- Ethereum’s Dencun improve went dwell on the thirteenth of March.

- There has since been a notable decline in transaction charges on L2 networks.

Main layer 2 networks (L2s) have witnessed a major drop in transaction charges prior to now 24 hours.

This can be a results of the profitable deployment of the Dencun improve and the activation of EIP-4844 on the Ethereum [ETH] mainnet.

The Dencun exhausting fork, which is the most important improve to the Ethereum community because the Merge in September 2022, went dwell at 1:55 pm UTC on the thirteenth of March.

As reported beforehand, the Dencun improve goals to reinforce Ethereum’s scalability and, notably, to lower the transaction charges of L2 resolution suppliers.

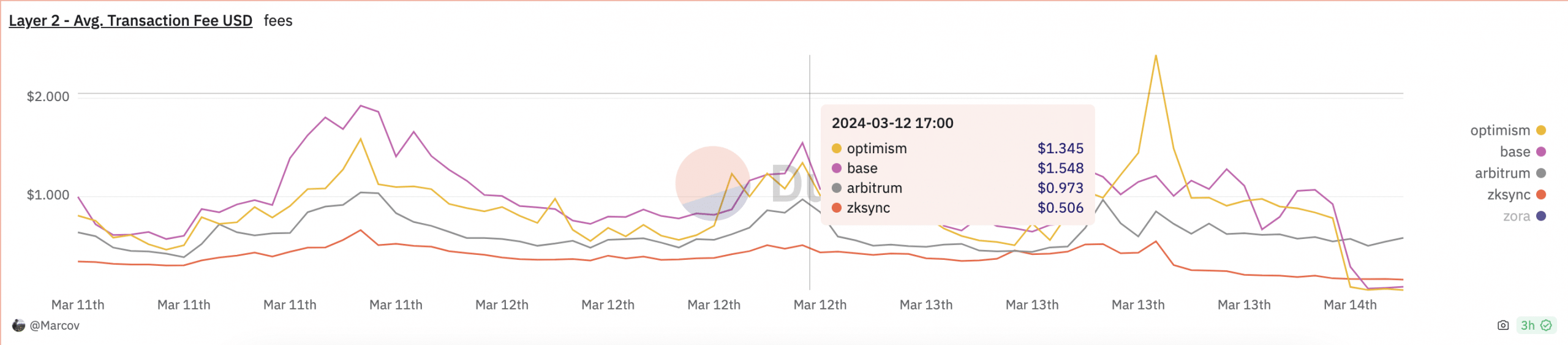

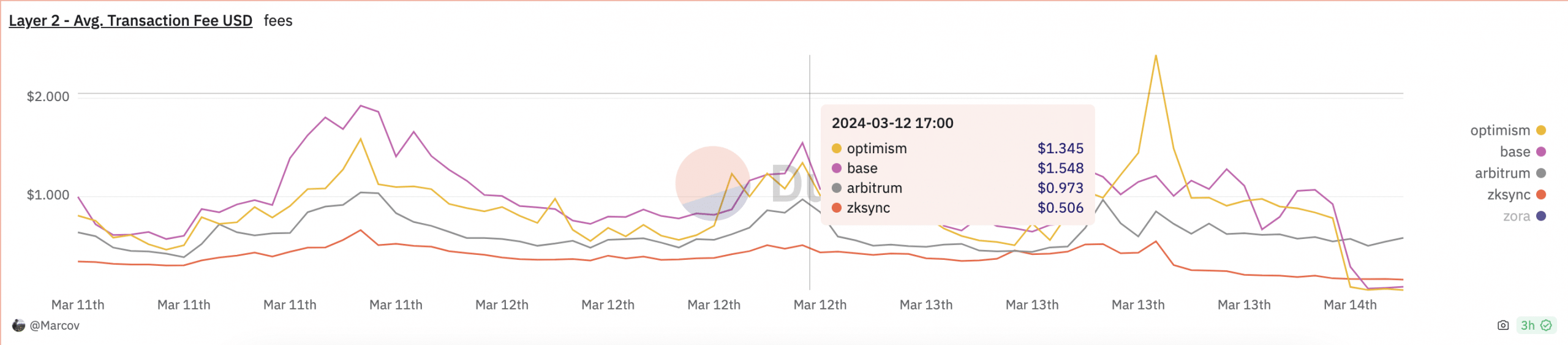

The typical transaction charges on L2s like Optimism [OP], Arbitrum [ARB], Base, and zkSync have dropped considerably by 92%, 23%, 94%, and 33%, respectively, because the implementation of the Dencun exhausting fork.

