Uncover the most recent 2023 defi developments. Discover breakthroughs and developments that formed the panorama of decentralized finance this yr.

Decentralized finance, extra generally referred to as defi, has gained prominence in crypto in the previous few years. It got here from a necessity to alter the way in which conventional monetary methods labored, making them extra open, unrestricted, and inclusive.

All through 2023, regardless of a number of hiccups, defi made a number of strides, introducing decentralized fintech options throughout quite a few monetary companies.

The demand surge is such that analysts venture the worldwide defi market will hit $239.19 billion by 2030, a big leap from $13.61 billion in 2022.

Allow us to take a more in-depth have a look at the developments in defi that formed the sector in 2023.

Main defi developments in 2023

Rise of layer-2 options

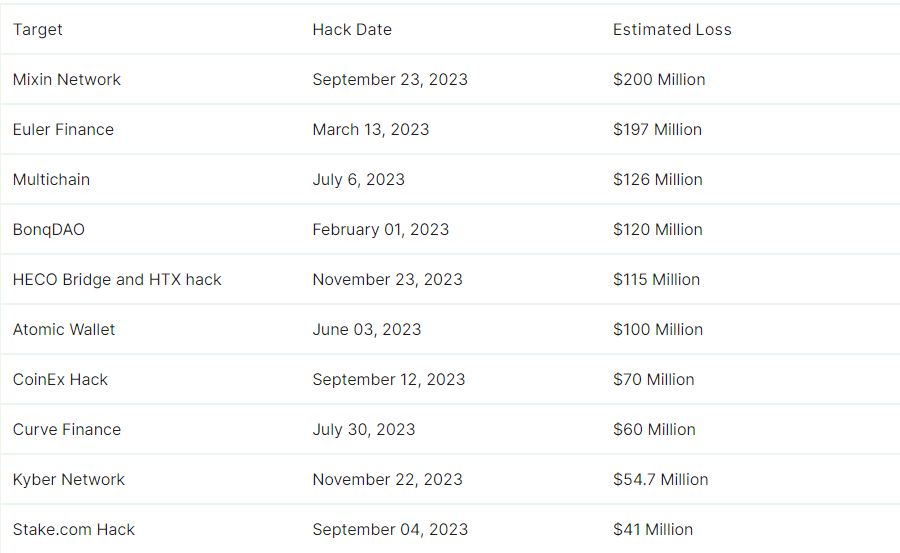

Among the many many developments in defi in 2023, one of many greatest was the expansion of layer-2 (L2) sidechains and rollups.

These protocols have been developed to unravel the excessive transaction charges and sluggish processing instances skilled on the Ethereum (ETH) community.

They work by enterprise transaction execution and sequencing whereas Ethereum ensures consensus and information availability, reaching a significant milestone in November 2023, when the entire worth locked (TVL) inside their contracts surpassed the $15 billion mark.

The sector consists of networks akin to Arbitrum One (ARB), Optimism (OP), Base, and Polygon zkEVM.

Earlier than June 15, the mixed L2 TVL was under $10 billion, per information from blockchain analytics platform L2BEAT. Nonetheless, by the tip of October, practically 20 weeks later, these networks approached a brand new peak of round $12 billion, with progress persevering with into November.

One of many triggers for the TVL surge was Optimism’s introduction of the OP token. At the moment, although, Arbitrum tops the chart by way of TVL.

L2 tasks by TVL. Supply: L2BEAT

Other than their attractiveness to customers attempting to keep away from the excessive gasoline charges and gradual affirmation instances skilled on Ethereum, particularly through the latest bull run, L2 networks rose in reputation by executing profitable advertising methods.

Nonetheless, their seeming success has not been with out criticism. Some key gamers within the sector, together with Shardeum’s Chief Progress Officer, Kelsey McGuire, have voiced concern in a dialog with Cointelegraph over the trade-off in decentralization.

In response to McGuire, there could possibly be potential points with centralized sequencer nodes on the execution layer, which may make L2 networks prone to censorship or authorities interference, rendering moot the precept of decentralization and trustlessness elementary to blockchain.

Though ETH transaction prices have diminished considerably, they nonetheless sometimes hover round a number of {dollars} for many defi operations, a big quantity in comparison with the mere cents charged by L2s.

Going ahead, analysts have recommended that attributable to Ethereum’s congestion and excessive gasoline charges, a development may emerge the place buying and selling quantity and TVL from ETH and different funds residing in EVM chains transfer to L2 networks in bigger quantities, thus sustaining their progress into 2024 and past.

