Kobus Louw

A Fast Take On DXC Expertise

DXC Expertise Firm (NYSE:DXC) reported its FQ2 2024 monetary outcomes on November 1, 2023, matching income and beating consensus earnings estimates.

The agency supplies a spread of enterprise and expertise software program engineering and outsourcing providers to organizations.

I beforehand wrote about DXC with a Maintain outlook on slowing progress amid a change in focus for its working mannequin.

Given the U.S. mushy demand atmosphere as purchasers reign in non-discretionary challenge spending and continued GIS phase drag on income, I stay Impartial [Hold] on DXC Expertise Firm shares for the close to time period regardless of sturdy share buybacks.

DXC Expertise Overview And Market

Virginia-based DXC Expertise was based in 1959 and operates in two enterprise segments:

-

World Enterprise Providers – software program engineering, analytics

-

World Infrastructure Providers – transforms legacy techniques to the cloud.

The agency is led by Chairman and CEO Mike Salvino, who joined DXC in 2019 and was beforehand Managing Director at Carrick Capital Companions and Group Chief Govt at Accenture Operations.

DXC additionally supplies enterprise course of outsourcing for chosen business verticals equivalent to insurance coverage.

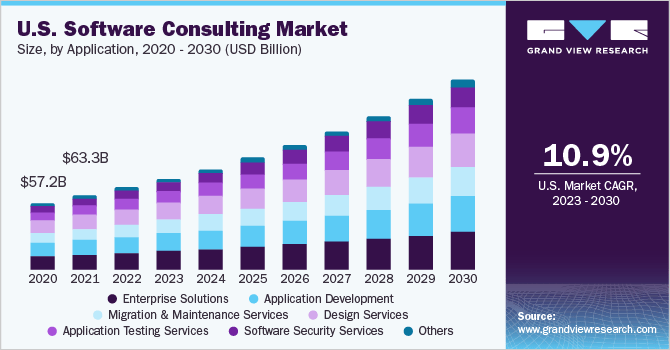

Per a 2023 market research report by Grand View Analysis, the worldwide marketplace for software program consulting (as a subset of the agency’s broader array of providers) was estimated at $273 billion in 2022 and is forecast to succeed in $681 billion by 2030.

This represents a forecast CAGR of 12.1% from 2023 to 2030.

The primary drivers for this anticipated progress are the continued transformation of enterprise exercise to the cloud, the rising use of digital touchpoints throughout all elements of the enterprise and the necessity to outcompete on the idea of expertise, wherever attainable.

Additionally, the chart under exhibits the historic and projected future progress trajectory of the U.S. software program consulting market from 2020 by way of 2030:

Grand View Analysis

Main aggressive or different business contributors embrace:

-

Accenture

-

Atos

-

Capgemini

-

CGI Group

-

Clearfind

-

Cognizant

-

Deloitte Touche Tohmatsu Ltd.

-

Ernst & Younger

-

IBM

-

Oracle Corp.

-

PricewaterhouseCoopers

-

Rapport IT

-

SAP SE.

