Authored by Simon White, Bloomberg macro strategist,

US fiscal coverage is more and more infringing upon the Federal Reserve’s independence, heightening already elevated secular inflation dangers and condemning the greenback to an excellent deeper debasement in its worth…

It was good whereas it lasted.

However the trendy period of financial coverage independence is drawing to a detailed, with central banks reverting to their normal place of subservience to their fiscal overseers.

That’s a nasty portent for fiat currencies, whose actual worth has already been decimated within the a long time because the hyperlink with gold was totally severed.

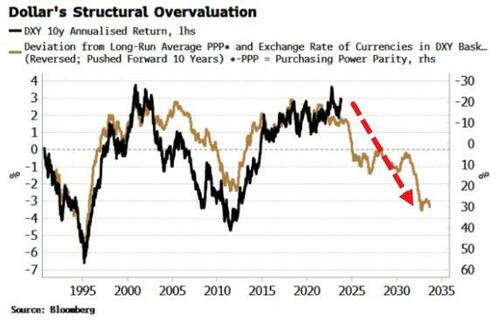

The exchange-rate worth of the greenback has been rallying in latest months, however short-to-medium time period main indicators of the USD comparable to long-dated OIS present that, outdoors of a major geopolitical-driven rally, it ought to quickly start trending decrease once more.

The greenback can also be structurally overvalued. The chart under reveals that the USD’s long-term progress fee will fall within the coming years if the foreign money follows its historic sample and adjusts all the way down to different DM currencies on an exchange-rate and purchasing-power-parity foundation.

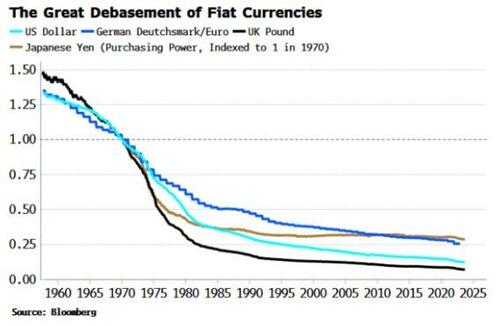

Extra relevantly for anybody who earns {dollars}, its actual worth can also be fated to maintain falling.

The greenback’s buying energy together with a number of different main DM currencies has collapsed because the finish of Bretton Woods in 1971, with the US foreign money shopping for barely a tenth of the products and providers it might purchase you in 1970, and sterling solely a fourteenth.

Sadly that pattern is about to proceed at an accelerated tempo as governments more and more encroach on financial coverage.

Fiscal dominance happens when the dimensions of presidency debt and deficits “dominate” the central-bank’s objective of preserving inflation in examine. Equivalently, it occurs when the central-bank’s maneuverability is circumscribed by the dimensions and construction of the sovereign’s debt and borrowing wants.

The US is already a number of the means there. Latest Fed feedback have highlighted that the term-premium pushed rise in longer-term yields will cut back the necessity for additional fee hikes. Moreover, fluctuations within the now giant (+$800 billion) Treasury account on the Fed have a major impression on liquidity.

None of that is a lot of a problem when the federal government is operating fiscal deficits nearer to their historic common. However the beginning of the Treasury put has meant that what’s anticipated from governments, particularly after the pandemic, has swollen significantly, and together with it sovereign spending and borrowing.

It’s comparable in Europe, with an implicit acknowledgment of bigger debt and deficits in new EU guidelines that may give nations better flexibility in breaching the three%-deficit and 60%-debt limits enshrined within the Maastricht Treaty (many nations are breaching them already).

The fiscal deficit within the US just lately hit its widest peacetime, ex-recession stage at 8.3% of GDP, whereas the debt-to-GDP ratio has risen to 129%, from 107% in 2019. The Treasury put implies that debt and deficits are prone to stay elevated for the foreseeable future.

With such giant financing wants, central banks rigidly making an attempt to implement an arbitrary inflation goal change into a nuisance.

Wants should, and central banks – already experiencing a chipping away at their de facto independence – will see its additional erosion and, presumably, its eradication finally in all however identify.