You may also like: Exploring the expansive ecosystem of EVM-compatible chains

Integration of conventional finance (tradfi) with defi

One other defi development that took root in 2023 was the drive to assimilate conventional finance extra successfully with elements of web3. It’s now attainable to rework tangible belongings like company credit score or mortgages into crypto tokens.

This migration of real-world belongings (RWA) onto blockchain know-how has allowed for unlocking huge liquidity and utility, which beforehand appeared impractical, if not downright unattainable.

Nonetheless, regardless of the progress made, tokenizing bodily belongings has not been fully seamless. The first cause is the sturdy legacy marketplace for most RWAs, which, regardless of its complexity, continues to be regarded by customers as dependable and well-established.

An exception could possibly be carbon offsets, an rising development with no deeply rooted legacy system. Analysts consider that the actual success story within the integration of tradfi and defi could lie within the growth of decentralized infrastructure for bringing carbon offsets on-chain.

Additional, defi lenders like Archblock, Credix, and MakerDAO are working individually, partnering with conventional monetary establishments to offer loans secured with RWAs.

Such collaborations spotlight one of many extra sensible functions of defi applied sciences, with trade watchers believing they maintain immense potential any longer, particularly since they mix defi’s pace, transparency, and low-cost benefits with tradfi’s compliance proficiency, superior threat administration, and extra established asset administration.

You may also like: Traders have to be prepared for the facility of asset tokenization | Opinion

Regulatory developments and their influence

Regardless of its potential to revolutionize conventional finance, defi know-how shouldn’t be with out threat. Latest information from cryptosec.data signifies that the sector misplaced an estimated $2.4 billion attributable to varied exploits and hacks.

Naturally, such points have sparked debate over defi and regulation. Some worry that regulatory intervention would possibly compromise the core tenet of defi tasks, their decentralization. Nonetheless, others consider rules are essential for the trade to construct belief with customers.

2023 noticed the movement for defi regulation get underway in earnest. For example, the European Union (EU) launched the European Markets in Crypto Property Regulation (MiCA) in 2021, ratified and adopted in 2023.

The World Financial Discussion board has additionally created a policy-maker toolkit to information lawmakers and regulators in varied jurisdictions on the authorized and regulatory elements of crypto and defi tasks.

Because the trade expands, observers anticipate regulatory our bodies worldwide to pay extra consideration and work in direction of balancing client safety and innovation promotion.

Going into 2024, we anticipate clearer tips from world regulators, together with the Monetary Stability Board (FSB), the G20, and nationwide regulators. This readability will probably embody digital asset classification, taxation, anti-money laundering (AML), and know-your-customer (KYC) necessities.

In 2023, the regulation of particular token sorts, together with safety tokens and stablecoins, got here to the fore, with regulators and the courts making pronouncements on the difficulty.

The Worldwide Group of Securities Commissions (IOSCO) lately highlighted the shortage of standardized information on ongoing and new defi tasks and the obfuscation ways utilized by market contributors as hindering efficient sector regulation.

IOSCO proposed a framework it hopes can be finalized by the tip of the yr that ensures the safety of traders, the administration of dangers, and the enforcement of legal guidelines associated to defi and crypto throughout the 130 jurisdictions which can be members.

You may also like: Crypto lobbying surges in 2023 amidst stablecoin regulation push

Monetizing web3 gaming

This yr additionally witnessed the rising integration of NFTs into in-game purchases. With the anticipation of the anticipated enlargement of one other web3 element, the metaverse, the main focus has shifted in direction of creating transferable digital belongings throughout video games.

There are at the moment greater than 1 billion customers engaged within the shopping for, promoting, and buying and selling of in-game belongings. With the appearance of the metaverse, analysts venture the quantity to achieve 5 billion and the sector to have a price of roughly $13 trillion by 2030.

Observers have posited that conventional monetization strategies akin to pay-to-play, in-game purchases, and promoting have created an imbalance between avid gamers and builders, typically resulting in participant dissatisfaction.

Nonetheless, the emergence of web3 recreation monetization holds promise for addressing these points in 4 vital methods:

- Play-to-earn video games: Web3 launched play-to-earn (P2E) video games, a game-changing development that incentivizes participant participation by incomes them crypto or NFTs, disrupting the everyday developer-centric monetization.

- Participant possession of in-game belongings: In P2E video games, gamers can personal in-game belongings represented as NFTs on the blockchain. It permits gamers to commerce their belongings inside a recreation or throughout titles, rising the objects’ worth and uniqueness and enabling real-world earnings from recreation achievements.

