bjdlzx

After a poor 2023, Vitality appears poised for a comeback as momentum wanes in Know-how. Laggards develop into leaders, and leaders develop into laggards, which is the place the Alerian Vitality Infrastructure ETF (NYSEARCA:ENFR) turns into an attention-grabbing power play. ENFR is a midstream power exchange-traded fund, or ETF. ENFR is constructed to mirror each the value and the yield efficiency of its benchmark index, the Alerian Midstream Vitality Choose Index (AMEI) previous to the deduction of any charges and bills. The AMEI index itself supplies a complete overview of North American power infrastructure entities, encompassing each firms and grasp restricted partnerships (MLPs).

The strategic design of ENFR is to leverage the surge in North American power growth, enabled by the arrival of progressive applied sciences which have launched substantial portions of oil and pure gasoline reserves. Vitality infrastructure firms, which personal and function pipelines, storage amenities, and processing vegetation, play a pivotal function in connecting North American power manufacturing to native and world demand.

Prime Holdings in ENFR

ENFR is comprised of quite a few firms working inside the power infrastructure sector. Prime holdings embody:

-

Enbridge Inc. (ENB): A multinational pipeline firm, Enbridge is primarily concerned within the transportation and distribution of crude oil, pure gasoline, and different liquids.

-

Enterprise Merchandise Companions L.P. (EPD): This American midstream pure gasoline and crude oil pipeline firm additionally offers with petrochemical and pure gasoline processing.

-

Vitality Switch LP (ET): An organization that gives pure gasoline pipeline transport and can be concerned within the storage and wholesale of refined petroleum merchandise.

-

ONEOK, Inc. (OKE): A number one midstream service supplier, ONEOK is engaged within the gathering, processing, storage, and transportation of pure gasoline within the U.S.

-

Cheniere Vitality, Inc. (LNG): A Houston-based firm primarily engaged in LNG-related companies, and owns and operates the Sabine Move and Corpus Christi LNG terminals.

The highest 10 holdings account for 62% of the ENFR portfolio. Hold that in thoughts, as this can be a pretty concentrated fund from that perspective.

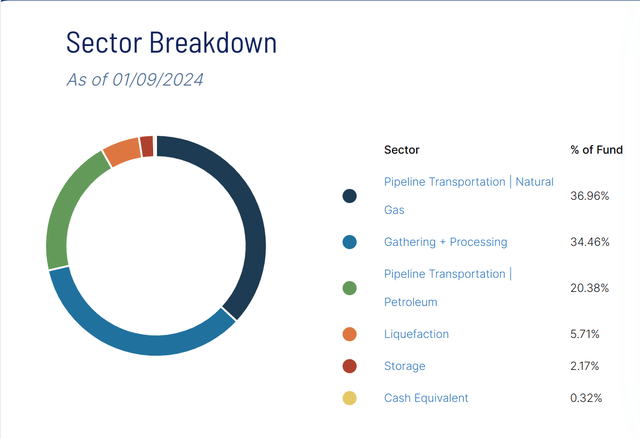

Sector Composition and Weightings

The ENFR ETF maintains a diversified portfolio by investing throughout numerous sectors inside the power infrastructure panorama.

alpsfunds.com

These weightings present a balanced publicity to the completely different sides of the power infrastructure sector.

Peer Comparability: ENFR versus Different ETFs

When in comparison with different related ETFs, ENFR stands out resulting from its distinctive give attention to North American power infrastructure. As an illustration, whereas the Alerian MLP ETF (AMLP) additionally affords publicity to the midstream power sector, it predominantly focuses on Grasp Restricted Partnerships (MLPs). In distinction, ENFR consists of each MLPs and firms, offering a extra complete illustration of the power infrastructure sector.

StockCharts.com

The Funding Case: Professionals and Cons of Investing in ENFR

Investing in ENFR comes with its share of benefits and potential dangers.

Professionals:

-

Inflation Safety: Actual property equivalent to pipelines and storage tanks present safety in opposition to inflation.

-

Secure Money Flows: Since midstream firms primarily function on a fee-based mannequin, their money flows are sometimes extra secure and fewer immediately uncovered to commodity worth fluctuations.

-

Potential for Progress: With no fund-level company taxes, ENFR affords potential for whole return.

-

Diversification: Investing in ENFR can present diversification advantages, particularly given its low correlation with different income-focused investments equivalent to bonds and utilities.

Cons:

Potential dangers of investing in ENFR primarily revolve round market and sector-specific components. These embody:

-

Commodity Worth Volatility: Whereas midstream firms function on a fee-based mannequin, the volumes of oil and gasoline they transport are not directly affected by commodity worth traits.

-

Regulatory Dangers: Modifications in regulatory insurance policies can impression the operations and profitability of power infrastructure firms.

-

Curiosity Charge Dangers: Rising rates of interest can enhance the price of capital for these firms, doubtlessly impacting their progress prospects and profitability.

Conclusion: To Make investments or To not Make investments?

ENFR presents a pretty funding alternative. With its distinctive give attention to North American power infrastructure firms and potential for secure money flows and progress, ENFR could be a useful addition to an investor’s portfolio.

Nonetheless, potential traders also needs to pay attention to the related dangers, significantly these associated to commodity worth volatility, regulatory adjustments, and rate of interest fluctuations. I feel it may be a very good yr for Vitality, and this fund would seemingly profit in a giant approach.

Markets aren’t as environment friendly as standard knowledge would have you ever imagine. Gaps usually seem between market indicators and investor reactions that assist give a sign of whether or not we’re in a “risk-on” or “risk-off” surroundings.

The Lead-Lag Report can provide you an edge in studying the market so you may make asset allocation choices primarily based on award-winning analysis. I’ll provide the signals–it’s as much as you to determine whether or not to go on offense (i.e., add publicity to dangerous property equivalent to shares when threat is “on”) or play protection (i.e., lean towards extra conservative property equivalent to bonds/money when threat is “off”).