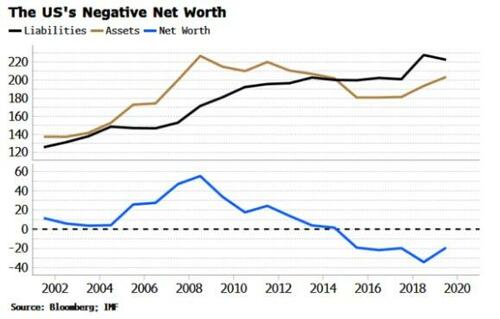

Giant fiscal deficits are compounded by the dismal net-worth positions of many DM nations. The IMF makes an attempt to calculate every nation’s whole belongings and liabilities. Property embody buildings and land owned by the federal government, whereas debt is just one a part of liabilities, which additionally embody public-sector pension obligations.

The US’s internet price – whole belongings minus liabilities – is now firmly unfavourable, at ~20% of GDP. Germany, Italy, France, the UK and Japan even have unfavourable internet worths.

DM nations’ fiscal positions will change into additional constrained from rising well being and social-security prices. Central-bank independence stands little probability as governments borrow hand-over-fist to attempt to make up for increasing income shortfalls.

That is inflationary. As Charles Calomiris of Columbia Enterprise College places it: “Each main inflation in world historical past is a fiscal phenomenon earlier than it’s a financial phenomenon.” When the general public is now not keen to fund the federal government (public sale failure), governments transfer to fund their deficits with non-interest bearing money owed, aka printing cash.

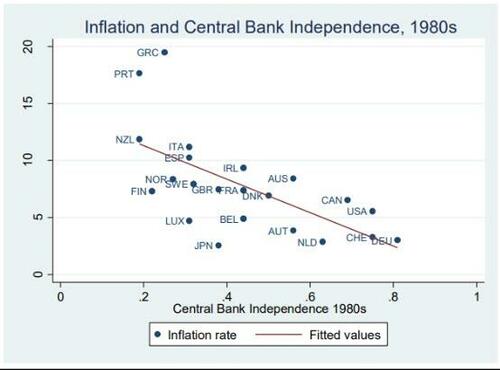

The Kennedy College at Harvard in a paper from 2018 discovered that from the Seventies to the Nineties there was a vital unfavourable relationship between central-bank independence and the extent of inflation, with much less impartial central banks related to increased inflation.

Kennedy College, Harvard College

The chance the present bout of worldwide inflation will probably be transitory as governments reclaim their dominance over financial coverage is turning into vanishingly small.

A secular rise in inflation within the US guarantees to additional debauch each the purchasing-power and exchange-rate worth of the greenback.

Mentioned Keynes, “by a seamless strategy of inflation, governments can confiscate … an essential a part of the wealth of their residents”.

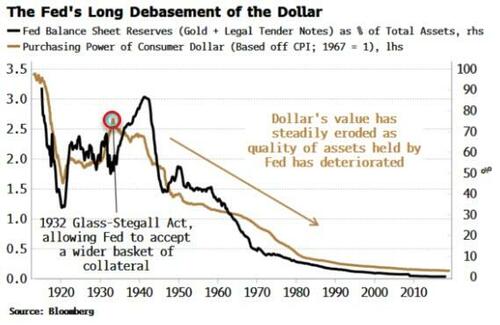

Because the Fed turns into an instrument of the federal government, the standard of the belongings on its stability sheet will progressively worsen. That may occur both via proudly owning ever extra authorities debt of deteriorating high quality via yield curve control-like insurance policies; or from having to periodically backstop a system vulnerable to extra frequent monetary crises in an elevated-inflation and high-rate vol surroundings (e.g. SVB in March of this 12 months).

The greenback is however a legal responsibility on the Fed’s stability sheet.

Earlier than the Glass-Steagall Act of 1932, which allowed the Fed to borrow towards a broader vary of collateral, its stability sheet consisted primarily of gold.

As its dimension has mushroomed over the a long time, it has additionally deteriorated in high quality, consisting of extra belongings of a riskier nature (the Fed was keen to purchase high-yield company debt in the course of the pandemic), whereas the proportion of gold held has fallen to close zero.

That pattern is about to proceed because the stability sheet more and more turns into subservient to the federal government’s borrowing wants, leaving the greenback going through no escape from its multi-decade debasement.

Loading…