- ETH’s captured worth remained excessive in Q2.

- A number of metrics hinted at a doable bull rally in coming days.

The primary quarter of 2024 witnessed a lot volatility available in the market, as high cash like Ethereum [ETH] and Bitcoin [BTC] registered large rallies.

Aside from value motion, issues for Ethereum additionally seemed fairly optimistic by way of income.

Ethereum’s Q1 report is right here!

Coin98 Analytics, a knowledge analytics platform, not too long ago posted a tweet highlighting the king of altcoins’ Q1 report. The report talked about the blockchain’s state on a number of fronts.

To start with, Ethereum witnessed promising development by way of earnings within the first quarter.

The blockchain’s charges and income elevated practically 1.8 instances quarter-on-quarter (QoQ), whereas its earnings tripled QoQ.

The token’s complete variety of holders reached 114.69 million, which was over 5% development QoQ. Due to the bull rally in Q1, ETH’s circulating market cap elevated by 48% and exceeded 350 billion.

Another fascinating stat about ETH’s P/F ratio. Put merely, a drop within the metric usually implies that an asset is undervalued.

ETH’s P/F ratio dropped by greater than 34%, which may be interpreted as a bullish sign.

What can we count on in Q2?

Since ETH’s P/F ratio dropped considerably, AMBCrypto deliberate to verify ETH’s metrics to see whether or not we might count on its value to maneuver up within the coming days.

