metamorworks/iStock by way of Getty Photos

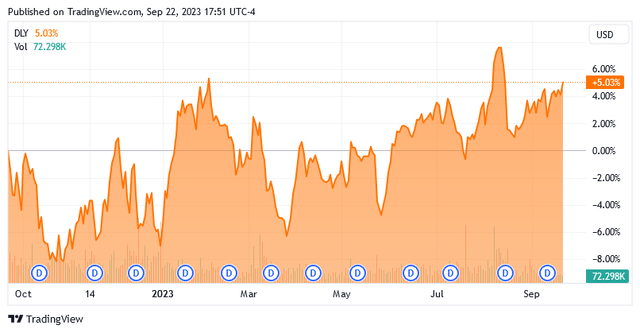

The DoubleLine Yield Alternatives Fund (NYSE:DLY) is a closed-end fund that can be utilized by buyers which might be searching for to earn a really excessive stage of earnings from their portfolios. The fund’s income-generation potential is instantly obvious within the fund’s present 9.53% yield, which is considerably larger than the yield of most fairness earnings closed-end funds in addition to the S&P 500 Index (SPY). Nevertheless, there are a number of bond funds that boast a better yield than this one, however this could partly be defined by the efficiency of this fund relative to many different closed-end funds that additionally put money into debt securities. Over the previous yr, the DoubleLine Yield Alternatives Fund is up 5.03% with respect to its share worth:

Searching for Alpha

The fund’s complete return over the interval is much more spectacular, as buyers who bought shares of this fund a yr in the past would now be 15.94% richer:

Searching for Alpha

That is, to place it mildly, a efficiency that drastically exceeds that of most different debt funds in the marketplace. In spite of everything, the rising rate of interest surroundings has triggered the costs of nearly any bond fund to say no. It might be sensible to analyze the components that differentiate this fund from different debt funds with a purpose to decide the supply of the market attraction for this fund, in addition to its potential to proceed this robust efficiency going ahead.

As common readers could recall, we final mentioned this fund again in July. At the moment, I discussed that the fund may have some dangers surrounding it, significantly as a result of it has been constantly failing to generate ample funding income to cowl its distribution. That was a couple of months in the past although, so it’s conceivable that some issues have modified since that point. Allow us to revisit this fund at present and see if we have to replace our thesis.

About The Fund

In line with the fund’s webpage, the DoubleLine Yield Alternatives Fund has the first goal of offering its buyers with a excessive stage of complete return. That is an uncommon goal contemplating that the title of this fund means that it’s investing in debt securities. The outline of the fund’s goal from its webpage confirms that assumption:

The Fund will search to realize its funding goal by investing in a portfolio of investments chosen for its potential to supply a excessive stage of complete return, with an emphasis on present earnings. The Fund could put money into debt securities and different income-producing investments of issuers anyplace on the planet, together with in rising markets, and will put money into investments of any credit score high quality.

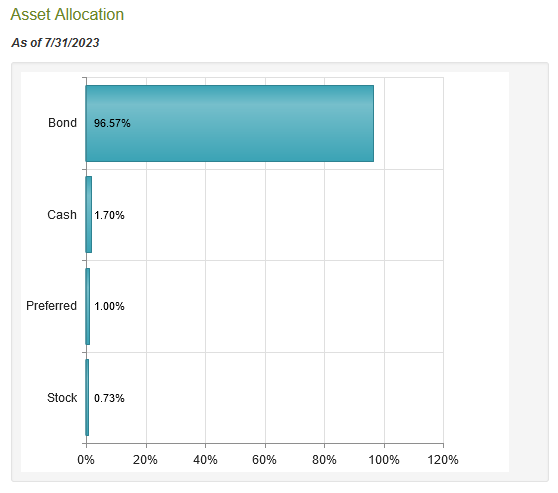

Technically, the time period “income-producing investments” may discuss with something that has a yield, together with dividend-paying frequent equities. Actually, there are some closed-end funds that use that phrase to explain frequent fairness investments in grasp restricted partnerships or actual property funding trusts. Nevertheless, on this case, the fund seems to be particularly referring to debt securities akin to bonds. As of the time of writing, 96.57% of the fund’s belongings are invested in bonds, with the rest in quite a lot of different issues:

