spooh

Enbridge (NYSE:ENB) is a well-run midstream power enterprise headquartered in Canada with appreciable pure gasoline belongings in North America. Enbridge submitted a powerful monetary framework for FY 2024 within the fourth quarter that strongly means that the midstream agency will have the ability to elevate its quarterly dividend this 12 months by 4-5%. Whereas shares will not be a whole discount based mostly on EV/EBITDA, I consider they proceed to symbolize sturdy revenue worth for traders in FY 2024 and within the years to come back!

Earlier score

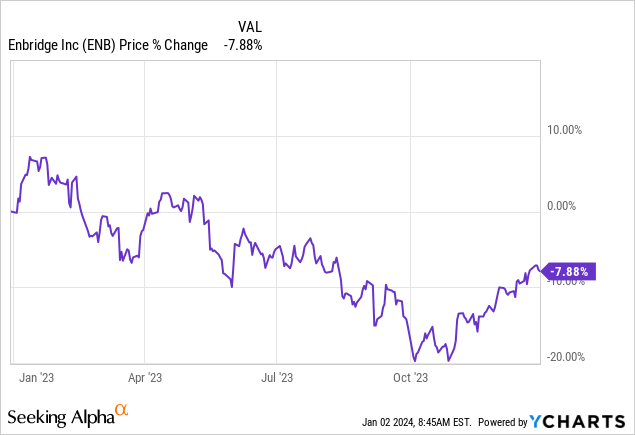

I beneficial Enbridge in September to revenue traders – This 7.6% Midstream Yield Has Potential – as a result of shares of the midstream firm on the time went by means of a protracted interval of share worth weak spot which created a novel funding alternative on the time. Shares of Enbridge have revalued larger within the final two months, however are nonetheless a powerful purchase, in my view, as a result of firm’s progress forecast for FY 2024. For the reason that integration of the corporate’s most up-to-date acquisitions is ready to spice up the midstream agency’s EBITDA outlook for FY 2024, I consider revenue traders are taking a look at yet one more 12 months of stable dividend progress.

Sturdy monetary execution over time

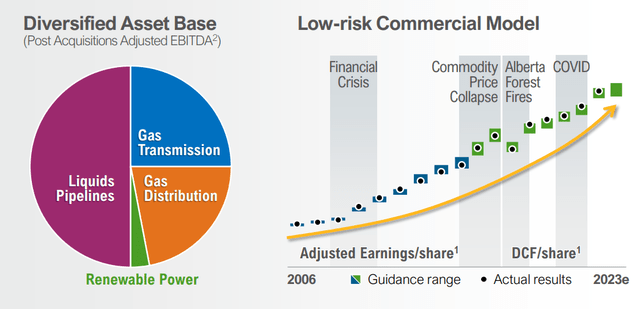

Enbridge is targeted on liquids and pure gasoline pipelines, that are the 2 largest segments for the midstream agency. With a market cap of greater than $76B, the midstream agency performs a important function in North American power infrastructure and is chargeable for making certain that producers can transport their power uncooked supplies to finish customers.

Enbridge has constantly delivered progress in EBITDA and distributable money circulation since 2006. The corporate’s constant progress within the final decade is supported by the truth that the midstream sector, versus the producer enterprise, has extremely predictable money flows. Within the midstream business, it’s a typical conference to enter into take-or-pay buyer contracts for the transport of power uncooked supplies which suggests the client both has to just accept the supply of a predetermined amount or pay a price. This shifts all of the transaction threat to Enbridge’s prospects and interprets right into a excessive diploma of money circulation predictability.

Enbridge

Liquids pipelines accounted for greater than half, 58%, of the corporate’s FY 2023 YTD adjusted EBITDA (January by means of September) with gasoline transmission and midstream belongings accounting for 27% of earnings earlier than curiosity, taxes and depreciation.

The excellent news for traders is that Enbridge gives a particularly stable 7.3% yield that remained well-supported with money circulation all year long, a proven fact that I do not see altering any time quickly.

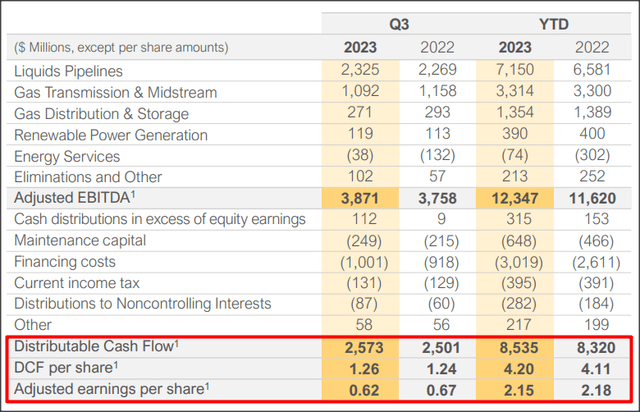

Within the first 9 months of FY 2023, Enbridge generated a ton of distributable money circulation, a big proportion of which was returned to shareholders. January by means of September, Enbridge earned $8.5B in distributable money circulation, displaying 3% year-over-year progress. Throughout this time, Enbridge additionally raised its dividend by 3%.

