cokada

The iShares MSCI Chile ETF (BATS:ECH) is a reasonably consultant slice of the Chilean market. Quite a lot of monetary exposures and a few mining exposures. In all, their financial system appears to be like respectable. That they had aggressive price hikes that they’re now dialing again and it’s enhancing the outlook for the banking shares which have been capable of profit from a interval of upper rates of interest whereas getting mortgage development. The mining exposures are additionally secularly fairly nicely positioned, though there’s the problem of nationalisation and the intermediate challenge of Chinese language EV demand. ECH would not look too dangerous, nevertheless it’s additionally not a no-brain ETF.

ECH Breakdown

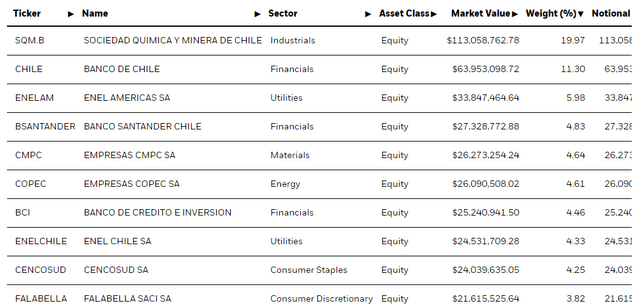

Financials (25%) are the most important publicity within the ETF, and there’s substantial skew within the prime holdings to monetary and industrial (22%) shares from Chile.

ECH High Holdings (iShares.com)

It’s worth discussing a number of the largest ones to grasp the route of the ETF. The banking exposures are correlated, so starting with these we see that there was some influence on their loss reserves because of the quickly rising rates of interest.

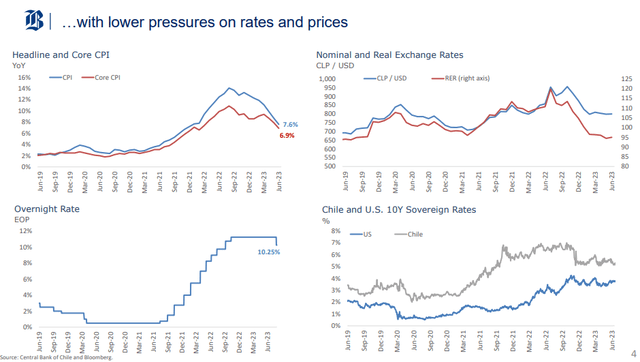

Macro Indicators (Q2 2023 Pres Banco De Chile)

Chilean charges had come up sooner than nearly every other nation however have since stalled at larger ranges to deal with the inflation, and at the moment are coming down. Their coverage price sees a 3% restrict to inflation, they usually have concluded the inflation is coming down at a passable tempo to be able to deliver down charges.

For banks, that is excellent news. They’ve benefited from larger NIMs for probably the most half, and whereas loss reserves grew because of the stress of upper charges on the financial system, the come-down of rates of interest is permitting loss reserves to launch. Furthermore, some mounted part of their lengthy portfolio has been established as nicely and that may add to earnings energy going ahead.

The principle mining and industrial publicity, Sociedad Quimica y Minera de Chile (SQM), is uncovered to secular tendencies in commodities like lithium. The difficulty is that the Chilean authorities needs to nationalise this useful resource as they did with copper. That does not imply appropriation, nevertheless it does imply that at some point within the subsequent 7 years or so, the state can be the one collaborating within the subsequent spherical of lithium contracts, and these firms’ lithium companies, among the many largest on the earth, will finally be moved to a state managed entity for a worth. That is pending congress approval although, and generally congress has been a tough test on all of the plans by the socialist president, the place attitudes are increasingly right-wing in the nation. There may be dis-synergy in state possession because it may include extra taxes and difficulties in buying Chilean lithium, and this will influence the phrases of the deal, which at this stage are undefined and unsure.

Backside Line

The ETF’s PE is low at round 5x. It’s because of the complexity across the mining exposures, and the truth that Chile generally has a reduction. Does it deserve that low cost? Sure, it most likely does. It is not very politically secure anymore regardless of for years being one of the vital strong nations within the area, though it handled the aftermath of the turnpike revolution higher than anticipated, with the brand new socialist structure not going via, and now the meeting being managed by the right wing who will draw up the brand new structure.

There may be upside on FX. Whereas the Chilean copper trade is nationalised, secular demand for copper lends power to the CLP, and for overseas traders that might current an upside. However demand of copper and lithium for that matter rely so much on Chinese language demand, particularly lithium. China is just not a dependable demand sink anymore and it shows in the SQM results.

Whereas monetary exposures are going to learn from higher wanting financial indicators, together with inflation, charges and possibly a bump to a beleaguered GDP line, we aren’t terribly compelled to get uncovered to this ETF proper now regardless of additionally the low PE ratio. The expense ratio is a bit excessive at 0.58%, and worrying a few risk-off surroundings, we aren’t certain the incremental greenback would go right into a market like Chile.