CEF Join

The truth that the overwhelming majority of the fund’s belongings are debt securities is what makes the fund’s give attention to complete return shocking. I defined why that is the case in my earlier article on this fund:

As a rule, bonds present all of their funding return within the type of direct funds to their buyers. A bond investor purchases a newly-issued bond at face worth, collects a daily coupon fee from the issuer that corresponds to curiosity on the mortgage, after which receives the face worth again when the bond matures. There aren’t any web capital good points over the lifetime of the bond as a result of bonds haven’t any inherent hyperlink to the expansion and prosperity of the issuing firm. Thus, the bond’s yield is the one supply of web funding returns.

As bonds haven’t any web capital good points over their lifetime, they’re present earnings automobiles, not complete return automobiles. This is the reason the fund’s give attention to complete return is a bit shocking, even when it does state that it expects nearly all of its complete return to come back within the type of direct funds from the securities that it holds.

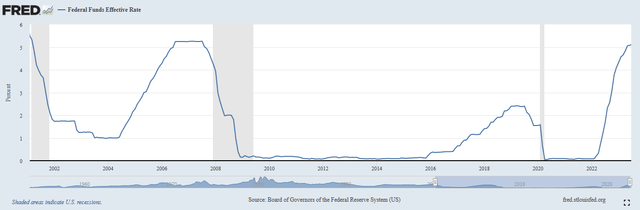

With that stated, the value of bonds varies inversely with rates of interest, so it’s doable to make some income by exploiting worth fluctuations. This inverse correlation makes the fund’s worth efficiency over the previous yr slightly shocking. As everybody studying that is little question properly conscious, the Federal Reserve has been very aggressively elevating rates of interest in an try and fight the very excessive inflation that we’ve been experiencing in the USA. As of the time of writing, the efficient federal funds charge is at 5.33%, which is the best stage that has been seen since February 2001:

Federal Reserve Financial institution of St. Louis

We instantly observe two issues right here:

- The present rate of interest is sort of a bit larger than the final time that we mentioned this fund. On the time the final article was revealed, the efficient federal funds charge was at 5.08%. Thus, the benchmark rate of interest within the economic system has risen by 25 foundation factors.

- The economic system in 2001 was fairly a bit stronger than the one which we’re at the moment in. There was a lot much less debt within the economic system, the nationwide debt was loads decrease, and the economic system as a complete was not hooked on extraordinarily low rates of interest.

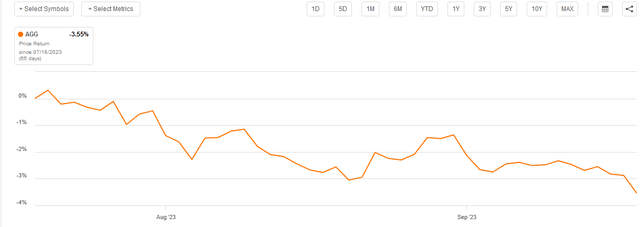

Of the 2 gadgets, the primary is a very powerful for the aim of our evaluation. The truth that the efficient federal funds charge has risen by 25 foundation factors will be anticipated to have a destructive impression on bond costs. Actually, that’s what occurred because the Bloomberg U.S. Mixture Bond Index (AGG) is down 3.55% since July 18, 2023, which is the date that the prior article on this fund was revealed:

Searching for Alpha

Curiously although, the DoubleLine Yield Alternatives Fund is up 2.80% over the identical interval:

Searching for Alpha

This fund has clearly managed to outperform the index by rather a lot. This has been the case over many of the previous yr.

