Ethereum confronted a major setback final week, with its value plummeting to a seven-month low. Curiously, the value decline coincided with the blockchain community complete gasoline payment dropping to a three-year low.

Over the previous week, the broader crypto market skilled extra volatility amid the continued battle between Israel and Palestine over the Gaza Strip.

ETH Worth Drops to a 7-month Low

In the course of the interval, ETH’s worth noticed a 6% decline, falling to round $1,520 because the Ethereum Basis and main whale addresses dumped the asset.

On October 9, the Basis swapped roughly 1,700 ETH value $2.7 million for the USDC stablecoin.

Ali Martinez, BeInCrypto’s world head of reports, revealed that ETH whales have offloaded greater than 5 million ETH, equal to roughly $8.5 billion, since February.

In the meantime, market observers counsel that the declining value motion signifies diminishing investor curiosity in Ethereum.

Google searches for the asset have reached their lowest level since 2020, reflecting declining public curiosity.

Furthermore, investor enthusiasm for Ethereum-related funding merchandise has remained lukewarm regardless of the launch of a number of futures exchange-traded funds.

However, some consultants keep optimistic forecasts, predicting a possible fivefold enhance in Ethereum’s worth by 2026.

Ethereum Gasoline Payment Crashes

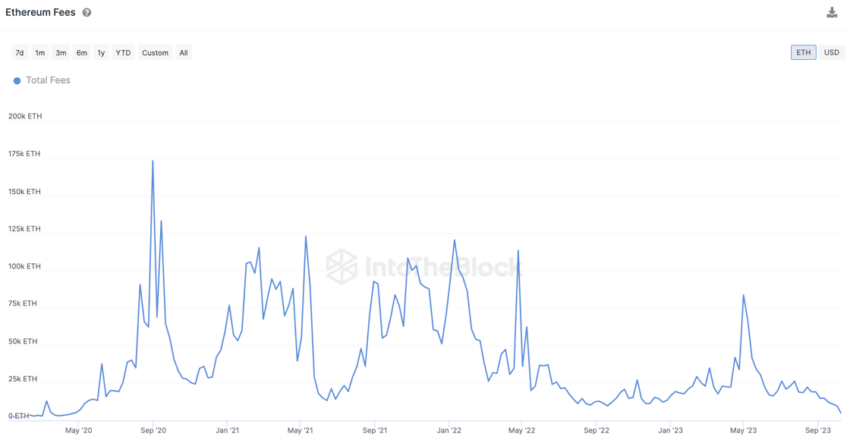

In a separate improvement, Ethereum’s gasoline charges have not too long ago hit a three-year low, in accordance with a report by IntotheBlock.

This information corroborates a earlier BeInCrypto report that acknowledged that Ethereum’s community charges have dropped to a yearly low. In keeping with the report, the autumn will be attributed to a latest decline within the community’s on-chain exercise.

IntoTheBlock additionally shares this sentiment, stating that “this lower is pushed by the migration to layer 2s and the lowering utilization of purposes in Mainnet.” It added:

“As speculative exercise on L1 disappears and L2s proceed to develop, Ethereum charges are prone to stay low. The upcoming introduction of EIP-4844 might additional speed up this pattern as it’s anticipated to lower L2 charges by an order of magnitude.”

Traditionally, Ethereum gasoline charges have been comparatively excessive attributable to intensive on-chain exercise. Nonetheless, the payment fell to its lowest since April 2020, marking a considerable 90% discount from its Might peak.

In the meantime, these concurrent developments elevate questions concerning the future trajectory of Ethereum as its market efficiency and transaction prices expertise vital shifts.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material.