DXC Expertise’s Latest Monetary Traits

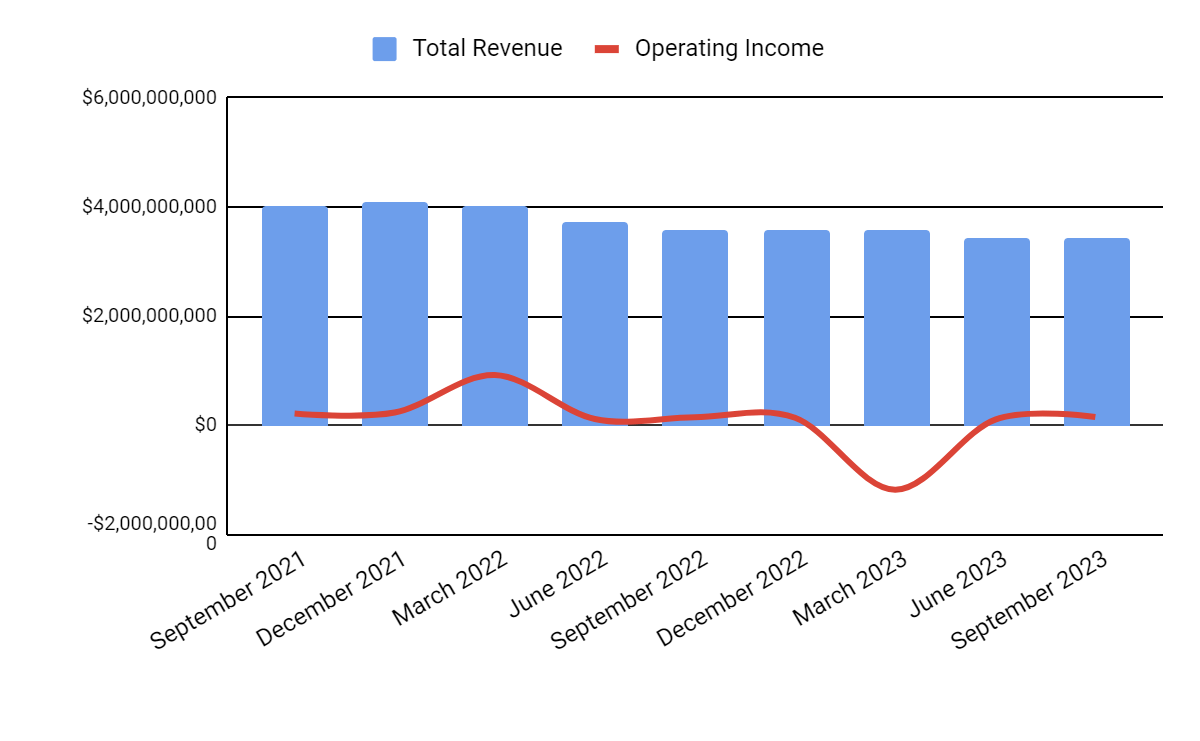

Whole income by quarter (blue columns) has continued to say no year-over-year; Working earnings by quarter (crimson line) has remained constructive:

Looking for Alpha

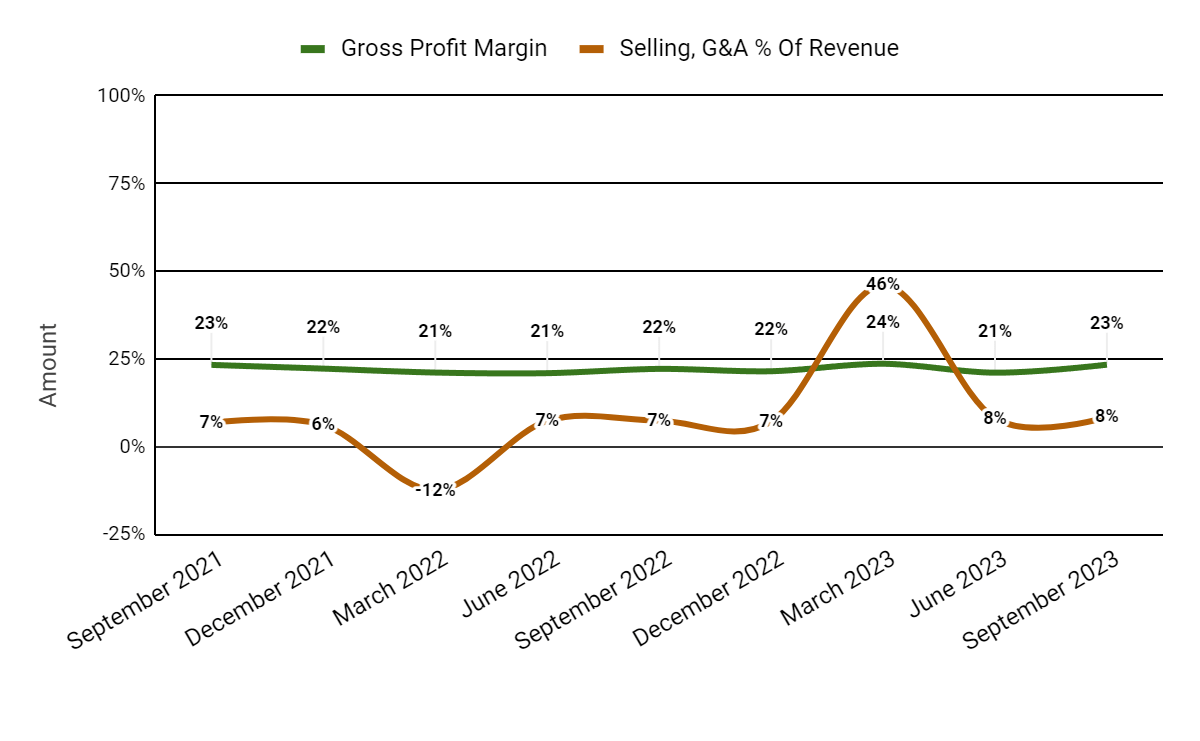

Gross revenue margin by quarter (inexperienced line) has trended barely greater just lately; Promoting and G&A bills as a share of whole income by quarter (amber line) have been risky:

Looking for Alpha

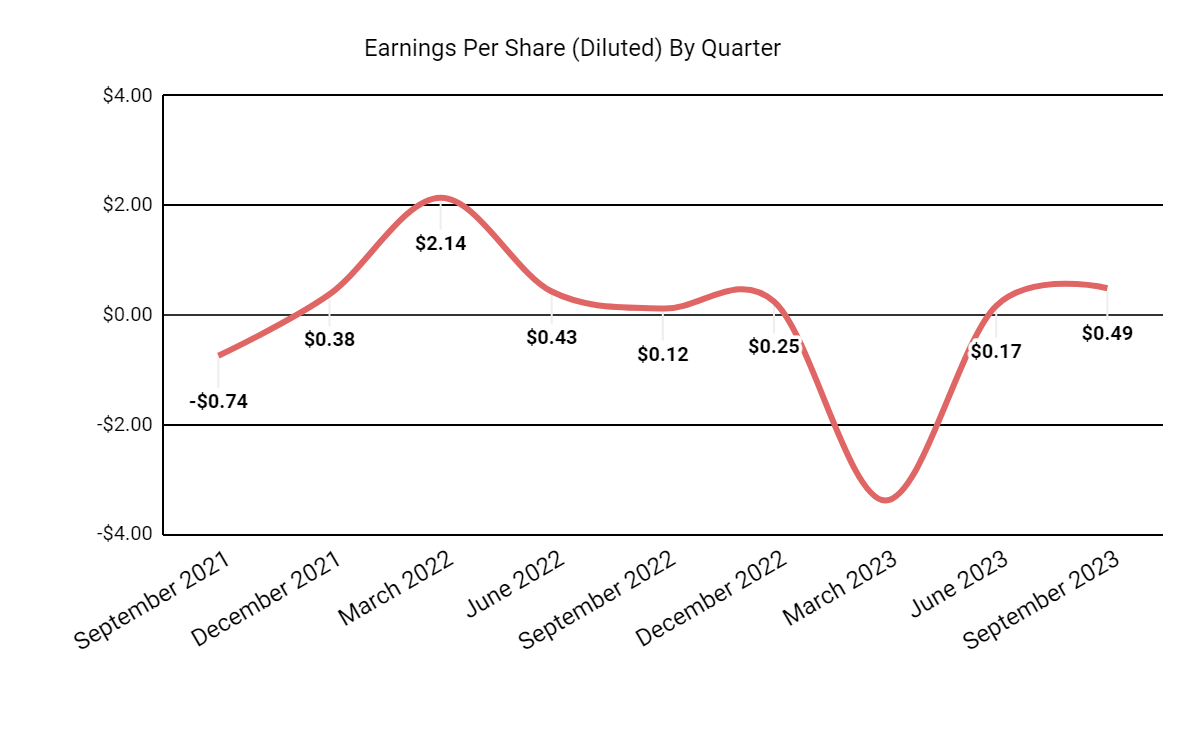

Earnings per share (Diluted) have recovered extra just lately:

Looking for Alpha

(All information within the above charts is GAAP.)