- Income sharing: Blockchain know-how has allowed extra clear income distribution between builders, avid gamers, and stakeholders.

- Decentralized autonomous organizations (DAOs): A defi development slowly taking root is the introduction of DAOs inside video games to empower communities, enabling them to make collective selections relating to recreation growth, distribution of rewards, and basic governance.

Regardless of the optimistic influence the monetization development may have on the blockchain gaming sector, it nonetheless faces a number of challenges, together with scalability and ease of use.

You may also like: Web3 gaming: a 2023 trade overview

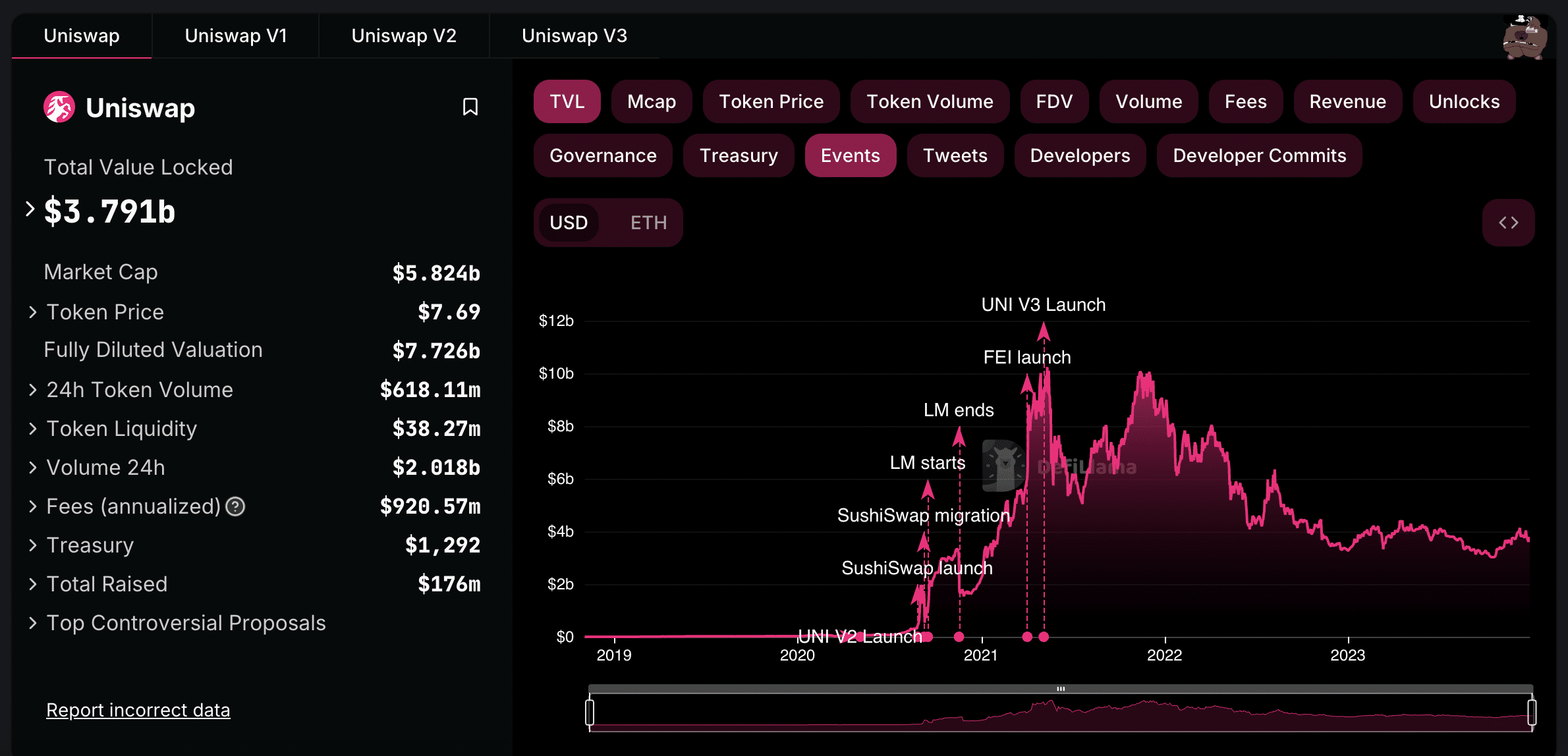

Decentralized exchanges (DEXs) make a comeback

Decentralized exchanges, or DExs, as soon as hosted a good quantity of the buying and selling within the defi sector. So excessive was their reputation that in 2021, such platforms collectively achieved a buying and selling quantity of over $60 billion. Nonetheless, as they continued to develop, DEXs confronted the twin challenges of price and time.

