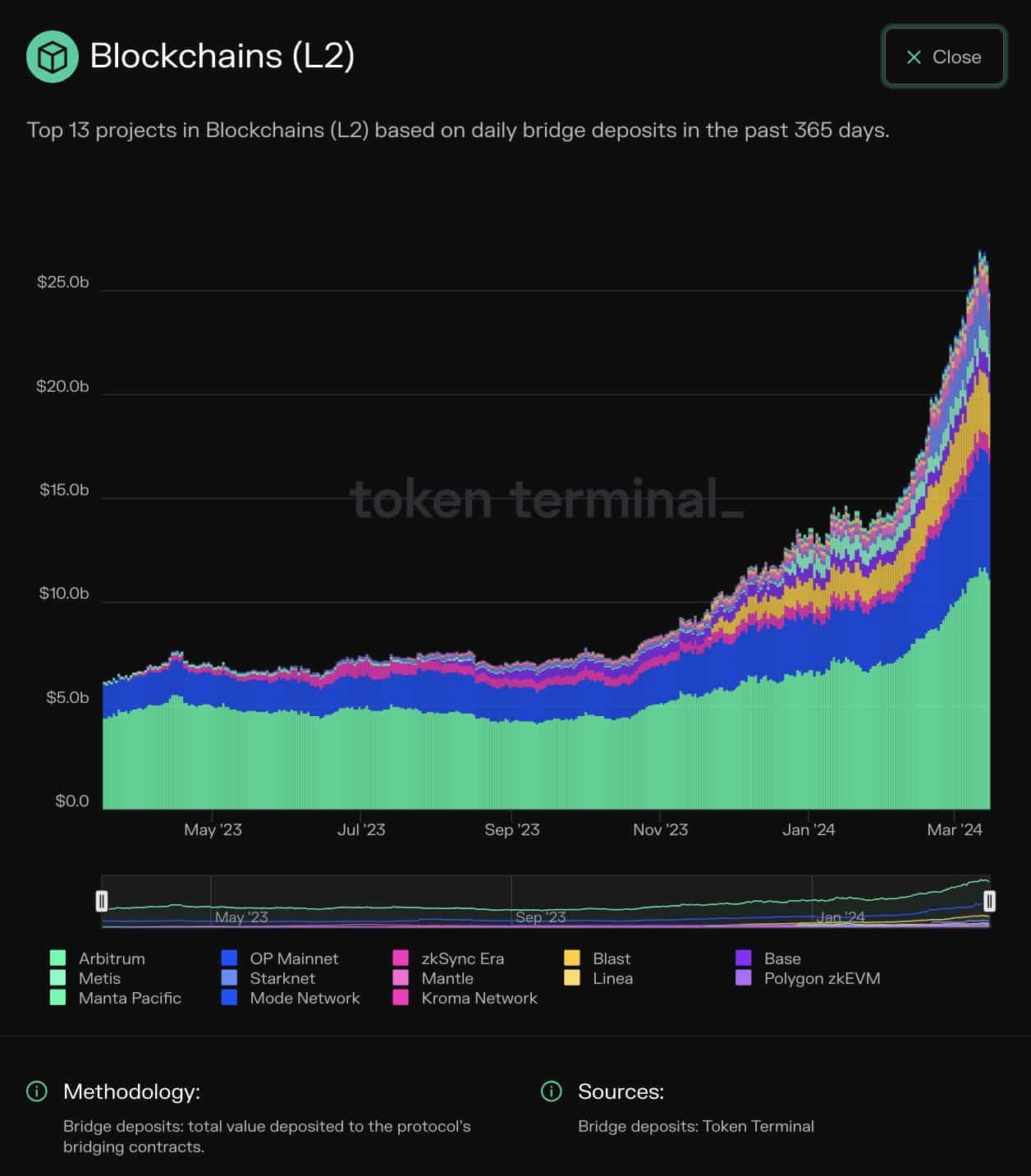

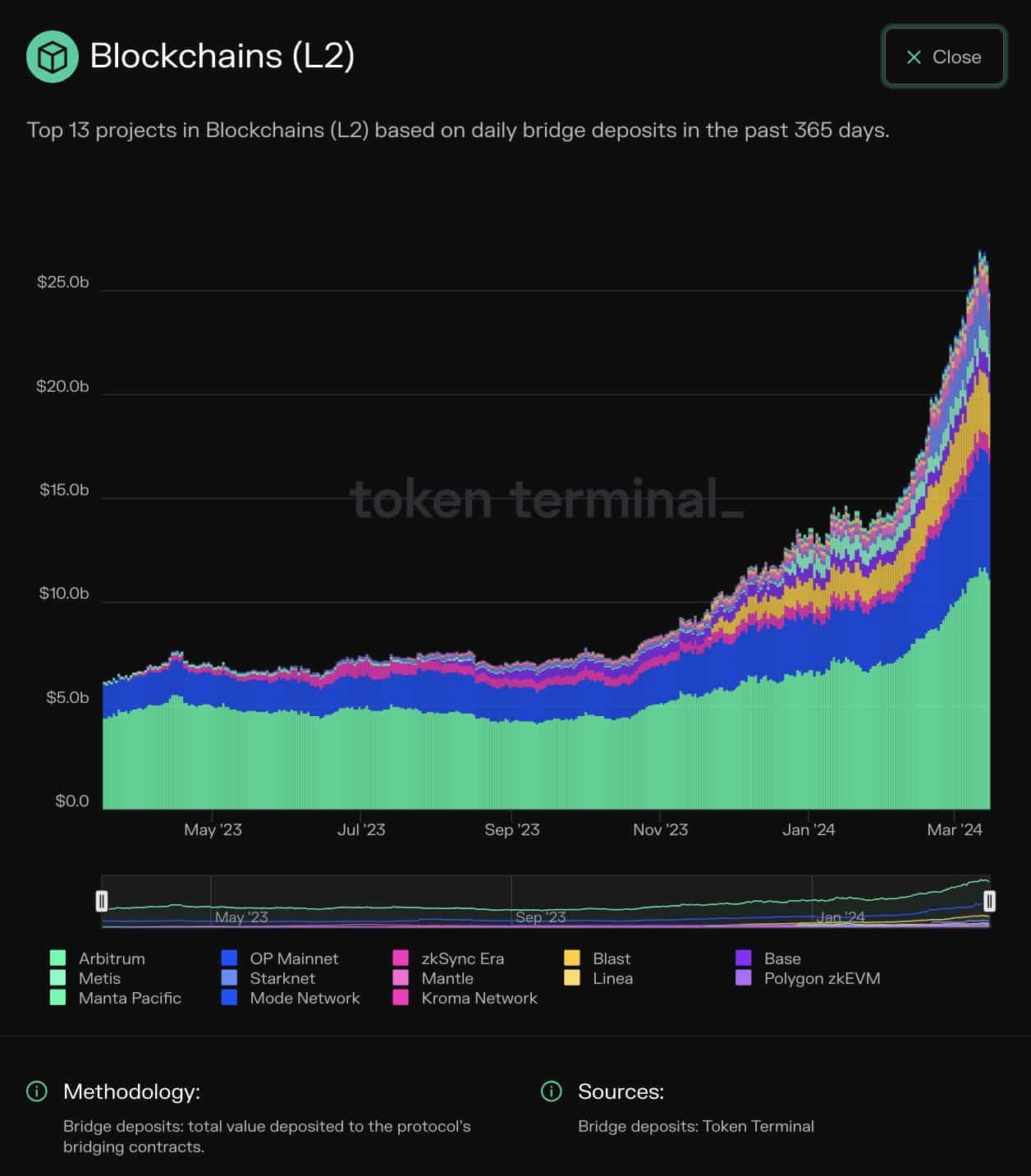

- ETH’s complete worth deposited surpassed $25 billion.

- The heightened demand possible stemmed from the anticipation of the Dencun improve.

Over the previous yr or so, scaling options have performed a considerable function in boosting demand for the Ethereum [ETH] ecosystem.

Constructed atop the bottom layer of Ethereum, these so-called layer -2 (L2) chains had been envisioned to handle Ethereum’s scalability downside.

It was deliberate that over time, these L2s would deal with the vast majority of low-value transactions, with the bottom layer taking good care of safety and decentralization.

Nicely, the imaginative and prescient gave the impression to be changing into a actuality.

In line with a latest put up by on-chain analytics agency Token Terminal, the variety of property bridged from Ethereum to L2s has jumped dramatically within the first three months of 2024.

Supply: Token Terminal

Customers capitalize on L2 advantages

Bridging, as you may already bear in mind, is the method of transferring funds from L1 to L2. That is executed to make the most of the high-speed and low-cost capabilities of the L2s.

As seen from the info above, the overall worth deposited has surpassed $25 billion as of the sixteenth of March, representing a 5x bounce from the identical time final yr.

Arbitrum [ARB] attracted 42% of the overall deposits, adopted by OP Mainnet [OP].

Dencun was the principle driver

The heightened demand in 2024 possible stemmed from the anticipation of the Dencun improve, which went stay final week.

The deployment has resulted in a pointy drop in gasoline charges on L2s, in some chains by as a lot as 90%. Consequently, customers scurried to get their funds transported to benefit from the cheaper prices.

