- Solana has weakened in opposition to Ethereum on the value charts

- Nonetheless, SOL maintained a bullish sentiment and market construction.

The continued hypothesis on Ethereum [ETH] ETF approval may threaten Solana [SOL] worth prospects, not less than within the short-term, per some market watchers.

SOL has since turn into a goal of social media dunk because the market more and more adapts to the potential of an ETH ETF. One Solana builder and person, Nigel Eccles, commented,

‘As a Solana maxi who has been constructing on Solana since 2021, listening to the ETH ETF information has been extremely powerful. Like I believed ETH was completed and Solana was the long run.’

Eccles added that an ETH ETF approval would sanction ETH because the reputable sensible contract chain. Consequently, he would relatively pivot to it than follow Solana,

‘However it’s not too late to pivot to the government-sanctioned chain. So, as of now, I’m dumping my Solana luggage and going all in ETH’

Is ETH eclipsing SOL?

Following the ETF growth, on Monday and Tuesday, SOL underperformed ETH on the value chart. On the weekly chart, efficiency stood at 29% and 25% for ETH and SOL, respectively, per CoinMarketCap knowledge.

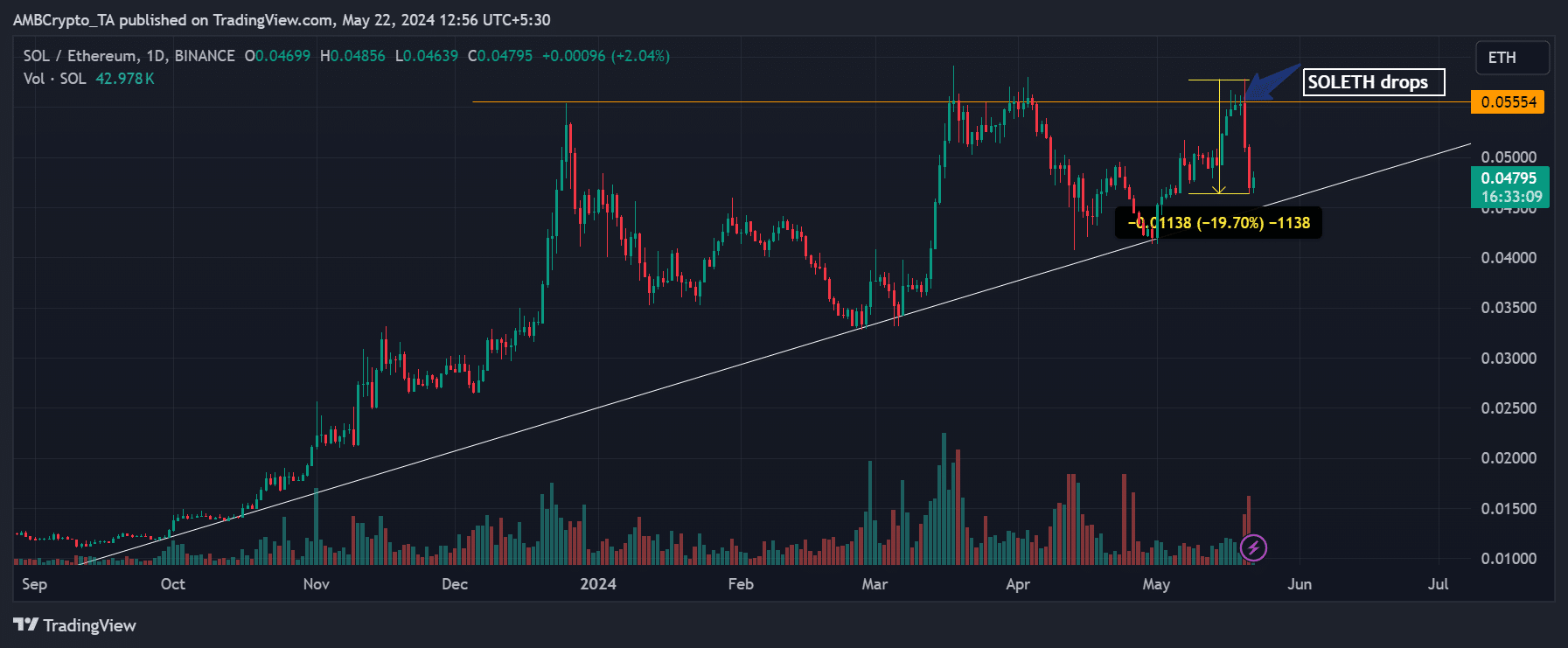

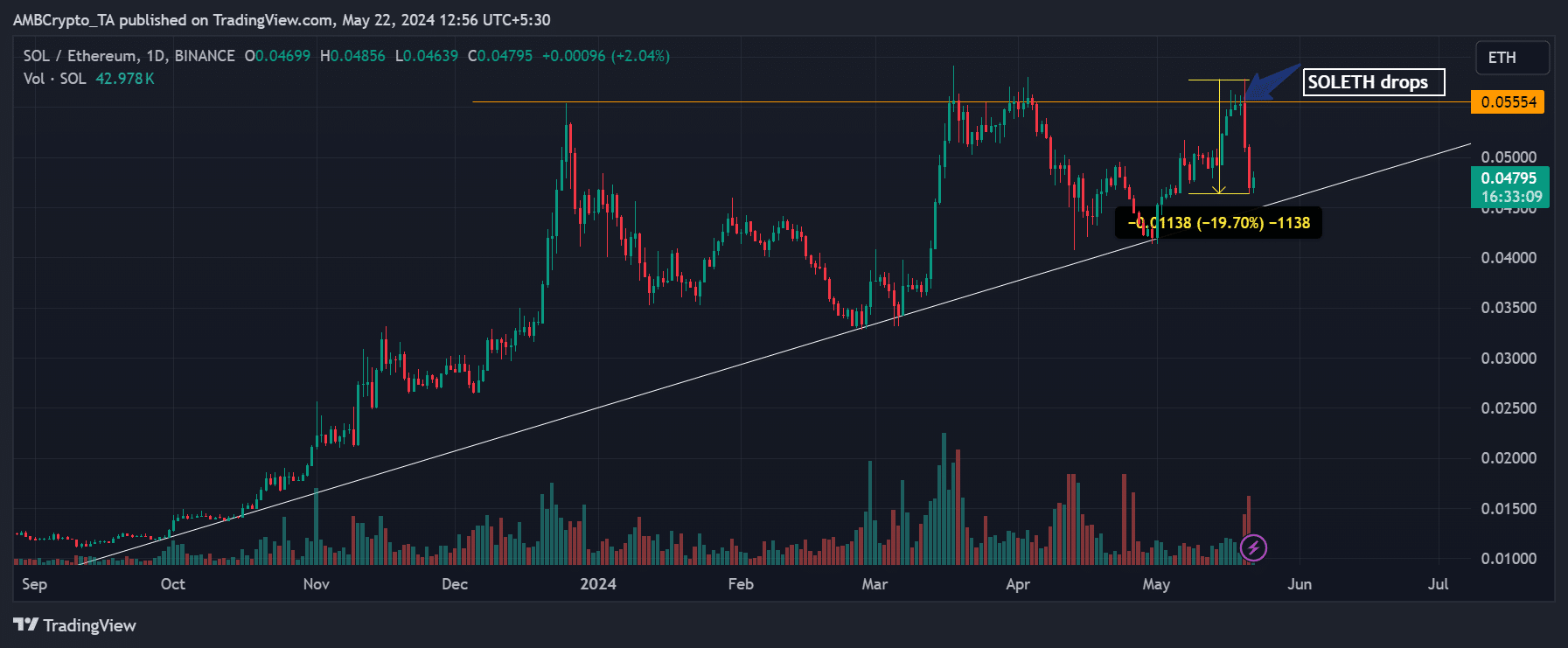

On a granular degree, the SOL/ETH ratio confirmed that SOL weakened in opposition to ETH at the beginning of the week.

Supply: SOL/ETH ratio, TradingView

For the uninitiated the SOL/ETH ratio tracks SOL’s efficiency in opposition to ETH. A rising worth signifies that SOL outperforms ETH, whereas a drop within the ratio exhibits a weakening SOL in opposition to ETH.

That mentioned, the SOL/ETH ratio dipped by 19%, from 0.05 to 0.046, earlier than trying a rebound at press time. It meant that SOL shed 19% of its worth in opposition to ETH.

So, the 2 purple every day candlesticks confirmed that SOL underperformed ETH on Monday and Tuesday. On the time of writing, ETH traded at $3.7K, up 2% up to now 24 hours, whereas SOL traded at $180, down under 0.5% over the identical interval.

