- Stash was acquired throughout ETH’s ICO at 31 cents per token

- Investor would lock a humongous 950719% in income in the event that they determine to promote

In what was a growth that caught the attention of the broader cryptocurrency market, an Ethereum [ETH] holder awoke after almost 9 years of dormancy to switch their complete holdings to a different pockets on Thursday.

Previous ETH on the transfer

In response to on-chain knowledge monitoring platform Lookonchain, an early investor who acquired 1,969 ETH throughout Ethereum’s preliminary coin providing (ICO) was seen transferring 1,960 ETH. The transferred provide was price $5.8 million at prevailing market prices. The participant acquired the ETH at 31 cents per token as a part of the ICO.

The aim of the switch was but to be ascertained, on the time of writing. Nonetheless, there might be a number of explanations behind the transfer, with essentially the most dominant narrative being realization of income. At present costs, the investor would lock a humongous 950719% in income.

Different components might be diversifying their portfolios for different tokens.

Not the primary time

Related cases of reactivation of outdated ETH acquired throughout Genesis had been seen earlier within the yr. On 24 March, as an illustration, a participant moved the whole lot of their 2,000 ETH acquired in the course of the ICO. Earlier than that, a pockets transferred 1,732 ETH to crypto-exchange Kraken on 2o February.

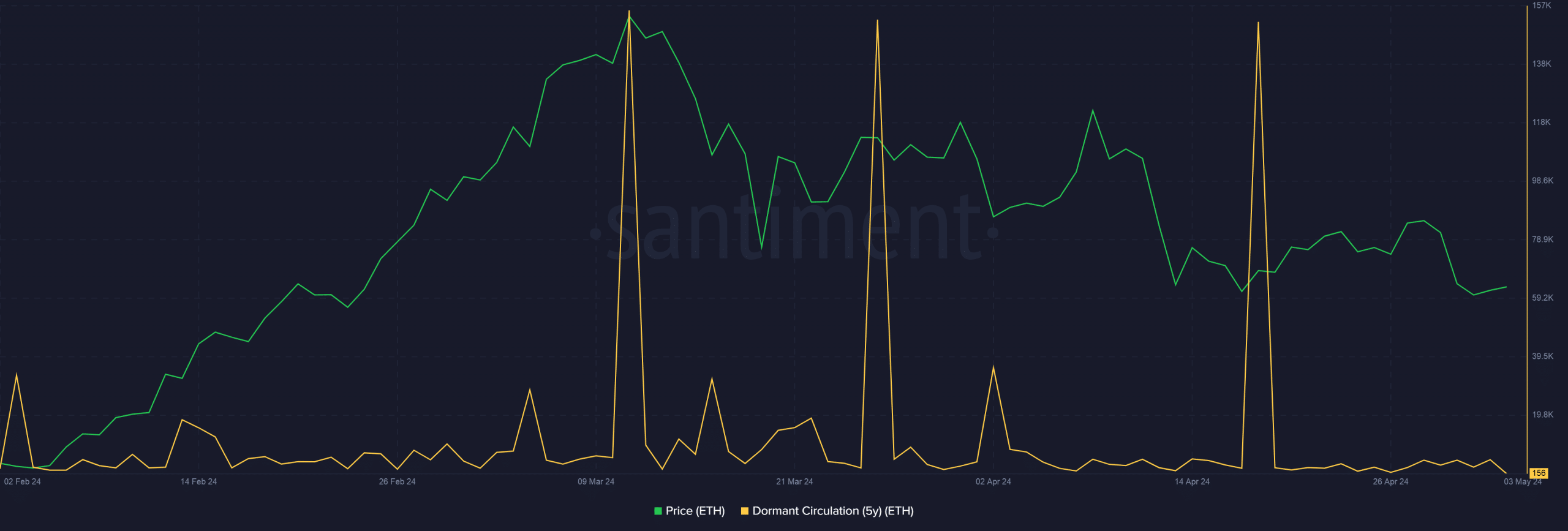

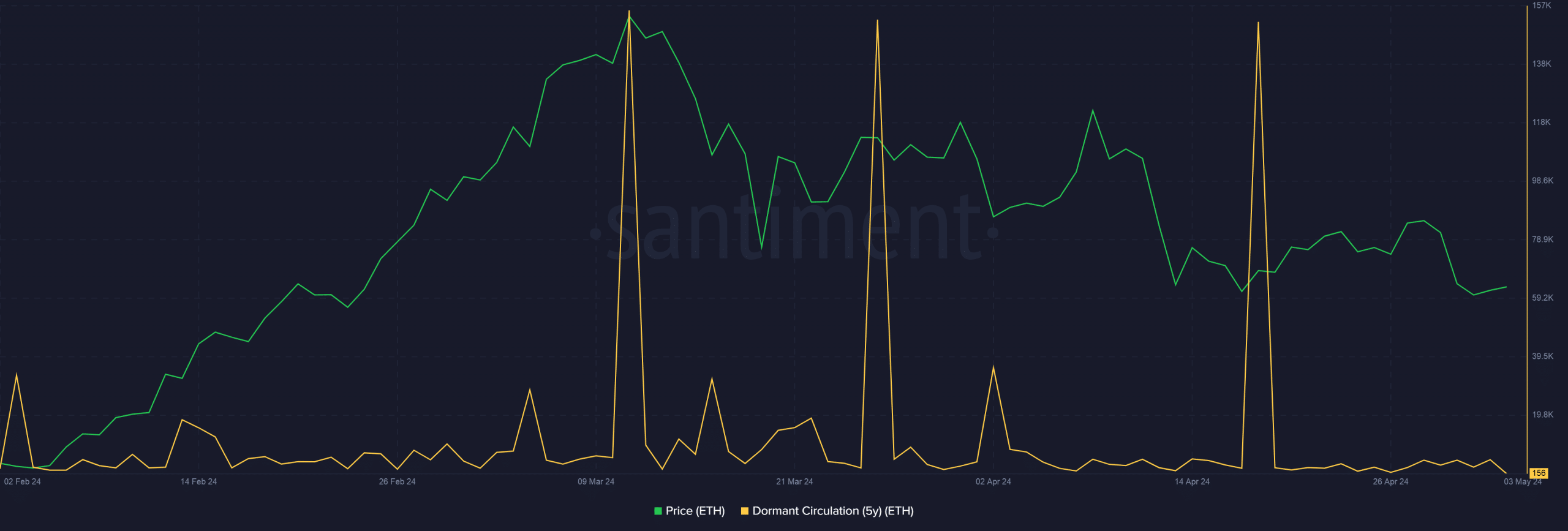

AMBCrypto investigated additional utilizing Santiment knowledge and noticed sharp spikes within the motion of ETH that had been inactive for greater than 5 years. In almost all of the cases, the motion of dormant cash was adopted by a worth drop. This discovering lends weight to the profit-taking concept mentioned earlier.

Supply: Santiment

Is your portfolio inexperienced? Try the ETH Revenue Calculator

How’s the sentiment round ETH?

At press time, ETH was wiggling within the vary round $3,000, based on CoinMarketCap. The second-largest cryptocurrency gave the impression to be recovering from a tough final month throughout which it plummeted by almost 10%.

During the last 24 hours, sentiment across the coin within the Futures market shifted dramatically too. The variety of merchants shorting ETH elevated vis à vis these longing it, as per AMBCrypto’s evaluation of Coinglass knowledge.