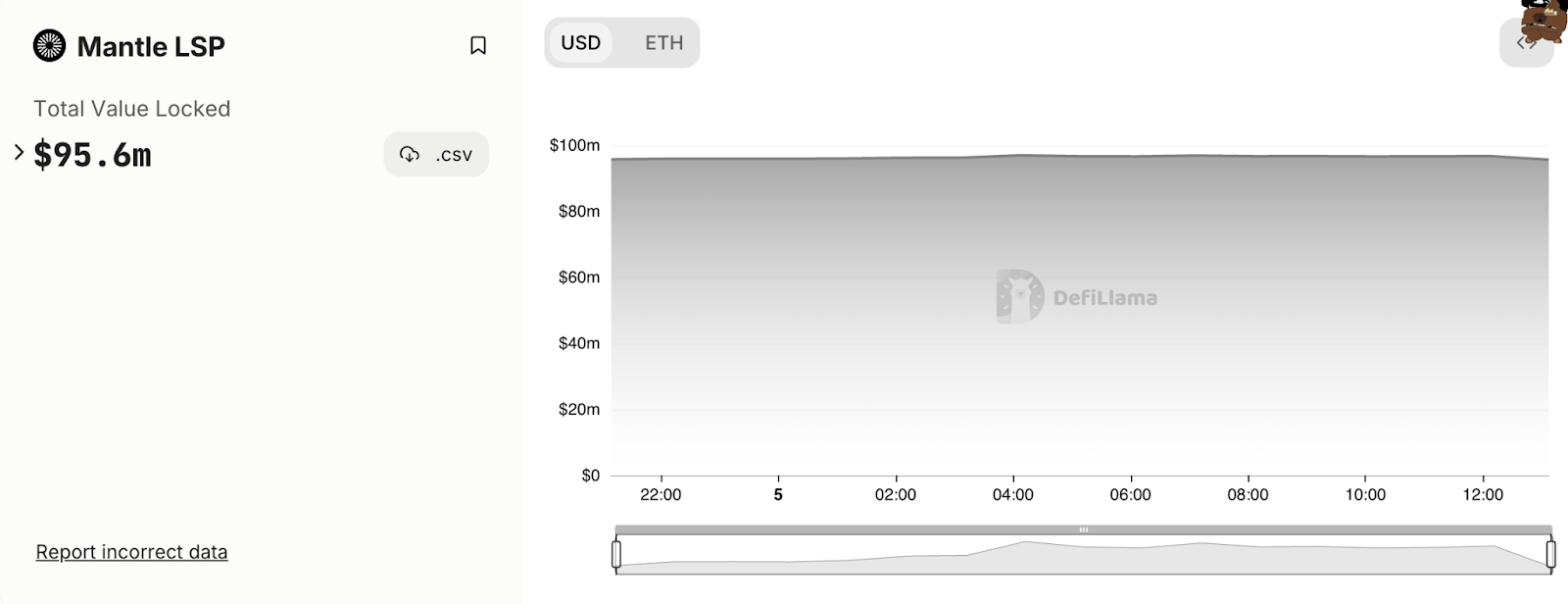

The Whole Worth Locked (TVL) of Mantle Liquid Staking Protocol (LSP) has nearly elevated to $100 million inside 24 hours of implementation. It affords native returns for Ethereum (ETH) and stablecoins.

The pattern of LSP has change into extraordinarily well-liked in recent times. Nevertheless, Lido has been the one dominant participant within the LSP sector, elevating skepticism about its centralization. Lido has a TVL of $20 billion, about 10 occasions larger than Rocket Pool, the mission with the second highest TVL within the liquid staking class.

Now new liquid staking initiatives are rising, aiming to problem Lido’s dominance.

Mantle LSP goals to supply a local APY yield of 4%

On Monday, Ethereum Layer 2 resolution Mantle introduced the deployment of its permissionless, non-custodial Liquid Staking Protocol, Mantle LSP. The protocol guarantees a 4% APY yield by way of Ethereum’s proof-of-stake (PoS) participation.

Learn extra: Prime 7 Excessive Yield Liquid Staking Platforms to Watch in 2024

Like Lido’s sETH, Mantle LSP has mETH as a “value-accumulating obtain token” of the protocol. Inside 24 hours of deploying Mantle LSP, it has nearly reached a TVL of $100 million.