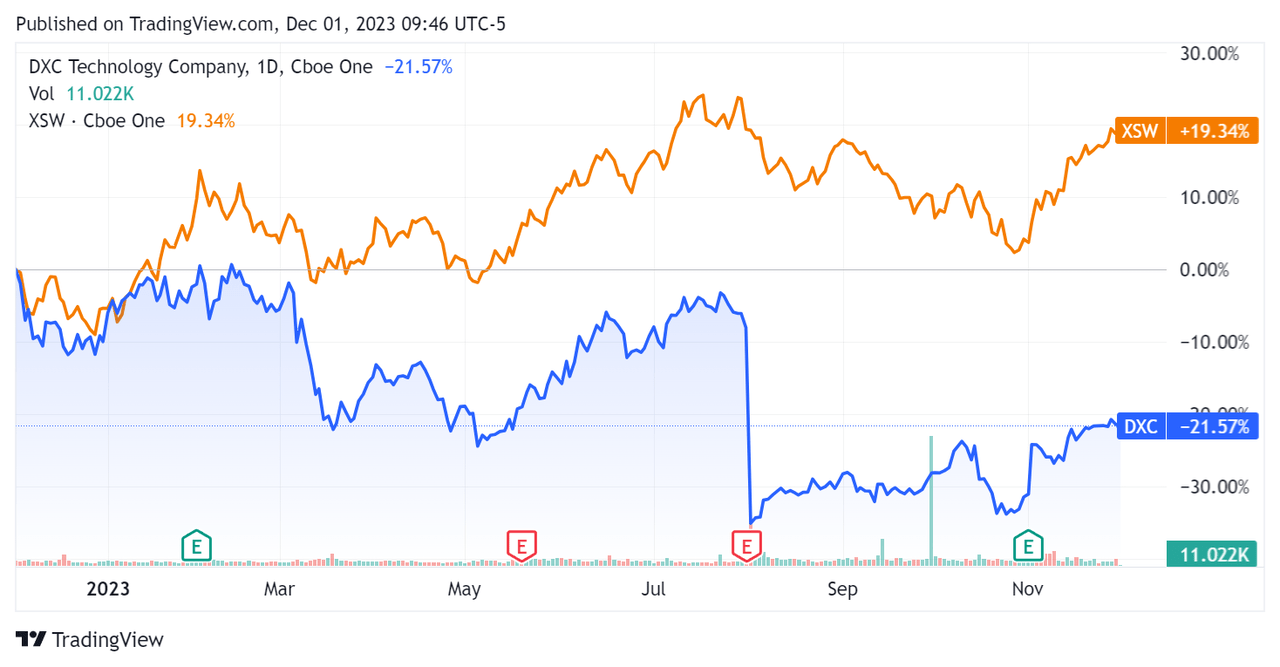

Previously 12 months, DXC’s inventory value has fallen 21.57% vs. that of the SPDR® S&P Software program & Providers ETF’s (XSW) achieve of 19.34%:

Looking for Alpha

For steadiness sheet outcomes, the agency ended the quarter with $1.4 billion in money and equivalents and $4.0 billion in whole debt, of which $476 million was categorized as the present portion due inside 12 months.

Over the trailing twelve months, free money circulation was $1.19 billion, throughout which capital expenditures had been $229.0 million. The corporate paid $100.0 million in stock-based compensation within the final 4 quarters.

Valuation And Different Metrics For DXC Expertise

Under is a desk of related capitalization and valuation figures for the corporate:

|

Measure (Trailing Twelve Months) |

Quantity |

|

Enterprise Worth / Gross sales |

0.6 |

|

Enterprise Worth / EBITDA |

18.2 |

|

Value / Gross sales |

0.4 |

|

Income Development Price |

-8.7% |

|

Internet Earnings Margin |

-4.0% |

|

EBITDA % |

3.4% |

|

Market Capitalization |

$4,520,000,000 |

|

Enterprise Worth |

$8,750,000,000 |

|

Working Money Stream |

$1,420,000,000 |

|

Earnings Per Share (Totally Diluted) |

-$2.47 |

|

Ahead EPS Estimate |

$3.23 |

|

Free Money Stream Per Share |

$4.47 |

|

SA Quant Rating |

Maintain – 3.09 |

(Supply – Looking for Alpha.)

DXC’s most up-to-date Rule of 40 calculation was destructive (4.3%) as of FQ2 2024’s outcomes, so the agency is in want of considerable enchancment on this regard, per the desk under.

|

Rule of 40 Efficiency (Unadjusted) |

FQ4 2023 |

FQ2 2024 |

|

Income Development % |

-11.3% |

-8.7% |

|

Working Margin |

3.9% |

4.4% |

|

Whole |

-7.4% |

-4.3% |

(Supply – Looking for Alpha.)

Commentary On DXC Expertise

In its final earnings name (Supply – Looking for Alpha), masking FQ2 2024’s outcomes, administration’s ready remarks highlighted natural progress for its GBS enterprise phase.

The corporate is shifting its focus towards its GBS phase however continues to see its GIS phase produce income declines, leading to total income decline.

The GBS phase now accounts for 49.7% of whole income.

Administration is transferring the agency to an “infrastructure-light” strategy which it believes will allow it to promote underutilized belongings and solidify the margin of the GBS phase sooner or later.

On capital allocation, the corporate has repurchased 10% of its inventory year-to-date and nonetheless had one other $500 million licensed beneath its fiscal 2024 repurchase program.

