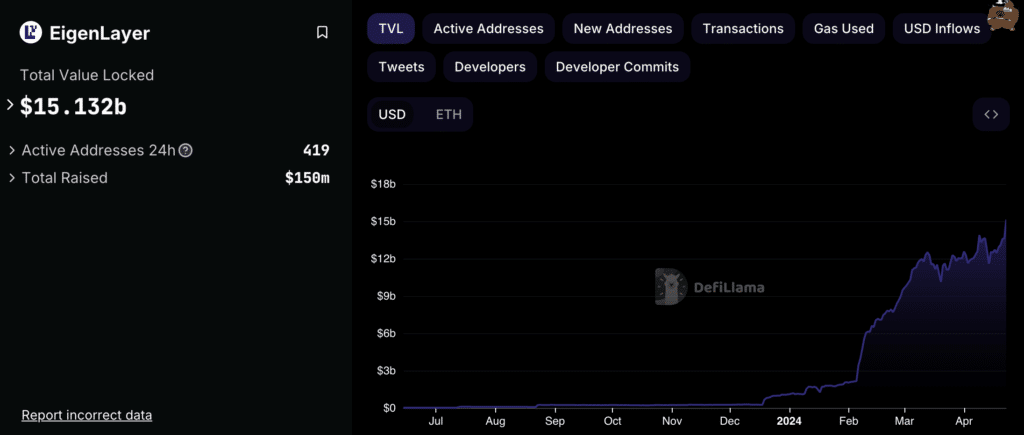

The entire worth of the funds locked up within the EigenLayer restoration protocol exceeded $15.1 billion.

In line with DefiLlama, the undertaking workforce lifted restrictions on pool limits, inflicting a noticeable improve in Whole Worth (TVL). This determine reached $11 billion originally of March, a rise of $4 billion in lower than two months.

Supply: DeFiLlama

EigenLayer’s TVL nonetheless must be improved to succeed in Lido Finance’s liquid staking protocol, which is at $29.6 billion.

You may also like: Glassnode: Restaking brings new income alternatives to the Ethereum neighborhood

In line with Dune Analytics, EigenLayer reached 115,000 distinctive customers in April. In early April, the protocol introduced the launch of the primary web and launched performance for operators and restakers. Customers now have entry to a number of new options. Furthermore, the builders promised to launch intra-protocol funds this 12 months.

Announcement: EigenLayer ♾ EigenDA Mainnet launch pic.twitter.com/bTp5BfnsKE

— EigenLayer (@eigenlayer) April 9, 2024

EigenLayer founder Sreeram Kannan stated the protocol will increase the utility of Ethereum and supplies financial safety to its holdings.

Our objective is to finally make @eigenlayer permissionless for the deployment assets.

———–

When an asset might be deployed, which asset *will* be deployed?

———–

– There’s a frequent false impression that property with decrease volatility are higher. So is USDC the asset with the bottom volatility?… https://t.co/YOrPlgprtB— Sreeram Kannan (@sreeramkannan) April 15, 2024

Kannan, an assistant professor on the College of Washington, developed the protocol in 2021. It’s primarily based on Ethereum and permits prospects to withdraw cryptocurrency and prolong crypto safety to new community functions resembling bridges and oracles.

You may also like: EigenLayer is approaching a TVL of $7 billion, turning into the fourth largest readmission protocol