patpitchaya

My warning on Eli Lilly and Firm (NYSE:LLY) has performed out since my final replace in September. Accordingly, LLY posted a complete return of simply 0.6%, relative to the S&P 500’s (SPX) (SPY) 7.6% acquire over the identical interval. My evaluation means that LLY is at a vital juncture, with dip consumers wanted to maintain its upward bias. Nevertheless, with LLY’s ahead adjusted P/E above 51x (properly above its 10Y common of 25.6x), questions should be requested whether or not it is applicable for traders sitting on important features to chop publicity.

LLY traders who added over the previous 12 months gained almost 57% in whole return phrases. Nevertheless, it also needs to be famous that it is a lot greater than its 5Y and 10Y whole return CAGR of 41% and 30%, respectively. In different phrases, traders trying so as to add publicity now want to significantly think about how a lot optimism has been priced into its weight reduction medicine thesis, however its market management with Novo Nordisk (NVO).

Wall Avenue expects Eli Lilly to proceed dominating the area, at the same time as its biopharma friends look to shut the hole. Because of this, Lilly is predicted to additional its dependence on its blockbuster GLP-1 therapies, with “close to two-thirds of the agency’s gross sales projected to return from this drug class by 2032.” Due to this fact, traders should proceed monitoring the competitors from Lilly’s friends, because the potential upside in LLY has doubtless mirrored important optimism.

Accordingly, opponents are additionally “growing weight reduction medicine,” together with oral therapies. It additionally caught the eye of an analyst on Lilly’s third-quarter earnings name, involved concerning the impression of oral diabetes medicine towards Lilly’s pricing levers. Administration clarified that it would not anticipate “a major impression on the pricing of injectable diabetes medicine.” The corporate burdened that “new diabetes drug courses don’t usually have an effect on the pricing of current drug courses.” Because of this, Lilly stays targeted on the success of its present portfolio and pipeline because it seems to sq. off towards Novo Nordisk within the essential diabetes/weight reduction medicine market.

Lilly highlighted the vital variations within the efficacy of tirzepatide primarily based on a “mixture GLP-1 and GIP agonist.” Its analysis has proven that tirzepatide “appeared to spice up efficacy whereas decreasing unwanted effects that restrict tolerability, suggesting a constructive consequence for GLP-1 agonism.” Observant traders ought to concentrate on latest research displaying how Lilly’s remedy “demonstrates a major benefit over Novo Nordisk’s rival remedy, semaglutide, in a real-world research.” Accordingly, tirzepatide was famous “to be 3 times extra prone to result in a 15% weight discount in comparison with semaglutide.” Coupled with Zepbound‘s (focused primarily at employers as an alternative of PBMs) extra aggressive worth competitors towards Novo Nordisk’s Wegovy, Lilly anticipates persevering with to achieve share with its latest FDA approval.

However the good news over the previous three months, as mentioned above, LLY’s relative underperformance towards the market may counsel underlying rotation. Because of this, traders who purchased into LLY earlier and have been sitting on important features doubtless noticed the chance to take income. I assessed that such warning is justified, with LLY trying more and more frothy.

With its 1Y efficiency manner above its long-term common, traders including on the present ranges doubtless want the corporate to carry out with perfection over the subsequent three to 5 years. Nevertheless, extra intense competitors from its friends may set again Lilly’s execution, worsened by the rising focus dangers baked into its present weight reduction medicine portfolio.

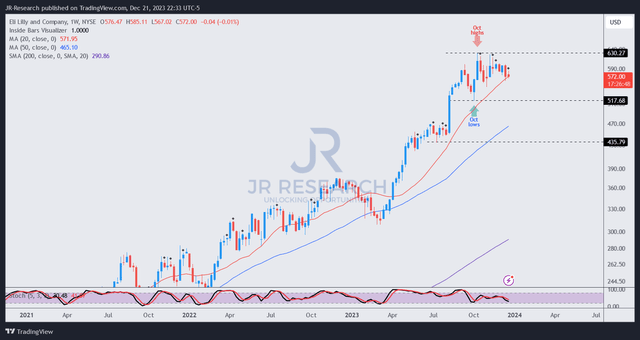

LLY worth chart (weekly) (TradingView)

LLY’s worth motion suggests it may have topped out in October 2023 and will precede a steep decline earlier than discovering a sustained backside, attracting dip consumers to return.

Whereas I did not assess a bull entice or false upside breakout, LLY consumers have been unable to muster enough momentum to push greater, however the numerous broad market restoration since early November.

Due to this fact, I consider astute traders may very well be distributing from LLY, taking income in a managed cadence earlier than ultimately unloading at a quicker tempo. With that in thoughts, LLY traders ought to think about chopping publicity earlier than that occurs, because it may set off a lot greater draw back volatility, forcing a steeper selloff to dissipate the latest optimism.

I assessed two key ranges to look at on LLY, with the $515 and $435 ranges as its two vital assist zones to underpin its medium-term uptrend. I would think about shopping for aggressively if LLY does get to the $435 degree and is supported by aggressive dip-buying.

I urge traders to contemplate chopping publicity (you’ll be able to nonetheless hold a core place if you wish to hedge towards upside potential) and rotate earlier than the remainder of the market does so.

Ranking: Downgraded to Promote/Minimize publicity.

Essential notice: Buyers are reminded to do their due diligence and never depend on the knowledge offered as monetary recommendation. Please at all times apply unbiased pondering and notice that the ranking is just not supposed to time a selected entry/exit on the level of writing except in any other case specified.

We Need To Hear From You

Have constructive commentary to enhance our thesis? Noticed a vital hole in our view? Noticed one thing necessary that we didn’t? Agree or disagree? Remark under with the goal of serving to everybody locally to study higher!

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.