A Bloomberg crypto market analyst says Ethereum (ETH) and one XRP rival are dominating institutional curiosity in real-world belongings issued on public blockchains.

Jamie Coutts says on the social media platform X that conventional finance is driving real-world asset (RWA) tokenization, and he predicts that extra corporations will enter the house quickly.

“Development is off a low base, however it’s rising steadily. Demand can be emanating from rising markets, which isn’t shocking given stablecoin adoption.”

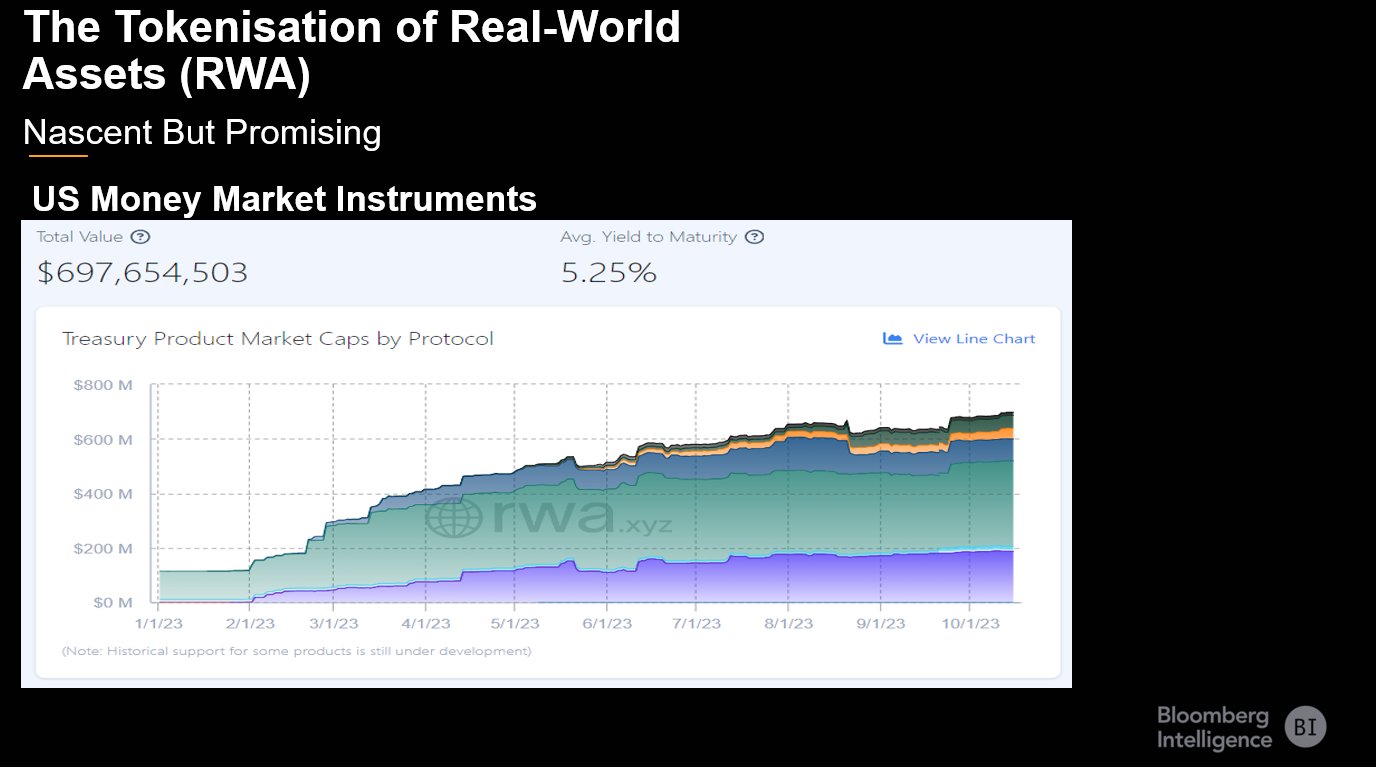

Coutts notes that the tokenization of US cash market funds is now nearing $700 million in whole worth, up from $100 million initially of the yr.

A cash market fund is a kind of mutual fund that seeks yield by investing in extremely liquid short-term debt devices like US treasuries, money and cash-equivalent securities.

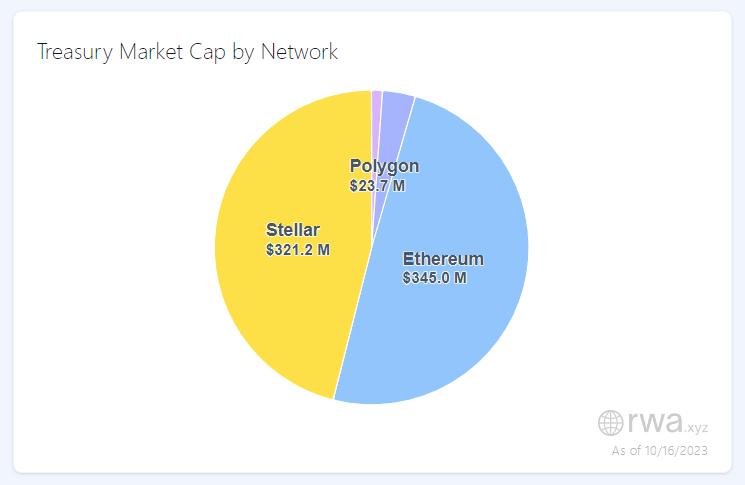

Ethereum is the primary alternative of community for tokenized cash market devices within the US, clocking $345 million in worth, although Stellar (XLM) is shut behind with $321.2 million, in keeping with Coutts. Blockchain scaling resolution Polygon (MATIC) ranks third, with $23.7 million.

In accordance with the Bloomberg analyst, RWA tokenization could possibly be one of many greatest drivers for blockchain adoption.

“Ideas: whereas stablecoins are seemingly essentially the most important driver for blockchain adoption, NFTs (non-fungible tokens), GameFi and now tokenization of real-world belongings (RWA), whereas nascent current immense potential.”

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Verify Worth Motion

Observe us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Generated Picture: Midjourney