PeopleImages

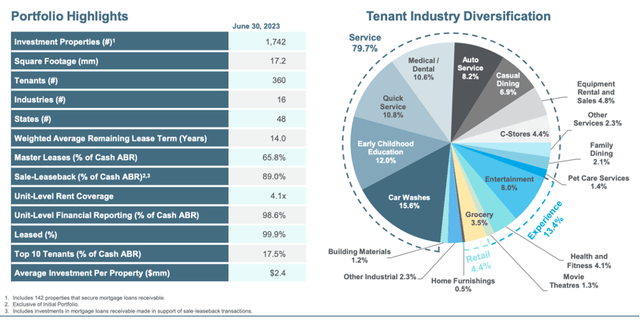

Important Properties Realty Belief (NYSE:EPRT) is a web lease REIT much like Realty Earnings (O). The REIT focuses on smaller single-tenant properties leased to service-oriented tenants, with a mean asset dimension of $2-5 million. The small constructing focus is nice as a result of these properties are typically extra fungible and simpler to launch or promote if want be.

EPRT

Sale leasebacks

Their technique is sort of distinctive in that they focus loads on sale leaseback transactions. These are typically nice for the owner in addition to the tenant.

Firstly, by promoting the property, the tenant is ready to elevate capital to run its core enterprise. That is particularly worthwhile to firms under funding grade, which can have a tough time accessing capital, given the latest rise in rates of interest and a tightening credit score market.

Then again, this kind of transaction can also be nice for the owner, as a result of they often get very landlord-friendly lease phrases. These embody an extended lease interval of 20+ years, above customary hire escalations clauses that common 1.6% and monetary reporting on a unit stage, which permits EPRT to know the precise hire protection in its properties.

Progress prospects

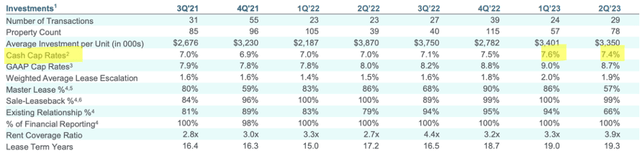

Past good lease phrases, which the company has been in a position to lock in, sale leasebacks have additionally enabled EPRT to not too long ago purchase properties at above market cap charges. It’s because at occasions when the tenant wants capital, they may be capable of promote for a lower cost. Over the previous two quarters, the REIT has locked in a handful of recent properties at a mean cap price of seven.5% on a money foundation.

EPRT

Going ahead, administration expects cap charges to plateau round mid-7% for a number of quarters, earlier than coming again down, so now could be a extremely good time for the corporate to buy groceries, particularly after we contemplate its low price of capital which stands at simply 3.4%.

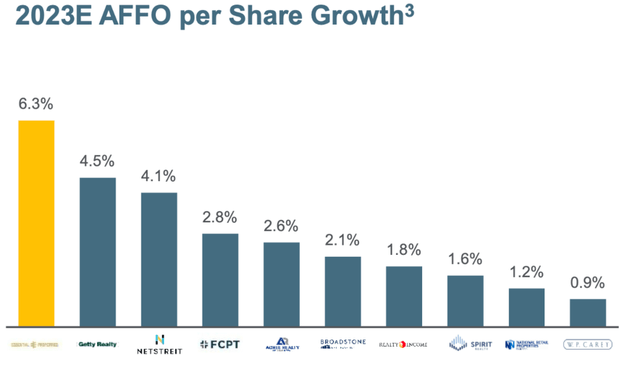

What units EPRT other than the competitors is their forecasted progress. Whereas established gamers, akin to Realty Earnings or NNN REIT (NNN) are anticipated to see sub-2% AFFO progress, Important Properties is guiding to six.3% this 12 months.

This superior progress is a direct consequence of their technique, which ends up in higher-than-average hire will increase, in addition to entry to cheaper properties for acquisition. Administration has acknowledged on earlier earnings calls that they count on this edge over competitors to decrease over time as extra REITs deal with sale-leasebacks, however within the meantime, EPRT is nicely positioned to lock in nice phrases for years to come back.

EPRT

Future progress will probably be supported by a robust steadiness sheet with low leverage of 4.2x EBITDA, low price of capital of three.4%, and no debt maturities till 2026 when their revolving credit score line matures. As such, EPRT’s rate of interest threat over the following three years could be very low, which positions it very nicely for a excessive rate of interest setting. The corporate has about $800 million in liquidity which is the best stage ever – that is nice as a result of it should allow the corporate to go searching for high quality offers now, that costs are low.

EPRT

I understand that many buyers take a look at REITs for his or her dividends. Traditionally, web lease REITs have been very rewarding on this entrance, with O and NNN have multi-decade observe data of accelerating their dividends. EPRT particularly pays a 4.8% dividend yield, supported by a really wholesome 65% payout ratio. Going ahead, I absolutely count on the dividend to develop at across the similar price as AFFO (about 5% per 12 months).

Valuation

The inventory presently trades at 14x FFO, which is under the historic common of 19x. Given the inventory’s comparatively brief historical past, I don’t assume the historic common is especially helpful, which is why I additionally embody a 10-year common P/FFO of Realty Earnings of 19x and of NNN of 17.5x.

Relative to those two, EPRT is anticipated to develop increased however possible isn’t as top quality as O, which is why I see a good a number of someplace between the 2, say 18x.

That leaves about 28% of upside from a number of growth, on prime of a virtually 5% dividend and about 5-6% AFFO progress.

FastGraphs

If EPRT can handle to re-rate to 18x FFO inside two or three years, buyers will earn double-digit returns.

Catalysts and dangers

The query is what catalysts will probably be wanted for this to occur. Effectively, for one, a lower in rates of interest would assist considerably.

My base case is that the Fed will lower charges considerably over the following 12 months, both as a result of they get inflation below management or as a result of unemployment ticks up (the inverted yield actually signifies {that a} recession is probably going) forcing the Fed to reverse course. This is able to possible end result within the double-digit upside we talked about being realized.

The danger, in fact, is that rates of interest keep increased for longer. On this case, I wouldn’t count on the a number of to lower from at this time’s ranges, however with a virtually 5% dividend yield, 5% FFO progress and a steadiness sheet with minimal rate of interest threat, I believe the REIT is comparatively positioned to ship constructive returns even below this threat state of affairs.

Due to this fact, I price EPRT as a BUY right here.