It will definitely led to their market share being largely gazumped by larger centralized exchanges (CEXs) akin to Binance and Coinbase.

The tail finish of 2022 noticed a number of CEXs, together with Sam Bankman-Fried’s FTX, shut down and file for chapter because the sector reeled from the results of a protracted bear market and unscrupulous practices by sure corporations.

You may also like: FTX saga: what occurred to FTX and Sam Bankman-Fried in 2023

The closures precipitated concern amongst many defi customers relating to these platforms’ transparency and management, or lack thereof, resulting in fears of potential losses.

It sparked a resurgence within the reputation of DEXs, which many noticed as alternate options to CEXs, regardless of their repute for being extra advanced and demanding better duty from customers.

Their comeback has been propelled by automated market makers, a instrument reportedly utilized by greater than 90% of all DEXs, in line with a previous Consensys report.

2023 additionally noticed the continued progress of liquidity mechanisms launched by a number of DExs in 2022, together with GMX’s GLP token and Features Community’s DAI vaults, which function counterparty liquidity.

Among the many DExs, Uniswap is at the moment boasting a TVL simply north of $4 billion per information from DefiLlama.

Uniswap TVL. Supply: DefiLlama

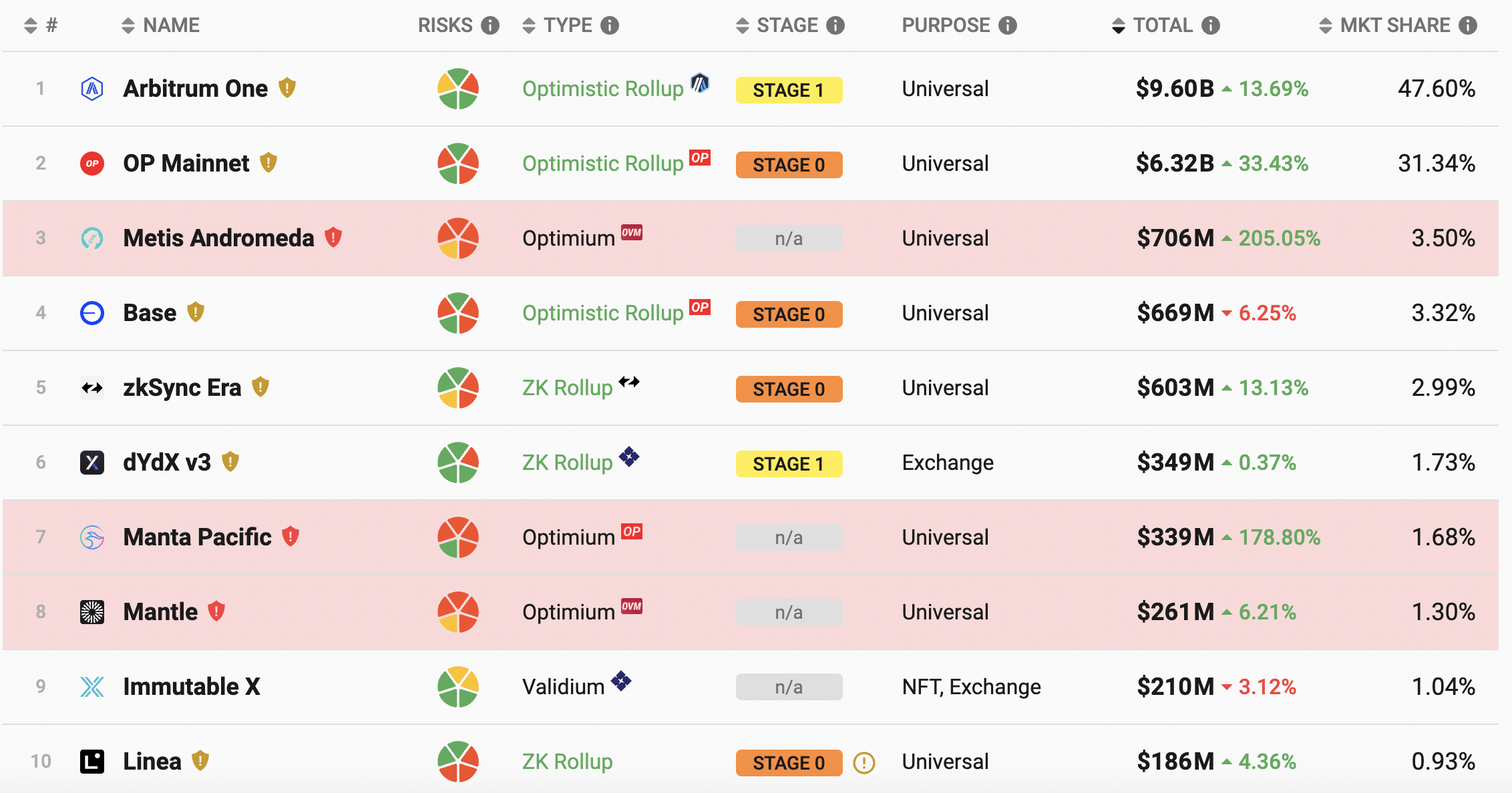

Hacks and safety breaches

Similar as in earlier years, 2023 was additionally marked by an alarming development of cyber assaults on defi tasks. Euler Finance, a pioneer within the defi sector, suffered a $197 million flash mortgage assault. Fortunately for a few of the victims of the assault, the hacker, who referred to as himself “Jacob,” returned a part of the stolen funds.

Different main assaults on defi platforms within the final 12 months embrace the next:

- Mixin Community: The platform obtained hit for $200 million in a cyber assault that particularly focused its cloud service supplier’s database. The assault precipitated Mixin to droop deposits and withdrawals.

- Multichain: The cross-chain bridge protocol misplaced over $125 million, changing into a chief goal for hackers attributable to its experimental nature and centralized asset repositories. The incident raised suspicion of an inside job, resulting in substantial losses from bridges like Fantom (FTM), Dogecoin (DOGE), and Moon River, which affected a number of belongings, together with wETH, wBTC, USDC, Dogecoin, and Tether (USDT).

