da-kuk

Pricey readers,

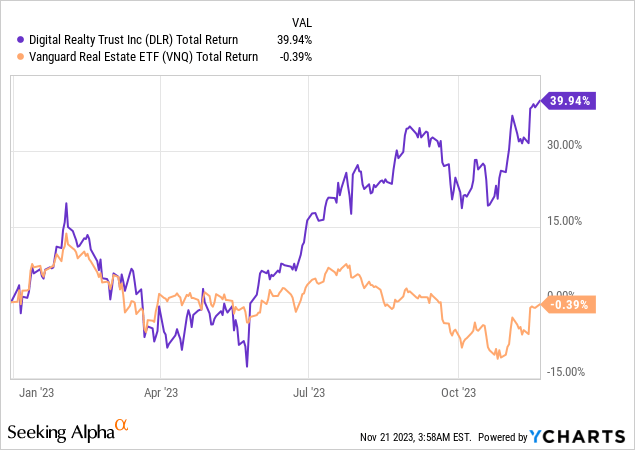

Digital Realty Belief (NYSE:DLR) is an information middle REIT and considered one of solely a handful of REITs with constructive RoR in 2023. The inventory has returned 40% year-to-date and considerably outperformed the broader REIT index (VNQ) which has been flat over the identical interval.

I’ve coated the inventory earlier than and issued a BUY ranking again in March at $97 per share. I noticed DLR as properly positioned to profit from AI-related tailwinds and anticipated an honest 11% annual return from an almost 5% dividend yield and a number of growth from 15x FFO to 16.50x FFO. Because the AI growth took over, the inventory value shot a lot greater in a a lot shorter time period than I anticipated, leading to RoR of 42% from my preliminary name vs an S&P 500 (SPX) return of 13%. I now assume it is time to trim the place. My reasoning is under.

Current outcomes

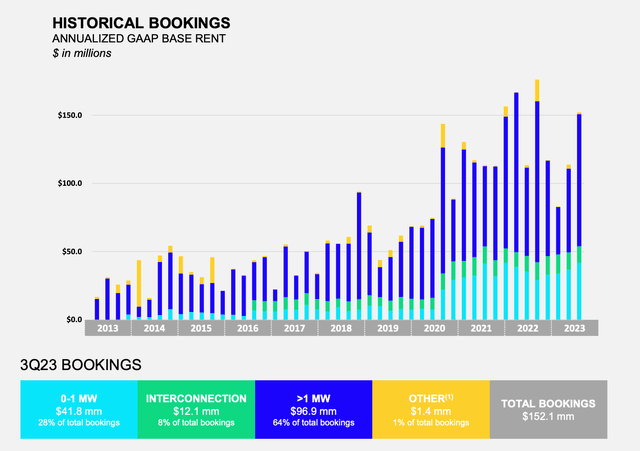

Demand throughout the third quarter has been very robust in DLR’s major product classes (the 0-1 MW and interconnections segments), and particularly within the >1MW phase which has seen a significant acceleration and has reclaimed the excessive ranges of leasing seen in 2021-2022.

DLR Presentation

It is value noting that for knowledge facilities, there is a vital lag between signing leases and tenants really shifting in, which reduces the speedy impact of signing a tenant, however makes near-term occupancy extra predictable. Not too long ago, this lag has elevated to 12 months on common and has resulted in a report backlog of leases of practically $500 Million. Administration expects about 15% of those leases to begin in This autumn and additional 50% subsequent 12 months.

Furthermore, robust demand coupled with relative tight provide has resulted in vital hire will increase on each new leases and renegotiations. Because of this money renewal unfold throughout the quarter have been the very best since 2015 at 7.4% YoY. And identical retailer money NOI progress has reached the very best ranges in 10+ years because it accelerated from 3.4% YoY in Q1, to five.6% YoY in Q2 and 9.4% YoY in Q3, resulting in elevated full 12 months steering.

Initially, considered one of my worries when analyzing knowledge facilities, was that their tenant base tends to be centered on massive tech firms with a scarcity of diversification. I frightened that these firms might determine to construct their very own knowledge facilities, which might create an existential risk to DLR. Since then, nevertheless, I’ve modified my view utterly. Massive tech is a high-growth and high-margin enterprise and it makes rather more sense to lease server capability from a REIT, corresponding to DLR, than to get entangled on this capital intensive low-margin enterprise. Furthermore, excessive hire spreads verify this view and present that tenants certainly worth the house and wish to maintain it.