As I famous in a earlier article, debt securities which have a floating charge have a tendency to carry their worth a lot better than fixed-rate bonds in a rising rate of interest surroundings. It is because the rate of interest that’s provided by the floating charge securities will all the time be aggressive with the rate of interest on newly issued bonds. In spite of everything, the explanation why bonds fell in worth so sharply is that it is not sensible to purchase a bond yielding 1% (for instance) when any investor may simply buy a brand-new bond yielding significantly greater than that. Thus, if the DoubleLine Yield Options Fund is investing in floating-rate securities, it could clarify a few of the outperformance.

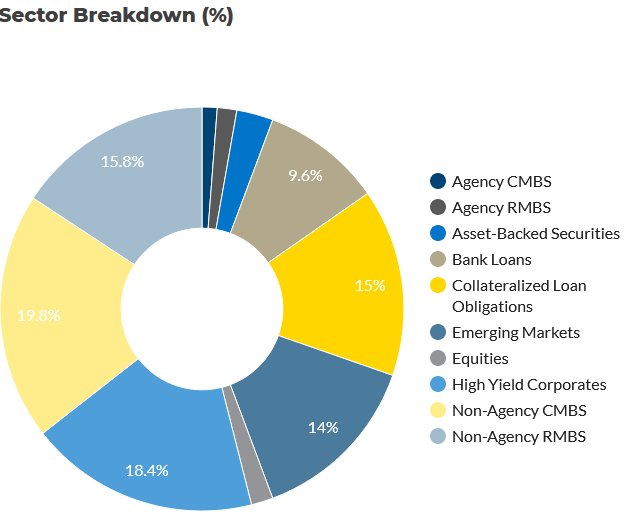

The fund’s description on its web site says nothing about floating-rate securities. Nevertheless, we do see that the fund has 15% of its belongings invested in collateralized mortgage obligations and 9.6% of its belongings invested in financial institution loans:

DoubleLine

These are usually floating-rate securities, and in reality, a have a look at the fund’s semiannual report does reveal that it has quite a few securities in each classes that particularly state that the yield modifications with some benchmark (akin to LIBOR). Nevertheless, that clearly doesn’t account for all the securities within the fund, and the fixed-rate securities that it holds will nonetheless decline in worth as rates of interest rise. Nonetheless, the floating charge securities within the portfolio do assist to clarify a few of the outperformance of this fund in opposition to the fixed-rate bond index.

One other potential issue that would clarify a few of the efficiency variations is the truth that this fund invests in rising markets, which are inclined to have decrease credit score rankings and better rates of interest than developed market bonds. For instance, the semi-annual report makes point out of Ukrainian authorities bonds at 7.25% and 9.75%. That isn’t the present yield-to-maturity, these numbers are the coupon yield at face worth. As I identified not too long ago, buyers have been more and more keen to purchase up junk bonds and different very high-yielding belongings over the previous few months. That is one motive why the Bloomberg Excessive Yield Very Liquid Index (JNK) has been outperforming the combination bond index year-to-date:

Searching for Alpha

Actually, as we will see right here, junk bonds are literally up year-to-date regardless of rising rates of interest. The information media claims that it’s because buyers wish to reap the benefits of the present excessive interest-rate surroundings and lock in enticing long-term yields for his or her cash. That’s pretty much as good a motive as any that I can consider. This similar phenomenon would possibly assist clarify the value efficiency of the DoubleLine Yield Alternatives Fund not too long ago, as buyers wish to get the yield whereas it nonetheless exists.

Nevertheless, there’s one huge downside that happens with debt funds that doesn’t happen with bonds. Within the case of a bond, an investor can make sure that they don’t lose cash by holding the safety till it matures. A bond will all the time return its face worth at maturity until the issuer defaults. A bond fund has open-ended maturity and won’t essentially all the time maintain a bond till maturity. As such, buyers attempting to lock in excessive yields in all probability shouldn’t depend on a fund to do it. Thus, we could have a state of affairs wherein the fund’s shares don’t replicate the fund’s precise efficiency.

