- Whales continued to stockpile ETH regardless of being underneath water.

- Majority of whale positions have been longing ETH in derivatives markets.

Ethereum [ETH] sank 4.73% during the last 24 hours of buying and selling, reversing the bullish momentum which it gathered following Bitcoin’s halving. The second-largest cryptocurrency was exchanging fingers at $3,125 as of this writing, based on CoinMarketCap.

The stoop nonetheless, did not affect the market conduct of whale traders, because the latter nonetheless appeared bullish on ETH’s prospects.

Whales purchase ETH’s dip

Based on on-chain monitoring platform Spot On Chain, whales accrued hefty quantity of ETH within the final 24 hours.

A selected pockets with handle 0xe0b snapped 1,524 stETH at a median worth of $3,159. With this seize, the pockets proprietor pushed their complete stETH holdings past $10 million, incomes an estimated 3.42% revenue.

In an even bigger buy, a whale amassed 7,128 ETH, price $22 million at prevailing costs, at $3,111. The rich investor reportedly sat on an enormous $482 million price of ETH stash.

As of this writing, the holder was in a state of unrealized loss.

Provide held by high addresses enhance

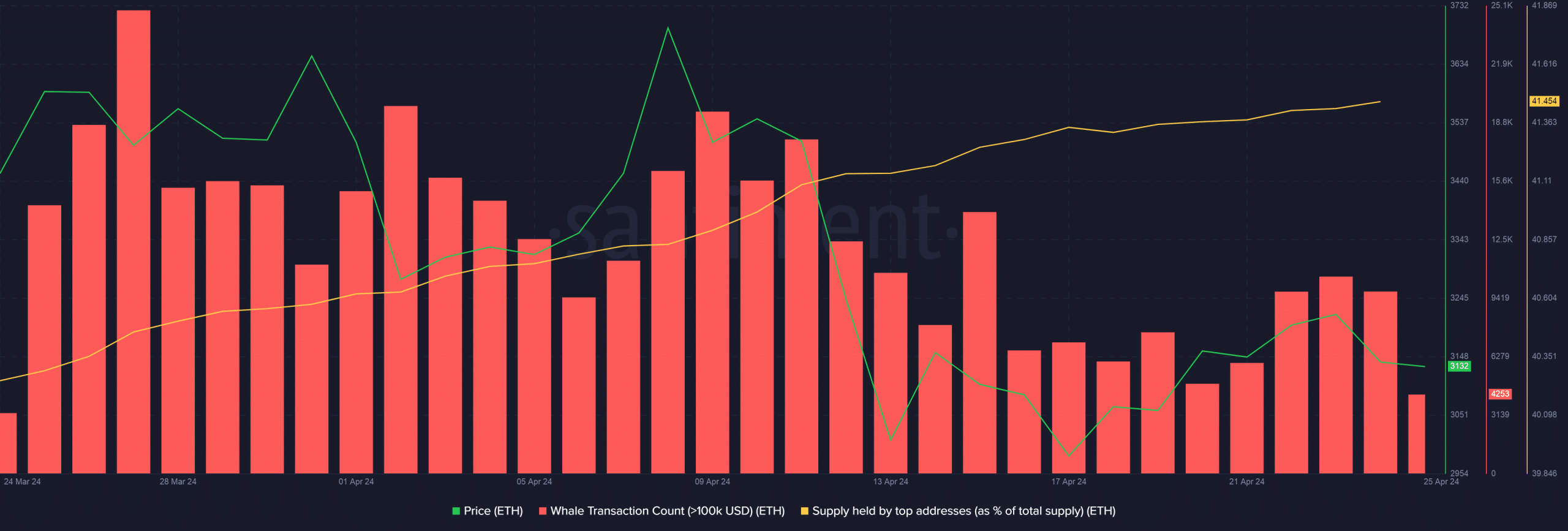

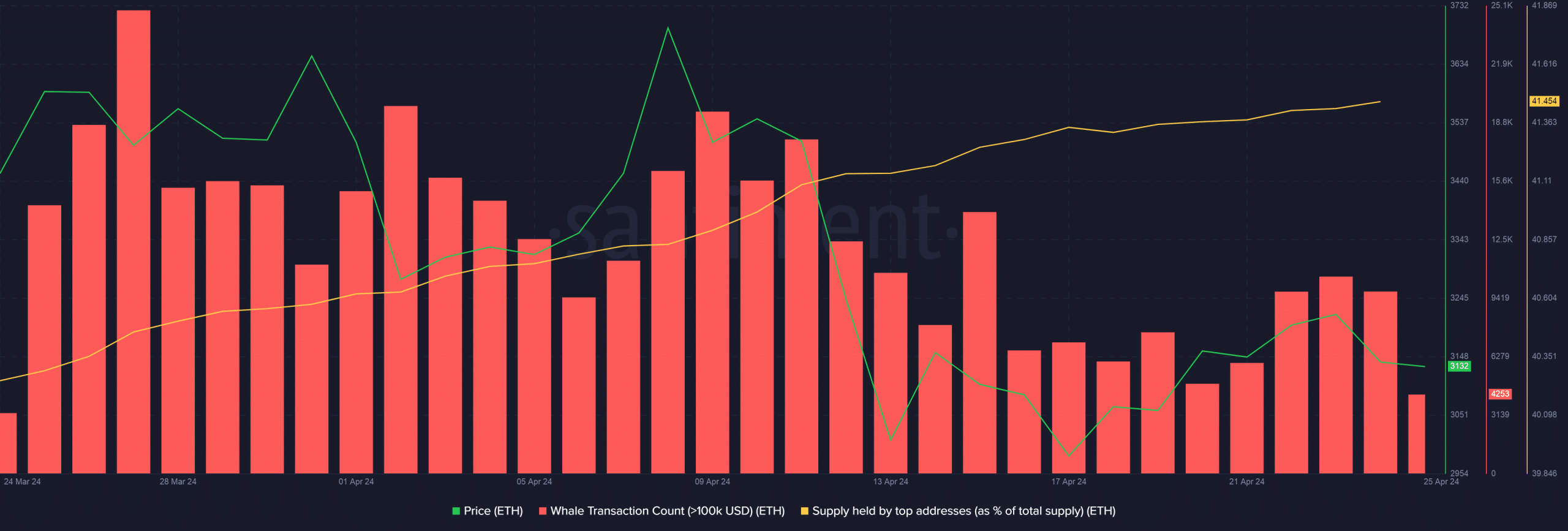

These weren’t remoted developments although. Based on AMBCrypto’s evaluation of Santiment’s information, ETH whales upped their transaction exercise within the final 2-3 days, as seen by the leap in massive transfers exceeding $100k.

Furthermore, the share of complete provide held by high addresses rose from 41.37% on the halving day to 41.45% on the twenty fourth of April, suggesting accumulation by whales.

