Monty Rakusen/DigitalVision by way of Getty Pictures

Funding thesis

My first cautious thesis about Digital Turbine’s (NASDAQ:APPS) inventory of early July aged properly for the reason that inventory value virtually halved over the past quarter. Such an enormous inventory value lower made the corporate’s present market cap look enticing in comparison with my honest worth estimations. Nevertheless, the inventory continues to be a “Maintain” for me as a result of the corporate experiences substantial headwinds as its income decreases quickly and profitability can also be shrinking. I can not name the corporate’s monetary place weak. Nonetheless, it is usually not robust, that means that APPS doesn’t have a stable place to gasoline progress or innovation within the present surroundings of quickly deteriorating monetary efficiency. Final however not least, the continuing Q3 earnings season revealed huge fears within the inventory market, and this sentiment doesn’t favor younger progress shares like APPS. I anticipate the inventory to proceed underperforming the broad U.S. equities market.

Latest developments

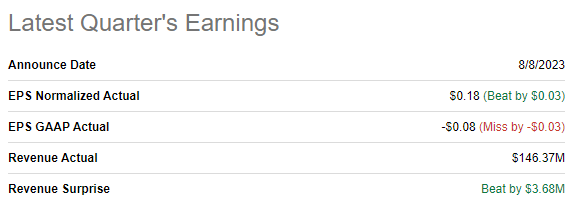

The newest quarterly earnings had been launched on August 8, when the corporate topped consensus estimates. Income declined YoY by over 20% for the second straight quarter, reflecting the tough macro surroundings. Weak point in income dragged down profitability metrics. Whereas the gross margin demonstrated relative resilience with a modest under three proportion factors decline, the working margin crashed and even went under zero. The elevated SG&A to income ratio by greater than ten proportion factors signifies that the administration doesn’t have options that may be environment friendly sufficient to deal with the income drop.

Looking for Alpha

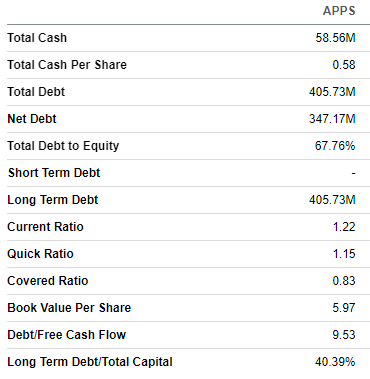

Because of the considerably shrinking working margin, the corporate generated virtually no working money stream through the newest quarter, and the money stability decreased by about $17 million through the quarter. This appears like a crimson flag as a result of the macro surroundings continues to be harsh, and the corporate’s stability sheet doesn’t appear to be a fortress with its substantial internet debt place and comparatively skinny lined and liquidity ratios.

Looking for Alpha

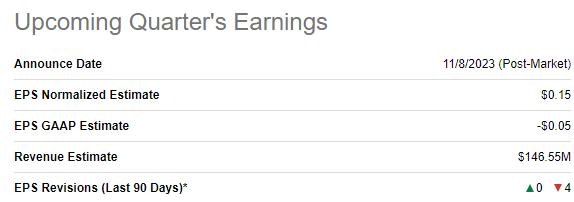

The corporate’s monetary efficiency is poised to deteriorate within the close to future. The upcoming quarter’s earnings are scheduled for November 8. Consensus estimates anticipate quarterly income at $146.5 million, which signifies a 16% YoY decline. The adjusted EPS is anticipated to observe the highest line and slender by greater than twice from $0.34 to $0.15. There have been 4 downward EPS revisions over the past 90 days, which is a bearish signal.

Looking for Alpha

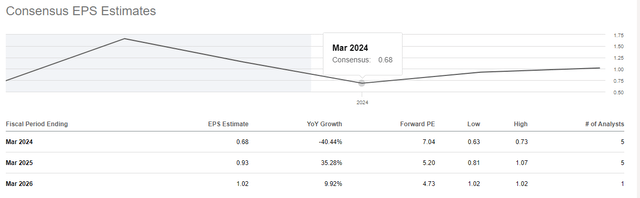

I feel the current weak spot within the inventory value was honest, principally as a result of I see little proof that the administration is doing sufficient to adapt to the present unfavorable surroundings. Not a lot deal with price effectivity was emphasised through the newest earnings name, which appears disappointing and doesn’t replicate the present surroundings. Subsequently, it’s unsurprising that consensus estimates forecast an enormous 40% drop in EPS in FY 2024, considerably outpacing the modest anticipated income drop of under 9%.

