The decentralized finance (DeFi) business continues to evolve, with a number of main launches and updates making waves. BeInCrypto has researched the most recent happenings and supplies a complete overview of essentially the most notable developments within the DeFi area.

From the launch of dYdX’s Android app to 3Jane’s spinoff yield layer, the business is buzzing with innovation and progress.

Mainnet launch of Time period Construction

Time period Construction has now launched its mainnet on Ethereum (ETH). This marks the debut of the primary institutional-grade market-driven mounted revenue protocol. It modifications the best way lenders and debtors handle liquidity in DeFi.

This platform permits customers to borrow tokens at mounted charges and phrases utilizing their liquid staking tokens (LSTs) and liquid restaking tokens (LRTs). They will additionally earn factors and redeem rewards. The public sale mechanism within the major markets facilitates borrowing and lending.

Moreover, the secondary markets provide a real-time order e book. This characteristic improves liquidity by supporting buying and selling of mounted revenue tokens.

Learn extra: High 11 DeFi protocols to look at in 2024

With this launch, Time period Construction goals to set new international requirements in liquidity administration. Permits customers to lock in mounted financial prices. This step is essential for benefiting from alternatives to doubtlessly earn larger variable annual share charges (APYs) or capitalize on a token worth improve.

“Our mainnet, designed to cater to institutional purchasers, merchants and retail traders, marks a pivotal growth in DeFi. It permits customers to leverage their digital property at mounted charges and phrases,” mentioned Jerry Li, CEO of Time period Construction.

Time period Construction is a fixed-rate lending and borrowing protocol powered by a customized zero-knowledge (ZK) rollup, zkTrue-up. The Taiwanese DeFi platform focuses on non-custodial mounted revenue protocols for peer-to-peer borrowing and lending.

dYdX Android app launch and chain improve

On one other entrance, dYdX, a decentralized buying and selling trade (DEX), is now providing its app on Android. The app accommodates all present options of the dYdX chain.

“dYdX Chain for Android contains a few of your favourite options like 24/7/365 markets, 20x leverage, 65 markets and counting, low gasoline prices, and way more,” the dYdX workforce famous.

Moreover, dYdX unveiled the improve to dYdX Chain v5.0. This software program improve was scheduled for block 17,560,000 round June 6 at 15:16 UTC.

This choice adopted a vote within the dYdX neighborhood, with 90% supporting the improve to model 5.0 and 98.5% voting in favor. The improve introduces a number of enhancements: remoted markets, batch order cancellation, protocol-enshrined liquidity supplier (LP) Vault, Slinky Sidecar/Vote Extension, efficiency enhancements, Mushy Open Curiosity Cap and Full Node Streaming. In keeping with DefiLlama information, the entire worth of dYdX Chain (TVL) on the time of writing is $146.28 million.

dYdX TVL. Supply: DefiLlama

3Jane revolutionizes resuming with spinoff returns on EigenLayer

3Jane, a spinoff yield protocol, is reside on EigenLayer. It unlocks a brand new spinoff yield layer by enabling the collateral provision of reinvested ETH in spinoff contracts.

Chudnov Glavniy, founding father of 3Jane, introduced the launch of the protocol. In keeping with Glavniy, the protocol unlocks a brand new derivatives yield tier for reinvestors by enabling the collateral provision of reinvested ETH in derivatives contracts, particularly name choices.

“3Jane is the primary ETH yield supply for all EigenLayer property and step one in direction of ‘financializing’ EigenLayer by not solely yielding [Actively Validated Services] AVS safety, but in addition from monetary derivatives,” Glavniy explains.

The protocol makes it potential to collateralize all unique yield-bearing ETH and Bitcoin (BTC) variants in EigenLayer, Babylon Chain and Ethena in choices contracts. Customers can bag native restaked ETH, restaked LSTs, ether.fi Staked ETH (eETH), Renzo Restaked ETH (ezETH), Ethena Staked USDe (sUSDe), and Financial savings DAI (sDAI) on January 3 to earn further premium choices returns . 3Jane Vaults sells deeply out-of-the-money choices and builds premiums on wrapped deposits.

Everclear: Connext’s rebranding and clearing layer introduction

Interoperability protocol Everclear has launched the primary “Clearing Layer” following the rebranding of Connext. These layers coordinate transactions between chains, netting the money flows earlier than deciding on the underlying chains and bridges. The reside testnet begins at the moment.

The Chain Abstraction stack goals to resolve fragmentation by eliminating the necessity for customers to fret concerning the chain they’re on. Nevertheless, it faces challenges in rebalancing and clearing liquidity throughout chains.

Everclear solves this downside by creating Clearing Layers. These layers coordinate market gamers to steadiness the cash flows between chains earlier than they set up themselves at underlying chains and bridges. They kind the muse of the Chain Abstraction stack and allow seamless liquidity and permissionless chain extension for protocols constructed on them.

Everclear reduces the associated fee and complexity of rebalancing by as much as 10 instances. The system is constructed as an Arbitrum Orbit rollup (by way of Gelato RaaS) and connects to different chains by way of Hyperlane with an Eigenlayer Interchain Safety Module (ISM).