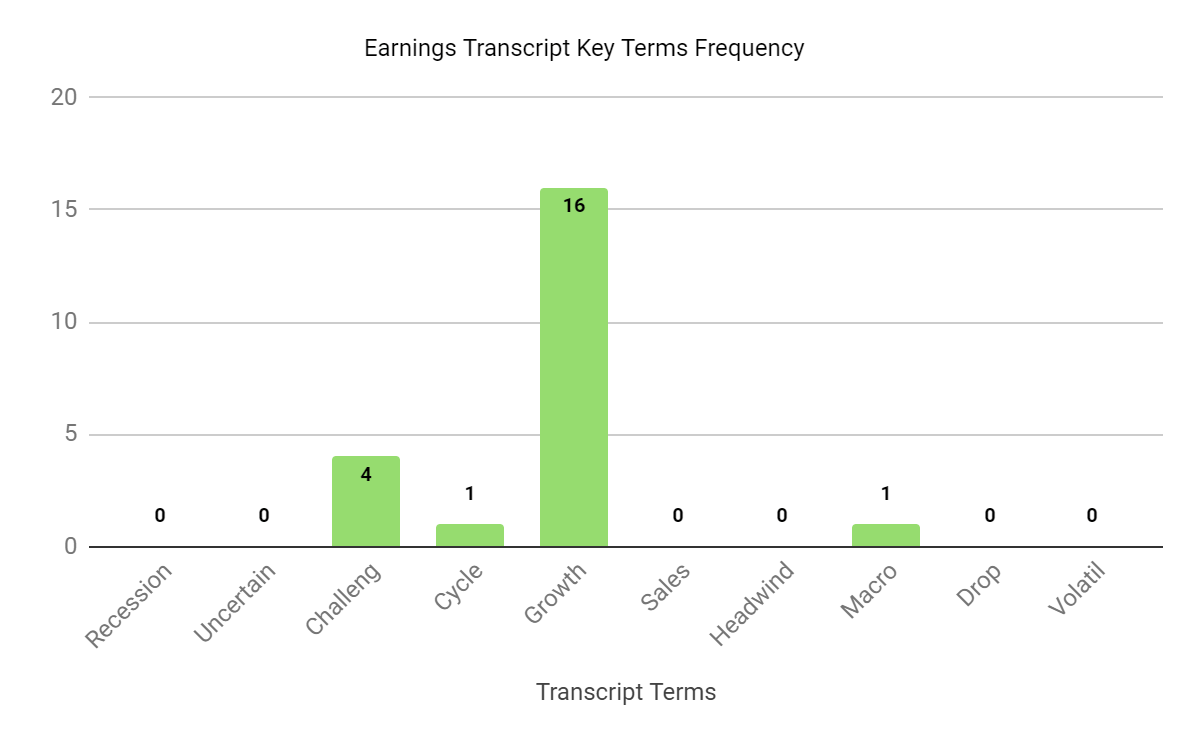

Within the earnings name, I tracked the frequency of assorted phrases and key phrases utilized by administration and analysts:

Looking for Alpha

The agency and its purchasers are dealing with cyclical challenges, with prospects centered on mission-critical work and delaying discretionary tasks amid macroeconomic uncertainties.

Analysts questioned management concerning the demand outlook and value financial savings alternatives.

Administration mentioned that it’s producing improved outcomes changing pipeline to income, admitting that bookings have been lumpy.

On decreasing prices, the agency is targeted on services optimization, decreasing contractors and rationalizing its onshore/offshore mixture of bills.

Whole income for FQ2 2023 fell by 3.6% YoY whereas gross revenue margin elevated by 1.2%

Promoting and G&A bills as a share of income rose by 1.1% year-over-year, and working earnings grew by 2.0%.

The corporate’s monetary place is sweet, with ample liquidity however important long-term debt and powerful constructive free money circulation.

Nevertheless, internet curiosity expense rose materially in FQ2, highlighting the agency’s substantial debt publicity.

Administration didn’t disclose any buyer or income retention charge metrics.

Wanting forward, consensus income estimates for fiscal 2024 recommend a decline of 5.3% versus fiscal 2023’s outcomes.

If achieved, this is able to signify a discount in income decline charge versus fiscal 2023’s decline charge of 11.3% versus fiscal 2022.

Given the U.S. mushy demand atmosphere as purchasers reign in non-discretionary challenge spending and the agency’s GIS phase drag on income, I stay Impartial [Hold] on DXC for the close to time period.