- Historic design proven by the MVRV ratio, led ETH to bounce.

- Whereas merchants booked some earnings, the OI indicated that extra was shut.

On the eighth of April, Ethereum [ETH] defied the varsity of thought that it was a gradual transfer this cycle as its market cap jumped by over 9%. This enhance positioned its market cap at over $440 billion.

Throughout this time, the altcoin’s worth surpassed $3, 700 earlier than its slight drop. However that was not the main spotlight.

The previous is usually the current

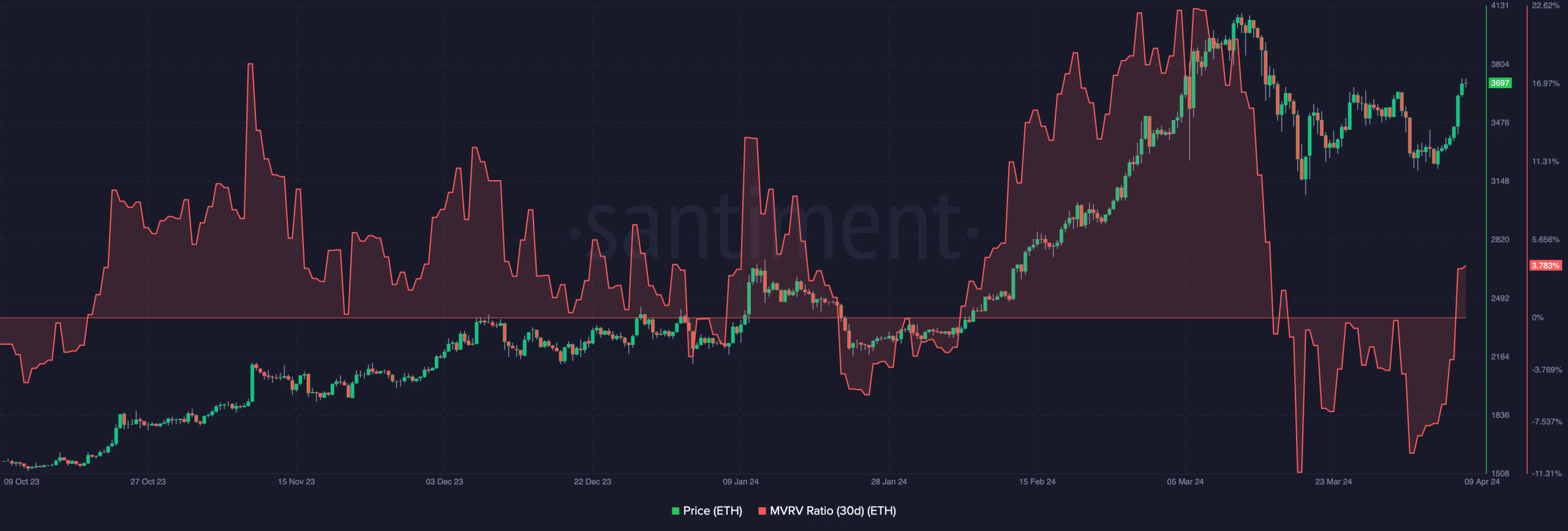

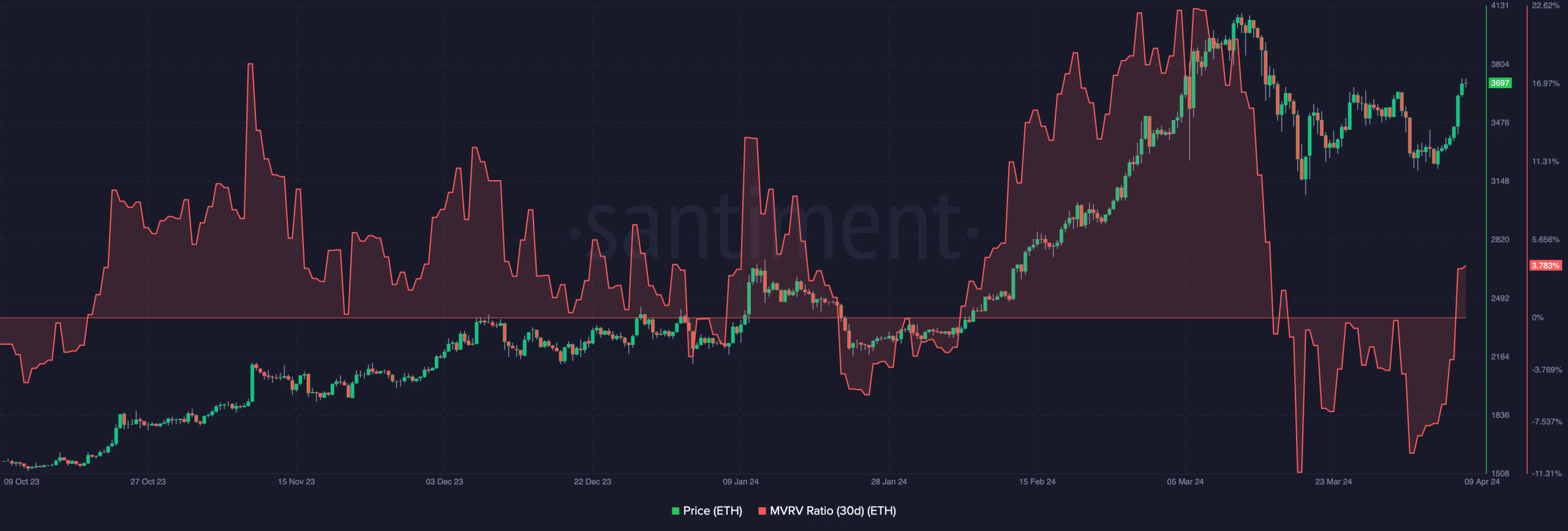

AMBCrypto analyzed Ethereum’s on-chain situation and noticed the Market Worth to Realized Worth (MVRV) ratio. This ratio gives insights into merchants’ shopping for and promoting habits. It will probably additionally assist to identify the bottoms and tops of an asset.

Between the first and seventh of April, ETH’s 30-day MVRV ratio was damaging, suggesting an uncommon shopping for alternative within the area. This prediction was based mostly on the cryptocurrency’s historical past.

Supply: Santiment

For example, the ratio was -4.90 in October 2023 whereas ETH modified fingers at $1,566. Weeks later, the worth crossed $2,000. An analogous state of affairs additionally occurred in January as ETH moved from $2,237 to $4,088.

On each events, the worth elevated by 21.7% and 45.27% respectively. This time, Ethereum has solely elevated by 7.89%. Ought to the historic sample repeat itself, the worth may rally towards $4,648 over the following few weeks.

However which may solely be the case if the market doesn’t expertise excessive volatility that would trigger costs to nosedive. If that is so, then the bullish prediction is perhaps invalidated.

Is it time for surplus positive aspects?