- BonqDAO: The decentralized autonomous group misplaced $120 million attributable to a sensible contract exploit triggered by an oracle vulnerability. The attacker manipulated AllianceBlock (ALBT) token costs by tampering with an oracle in a sensible contract, resulting in the creation of enormous quantities of Bonq Euro (BEUR). They then traded the stolen BEUR on Uniswap, inflicting a pointy value drop and initiating ALBT trove liquidations. The loss included $108 million from 98.65 million BEUR tokens and $11 million from 113.8 million wALBT tokens.

- HTX and HECO: The 2 crypto platforms related to Justin Solar have been the targets of separate hacks on Nov. 23, ensuing within the lack of roughly $115 million. HTX, previously Huobi, misplaced round $30 million, whereas HECO Chain misplaced an estimated $85.4 million, primarily in USDT and ETH. HTX’s native cryptocurrency, HBTC, was additionally considerably impacted. The corporate has pledged to compensate for the losses arising from the assault totally. You may also like: Main crypto hacks of 2023: how the trade misplaced over $1 billion in minutes

Defi and the broader crypto market

The resurgence in ETH costs, marked by a 13% achieve within the final 30 days, has been accompanied by a big shift in investor curiosity towards the defi market.

Information from CoinGecko signifies that the entire market cap of defi tokens at the moment stands at round $72 billion, up from about $51 billion on Nov. 5, which suggests an extra $21 billion funding in varied defi tokens inside the Ethereum sensible contract surroundings.

The commensurate rise in ETH’s worth attracted investor consideration and stimulated exercise round a number of defi tasks constructed on the community.

A number of defi tokens registered double-figure spikes in tandem with ETH’s resurgence in the previous few days. In response to analysts making defi predictions, these surges sometimes point out elevated capital influx in direction of defi belongings traded on such platforms.

Traditionally, excessive ETH costs would result in an increase in gasoline charges, discouraging transactions with ETH-based defi tokens attributable to community congestion. Nonetheless, the emergence of L2 scaling options has helped alleviate congestion on the community.

Consequently, with decrease dangers of excessive charges and community congestion, the defi prediction market has such tokens pegged to proceed their progress trajectory.

2024

Like the remainder of crypto, defi continues to be in flux. Business watchers anticipate the developments noticed in 2023 can be essential in shaping defi occasions in 2024 and past.

Collectively, the developments are anticipated to immediate constant progress and maturity. Nonetheless, safety and regulatory points persist, and customers hope that the brand new yr will usher in regulatory readability and improved safety for belongings underneath decentralized finance protocols.

Learn extra: Key safety errors that will lead a defi venture to foul play | Opinion