Win-win for ETH?

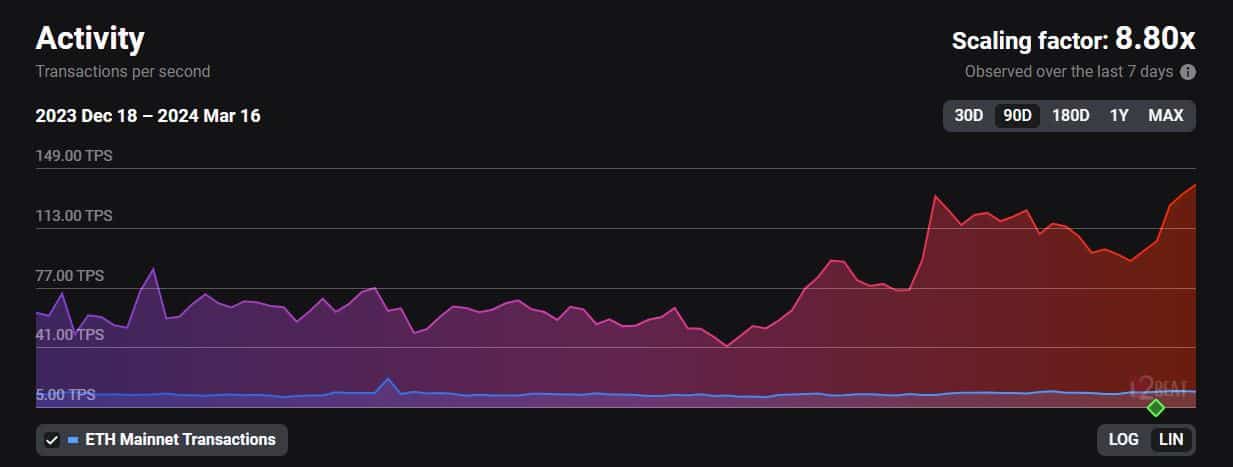

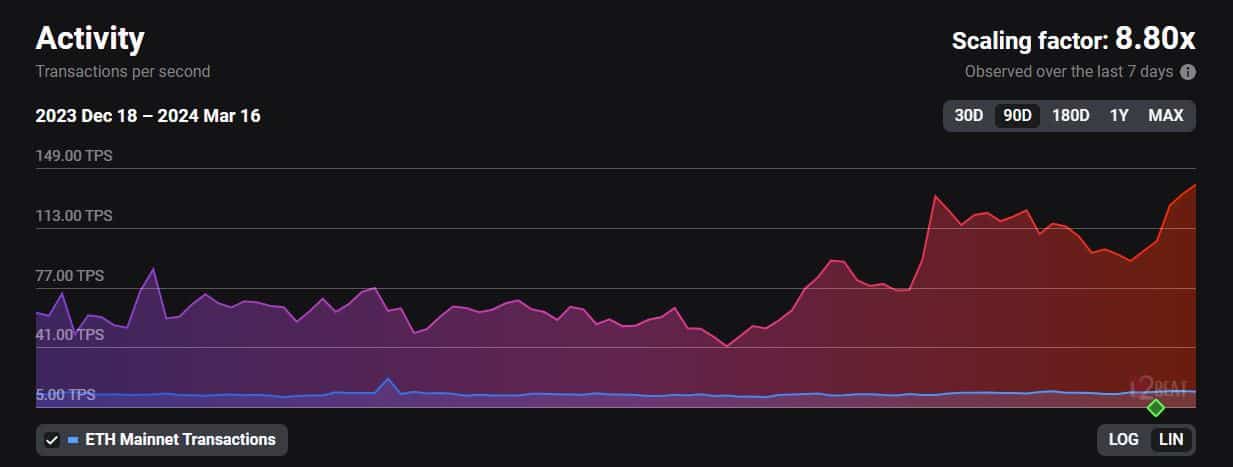

The rising demand has additionally spiked on-chain exercise, with L2s settling greater than eight instances the transactions at press time, AMBCrypto famous utilizing L2Beats knowledge.

Supply: L2Beat

Be aware that after validation, L2s batch the transactions and ship a compressed model to the bottom layer for settlement.

Is your portfolio inexperienced? Try the ETH Revenue Calculator

For every transaction despatched by an L2, the Ethereum community burns a small share of the overall ETH provide. In consequence, excessive community exercise on Ethereum L2s immediately accrues worth to ETH.

As of this writing, ETH was exchanging arms at $3,570 with a fall of 4.56% within the final 24 hours, in response to CoinMarketCap.