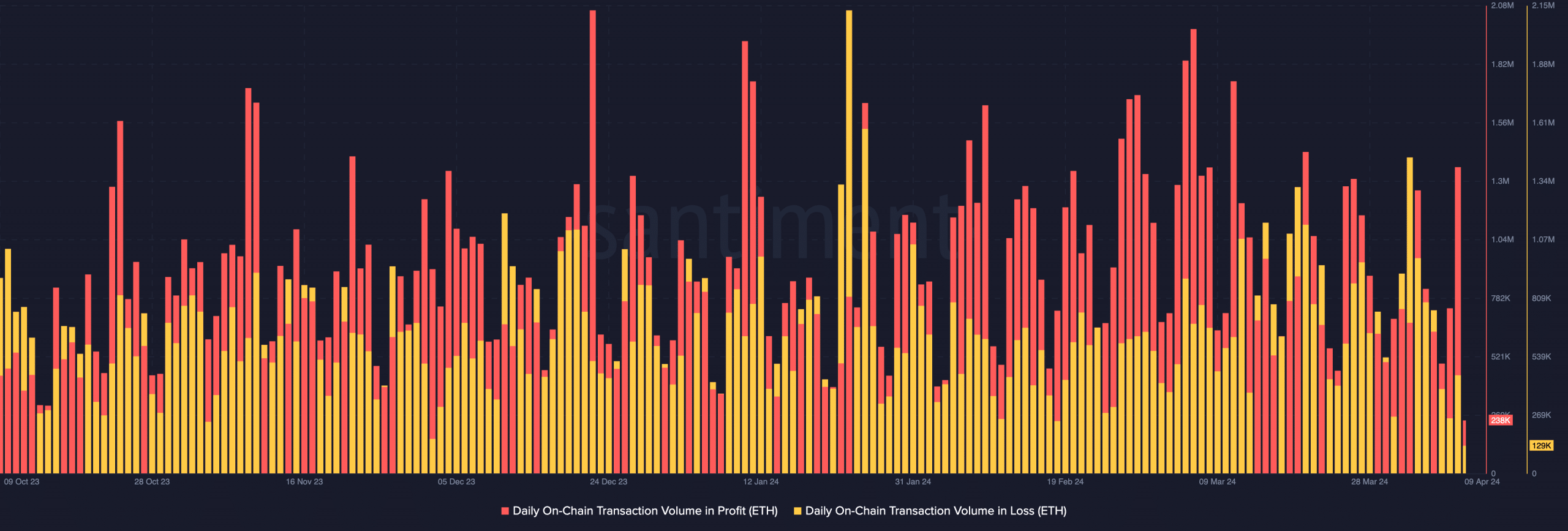

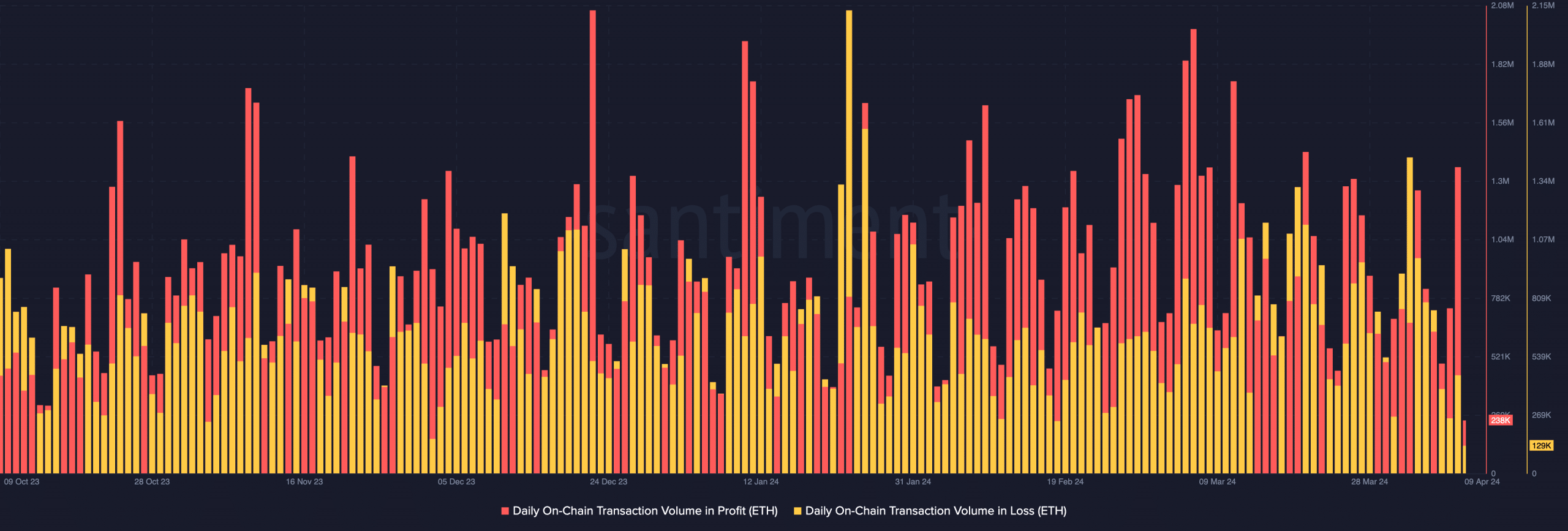

Within the meantime, merchants took benefit of the worth enhance to comprehend some earnings. This was one thing that ETH holders couldn’t boast of in latest weeks.

A take a look at the each day on-chain transaction quantity in loss showed that it was $129,000. Then again, the on-chain transaction quantity in revenue was about 238,000.

Supply: Santiment

If the worth of the cryptocurrency continues to extend, then the quantity in revenue may very well be double these within the crimson. However will Ethereum give in to the rally?

