MakerDAO, the governing physique of the favored DAI stablecoin, is contemplating a considerable allocation of 600 million DAI to the fast-growing USDe artificial greenback stablecoin by means of Morpho Labs. This strategic transfer comes as Ethena Protocol, the platform behind USDe, prepares to launch its personal ENA token airdrop.

This choice displays the group’s confidence in USDe’s potential. Moreover, if the proposal turns into actuality, it may very well be a constructive catalyst for Ethena, particularly for TVL progress.

USDe swimming pools provide customers extra advantages

An in depth evaluation by MakerDAO Advisory Board member BA Labs reveals robust person demand for USDe-backed credit score swimming pools inside the MakerDAO ecosystem. This choice stems from USDe’s enticing return potential and the chance to earn ENA tokens.

Moreover, the results of the evaluation recommends specializing in increased leverage USDe swimming pools (86% and 91.5% LLTV) with a proportionately bigger allocation of DAI. Ethena’s revised rewards program reinforces this method and favors USDe over different collateral choices.

Learn extra: What’s the Ethena Protocol and its USD Artificial Greenback?

The strategic reorientation of DAI in the direction of USDe swimming pools brings a number of benefits. Specifically, it affords decrease liquidity danger for the collateral, as USDe could be redeemed instantly through Ethena.

Quite the opposite, sUSDe requires a one-week non-deployment interval. Moreover, this shift ensures that Ethena can retain a bigger income share for its insurance coverage fund. In the end, it should enhance the chance profile of Maker’s Ethena allocation over time.

Whereas the allocation carries inherent dangers related to custody, trade counterparties and publicity to liquid staking tokens, BA Labs acknowledges steps Ethena has taken to mitigate these dangers. MakerDAO’s rigorous due diligence additional safeguards the method and ensures a calculated method to maximise returns whereas minimizing potential losses.

Danger mitigation and transparency

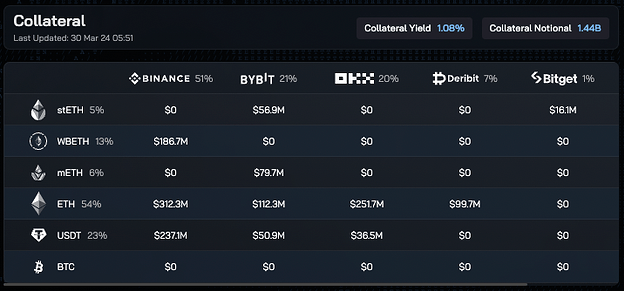

The evaluation additionally notes the Ethena Protocol’s dedication to keep up transparency by disclosing breakdowns of collateral and deposit addresses.

Nevertheless, to additional improve belief and credibility, the BA Labs workforce recommends further measures, equivalent to higher visibility of hedging positions in futures. This additionally contains product and foreign money breakdowns and periodic assertions from custodians to confirm the belongings underneath custody (AUC) attributable to Ethena.

Learn extra: The best way to use Ethena Finance to stake USDe

Ethena’s Collateral Distribution. Supply: Ethena dashboard

Commenting on this vital allocation from MakerDAO, Seraphim Czecker, head of progress at Ethena Labs, expressed his pleasure and confidence.

“No joke: MakerDAO is contemplating committing as much as $600 million in DAI to sUSDe and USDe by means of MorphoLabs, with the power to develop as much as $1 billion. Ethena TVL’s progress is on observe with inner expectations,” Czeker wrote.

On the similar time, the Ethena Protocol introduced that it’ll drop its personal token, ENA, to its group on April 2, 2024.

Based mostly on CoinGecko knowledge, USDe, with a market capitalization of $1.56 billion, has risen to fifth place within the world stablecoin rankings, behind Tether, USDC, DAI and FDUSD.