Within the first 9 months of the 2023 fiscal 12 months, Enbridge distributed $2.01 per share in dividends, which calculates to a protection ratio of 209%. This protection ratio ensures that Enbridge can simply afford to boost its dividend in FY 2024 and on the similar time, the midstream agency has sufficient money to spend money on its enterprise and probably do extra acquisitions this 12 months as properly.

Enbridge

Sturdy monetary framework for FY 2024

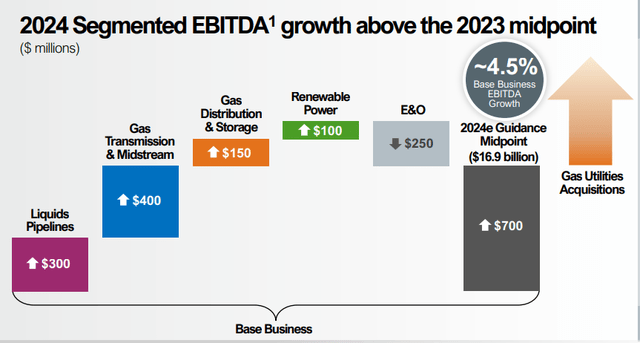

Enbridge continues to anticipate sturdy efficiency in all of its companies in FY 2024, particularly within the liquids pipelines and gasoline transmission/midstream segments. In complete, Enbridge tasks $16.6-17.2B in adjusted EBITDA in addition to $11.0-11.8B in distributable money circulation. Damaged all the way down to the per-unit stage, dividend traders can anticipate Enbridge to earn someplace between $5.40-5.80 per unit which, on the mid-point, implies roughly 3% Y/Y progress (based mostly on preliminary expectations for FY 2023 distributable money circulation).

Enbridge’s steerage implies roughly 4.5% year-over-year EBITDA progress and assumes that Enbridge’s earlier introduced gasoline acquisitions shut this 12 months. Enbridge disclosed that it acquired three utilities for $14B in September, and the acquisitions are anticipated to be accretive to distributable money circulation.

Enbridge

Enbridge’s valuation

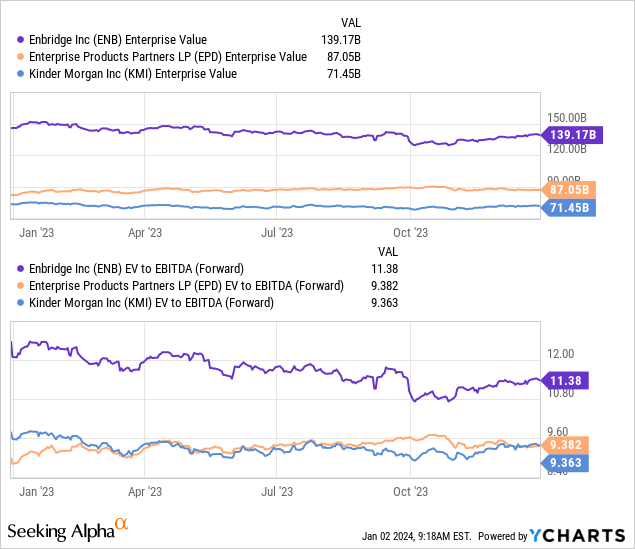

Enbridge shouldn’t be the most affordable midstream agency, largely as a result of traders worth firms that produce sturdy and predictable monetary outcomes. The agency is due to this fact buying and selling at a premium to its U.S. rivals within the midstream enterprise, and it’s considerably bigger by enterprise worth as properly. Shares of Enbridge are valued at 11.4X enterprise-value-to-EBITDA, which is the valuation ratio I have a tendency to make use of for capital-intensive midstream firms. Enterprise Merchandise Companions (EPD) and Kinder Morgan (KMI) each commerce at EV-to-EBITDA ratios of about 9.4X, so revenue traders positively pay a premium right here.

Dangers for Enbridge

There are two industrial dangers that I see with Enbridge in 2024 and past. One, the midstream agency could possibly be uncovered to adversarial regulation within the fossil gasoline business as authorities businesses want the business to transition to inexperienced power sources. Two, the corporate might even see slower dividend progress sooner or later if growth tasks are curtailed.

Last ideas

Enbridge is a well-run, rising midstream power firm that has appreciable power belongings in Canada and the U.S., in addition to further offshore wind belongings in Europe. The corporate is projecting greater than 4% 12 months over progress, on the mid-point, in its very important adjusted EBITDA measure in FY 2024 and traders can anticipate Enbridge to proceed to boost its dividend as properly. In keeping with Enbridge’s monetary framework for FY 2024, the midstream firm tasks continuous progress in its two core companies, liquids pipelines and gasoline transmission and midstream belongings. Shares will not be the most affordable within the midstream phase, however traders who wish to sleep properly and never fear concerning the stability of the 7.3% dividend yield, could also be nice with paying a premium!