- Analyst claims ETH will eclipse BTC in crypto summer time.

- The US liquidity injection might enhance the market within the second half 2024.

Ethereum [ETH] might outshine Bitcoin [BTC] as we inch nearer to crypto summer time. The daring projection was made by Raoul Pal, founding father of Actual Imaginative and prescient and key crypto market commentary determine.

In an X put up, Pal underscored that crypto summer time is an altcoin season that shifts consideration from Bitcoin to others. A part of his put up read,

“Crypto Summer time is normally the beginning of Alts season, which matches full “bubble-tastic” in Fall. That is when ETH bases and begins to outperform BTC. That is when SOL accelerates its outperformance of BTC & ETH.”

Including a timeline to his projection and the way “loopy” issues can get, Pal highlighted that,

“As soon as the markets are full refreshed, that’s normally when The Banana Zone begins, selecting as much as full mania in the direction of the latter a part of the yr…and nicely into 2025”

Supply: X/Rauol Pal

The US liquidity issue

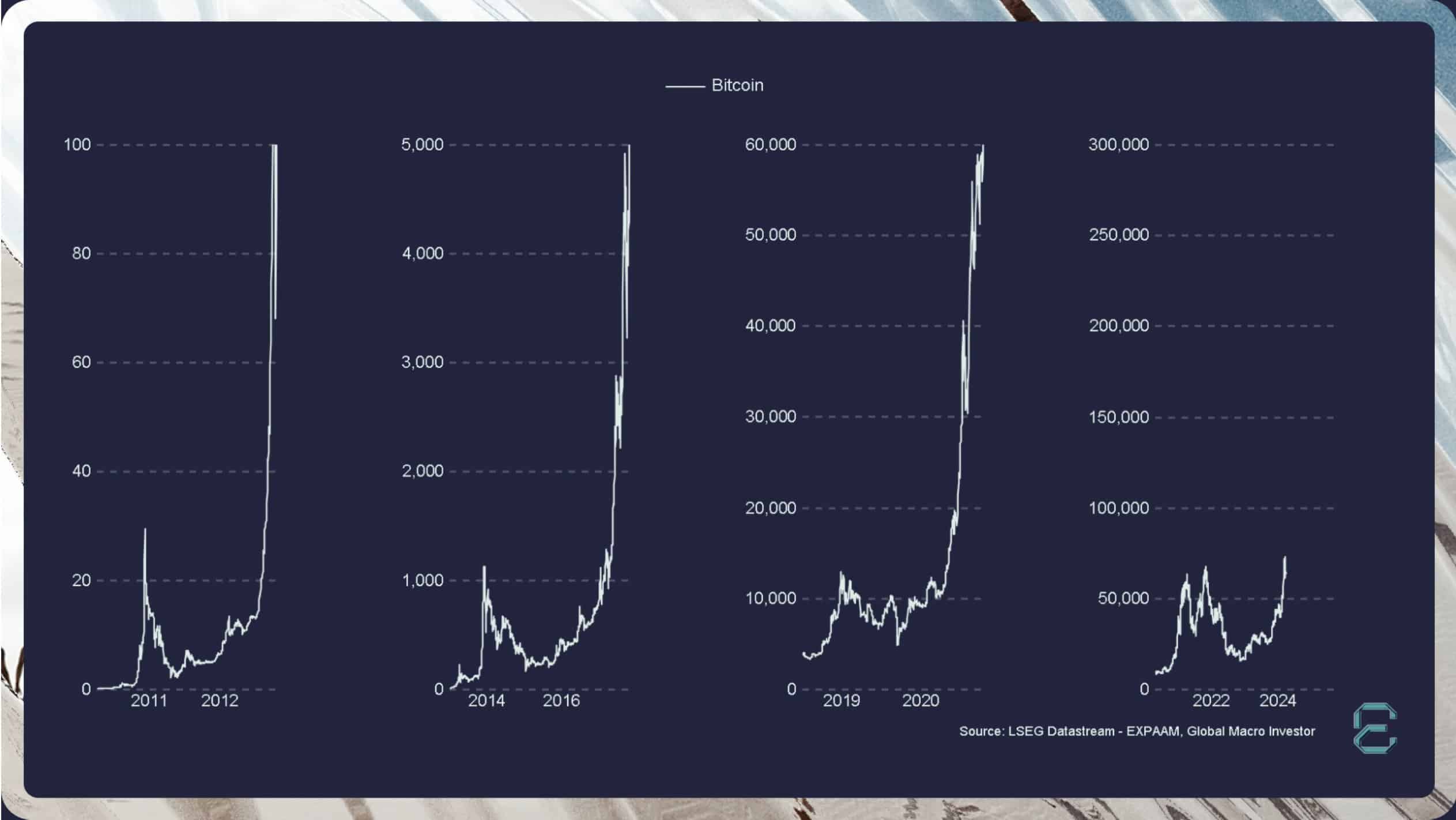

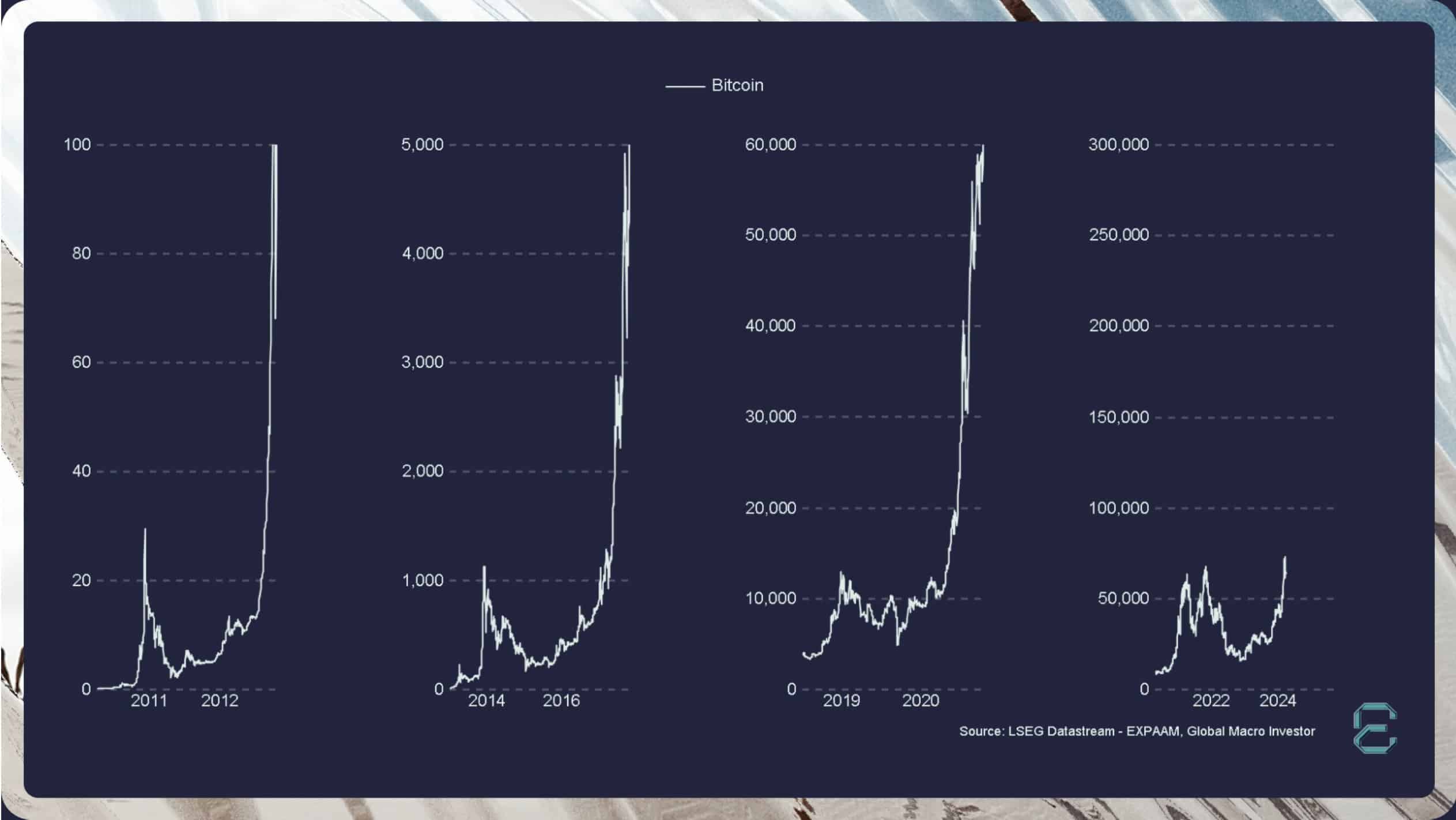

Pal’s projection is solely based mostly on historic knowledge. Nevertheless, previous efficiency doesn’t essentially dictate future outcomes. So, what may very well be the important thing catalyst for Pal’s wild projection?

An easing macro entrance is likely one of the doubtless components. The Singapore-based crypto buying and selling agency, QCP, emphasised how US liquidity injection might drive markets.

In a weekend replace over Telegram, the agency acknowledged that US inflation was nonetheless scorching. Nevertheless, it reiterated that the US treasury might inject extra liquidity within the second half of the yr. A part of the assertion read,

“Nevertheless, at this level, financial coverage would possibly matter a lot lower than fiscal coverage, which would be the essential driver of liquidity and asset efficiency.”

The agency added that,

“The upcoming Quarterly Refunding Announcement (QRA) on 1st Could might additionally see larger issuances in short-term US payments. This can drain the RRP, which presently has USD 400 billion, and in addition improve liquidity.”

Final week, BitMEX founder Arthur Hayes made a similar projection. He highlighted that additional liquidity shall be injected into the economic system in the course of the US elections.

Extra liquidity means an more money provide inside world or native markets, particularly when central banks minimize rates of interest. This can be a good situation for risk-on property to rally.

Whether or not Ethereum outperforms Bitcoin stays to be seen. Nevertheless, a lot of the hyped “crypto summer time” may very well be fueled primarily by macro components somewhat than historic cycles.