Supply: Santiment

Whales nonetheless betting on ETH’s rise

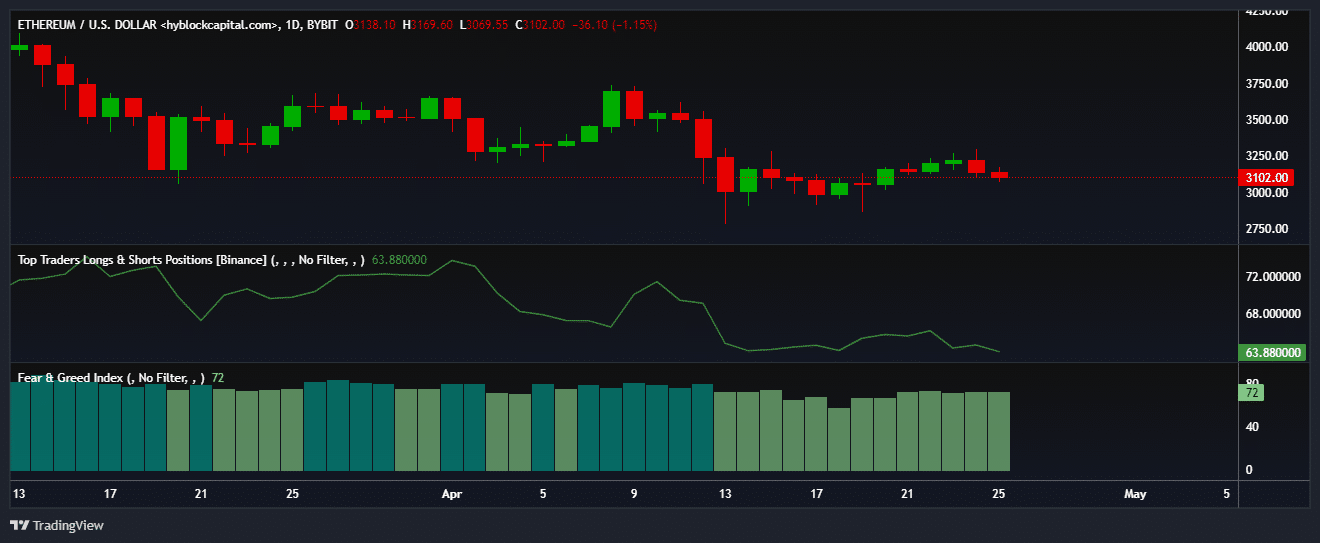

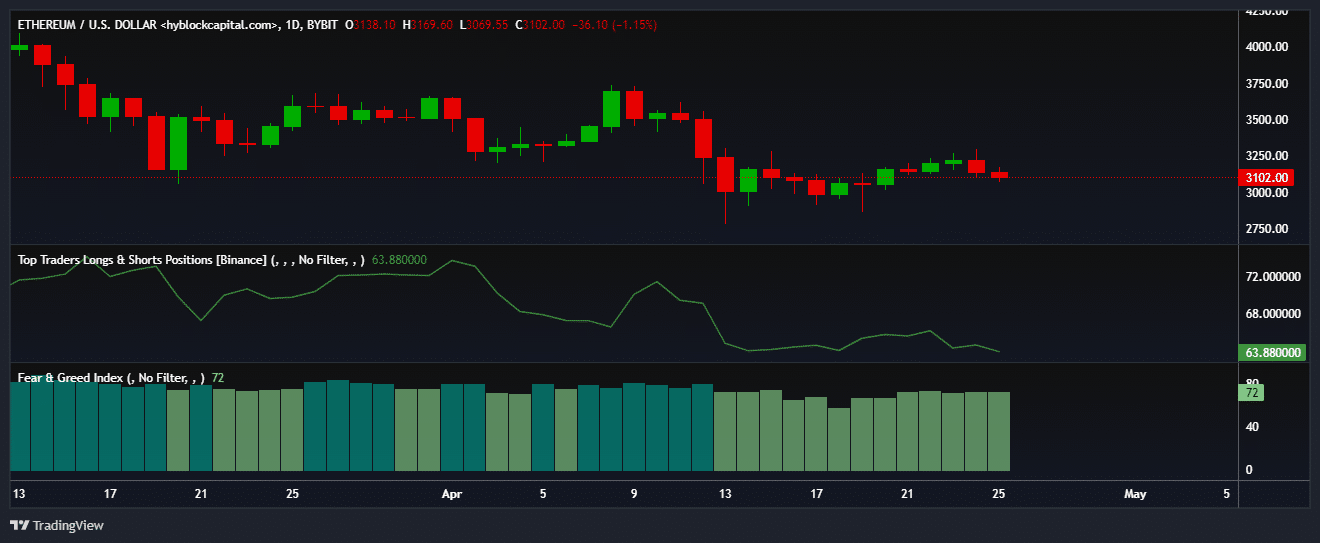

On the derivatives markets too, majority of the whales have been bullishly positioned. About 63% of the whole whale positions on Binance have been lengthy on ETH, as per AMBCrypto’s evaluation of Hyblock Capital information.

Is your portfolio inexperienced? Try the ETH Revenue Calculator

Although, it was price mentioning that the lengthy publicity got here down after the halving.

The market sentiment leaned in the direction of greed, indicating the opportunity of enhance in shopping for strain within the days to come back. This might assist ETH’s rebound within the days forward.

Supply: Hyblock Capital