A dealer recognized for making a collection of correct calls says that Ethereum (ETH) seems to be like it could be setting as much as outperform Bitcoin (BTC) because the longer-term development continues.

Pseudonymous analyst and dealer Dave the Wave tells his 140,000 followers on social media platform X that Ethereum versus Bitcoin (ETH/BTC) seems to be printing decrease highs and decrease lows, however a special image kinds when zooming out.

“ETH/BTC:

Cautious of (shorter-term) hindsight bias – it’s a collection of decrease highs till it’s not.

The longer timeframe trumps the shorter…. and helps to foretell future value motion, which is what hypothesis is all about, versus merely describing latest previous value motion…

These captured by hindsight bias are usually armchair critics, not precise speculators… Certainly, they might have the purist’s distaste for such…. having been burnt on the prime.”

Zooming out on a multi-year timeframe, Dave the Wave exhibits how ETH/BTC could the truth is be close to the tip of a giant wedge sample, suggesting a breakout to the upside across the starting of subsequent 12 months or so.

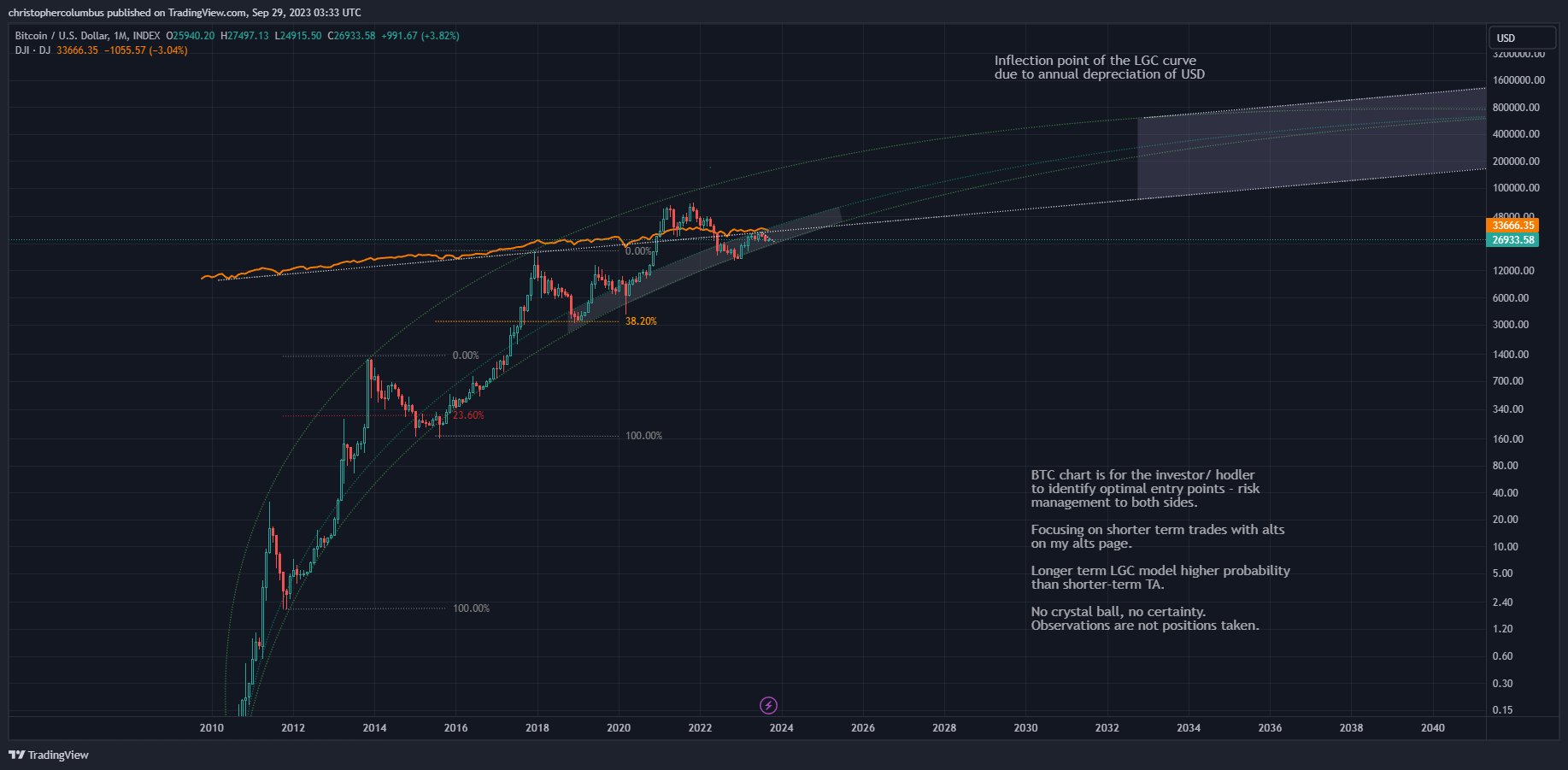

As for Bitcoin, the dealer makes use of his personal model of logarithmic development curves (LGCs) which try and plot BTC’s long-term market cycle highs and lows whereas filtering out volatility and noise.

He says that Bitcoin is on monitor to outperform conventional property just like the inventory indices for at the very least one other decade, based mostly on the LGC.

“One other decade recommended by the LGC chart earlier than BTC is totally capitalized and on a par with extra conventional investments… maintaining tempo with inflation.

Till then, the first car for wealth creation.”

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Value Motion

Observe us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Featured Picture: Shutterstock/SF Textitle Design