Edsel Querini

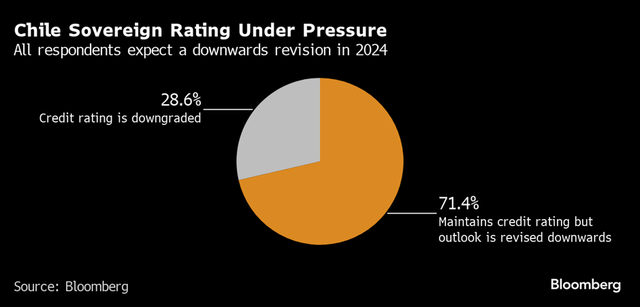

Chile got here out earlier this month with some relatively underwhelming economic growth numbers – whereas up 0.3% YoY, GDP was sequentially down 0.1% on a month-on-month foundation and beneath consensus expectations. Crucially for the iShares MSCI Chile ETF (BATS:ECH), a fund, immediately and not directly, levered to commodities, mining manufacturing was the important thing detractor, declining 4.0% YoY. Going ahead, there’s additionally renewed threat on the political entrance, as another constitutional rewrite is arising for a vote later this week. Whichever manner the vote goes, political uncertainty is unlikely to ease amid continued stress on President Gabriel Boric’s faltering reform agenda. No shock, then, that sentiment on Chile’s credit score outlook is especially downbeat heading into 2024.

Bloomberg

That mentioned, the headline valuation is as interesting because it’s ever been – the ECH portfolio is presently priced properly beneath its historic common, and the remainder of Latin America at ~4x trailing earnings. This quantity must be considered in context, although, given the cyclicality of its key holdings (word the forward P/E for MSCI Chile is 4 turns greater at ~8x) and underlying earnings path (-24.0% in 2023; -2.1% in 2024 per consensus estimates). The present ~8% trailing yield will not be all that sustainable both, ought to the cycle flip decrease. Financial easing ought to assist fairness valuations considerably, however not sufficient to positively transfer the needle on the chance/reward. Having been cautious about Chilean fairness publicity because the begin of the yr, I see no purpose to change my stance right here.

iShares MSCI Chile ETF Overview – Nonetheless a Very Concentrated Chilean Funding Car

The iShares MSCI Chile ETF tracks the overall return efficiency (earlier than charges) of the MSCI Chile IMI 25/50 Index, a basket of large-cap Chile shares topic to the next focus limits – 1) lower than 25% of belongings invested in a single holding and a pair of) sum of all +5% holdings capped at 50% of complete belongings. The ETF presently manages $576m in web belongings – unchanged vs Q1 ranges regardless of seeing its efficiency deteriorate since then. ECH expenses an expense ratio of 0.58%, barely above most different iShares rising market ETFs, however maybe justified by this being the one passive car obtainable to US buyers for Chilean equities publicity.

iShares

By sector, ECH is skewed closely towards its 4 largest exposures. Main the way in which is Financials at 26.2%, adopted by Industrials (22.2%), Utilities (18.2%), and Shopper Staples (13.8%). Supplies (6.0%) rounds out the highest 5, with no different sector contributing greater than 5% of the portfolio. Because the fund’s high 5 sectors make up ~86% of the portfolio, ECH’s fortunes are intently tied to a handful of key sectors.

iShares

Given the comparatively small 27-holding portfolio, ECH additionally screens as pretty concentrated from a single-stock perspective. Main world lithium and chemical compounds producer Sociedad Quimica y Minera de Chile S.A. (SQM) stays the most important holding, albeit at a diminished 16.6%. Industrial financial institution Banco de Chile (BCH) has gained some share at 11.2%, whereas Banco Santander-Chile (BSAC) has been the most important gainer at 6.3%. Utility firm Enel Américas S.A. (OTCPK:ENIAY) strikes one step decrease at 5.3%, with retailer Cencosud S.A. (CNCO) rounding out the highest 5 at 4.6%. Whereas the fund has seen its SQM focus reduce in current months, ECH stays a extremely concentrated fund, with the most important 5 holdings representing ~44% of the portfolio.

iShares

iShares MSCI Chile ETF Efficiency – YTD Return and Yield Fades Following a Robust Begin

On a YTD foundation, the ETF’s complete return has decayed to +5.6%, with its one-year return now at +5.9% (+5.7% in market value phrases) regardless of a powerful 2022 efficiency. Over longer timelines, ECH has created little worth for shareholders, annualizing at -5.4% and -2.8% during the last 5 and ten years, respectively. Since its inception in 2007, the fund has depreciated by -1.5%/yr or a cumulative -21.0%. Relative to the US-listed iShares Latin America 40 ETF (ILF), the fund has additionally underwhelmed on close to and longer-term timelines, in addition to since inception.

iShares

The one brilliant spot has been ECH’s distribution (paid out on a semi-annual foundation), presently at a trailing twelve-month yield of seven.6%. But, the sustainability of this yield within the face of a weaker commodities outlook, the important thing driver of Chile’s broader financial system, is questionable. The 30-day SEC yield, down to five.7%, displays this uncertainty, although the fund’s focus in dividend-paying banks ought to supply some assist.

Morningstar

Valuations additionally display attractively at 4.0x P/E, although the upper P/B (20% premium to ebook) is a greater gauge of market pricing, in my opinion, given the cyclicality of the ECH portfolio. Plus, MSCI Chile has been seeing vital adverse revisions in current months and is not anticipated to develop earnings anytime quickly; on this context, I view the low a number of as extra ‘worth lure’ than worth.

iShares

Do not Chase the 8% Yield Supplied by Chilean Shares

As rocky a yr as it has been for Chile, the 2024 outlook is not trying a lot better. The nation’s linkage to world commerce, specifically, could show to be a key weak spot as world financial tightening begins to chew. Its key holding, SQM, is especially uncovered to commodity value fluctuations, which, in flip, is leveraged to a Chinese language financial system cracking below the load of a property downturn. In keeping with slowing world PMI knowledge, Chilean GDP progress has began to show as properly – October knowledge noticed a marked slowdown sequentially, led by the all-important mining sector. Political threat is not easing up both forward of this week’s vote on one other constitutional rewrite; negotiation outcomes with state miner Codelco additionally stay an ever-present threat for ECH’s holdings (e.g., the lithium joint venture with SQM). Even aggressive financial easing, historically a tailwind for equities, could not increase ECH fairly as a lot as a result of its outsized banking publicity.

Whereas bulls will level to the seemingly low ~4x earnings a number of and an almost 8% trailing distribution yield as factoring in these negatives, I am not solely satisfied. Roll the earnings ahead, and the MSCI Chile P/E a number of out of the blue rises to ~8x – virtually double the trailing determine as a result of a cyclical downturn in underlying earnings. Ditto for the yield. If earnings revisions in current months are any indication, the trail for bottom-line progress is additional down (not up) subsequent yr – even after a lowered base following this yr’s low-double-digit proportion earnings decline.

Yardeni