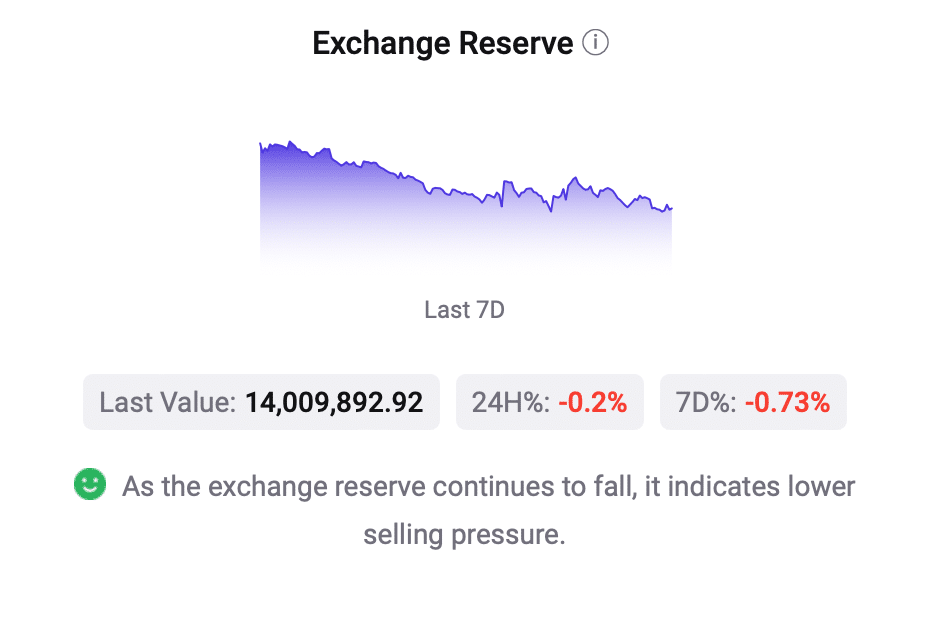

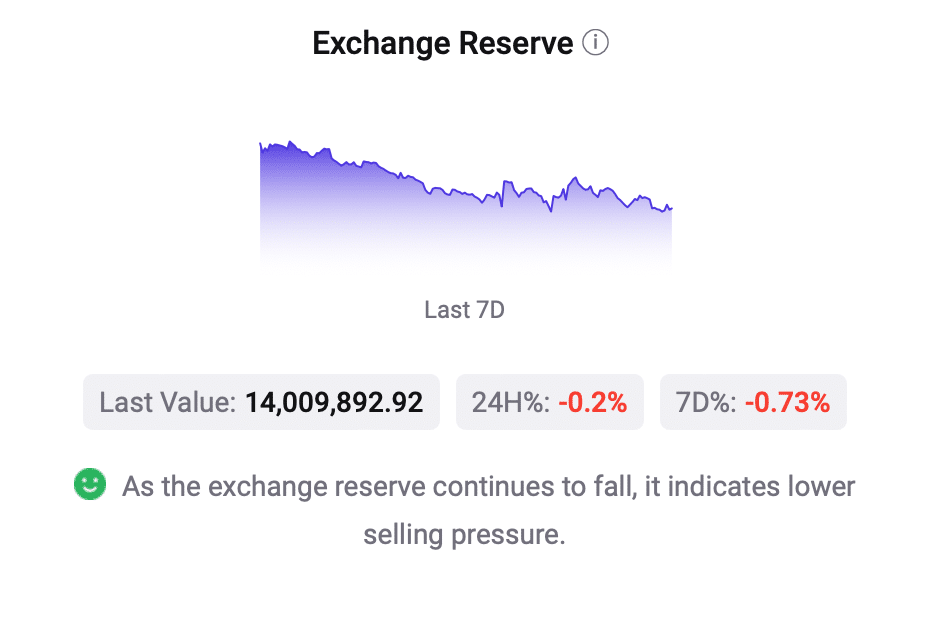

Our evaluation of CryptoQuant’s data revealed that ETH’s alternate reserve was dropping, which means that promoting strain on the token was low.

Moreover, its transaction quantity and complete variety of transactions additionally elevated within the final 24 hours.

