Authored by Ven Ram, Bloomberg cross-asset strategist,

Historical past exhibits that shares are properly poised to achieve earlier than the Federal Reserve begins slashing charges, however daunting valuations for expertise names counsel that the S&P 500 might outperform the Nasdaq within the first half of the 12 months.

Each the S&P 500 and Nasdaq 100 baskets have historically rallied within the interregnum between the tip of a Fed tightening cycle and the beginning of coverage loosening, besides on one event: the 2000-01 cycle, when the markets have been caught deep in a bubble.

Within the run-up to the speed cuts of 2001 — when the Fed slashed its benchmark charge by a whopping 475 foundation factors – the S&P slid greater than 12%, whereas the Nasdaq slumped 42% as patrons’ regret begin to grip the markets after the dotcom mania had run its course. Given the humongous rally in expertise shares over the previous 12 months, we might properly see a repeat of that cycle.

Whereas valuations of expertise shares will not be as daunting as they have been then, the Nasdaq is buying and selling removed from ranges that many buyers would think about cheap.

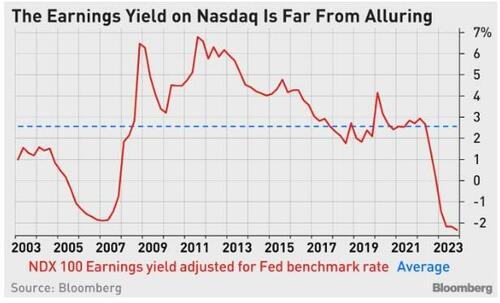

At present ranges, the Nasdaq 100 affords an earnings yield that’s the lowest in relation to the Fed funds charge because the days earlier than the dotcom bubble burst.

The truth is, the three.25% potential earnings yield on shares is tantamount to the basket buying and selling as if the Fed’s fund charge has already fallen to these ranges, even assuming that they’ll commerce pari passu with the benchmark charge.

The truthful worth of the Nasdaq is 12,877 when the expertise basket is seen as a long-duration bond.

Beneath situations of steady long-term rates of interest and regular dividend progress charges, that valuation can’t activate a dime.

That truthful worth means that expertise shares are actually buying and selling at a wealthy premium of greater than 30%. That extra could also be considered the worth that the markets are assigning to the expansion potential of synthetic intelligence.

Whereas a few of that enthusiasm could also be condoned, historical past exhibits us that merchants usually have he proper thought, however the improper value — and which may be the case with estimating the potential of AI-related shares, too.

As compared, the S&P 500 is buying and selling kind of the place it’s indicated truthful.

Whereas totally valued at present ranges, the froth — given a good worth of 4,632 — is inside acceptable limits, particularly in opposition to a backdrop the place a Fed pivot might stoke earnings progress.

The Nasdaq 100 has rallied about 3% thus far this 12 months forward of anticipated charge cuts.

Approaching high of gorgeous positive aspects of virtually 55% final 12 months, expertise shares have priced in all the excellent news on the market and extra — making them susceptible to an even bigger correction than brick-and-mortar shares.

Loading…