US Macro Shock knowledge declined for the sixth straight week… to its weakest since January 2023…

Supply: Bloomberg

However that ‘unhealthy information’ prompted a run to file highs for dangerous shares…

Supply: Bloomberg

Because the market appears to be fully discounting the collapse in mushy survey knowledge…

Supply: Bloomberg

The unhealthy information prompted rate-cut expectations to rise on the week (extra for 2025 than 2024). Three full cuts priced in for 2025 and two cuts priced in for 2024…

Supply: Bloomberg

All of which despatched shares increased on the week led by Nasdaq. Friday noticed the majors blended to flat after a tumultuous week..

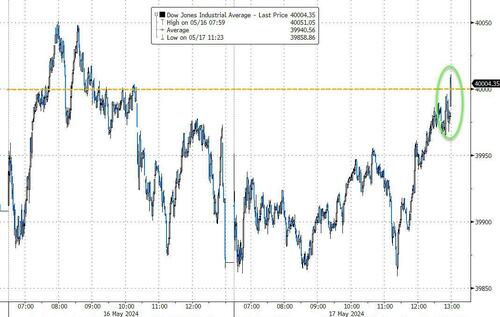

In the previous few seconds, the algos took The Dow again above 40,000 for its first shut above that historic degree…

Industrials have been the one sector to finish the week purple whereas Tech and Financials outperformed…

Supply: Bloomberg

The brief squeeze in the beginning of the week pale quick because the week progressed…

Supply: Bloomberg

VIX was clubbed like a child seal again to an 11 deal with on the week – decoupling from shares at the moment…

Supply: Bloomberg

Treasury yields ended the week decrease, regardless of the final two days seeing charges rise. The short-end modestly underperformed…

Supply: Bloomberg

The greenback tumbled this week, erasing the good points since April’s CPI print surge…

Supply: Bloomberg

A giant week for bitcoin with the most important cryptocurrency again above $67,000 to its highest in six weeks…

Supply: Bloomberg

Bitcoin ETFs noticed a strong week of inflows (for a change)…

Supply: Bloomberg

Oil costs bounced on the week with WTI again above $80 to 2 week highs…

Supply: Bloomberg

Gold surged to a brand new file closing excessive this week, its first shut above $2400…

Supply: Bloomberg

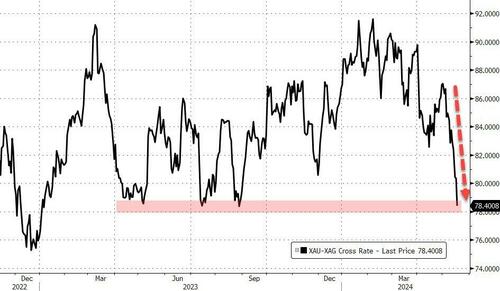

… however most notably, silver dramatically outperformed gold (topping $30) – its greatest relative weekly efficiency since August 2020…

Supply: Bloomberg

Whereas The Dow topped 40,000 for the primary time, it stays a laggard in comparison with gold for the previous few years…

Supply: Bloomberg

Lastly, how for much longer can the market (and The Fed) ignore the surge in inflation shock knowledge and simply watch the de-growth with blinkers on…

Supply: Bloomberg

…hoping that the ‘unhealthy information’ is all that issues to raise rate-cut hopes.

Loading…