Supply: CryptoQuant

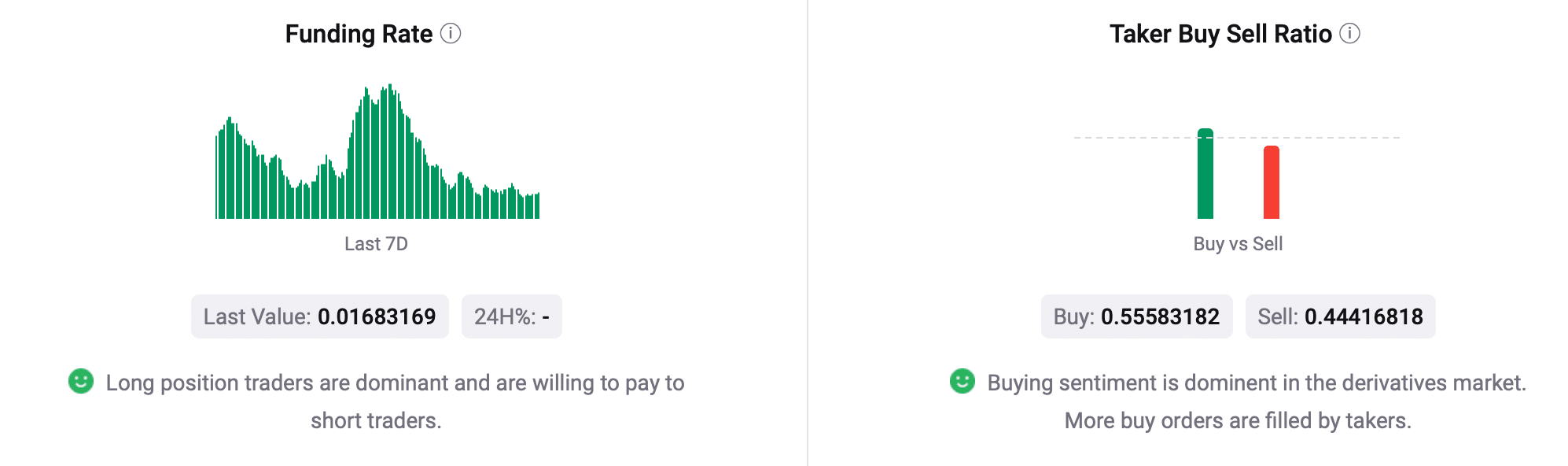

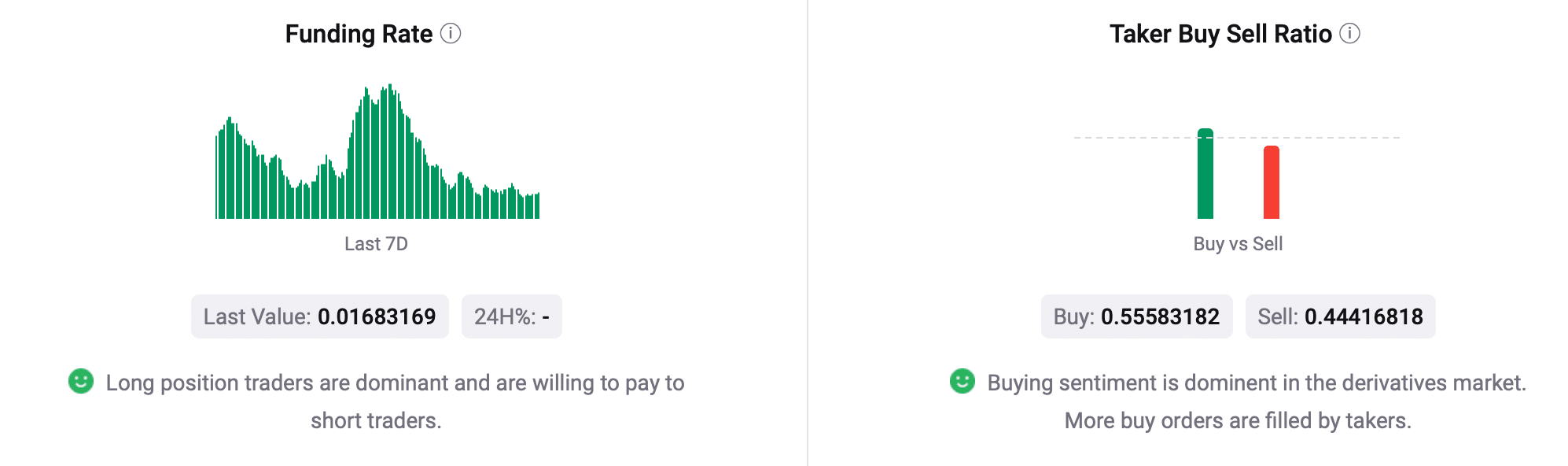

Issues within the derivatives market additionally seemed optimistic. ETH’s Funding Charge was inexperienced, indicating that long-position merchants have been dominant and have been prepared to pay short-position merchants.

On high of that, ETH’s Taker Purchase Promote Ratio was additionally inexperienced. That meant that purchasing sentiment was dominant within the derivatives market.

In accordance with CoinMarketCap, on the time of writing, ETH had moved marginally up and was buying and selling at $3,319.92 with a market cap of over $398 billion.

