- DOT’s value dropped by 20% within the final 30 days.

- A number of technical indicators regarded bullish on the token.

Polkadot [DOT] bears have been controlling the token’s value for a number of days as its worth moved sideways. Nevertheless, this may simply be the tip of the iceberg, because the bigger image regarded completely different.

If the newest information is to be thought of, the potential of DOT initiating a bull rally is excessive.

Polkadot is preparing for a pump

Based on CoinMarketCap, DOT’s value solely moved marginally within the final seven days. However issues obtained worse within the final 24 hours because the token’s worth dropped by over 1.8%.

On the time of writing, DOT was buying and selling at $8.42 with a market capitalization of over $12 billion. Nevertheless, buyers should not get disheartened, as a bull sample appeared on the token’s value chart.

As per a tweet from FLASH, a well-liked crypto analyst, Polkadot’s value was about to interrupt out of a bull sample that earlier had resulted in bull rallies.

To be exact, DOT’s value gained bullish momentum again in February and November 2023 after it broke above an identical sample. If historical past repeats itself, then buyers may quickly witness DOT’s value contact its March highs as soon as once more.

Aside from this, DOT additionally reached a milestone when it comes to its community exercise. AMBCrypto reported a number of days in the past that DOT’s whole variety of energetic accounts within the ecosystem surpassed 605,000, reflecting excessive community utilization and adoption.

Is a bull rally inevitable?