The webpage backs up this assertion. As we will see right here, the DoubleLine Yield Alternatives Fund managed to generate an 8.58% complete return year-to-date from its portfolio. Nevertheless, the shares produced a 17.94% complete return. The identical factor occurred over the trailing one-year interval:

DoubleLine

Thus, we’re seeing a case wherein the fund’s efficiency drastically exceeds its precise market efficiency. As such, the fund could have change into considerably overvalued proper now and that would characterize a threat given the market’s optimism that the Federal Reserve will minimize charges within the close to future. We’ll focus on this in only a second.

Leverage

As is the case with many closed-end funds, the DoubleLine Yield Alternatives Fund employs leverage as a technique of boosting its complete returns. I defined how this works in my earlier article on this fund:

Briefly, the fund borrows cash after which makes use of that borrowed cash to buy bonds or different income-producing belongings. So long as the bought belongings have a better yield than the rate of interest that the fund has to pay on the borrowed cash, the technique works fairly properly to spice up the efficient yield of the portfolio. As this fund is able to borrowing cash at institutional charges, that are significantly decrease than retail charges, it will normally be the case. Nevertheless, it is very important observe that leverage is way much less efficient at boosting the fund’s efficient portfolio yield at present with charges at 6% than it was two years in the past when charges had been at 0%.

Sadly, the usage of debt on this style is a double-edged sword as a result of leverage boosts each good points and losses. As such, we wish to make sure that the fund is just not using an excessive amount of leverage since that may expose us to an excessive amount of threat. I usually like a fund’s leverage to be lower than a 3rd as a proportion of its belongings for that reason.

As of the time of writing, the DoubleLine Yield Alternatives Fund has levered belongings comprising 20.24% of the portfolio. This simply satisfies the one-third most restrict and will characterize a fairly good stability between threat and reward. We should always not want to fret an excessive amount of about this fund’s use of leverage to finance its operations.

Distribution Evaluation

As talked about earlier on this article, the first goal of the DoubleLine Yield Alternatives Fund is to supply its buyers with a excessive stage of complete return. The fund particularly states that it intends to supply nearly all of its complete return within the type of present earnings, which signifies that it needs the belongings within the portfolio to pay it. The fund invests in a portfolio of bonds from all over the world with this goal in thoughts after which applies a layer of leverage to spice up the efficient yield past that supplied by any of the bonds within the portfolio. It then goals to pay out most to all of its funding income, web of any bills, to the shareholders by way of a daily distribution. As such, we’d anticipate that the fund would boast a really excessive distribution yield itself.

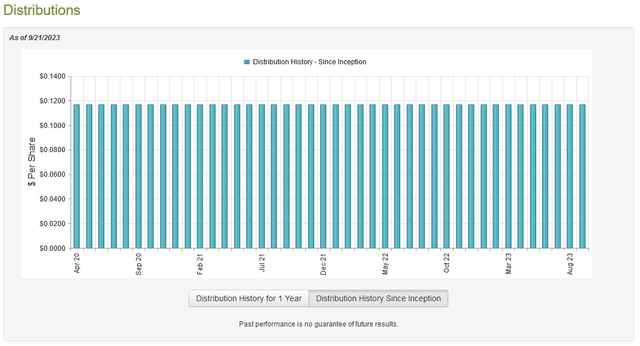

That is actually the case, because the DoubleLine Yield Alternatives Fund at the moment pays a month-to-month distribution of $0.1167 per share ($1.4004 per share yearly), which provides it a 9.53% yield on the present worth. The fund has been remarkably per its distribution over its lifetime:

CEF Join

The consistency of this distribution could clarify a few of the enchantment that we’ve seen with respect to this fund not too long ago. In spite of everything, most debt funds have minimize their distributions in response to the Federal Reserve’s financial tightening coverage so the truth that this one has not will undoubtedly enchantment to these buyers which might be searching for a secure and safe supply of earnings with which to pay their payments or finance their life. Nevertheless, we do wish to look at its funds because it appears odd that this fund may keep a secure distribution when a lot of its friends couldn’t.