On common, roughly 80% of every day capital flows may be settled between chains. For each $1 bridged in a series, $0.80 is bridged. If solvers, market makers and centralized exchanges coordinated, they might cut back bridge charges by greater than 5 instances.

TrueFi’s wager on arbitrage

TrueFi is now reside on Arbitrum, marking a major enlargement in partnership with Cicada Credit score to carry on-chain credit score to Arbitrum with market-neutral debtors. The TrueFi workforce defined a number of the reason why they selected Arbitrum.

“Arbitrum is the biggest Layer 2 by TVL, variety of DeFi protocols and steadiness of stablecoins. In keeping with L2beat, Arbitrum is the furthest alongside the trail of decentralization. They make investments important quantities of cash from their coffers [real-world assets] RWAs, as seen of their current STEP program, which we additionally leveraged with Adapt3r Digital,” the workforce outlines.

Within the coming days and weeks, TrueFi will share extra concerning the particular configuration of the swimming pools and particulars about every of the debtors. The primary two teams will likely be with Gravity Workforce and AlphaNonce, with many extra to observe.

Nostra’s NSTR Tokenomics and Launch Occasions

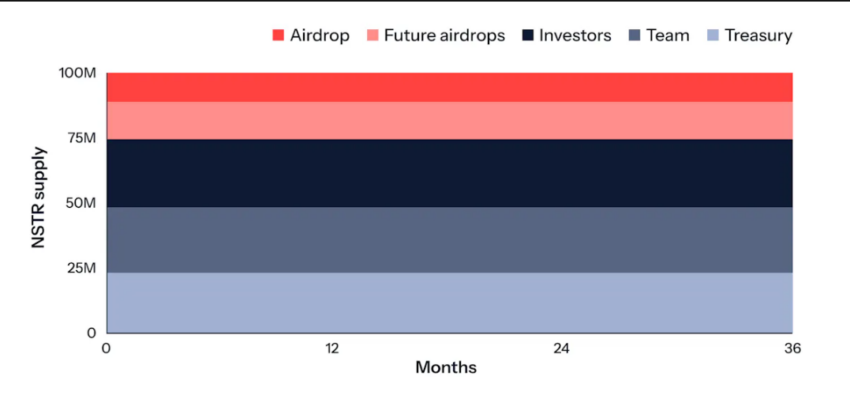

Nostra unveiled their tokenomics for NSTR, with a complete provide of 100 million tokens absolutely unlocked at launch. NSTR will function the governance token for the Nostra ecosystem.

They plan to distribute 11% to the neighborhood by way of an airdrop. Launch occasions embrace an upcoming Snapshot, a Liquidity Bootstrapping Pool (LBP) operating from June 10 to 13, and the Token Era Occasion (TGE) on June 17.

NSTR provide. Supply: Nostra

Nostra claims that NSTR would be the fairest launch in DeFi. The Liquidity Bootstrapping Pool (LBP) pre-listing occasion goals to fund DEX liquidity.

They may ship tokens to essentially the most lively customers and neighborhood members. All proceeds go to DEX liquidity owned by the Treasury Division.

Solv Protocol integrates Ethena for Yield Vault

Solv Protocol, a platform for optimizing the returns and liquidity of key property, has built-in Ethena to introduce the primary yield vault for SolvBTC. This vault permits customers to earn returns from Ethena’s methods whereas sustaining publicity to Bitcoin.

Customers can earn enticing returns with SolvBTC in two methods. First, by using Solv’s Yield Vaults, customers can deposit their SolvBTC into these vaults to entry sources of premium returns comparable to BTC staking, retake, and delta-neutral buying and selling methods.

Secondly, customers can discover DeFi alternatives utilizing SolvBTC by way of numerous DeFi protocols. This provides entry to numerous yield-generating choices, maximizing income throughout the vibrant DeFi ecosystem.

The ‘SolvBTC Yield Vault – Ethena’ is the primary of many deliberate collaborations from Solv Protocol. These partnerships intention to introduce new income sources and techniques to the rising SolvBTC ecosystem.

MakerDAO’s new proposal: Etherfi’s weETH in SparkLend

MakerDAO has opened a brand new proposal to combine Etherfi’s weETH into SparkLend. weETH is the biggest Liquid Restaking Token (LRT) available on the market. It’s also the one main LRT with absolutely permitted withdrawals, guaranteeing secure liquidity and a powerful peg to ETH.

Phoenix Labs has proposed itemizing weETH to extend DAI lending on SparkLend, given the low competitors for USD stablecoin lending utilizing LRT collateral. The preliminary parameters and threat evaluation are primarily based on present market and liquidity circumstances for weETH:

- Liquidation threshold: 73%

“If accepted, this variation will likely be a part of an upcoming Government Vote in SparkLend,” the MakerDAO workforce mentioned.

Learn extra: Figuring out and Investigating Dangers on DeFi Lending Protocols

These developments spotlight the evolution of the DeFi sector and showcase the relentless innovation and progress that’s driving the business ahead. With tasks like dYdX, 3Jane, and MakerDAO regularly breaking new floor, the way forward for decentralized finance appears exceptionally promising.