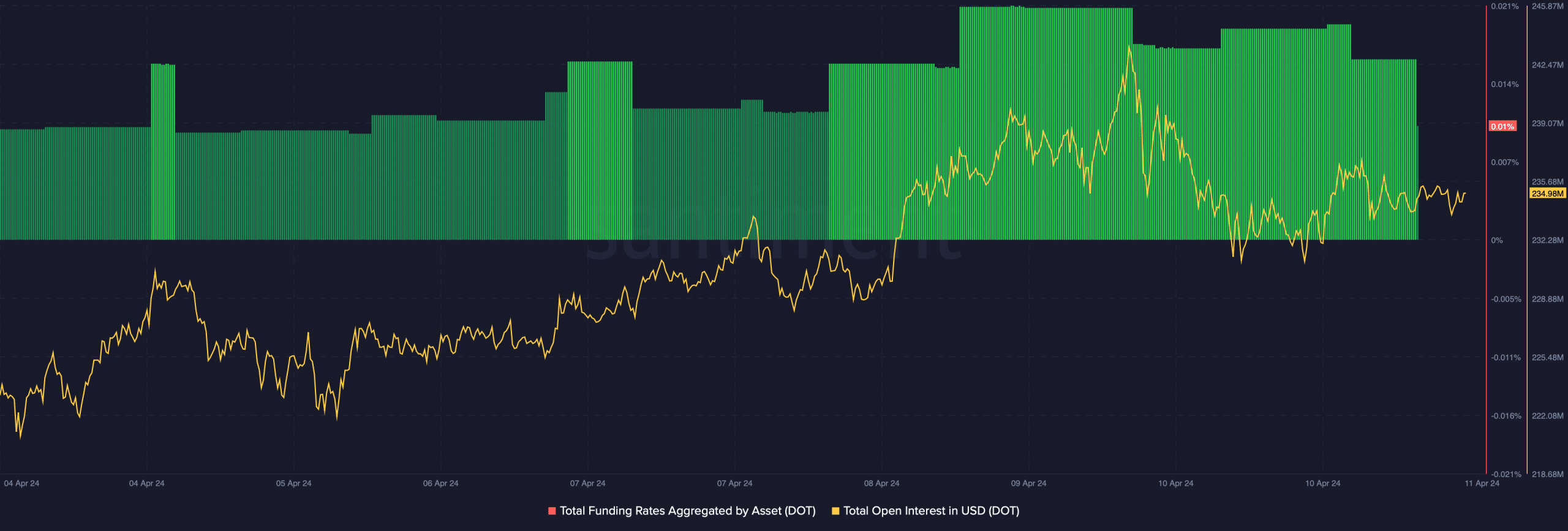

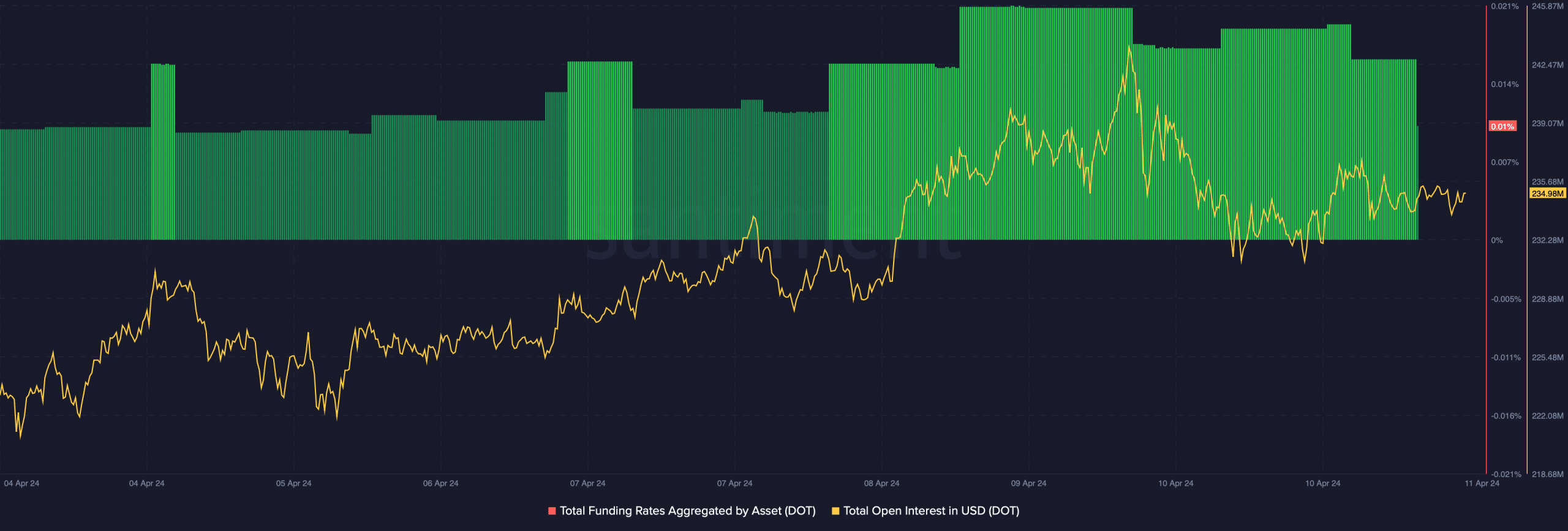

To test the potential of DOT really bearing above the sample, AMBCrypto took a have a look at its on-chain metrics. Our evaluation of Santiment’s information revealed that DOT’s open curiosity remained comparatively excessive.

At any time when the metric rises, it signifies that the on-going value development may proceed, which on this occasion was bearish.

The token’s funding fee additionally regarded bearish. Typically, the worth tends to maneuver the opposite means than the funding fee. Since DOT’s funding fee was excessive, the possibilities of DOT’s worth declining additional appear excessive.