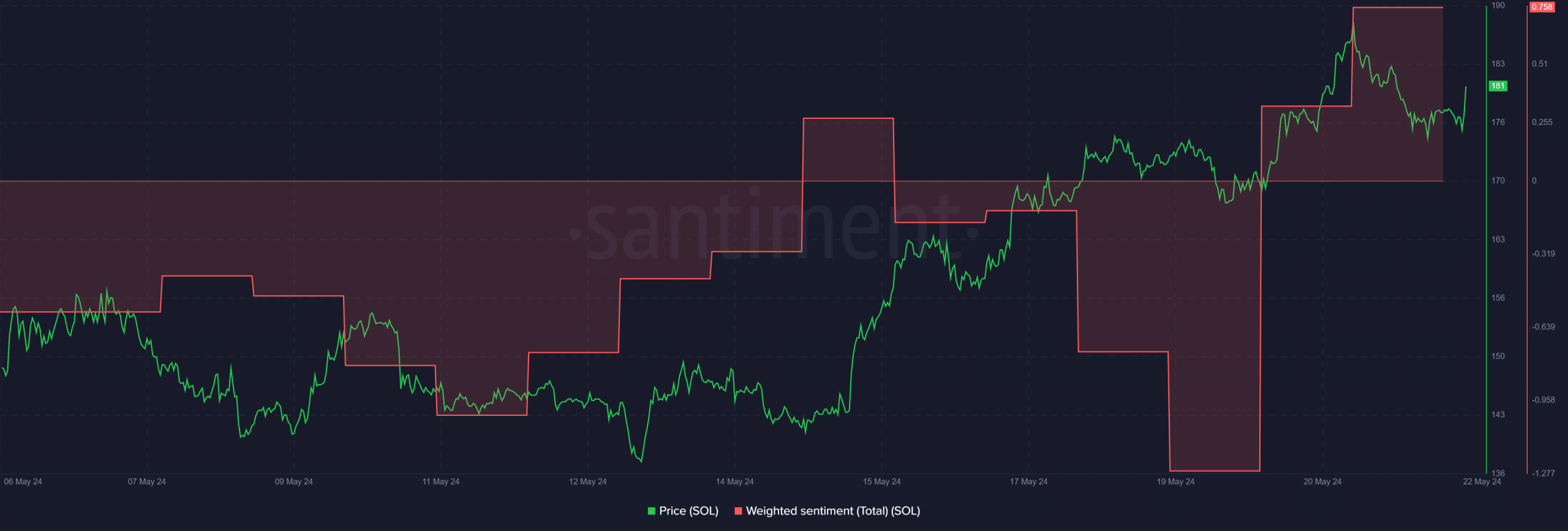

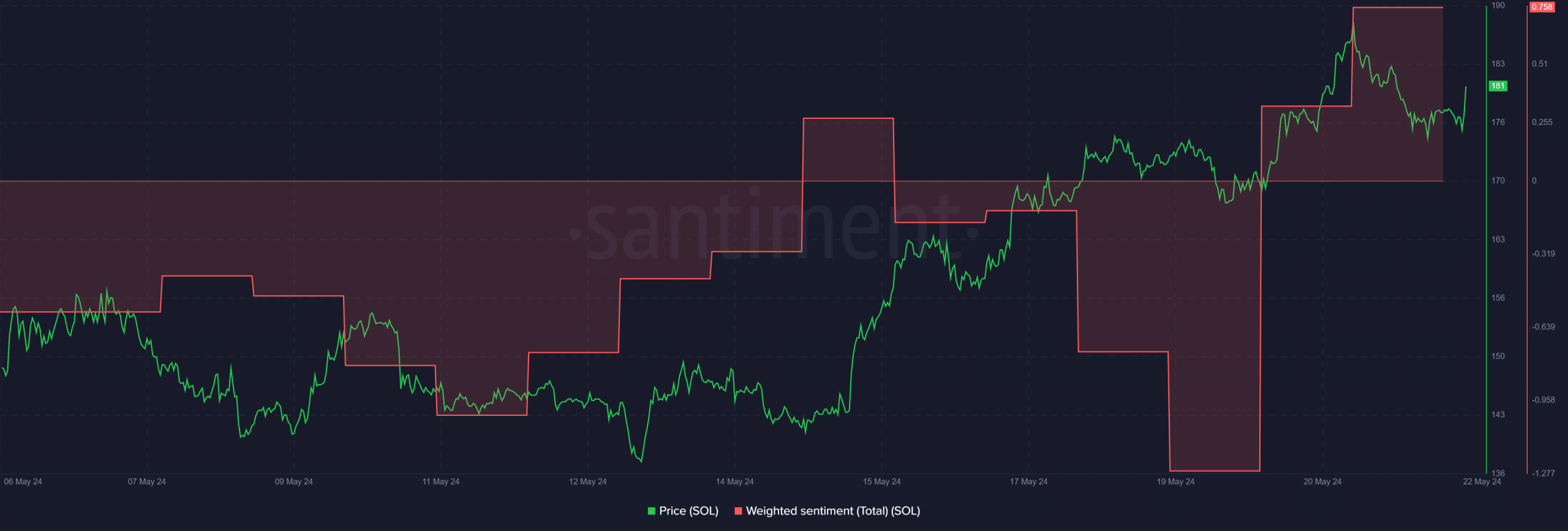

Regardless of the marginally dismal efficiency in opposition to ETH and Eccles’s pessimistic view on ETH ETF’s impression on SOL’s prospect, market individuals have been nonetheless bullish on the house of meme coin buying and selling, as proven by the constructive Weighted Sentiment.

Supply: Santiment

Moreover, SOL maintained a bullish market construction on larger timeframe charts and will eye the $200 mark if the bulls defended the $180 as short-term help.

That mentioned, market gamers have been nonetheless bullish on SOL amidst ETH ETF hypothesis, in contrast to Eccles’s damaging tackle the state of affairs.