Looking for Alpha

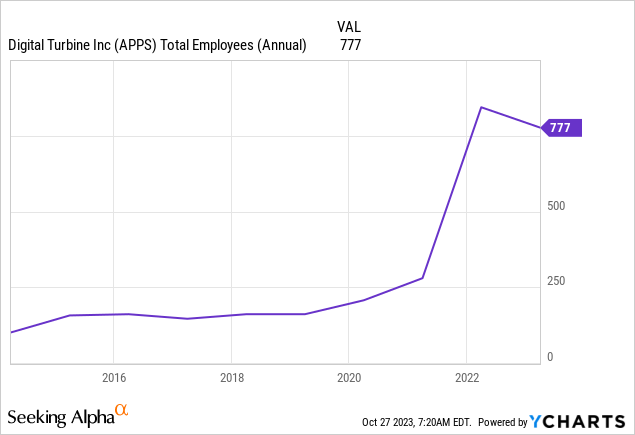

When the EPS drop outpaces the top-line lower, it means that the administration will not be able to make unpopular selections to enhance shareholder worth. I discovered no information concerning notable layoffs in APPS and it appears insufficient to quickly shrinking income. There are ongoing massive layoffs within the expertise trade after speedy headcount progress through the pandemic, with even far more financially robust corporations chopping their workforce to maintain profitability. On the similar time, APPS headcount shank by a slender margin from its peak, based on the chart under.

I feel that there’s a stable potential to save lots of profitability if the corporate’s headcount moderates to ranges consistent with income dynamics. Nonetheless, current information offers virtually no hits that the administration plans new rounds of layoffs. Information concerning notable headcount cuts is prone to be a stable constructive catalyst for the inventory, however the chance of such a situation within the foreseeable future appears low to me, given the administration’s tender rhetoric concerning effectivity measures.

Valuation replace

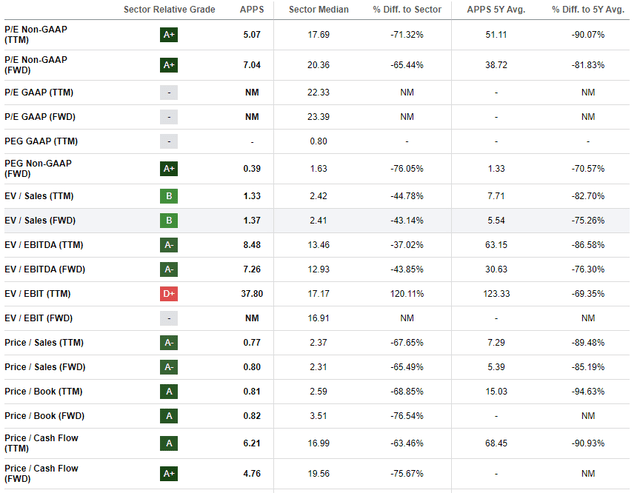

The inventory suffered quite a bit this 12 months, with a 68% year-to-date decline, which is a a lot weaker efficiency than the broad U.S. market. Looking for Alpha Quant assigns APPS a good “B+ valuation grade as a result of present ratios are considerably decrease than the sector median and the corporate’s historic averages throughout the board. From the valuation ratios perspective, the inventory appears considerably undervalued.

Looking for Alpha

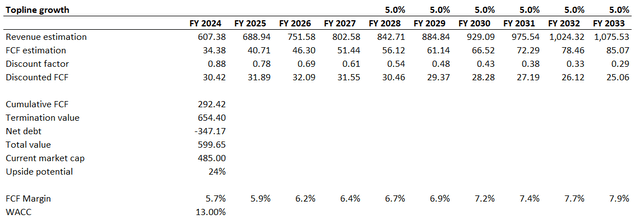

Now, let me proceed with my evaluation of the discounted money stream [DCF] simulation. I exploit an elevated 13% WACC because of the current hawkish Fed rhetoric and the corporate’s deteriorating monetary efficiency in current quarters. I exploit a TTM FCF margin of 5.7% and anticipate a 25 foundation factors yearly growth. I’ve consensus income estimates obtainable till FY 2027 and forecast a 5% long-term income CAGR for the years past.

Writer’s calculations

In line with my DCF valuation, the enterprise’s honest worth underneath the conservative assumptions above is near $600 million, which is about 24% increased than the present market cap. That mentioned, my goal value for the APPS inventory is $6.

Dangers to my cautious thesis

The valuation of progress inventory closely depends upon the Fed’s financial coverage. To be extra concise, progress inventory costs often overreact even to rumors concerning upcoming rate of interest hikes or cuts. That mentioned, if traders see between the strains in Jerome Powell’s speeches that the pivot within the financial coverage is approaching, it may be a robust constructive catalyst for progress shares, particularly oversold ones like APPS. However, the newest information suggesting that the U.S. economic system nonetheless grows at a formidable tempo makes this danger distant.

For a corporation working in a promising area of interest that’s oversold and attractively valued, there’s additionally a possible to turn out to be an acquisition goal from one of many expertise behemoths. Any information or rumors a few potential acquisition by one of many American hyper scalers may additionally be an enormous constructive catalyst for APPS inventory value.

Backside line

To conclude, APPS continues to be a “Maintain”. Whereas my valuation evaluation means that the inventory presently trades with a notable low cost in comparison with its intrinsic worth, I’ve a excessive conviction that the present surroundings, each from the enterprise and the inventory market views, is unfavorable for APPS. The income is declining at a speedy tempo, and so does the profitability. The corporate’s stability sheet will not be weak however not robust sufficient to offer APPS with good choices to gasoline income progress or innovation. There are a few important dangers to my cautious thesis, however I nonetheless assume there’ll probably be significantly better entry factors for potential traders.