Happily, we do have a reasonably current doc that can be utilized for the aim of our evaluation. As of the time of writing, the fund’s most up-to-date monetary report (linked earlier) corresponds to the six-month interval that ended on March 31, 2023. As such, this report ought to give us a good suggestion of how properly the fund managed the steep decline in bond costs that occurred in November and December of final yr. As soon as the yr turned although, the market obtained optimistic that charge cuts would quickly be applied and drove up bond costs. The fund could have been in a position to reap the benefits of this to promote some bonds at a revenue. This may all be mirrored on this report.

In the course of the six-month interval, the DoubleLine Yield Alternatives Fund acquired $41,561,081 in curiosity and $806,636 in dividends from the belongings in its portfolio. This provides the fund a complete funding earnings of $42,367,717 in the course of the interval. It paid its bills out of this quantity, which left it with $30,075,994 accessible to shareholders. Sadly, this was not sufficient to cowl the $33,571,635 that the fund paid out in distributions. It did get fairly near protecting the distribution although, which is encouraging.

The fund does have another strategies that may be employed to acquire the cash that’s wanted to cowl the distribution. For instance, it might need been in a position to exploit modifications in bond costs to generate some capital good points. Sadly, the fund failed at this process in the course of the interval. It reported web realized losses of $14,741,558 however these had been partially offset by $11,510,376 web unrealized good points. General, the fund’s web belongings declined by $6,726,823 after accounting for all inflows and outflows in the course of the interval. That is regarding because the fund’s web belongings additionally declined in the course of the full-year interval that ended on September 30, 2022. Thus, the fund has didn’t cowl its distributions for eighteen months as of the latest monetary report. It’s troublesome to see the way it can maintain its distribution ought to this proceed. There may very well be some motive for concern right here, and the fund’s buyers ought to pay explicit consideration to its full-year report when it comes out in a couple of months. In spite of everything, we have to guarantee that the fund doesn’t have a full second yr of failing to cowl the distribution and declining web belongings.

Valuation

As of September 21, 2023 (the latest date for which knowledge is at the moment accessible), the DoubleLine Yield Alternatives Fund has a web asset worth of $15.21 per share however the shares at the moment commerce for $14.82 every. This provides the fund’s shares a 2.56% low cost on web asset worth on the present worth. That is considerably larger than the 5.66% low cost that the shares have averaged over the previous month.

I’ll admit that it’s shocking to see this fund buying and selling at a reduction contemplating that the shares have been outperforming the portfolio efficiency for the previous yr. Nevertheless, over the previous 52 weeks, the fund’s shares have by no means been costlier than a 1.17% low cost on web asset worth. The present worth is a bit costly primarily based on the fund’s historic pricing, however it’s nonetheless a reduction.

Conclusion

In conclusion, the DoubleLine Yield Alternatives Fund has delivered a reasonably robust efficiency out there. Nevertheless, its portfolio has not been performing almost in addition to the shares would counsel. To this point, it has not resulted within the shares buying and selling for a worth that’s above their intrinsic worth although. There’s positively a threat right here, particularly if the market proves to be too optimistic concerning the Federal Reserve’s capability to engineer a “comfortable touchdown” for the economic system, however that may be a threat possessed by something aside from money proper now. My greatest concern is that this fund has been constantly failing to cowl its distribution, which is unsustainable. Whereas it’s doable that it has managed to appropriate this downside within the time since the latest monetary report has come out, there isn’t a assure of that so risk-averse buyers could wish to be cautious till we’ve extra data.