Mantle LSP TVL. Supply: DefiLlama

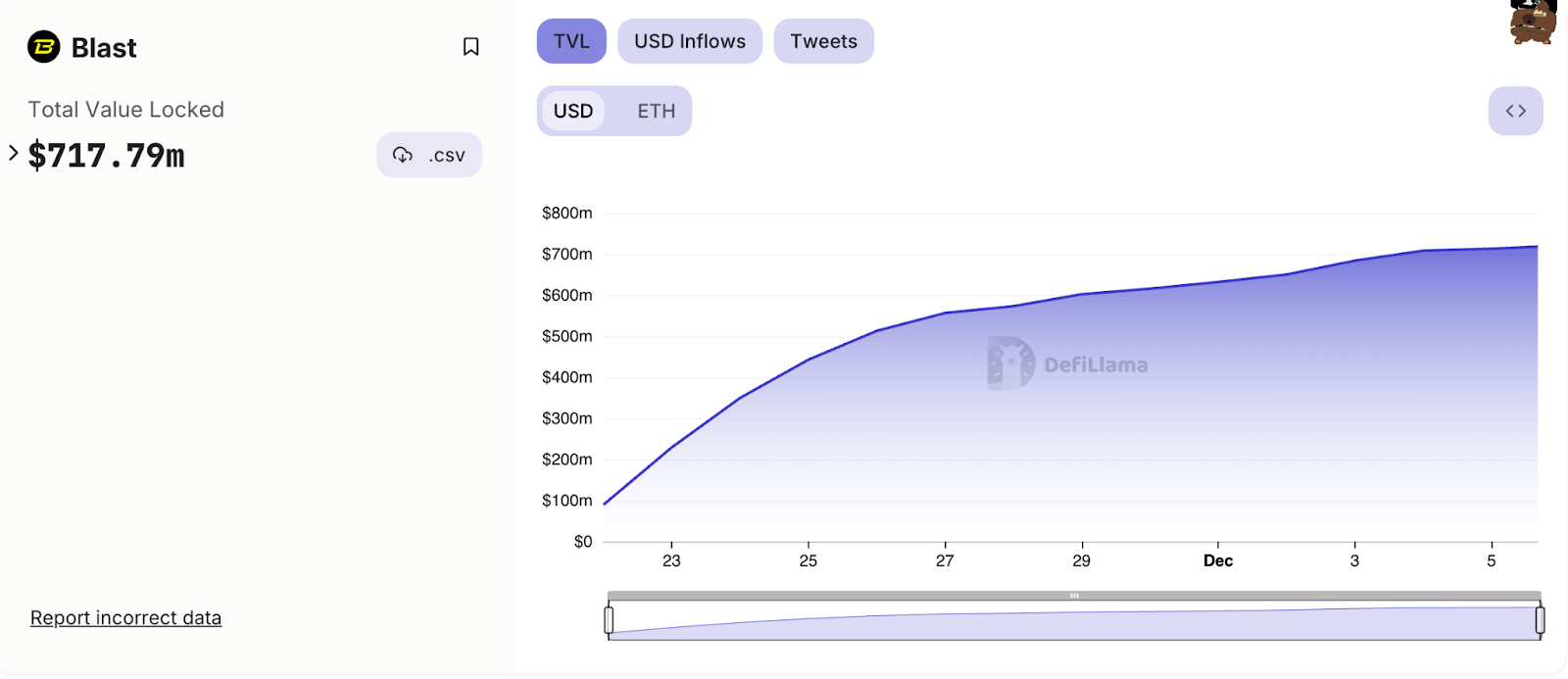

Along with Mantle LSP, many new protocols have emerged that present native yields. For instance, in November, Pacman, the founding father of Blur, introduced a Layer 2 protocol, Blast, that gives native returns for ETH and stablecoins.

It instantly grew to become the middle of neighborhood consideration as neighborhood members anticipated an airborne touchdown. On the time of writing, Blast has a TVL of over $700 million.

Learn extra: What’s Mantle Community? A information to Ethereum’s Layer 2 resolution

Blow TVL. Supply: DefiLlama