The put up Ethereum is Poised to Maintain $1800- Will ETH Worth Break Above Resistance Line? appeared first on Coinpedia Fintech Information

The crypto market has just lately met a pointy collapse, creating panic promoting amongst traders. The Securities and Alternate Fee (SEC) has just lately filed lawsuits towards two main cryptocurrency exchanges, Binance and Coinbase, resulting in a major downturn out there. This bearish momentum has created a massacre within the crypto area, with Ethereum (ETH) gaining consideration. Nevertheless, regardless of the adverse information, the ETH worth continues to point out constructive momentum, leaving traders on the sting of the following worth stage.

Ethereum’s On-Chain Information Gives Bullish Confidence

Ethereum whales, or massive non-exchange holders, have been steadily buying extra of the cryptocurrency this 12 months, now proudly owning an unprecedented 31.8 million ETH, valued at over $59.6 billion. This pattern, famous by analytics agency santiment

On-Chain

, happens amidst latest market instability because of U.S. regulatory actions.

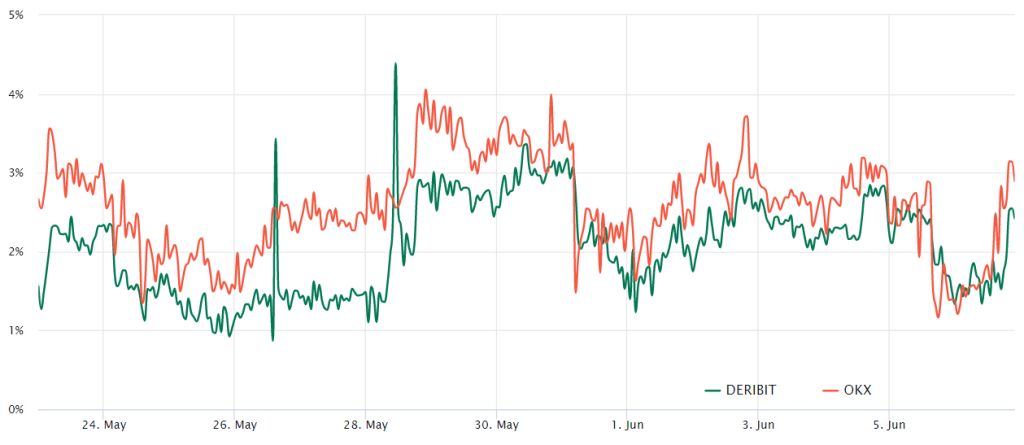

Quarterly futures of Ether are favored by massive traders, often called whales, and arbitrage desks. These fixed-month contracts often carry a small premium over the spot markets, suggesting that sellers demand a better worth for suspending settlement.

Consequently, in a sturdy market, ETH futures contracts ought to exhibit a 4 to eight% annualized premium. This situation, known as contango, is a standard incidence not unique to cryptocurrency markets.

Based mostly on the futures premium, additionally known as the fundamental indicator, it seems that skilled merchants have been steering away from leveraged lengthy positions or bullish bets. Nevertheless, even when the worth retested the $1,780 mark on June 6, it wasn’t enough to shift the sentiment of those massive traders and market makers in direction of a bearish outlook.

Additionally Learn: Will Bitcoin and Ethereum Encounter a ‘Merciless Summer season’? Listed below are Necessary Ranges to Watch

What To Count on From ETH Worth Subsequent?

Within the final two days, Ether’s (ETH) worth fell beneath the resistance line of its descending wedge sample, however the bears didn’t capitalize on this momentum, indicating demand at lower cost factors.

Following the bearish breakout, bullish merchants pushed the worth again above the transferring averages, however they confronted vital promoting stress close to the $1,895 stage. At present, sellers are attempting to maintain the ETH worth beneath the resistance line, and if profitable, this might result in an extra drop in ETH’s worth to the assist line of the sample.

As of writing, ETH worth trades at $1,851, declining over 0.5% within the final 24 hours. At present, the RSI stage hovers close to the 50-level, making a secure area for Ethereum. Nevertheless, if the ETH worth fails to carry its present pattern, it could drop to the speedy assist stage of $1,760, beneath which the following assist will likely be $1,610.

Conversely, if the worth breaks above the resistance line, it could suggest that the bulls have transformed this line right into a assist stage. Ethereum worth might then provoke an upward momentum towards $2,000 and finally contact the resistance at $2,115.