AMBCrypto sourced this information through a Dune Analytics dashboard compiled by Marcov.

Supply: Dune Analytics

ETH stays in good palms

ETH exchanged palms at $3,988 at press time, per CoinMarketCap’s information.

Its statistically optimistic correlation with Bitcoin [BTC], whose worth has climbed by over 10% within the final week, brought on the altcoin to witness a 5% worth uptick throughout the identical interval.

A 2% enhance in its provide on cryptocurrency exchanges over the previous week indicated an increase in profit-taking exercise.

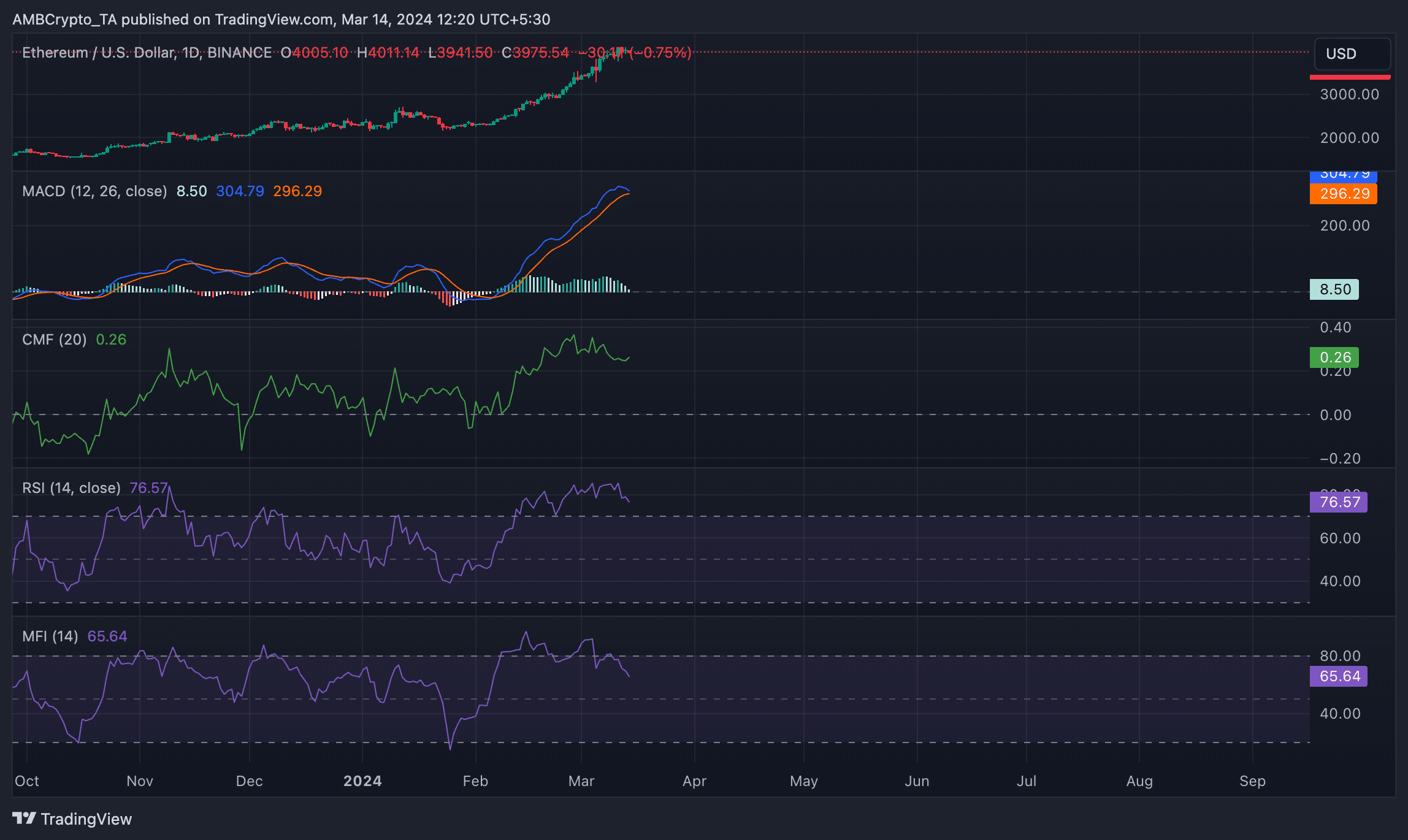

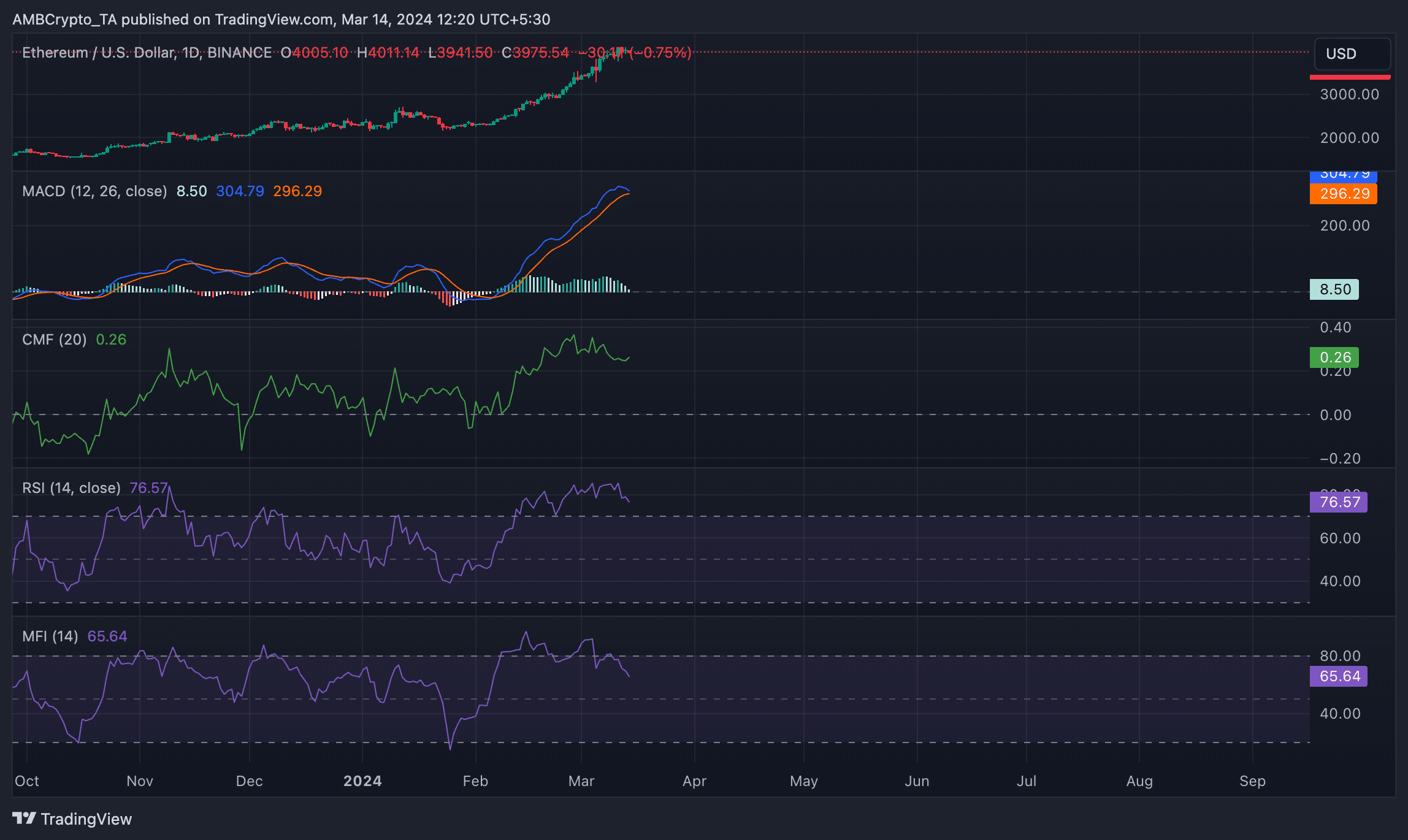

Nonetheless, a take a look at its efficiency on a each day chart revealed that market sentiment stays markedly bullish.

For instance, studying from ETH’s Transferring Common Convergence Divergence (MACD) indicator which tracks market tendencies, confirmed the MACD line (blue) considerably above the development (orange) and 0 strains.

When these strains are positioned on this method, it signifies robust bullish momentum out there.

It means that the short-term transferring common is above the long-term transferring common, and there’s potential for continued worth progress.

Learn Ethereum’s [ETH] Value Prediction 2024-25

Additional, the altcoin’s Chaikin Cash Move (CMF) was 0.26 as of this writing. In an uptrend and above zero, ETH’s CMF confirmed that liquidity influx into the market remained excessive.

Supply: TradingView

Relating to the demand for the main altcoin, its Relative Energy Index (RSI) and Cash Move (MFI) have been 76.57 and 65.54 at press time. These values confirmed that coin accumulation exceeded sell-offs.