Supply: Santiment

Sensible or not, right here’s DOT market cap in BTC’s phrases

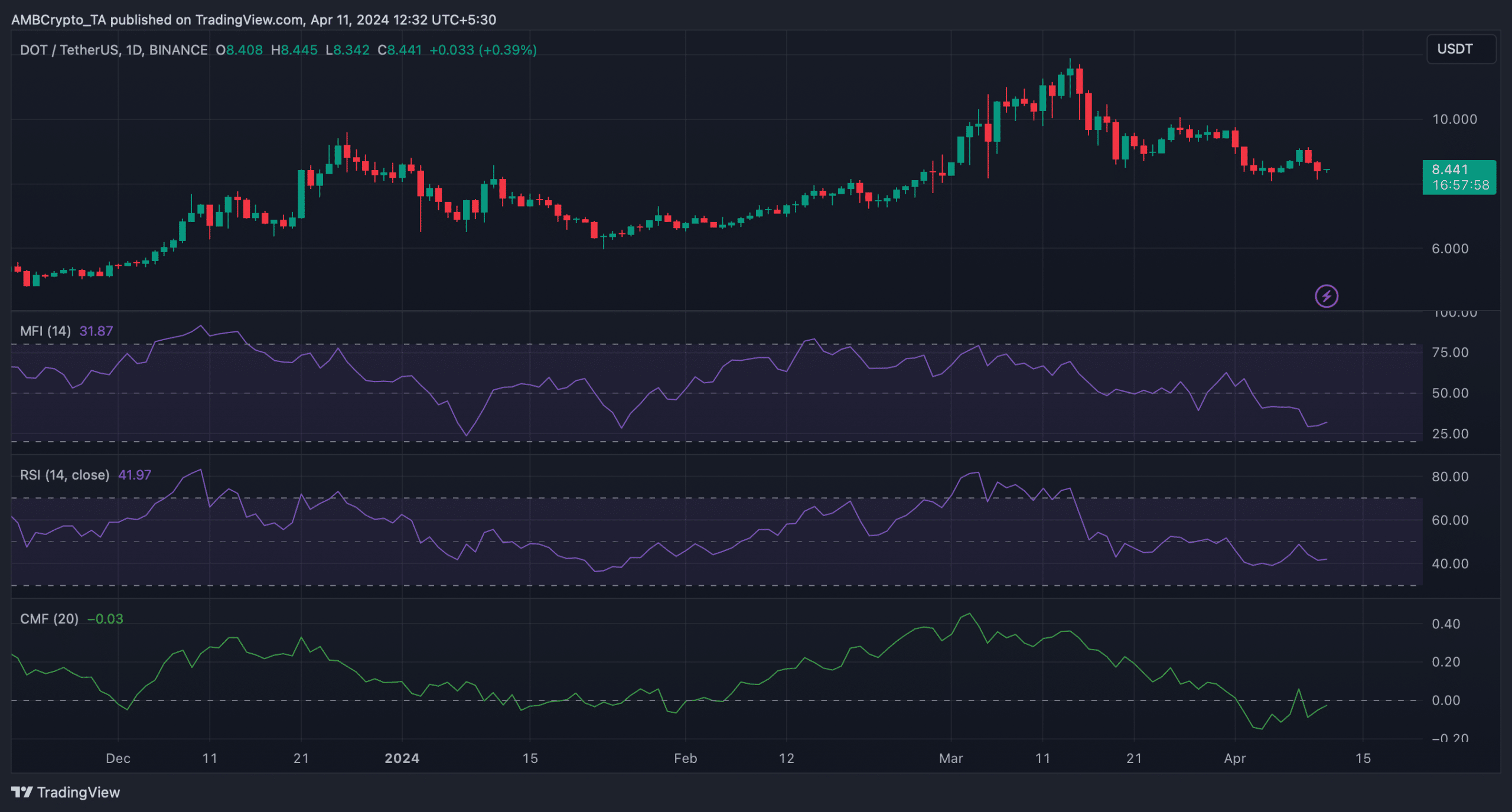

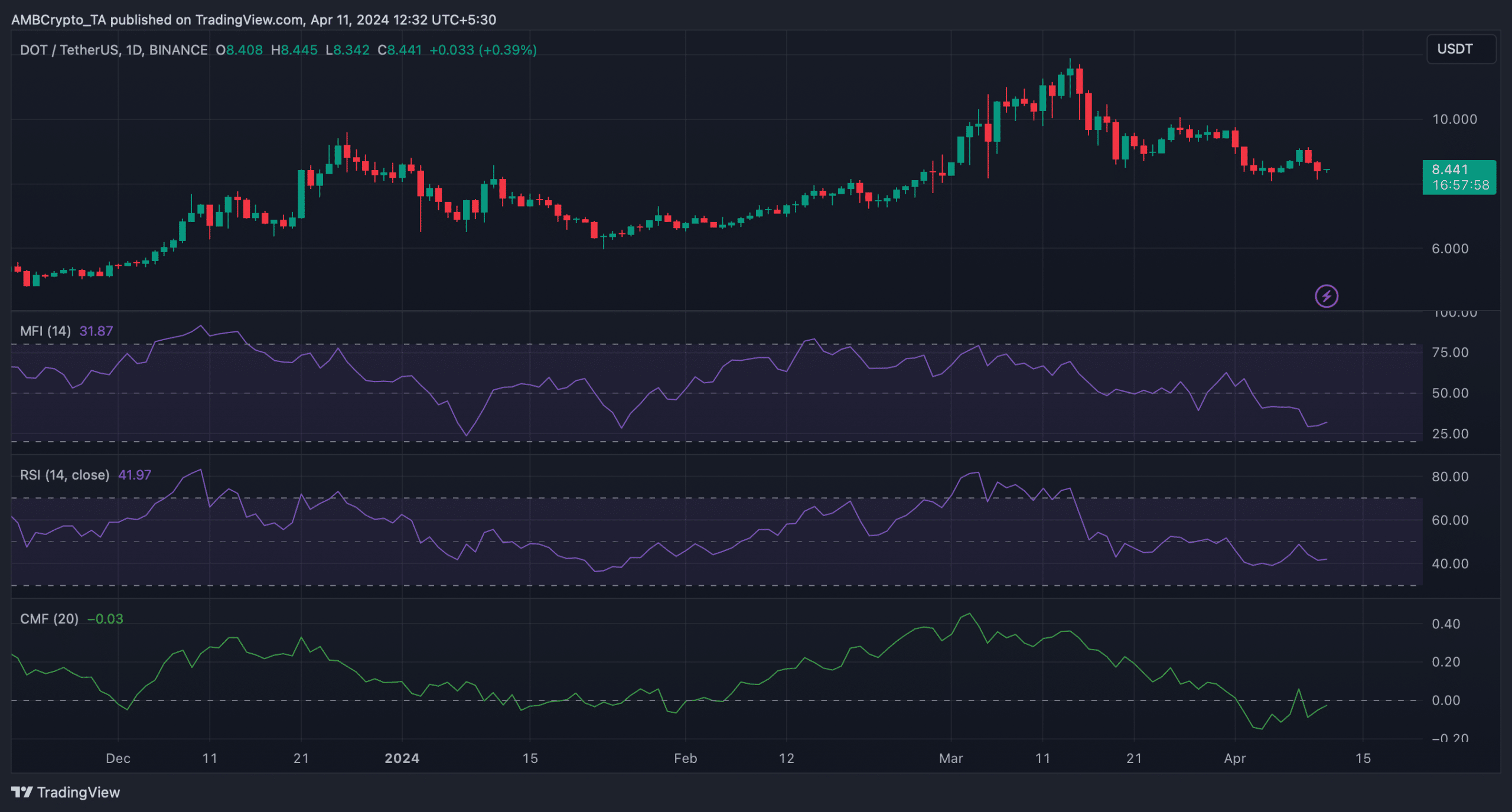

We then deliberate to test Polkadot’s every day chart to raised perceive the possibilities of DOT’s value gaining bullish momentum. As per the evaluation, DOT’s Relative Energy Index (RSI) was bearish because it was resting under the impartial mark.

Nevertheless, the Chaikin Cash Stream (CMF) and Cash Stream Index (MFI) supported the potential of DOT breaking above the bullish sample. This was the case as each of those technical indicators registered upticks in the previous few days.

Supply: TradingView