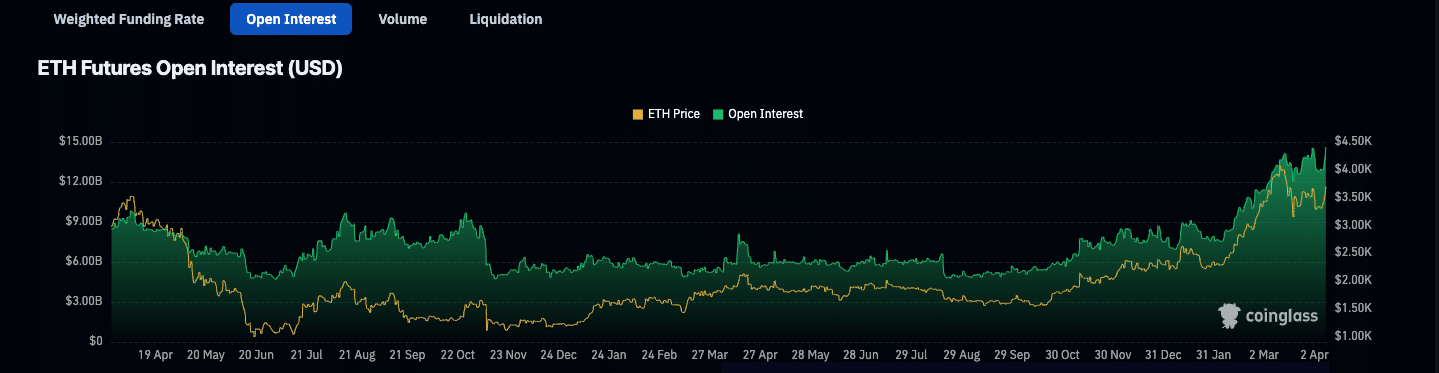

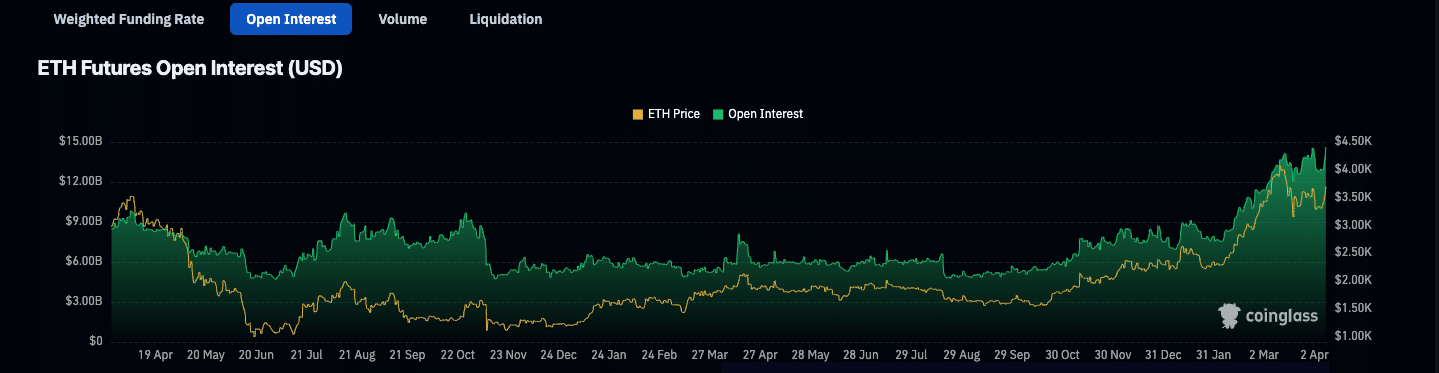

To determine this chance, AMBCrypto seemed on the Open Curiosity (OI). In line with data from Coinglass, ETH’s OI jumped to $14.41 billion.

OI measures merchants’ exercise based mostly on web positioning. If the OI decreases, it implies a rise in positions closed. Then again, a rise within the metric suggests a surge in liquidity added to open positions.

Supply: Coinglass

Subsequently, the rise within the final 24 hours meant that extra contracts had been opened, with patrons being the aggressive ones.

Learn Ethereum’s [ETH] Worth Prediction 2024-2025

Taking a look at ETH’s worth and the OI, plainly the convergence would possibly set off a major worth motion.

From a buying and selling perspective, the massive OI alongside the rising worth would possibly result in a breakout. Ought to this be the case, ETH’s rise above $4,000 may very well be subsequent.