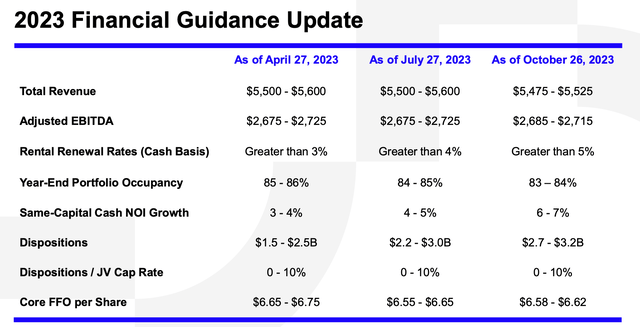

Full 12 months steering now requires >5% money hire spreads and same-store NOI progress of 6-7%. The rise in these progress metrics has been largely in a position to offset a drop in occupancy by year-end from 85.5% to 83.5%.

DLR Presentation

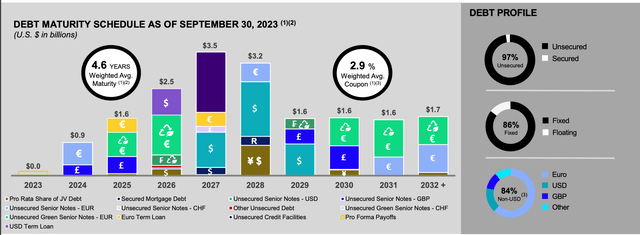

Digital Realty has been aggressively making an attempt to decrease their leverage. And efficiently so. Yr up to now, their internet debt/EBITDA has decreased by 0.8x they usually have elevated their liquidity to over $3 Billion, together with $1 Billion in money.

They’ve been ready to do that due to aggressive capital recycling, which included $2.3 Billion of JVs and non-core asset gross sales accomplished in Q3. With $2.5 Billion in transactions year-to-date, the REIT is properly on monitor to realize its full 12 months goal of $2.7-$3.2 Billion. Of the $2.5 Billion, roughly $1 Billion was redeployed into DLR’s improvement initiatives and about $500 Million was used to repay their borrowing on the revolving line of credit score, which was accruing the very best curiosity of all of their debt.

Presently DLR’s leverage (internet debt/EBITDA) stands at 6.3x and is on monitor to hit the 6x aim by the top of the 12 months. The weighted common maturity is considerably quick at 4.5 years, which signifies that there are some debt maturities within the upcoming years, which can contribute to an curiosity expense enhance on high of the 14% of floating charge debt.

DLR Presentation

All issues thought of, DLR has had an excellent third quarter and certain deserved to see its inventory value go up. However let’s not overlook that this can be a extremely leveraged REIT and rates of interest are nonetheless excessive. With this in thoughts, we must be very conservative in our expectations.

Valuation

Digital Realty reported an annualized Q3 NOI of $2.97 Billion which corresponds to an implied cap charge of 5.1%. That is a really aggressive valuation in gentle of excessive rates of interest and signify a variety of solely 40 bps to 10-year treasury yields.

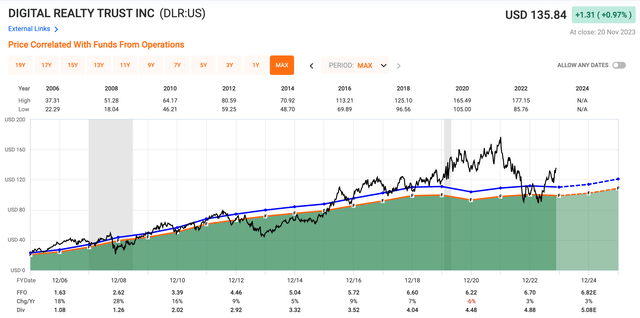

Furthermore, the inventory now trades at 20.5x FFO which is considerably above the long-term common of 17x, regardless of comparatively flat FFO expectations going ahead. Briefly, DLR is pricey by any customary.

Quick graphs

All issues thought of, I really feel pretty assured that the inventory has overshot to the upside on AI-related pleasure. Consequently it has develop into indifferent from fundamentals, leaving basically no upside potential and shedding any form of margin of security. Subsequently, I feel it is best to promote the place, or on the very least trim right here at $135 per share and reallocate into different investments with a greater danger reward profile.