Supply: CryptoQuant

Learn Ethereum’s [ETH] Value Prediction 2024-25

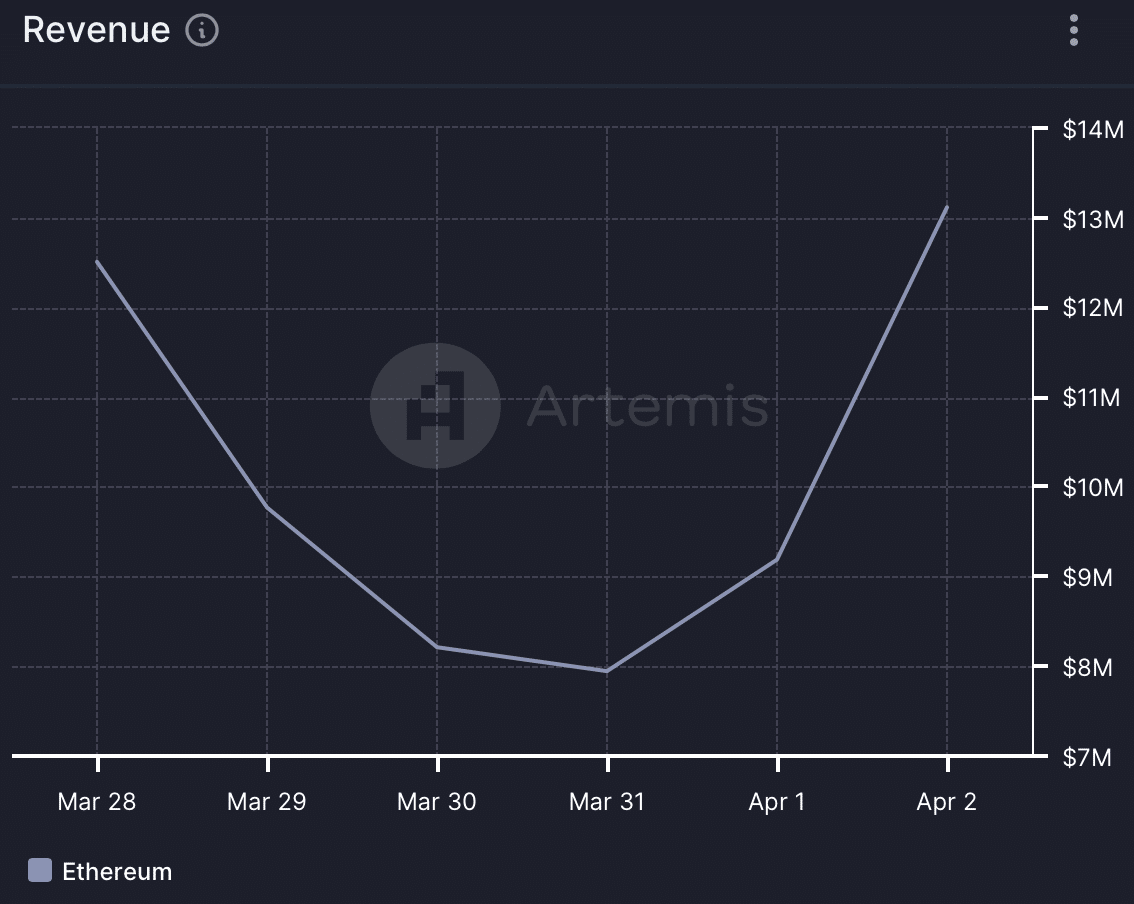

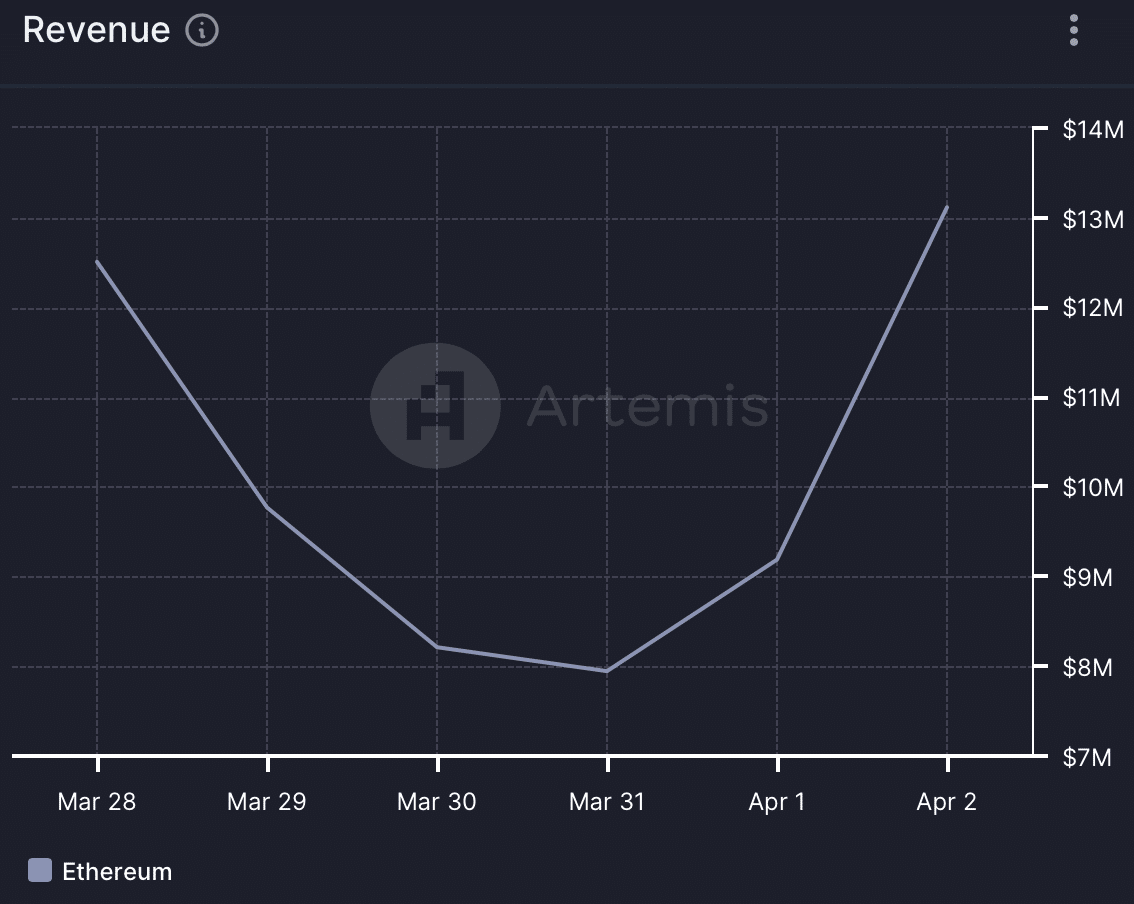

Like value motion, ETH’s captured worth additionally remained in direction of the upper facet in Q2. AMBCrypto’s evaluation of Artemis’ data revealed that ETH’s charges elevated sharply final week.

Its income adopted an identical rising development, marking an optimistic begin to Q2 2024.

Supply: Artemis